Wednesday, August 31, 2016

Nifty

Nifty Has finally broken out on upside yesterday and closed above 8760

Now one can buy and add at 8750-8710

Stoploss 8660

Tuesday, August 30, 2016

Train Your Brain for Trading (No, Really!)

Recent research finds that traders looking at prices use parts of the brain associated with reading other people.

A stock's price is ticking up and down on a screen in front of you. Do you rationally evaluate the probabilities that the price will rise before you pull the trigger on a trade? Or do you go with your gut?

You may prefer to think superior ability—that mysterious X-factor some traders appear to have—is rooted in the former scenario. But a few years ago, researchers at the California Institute of Technology went to the trouble of taking pictures of people’s brains while they were evaluating trades. Surprise: As rational as you are, you probably opt for that gut feeling a lot.

Using fMRI scans, neuroscientists can identify which brain structures are associated with particular activities. To do so, they might put a subject in a machine and have him solve a math problem so they can watch the fireworks go off. Those math-related structures aren’t what lit up in the Caltech experiment. Instead, the activation occurred in parts of the brain associated with something psychologists call “theory of mind.”

That’s essentially the ability to read other people. “It’s a viewpoint on what another person is thinking and feeling and what they’re likely to do,” says Denise Shull, founder of the ReThink Group, a New York research and consulting firm that coaches financial professionals and athletes. You unconsciously use theory of mind all the time to process experiences in the world, says Shull. It’s what helps you navigate a busy Manhattan sidewalk: You can tell that the guy in front of you is about to veer to the right, so you step to the left. It’s also what enables some traders to look at the tape, she says, and see that “someone’s slamming the bid.”

In the Caltech experiment, detailed in “Exploring the Nature of ‘Trader Intuition,’ ” a paper published in the Journal of Finance in 2010, researchers set up a stylized market. They had participants trade two “stocks” in a series of sessions. The payoff from the two stocks together was fixed at 50¢, but the portion of the payout that would come from each stock was revealed only after the session ended. One might pay 49¢ and the other would pay 1¢, for example.

In some of the sessions, none of the participants had any additional information about the payoffs. In other sessions, some participants were given a hint about what the payoffs would be. Based on that hint, those participants might bid up one of the stocks.

The trading during those sessions took place electronically and was videotaped. Later, a different group of subjects watched replays. After a while, a researcher would stop the video and ask the subjects to predict what the next price would be.

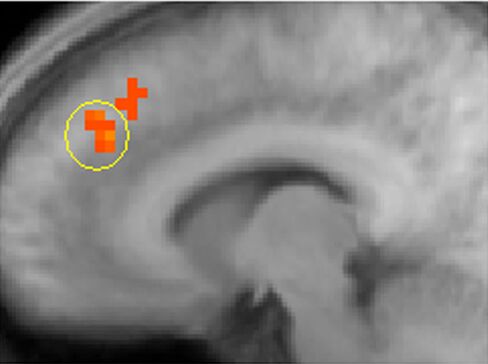

In the sessions where some traders were acting on hints about the payoff, the observers could infer information about how stocks would move just from watching the prices and flow of orders. The explanation: The fMRI scans showed the observers had engaged the theory-of-mind-related parts of their brains. Also, the observers who were better at predicting prices did better on separate tests of theory-of-mind abilities.

An fMRI image from the Caltech study shows the main activation in the paracingulate cortex, an area associated with theory of mind.

Peter Bossaerts

The Caltech study has some interesting implications. Among them: Theory of mind may explain how uninformed traders infer new information and act on it in such a way that prices quickly come to fully reflect it—as is posited by the efficient markets hypothesis, a cornerstone of finance theory.

Peter Bossaerts, an author of the Caltech study who’s now a professor of experimental finance and decision neuroscience at the University of Melbourne, says subsequent research also supports the idea that theory of mind may explain how information flows through markets. “We have more evidence for it,” he said in an e-mail, citing papers that show connections between theory of mind and market bubbles.

The mysterious X-factor isn’t such a mystery after all, according to ReThink’s Shull. “I would describe the X-factor of risk judgment as part of a suite of emotional competencies that extends from knowledge to recognition to understanding,” she says. One part is emotional self-awareness—knowing not to make a decision when you’re agitated, for example. Another is the ability to predict prices and read people.

.

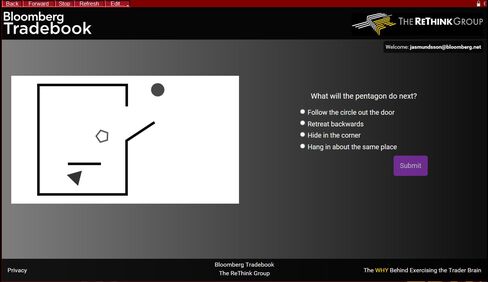

The Bloomberg Tradebook Trader Exercise lets you exercise your trader brain.

So, can you sharpen your skills for that? Yes, says Shull. “It’s trainable.” Although theory of mind is unconscious, Shull says there’s a conscious version of the same type of processing, which she calls cognitive empathy. “Cognitive empathy is thinking about it and trying to do it intentionally, and that’s where you can train yourself,” she says. The new Bloomberg Tradebook Trader Exercise lets you test your abilities and practice to improve them. Developed by Shull’s ReThink Group in conjunction with Tradebook, Bloomberg’s agency brokerage, the activity uses various animated shapes to challenge your gray matter. Keep an eye on that pentagon!

Nifty

All traders kindly observe nifty it is very flat in movement..

We are repeatedly writing this:

"We are not giving nifty figures since few days because the trend is not clear"

Our figures 8760 and 8545 remains intact..

Close above or below these figures will decide the trend of nifty.

Till then we recommend not to trade Nifty.

Our paid subscribers are enjoying our stock specific trades by following our private blog,....

We are repeatedly writing this:

"We are not giving nifty figures since few days because the trend is not clear"

Our figures 8760 and 8545 remains intact..

Close above or below these figures will decide the trend of nifty.

Till then we recommend not to trade Nifty.

Our paid subscribers are enjoying our stock specific trades by following our private blog,....

Monday, August 29, 2016

Europe’s New M&A Patron: China

It’s not shaping up to be a banner year for mergers and acquisitions in Europe. Deal value totaled about $400 billion as of July 26 and is on track to reach $800 billion by year-end, which will put it some $200 billion short of last year. And parts of the horizon beyond that aren’t exactly compelling, either: A Credit Suisse survey of European executives shortly after the U.K.’s June vote to leave the European Union found that the Brexit shock had already made business leaders more reluctant to spend. What will turn things around? In a word, China. Credit Suisse likes the prospects of a European M&A revival fueled by a country increasingly searching for investment opportunities outside its borders.

Chinese firms have spent $144 billion buying non-Chinese firms so far this year, surpassing the total for all of 2015 and already marking a new annual record for the Middle Kingdom before the year is much more than half over. Among European deals this year, 18.5 percent of acquirers have been Chinese, more than any other country. In February, the Swiss pesticide giant Syngenta agreed to a $43 billion takeover by the state-owned Chinese agrochemical company, ChemChina. Why are Chinese companies engaging in a shopping spree when the rest of the world seems in belt-tightening mode? One way to understand it is to understand that it’s not just Chinese companies but China itself. Last year, 70 percent of Chinese investment in EU companies and assets came through Chinese state-owned companies, according to a report by the Mercator Institute for China Studies (MERICS), a German think tank. “Chinese investment now takes a top spot on the agenda of major diplomatic occasions as China is eager to counterbalance growing negativism about falling Chinese demand for foreign goods and China’s ballooning trade surpluses,” the report’s authors wrote, adding that Chinese officials are increasingly using “the promise of investment” to influence diplomatic negotiations with the EU. Credit Suisse observes that there are also clear financial motivations underpinning China’s love affair with European companies. Chinese companies now have the firepower for an international shopping spree thanks to its overvalued currency and a surfeit of cheap capital provided by Chinese banks. Furthermore, as growth inside China’s borders continues to slow, Chinese companies are doing as any company does in their position: they are trying to buy that growth elsewhere. For them, Europe offers a bevy of acquisition targets with relatively low leverage ratios and free cash flow yields high enough to rival those of junk bonds. The weakness of the pound, meanwhile, makes U.K.-based companies particularly appealing. Industries that rank high on China’s M&A wish list will include travel and leisure, insurance, aerospace and defense, metals and mining, hardware and semiconductors, utilities, capital goods, and entertainment.

Some purchases may be strategically driven in addition to financially so. Credit Suisse believes China’s state-owned tobacco monopoly is likely to seek out European tobacco companies in an effort to leverage their production expertise and to spread Chinese tobacco brands into foreign markets. Chinese manufacturing companies are surely also considering buying entire capital goods firms for the sole purpose of acquiring their automation technology, a step that could help Chinese companies move up the value chain. But not all Chinese firms will target European companies with equal fervor. Credit Suisse believes industries with low or uncertain potential for new acquisitions by Chinese firms include chemicals and pharmaceuticals, where opposition from European regulators could pose a significant hurdle.

Friday, August 26, 2016

Thursday, August 25, 2016

Even Average Mutual Funds Are Out-Performing Warren Buffett’s Stock Picking: Expert

Till recently, Warren Buffett held the exalted title of “World’s Greatest Investor” for his incredible investing skills. He was dethroned from the position recently by Billionaire Carl Icahn. This is because while Warren Buffett compounded his wealth at a CAGR of 19.5% since 1968, Carl Icahn compounded his wealth at 31%.

The difference in the two figures is enormous. A sum of Rs. 1,000 invested with Warren Buffett in 1968 would be worth Rs.50 lakhs today while the same amount invested with Carl Icahn would be worth Rs. 40 crore.

Warren Buffett also got dethroned from the position of “World’s third richest man” by Jeff Bezos of Amazon. Jeff Bezos pocketed USD 65.3 billion even while the octogenarian Billionaire had to stay content with a net worth of USD 64.9 billion.

Now, the latest embarrassment that Warren Buffett has to endure is that the humble Indian mutual funds have out-performed his track record.

This sensational revelation has been made by Sachin P. Mampatta of Mint.

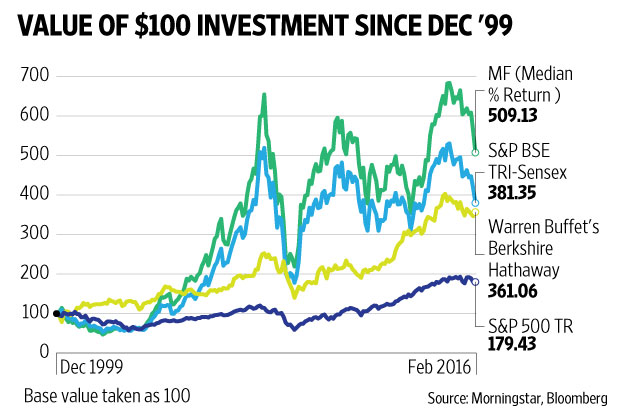

Mampatta points out that a million dollars invested with the Oracle of Omaha at the turn of the millennium would be worth an additional $2.6 million by the end of 2015. However, if the same sum was invested in an average mutual fund in India, the investor would be richer by over $4 million.

(Image Credit: Mint)

Mampatta has done a lot of number-crunching to support his analysis. He has not only looked at the “total returns over a 15-year period” but also considered the “one-year rolling returns”. He has also taken into account the “Alpha” of the mutual funds i.e. the excess returns that a fund returns over its benchmark on a risk-adjusted basis.

Whichever way one looks at it, it is clear that Indian mutual funds are the winner, Mampatta says with obvious pride in his voice.

The gratifying aspect is that the out-performance is not confined to the whiz-kid mutual fund managers but even average Raju sort of fund managers have put in an impressive performance.

Mampatta has credited the out-performance of the mutual funds to the “enormous tailwind of a soaring equity market, coupled with smaller asset size and market inefficiencies associated with an emerging nation”.

Several experts rushed to defend Warren Buffett on the basis that he is “hamstrung by the size and the maturity of the markets and economy in which he operates”. However, Mampatta has countered this by arguing that Warren enjoys several benefits that mutual funds don’t have access to, such as billions of dollars of insurance float money, the use of derivatives etc.

The bottom line of Mampatta’s analysis is that if we adopt the techniques of investment taught to us by Warren Buffett and apply it to the Indian context, we will be able to generate returns that will surpass those of Warren Buffett. This will please the Sage of Nebraska more than anything else!

Nifty

Nifty Figures are not given since few days since there is no trend in Nifty and we are yet waiting for our figures (given previously) to breach

Wednesday, August 24, 2016

Gusto for Gold Mines

It’s been a good year for gold. Gold spot prices hit $1,360 per ounce in early August, up 28% percent since the beginning of the year, buoyed by low interest rates and more recently, demand from investors seeking a safe haven from Brexit-related economic uncertainty. But for equities-minded investors, it’s worth considering the miners behind the metal. Gains by gold mining stocks have outpaced those of gold prices, with the NYSE Arca Gold Miners Index up more than 125% percent year-to-date, and Credit Suisse team believes there’s good reason for the gold mining rally to keep rolling.

In short, the industry has learned from its mistakes. The last time we saw a surge in gold prices like this one was in the summer of 2011, when gold shot up from below $1,600 in June to a record $1,910 per ounce that August. It was the last leg of a years-long gold rally that started during the financial crisis in 2008. Mining companies, which hadn’t enjoyed such attention from investors since 1980, threw caution to the wind and began operating under the assumption that the high prices were going to last a while. In particular, they expanded production to low-grade mining projects that would only be profitable if gold prices stayed aloft.

Then the bottom dropped out. In 2013, gold prices began a steep decline, those low-grade projects turned into money pits, and companies were forced to suspend operations everywhere from South Africa to New Zealand. Many gold miners still “suffer from a bad reputation for destroying capital,” says Dan Scott, a senior research analyst with the Bank’s IS&P team. Conflicts with national governments over environmental concerns haven’t helped. In 2013, Chilean authorities ordered Barrick Gold, a Canadian firm, to suspend operations at its Pascua-Luma mining project on the Chile-Argentina border for flouting environmental regulations. Barrick ultimately declared a $6 billion loss on the project. That same year, British mining giant Anglo American pulled out of a project in Alaska’s Bristol Bay after the U.S. Environmental Protection Agency issued a report detailing how mining activity could harm the area’s wildlife, raising concerns that the agency would eventually block the project. The stakes were high enough that Anglo American walked away from the more than $500 million it had spent to develop the site, which continues under the aegis of Canadian mining company Northern Dynasty Minerals. So what’s changed?

The financial health of gold miners is demonstrably better today than it was just three years ago. Following the drop in gold prices, the industry moved aggressively to slash costs, including cuts to capital expenditures, exploration budgets, and overhead operating costs. All-told, the industry’s “all-in sustaining costs”—a measure of mining efficiency that takes into account the price of exploration projects as well as the cost of production—have dropped as much as 30 percent since 2013. Having revamped itself to ensure it could survive gold prices as low as $1,000 per ounce, the industry is now enjoying prices above $1,300, and today’s leaner mining companies are throwing off rising levels of free cash flow. The Bank’s IS&P team believes gold miners have learned from the past and will continue to exercise tight fiscal discipline. Scott says macroeconomic uncertainty will encourage miners to keep their focus on high-grade ore to limit production costs, and that they’ll likely continue deferring capital expenditures as well. A more conservative approach to new projects should also constrain gold supply, providing more support to gold prices. And those are just the things under their control. Factors outside the mining industry may fuel further price increases, such as a Brexit-borne European or global economic slowdown that sends investors scurrying to safe havens. Any delays in interest rate hikes by the Federal Reserve could also bolster the yellow metal. Credit Suisse’s Global Markets team expects gold prices to rise to $1,500 per ounce by the first quarter of 2017. For the gold mining industry, it’s all just icing on a very shiny cake.

Tuesday, August 23, 2016

The Future of Work is changing. Stay ahead.

Super article

http://learnmore.economist.com/story/57ad9e19c55e9f1a609c6bb4

http://learnmore.economist.com/story/57ad9e19c55e9f1a609c6bb4

Monday, August 22, 2016

How the biggest retail traders got rich?

http://www.themultiplier.in/2016/08/how-biggest-retail-traders-got-rich.html

Friday, August 19, 2016

A tsunami of debt is building up in Tamil Nadu – and no one knows where it is headed

G Venkatasubramanian trots out some astonishing numbers.

Over the last 15 years, he and his fellow researchers at Pondicherry's French Institute have been studying debt bondage among families in 20 villages in Tamil Nadu. Half of these settlements are in the coastal district of Cuddalore, and the others are in the adjoining district of Villupuram.

Their study is throwing up some puzzling changes in how much these families borrow – and how.

In 2001, the average annual income of these families was Rs 16,000. Average debt was Rs 10,000. Come 2016, annual income has risen five-fold to Rs 80,000. Average debt, however, stands at Rs 250,000. This is a 25-fold increase.

How these families borrow has changed too. Earlier, only land-owning communities – Mudaliars, Chettiars or Reddiars – lent money. But now, said Venkatsubramanian, the Scheduled Castes are increasingly lending and borrowing among themselves. “A family will borrow Rs 50,000 and lend Rs 25,000,” he said.

At the same time, communities that once looked down upon moneylending are entering the trade. The Nadars of southern Tamil Nadu, for instance, have begun lending in central and northern parts of the state.

In other places, other changes

Other parts of Tamil Nadu are also seeing large changes in how people lend and borrow.

In a village near the town of Trichy, a nurse at a primary health centre flagged a spurt in debt-based consumption. People, she said requesting anonymity, “are buying apartments, plots, cars, all on loan. All this has started in the last ten years.”

In Trichy, bank officials talk about an informal lending boom. Businessmen with Rs 10 lakhs, said the manager at a Central Bank of India branch, “take a Rs 30 lakh loan, use Rs 20 lakh in their company and lend the remaining Rs 20 lakhs to others”.

They lend, he said, at very high rates. A Rs 50,000 loan has to be returned in 100 instalments of Rs 600 a day – an effective interest rate of 300%.

At the same time, bankers like him are seeing a weakening of credit culture. Loans without a security deposit, says the manager of a small branch outside Trichy, are seeing very high default rates. “Seventy five percent of my education portfolio is an NPA”, or non-performing asset that is in danger of seeing a default, he said.

In the fishing village of Pichavaram between Pondicherry and the tsunami-hammered town of Nagapattinam, fisherfolk are borrowing more. These loans are expensive – going as high as 5%-6% a month. The parties they borrow from have changed – government employees are among the new moneylenders here.

Picharvaram, Pondicherry, Trichy and Shivagangai – the fourth town from where Scroll.in reported for this story – are in and around Central Tamil Nadu. But secondary data like the NSSO's Situation Assessment Survey for agricultural households show that both borrowing and borrowers are rising across the state.

Why are farmers borrowing in Tamil Nadu?

The first part of the story is simple enough to understand. Neither traditional livelihoods (like farming or fishing) nor their modern alternatives (industrial labour, construction or trading) generate enough income to support families.

Take Sambath. A farmer in his early fifties, he lives in a village called Mahashivanendal near the town of Shivagangai. He has defaulted on the bank loan he took to build his house.

Many factors are to blame. Lying to the south of the Cauvery delta, these villages around Shivagangai used to get a soaking from both the southwest and the northeast monsoons. But now, one has faded and the patterns of the other are changing. The southwest, which used to account for 20% of Tamil Nadu's rainfall, was the first to go. For the last 20-25 years, “the southwest monsoon has completely failed", said Annasamy Narayanamoorthy, who heads the department of economics and rural development at Alagappa University in nearby Karaikkudi. "People do not rely on it any more.”

Now, the northeast monsoon – which supplies Tamil Nadu with 70% of its rainfall – is changing too. According to M Arjunan, a Communist Party of India (Marxist) leader in Shivagangai, the northeast monsoon used to lash this part of Tamil Nadu for three months – from September to November – each year. Then it shrank to a 60-day cycle – in October and November. Of late, Shivangangai has been seeing something even more abnormal: “Last monsoon, whenever a cyclone was announced in the Bay of Bengal, we got heavy rain. Otherwise, no rain,” he said.

This dwindling rain has affected his incomes in many ways. This part of Tamil Nadu used to harvest two crops a year – groundnuts with the southwest monsoon and paddy with the northeast. But now, fewer farmers are planting crops during the southwest monsoon.

The weakening of rains has also forced Sambath and his fellow villagers to sell livestock. He once had 50-60 goats. They have all been sold over the past two years. “When agriculture fails, livestock also fails," said Narayanamoorthy of Alagappa University. "Without the crop residue, you cannot keep buffaloes.”

Even with paddy, yields have fallen. At one time, said Sambath, his three acres gave him 80 konis each of paddy – a koni is the local measure of weight that translates to about 66 kilos. But now, given unpredictable rains, he gets 25 konis. "The last two years have been especially bad," he said.

Even as yields fell, farmers like him have been hit by two other factors. Farm prices have not risen enough. “One kilo of raw rice should fetch Rs 16,” he said. “But the government doesn't buy and so private traders buy at Rs 12.” At the same time, expenses on inputs like urea, wage rates have kept rising.

Between falling yields, low prices and rising expenses, he has seen margins erode.

Put it all together and it's apparent that while NSSO data for Tamil Nadu shows that gross farmer incomes have climbed from Rs 24,864 in 2002-'03 to Rs 83,760 in 2012-'13, profitability has fallen. “In the 1970s, you could invest Rs 2,000 and get back Rs 3,000,” said Narayanamoorthy. "Now, you invest Rs 40,000 and you might get back Rs 43,000."

With such economics, farmers have to borrow to plant the next year's crop. This has resulted in several farmers in the state giving up on agriculture entirely. Large swathes of farmland across the state are lying fallow, or being cut into residential plots.

Take Sambath. At one time, the land around his house used to be tilled. Now, it lies fallow with clumps of the Prosopis juliflora weed growing on it. His family's annual income is around Rs 60,000 – partly the money his son sends from Dubai and the Rs 900 he gets as pension each month from a local factory where he used to work.

It's nowhere enough, he said: “Just the monthly cost of running the house is Rs 3,000.”

Why are even those outside agriculture turning to debt?

Travelling around the state, this refrain about expenses outstripping incomes comes up repeatedly. As the previous story in this series reported, fish catches have dropped so precipitously that fishermen are borrowing to buy diesel for their next fishing trip. A woman this reporter spoke to in Valgadi, a village near Trichy, said she has one child, who goes to a school where the annual fees are Rs 30,000. Both she and her husband work and have a combined salary of Rs 7,000 a month – or Rs 84,000 a year. “Families with two children are in real trouble,” she said. “Incomes are not rising. Jobs are hard to find. People are taking up work for even Rs 2,000.”

Many shopkeepers this reporter spoke to around bus-stands in the smaller towns of the state estimated their monthly earnings between Rs 4,000-Rs 5,000. Workers in industrial clusters pegged their monthly incomes between Rs 5,500 to Rs 8,000.

This is far from unique to Tamil Nadu. Over the last two decades, says S Ananth, a researcher in Vijayawada who studies India's informal economy, with incomes growing slowly, families have begun borrowing more – for education, daily needs, medical expenses, repaying old loans and housing.

This is resulting in two outcomes. First, debt is now an integral feature of some households. In neighbouring Andhra Pradesh and Telengana, he says, some families are basing as much as 50%-60% of their expenditure on borrowed money. Second, such families live so close to the margins that any shock could easily push them into indebtedness. In Sambath's case, the push came from a medical emergency – an abdominal surgery for which he had to go to a private hospital in Madurai. (The doctors in the government hospital had told him to come back later.)

This is where things take a turn. In Tamil Nadu, however, even as the need for debt was rising, cheaper debt was vanishing. Blame that on the state government.

Why did cheaper debt disappear?

For a long time, a major source of credit for poorer households in Tamil Nadu was the state government's Self Help Group programme. NGOs banded women into groups of 15 or so women, got them bank loans and monitored repayment. Over the years, the self help groups, which started with modest bank loans of Rs 20,000 to the whole group, amped up their loans to Rs 300,000.

This model ended after Jayalalitha became the chief minister in 2011. In the run-up to the previous elections, said Venkatsubramanian, “NGOs demanded the state government write off women's loans.” Stalin, the son of DMK leader K Karunanidhi, acquiesed after a meeting with 100,000 NGO leaders. His capitulation, says the researcher, underscored the power of these NGOs – “They had almost all women in the state under their ambit.”

After coming to power, Jayalalitha nationalised the self help group programme. The NGOs were turfed out. The self help groups were brought under a new structure, run by the state government in partnership with the World Bank.

The new plan left banks unenthused. In the earlier model, NGOs ensured repayment. Now, says Venkatsubramanian, with the government unwilling to provide similar comfort, bank loans to self help groups shrank.

Who are the new moneylenders?

The void was filled by new forms of formal and informal credit. At the time NGOs were active, adds Venkatsubramanian, they did not allow companies like Muthoot to enter their areas. Now, finance companies came in. In his fieldsite, Venkatsubramanian has seen Muthoot Finance and Equitas scale up their presence over the last year.

The informal market began seeing some action as well. People began borrowing from locally affluent people – those with children working abroad; the landed elite; and those with government jobs, who have assured incomes and usually a surplus too.

Agreed Narayanamoorthy, “Most teachers marry only teachers – and they have a combined monthly salary of Rs 100,000. And so they lend.”

At the same time, attracted by the high returns from informal lending, new lenders came in – like the Nadars from southern Tamil Nadu. “A group of their boys will travel north, take a room in a lodge, and start lending,” said Venkatsubramanian. "Each might lend individually out of his corpus but they share info about whom they are lending to." Calledthandal, these are peculiar loans, with no collateral. They are small in size – around Rs 5,000. The lenders make an initial deduction of Rs 500 so the loan amount is actually Rs 4,500. These need to be paid back in 100 days with daily instalments of Rs 50. This works out to a monthly interest rate of 21%. If such a loan were to run on for a year – which, as short duration loans, they don't – they rate of interest would be 78%.

Yet other people, as the bank manager in Trichy says, began borrowing from banks and lending further.

Do the new lenders do due diligence before lending?

Between these new players, Tamil Nadu is seeing an intensification of lending.

Take the microfinance companies. According to the 2015 Inclusive Finance India Report, an annual report brought out by Delhi-based Access Development Services, which monitors sectors like microfinance which lend to the poor, between 2013-'14 and 2014-'15 alone, fresh loans given by microfinance institutions in Tamil Nadu rose from Rs 4,596 crores to Rs 6,941 crores. Due diligence to ensure families did not borrow more than what they can repay doesn't seem to have kept pace.

That table shows that the size of individual loans is rising. At the same time, the resources of microfinance institutions managing the lending are growing at a fraction of the disbursement rate.

Checks and balances are similarly missing in the informal economy. In his fieldsite, Venkatsubramanian is seeing an intensification of borrowing by households. “It is not only the women who borrow," he said. "The husband and the son borrow too. And each of them borrows from different places.” A woman might, he said, borrow at her house and at her sister's house. The son might borrow at her house and at his workplace.

Along with this, there is also lending. A woman might take a loan at 3% and lend it to another at 4%. All this, says the researcher, an attempt to increase lending options, to expand lending relationships.

What does all this add up to? How much debt do these households carry? It's hard to say. Credit bureaus are useless at capturing this change. They only track formal sector loans.

The microfinance institutions do not know either. Take Equitas. Its managing director, PN Vasudevan, told Scroll.in that the firm doesn't know about the informal borrowings of the households it lends to. “We do not factor these in while making our lending plans,” he said.

This is partly because such exposure is hard to quantify, he said. In addition, this is because the microfinance model, where other group members have to pay if one member defaults, ensures repayment.

As for the informal lenders, they seek to hedge their risk by mostly making small, short-term loans – Rs 5,000 to be repaid over 100 days, for instance.

But what is not known is the cumulative debt burden on these families. An indicative answer comes from NSSO data. It suggests that, around 2013, rural families' gross annual income was Rs 83,760. Their outstanding debt, Rs 115,420.

That is gross income. What is left for repaying loans – after meeting expenses – would be a fraction of that.

How are people repaying these loans?

This explosion of debt is dramatically reordering the lives of the poor in Tamil Nadu.

For repayment, families turn to desperate measures. Some, as Sambath says, sell their land. Yet others migrate to cities seeking work. In the Thagatti panchayat of Krishnagiri, one of the poorer districts of Tamil Nadu, families have to put up ration cards as collateral. Said Bhairamma, a woman in her early fifties in an Arundhatiyar (or Scheduled Caste) colony in the panchayat, “The moneylenders collect the PDS rations and sell them in the market.”

Others tie up as bonded labour with contractors for cane farming. “A family might take as much as Rs 80,000 as advance and, then, another Rs 100 or Rs 200 per day,” said Venkatsubramanian. This converts them into seasonal migrants. And, apart from assuring them an income between January and August, it also signals creditworthiness.

It, however, can also be a vise. Having repaid the loan, the families have little to live on. And so, they borrow once more and then have to get conscripted as labour once more.

Some loans, however, are more unsustainable. The lending boom has fanned a spike in consumption. Bankers in the state observe that business is not good. Even the land markets have plateaued. Asked the official in the lead banker's office in Trichy: “But people are spending. Where are they getting the money?”

Added Venkatsubramanian, “A wedding will now cost Rs 3 lakhs-Rs 5 lakhs. Marriages now take place in wedding halls. Scooters are being given as dowry. No wedding takes place without at least 10 sovereigns of gold.”

Venkatsubramanian of the French Institute spoke about an old woman he had met. “She had no assets," he said. "And Rs 300,000 in loans. And now, she wanted to marry her daughter off at Rs 5 lakh. And she said she will not have any problem. She will get money two weeks before the wedding.”

But if that is the case, aren't lenders baulking? Evidently not. Lending to someone at 5% a month translates to an annual return of 60%. The lenders keep coming.

Is Tamil Nadu heading towards a sub-prime crisis?

All this is uncomfortably similar to the 2010 Microfinance crisis in Andhra Pradesh.

By 2010, loan penetration among poor households by microfinance companies had reached an astounding 910% – poor households in the state had nine microfinance loans apiece. To repay earlier loans, households were borrowing anew and getting more and more indebted.

Matters came to a head in the middle of 2010 when Andhra saw anabrupt statewide default. Similar questions need to be asked about Tamil Nadu's debt boom. Given their interest rates – and unregulated lending –how sustainable are these loans?

Signs of distress are already visible. Borrowers are defaulting on bank loans, which cannot harass clients the way the informal economy or microfinance institutions can. Sambath, for instance, has not made his house loan repayments for the last 18 months.

This cycle will continue, says MS Sriram, IIM Bangalore professor and a rural finance expert, till there is a political resolution. “A local politician might notice people are struggling to pay and pick this up as an issue," he said. "Which is when there will be a mass default.”

At that time, a great many people in Tamil Nadu – not just the banks – will lose a lot of money.

Nifty

We did not give trading figures for nifty yesterday because the breakout or break down figures remain the same

8760 on upside and 8545 of downside on close only

Till then we recommend not to trade nifty and to go stock specific.

8760 on upside and 8545 of downside on close only

Till then we recommend not to trade nifty and to go stock specific.

Thursday, August 18, 2016

Goldman Warns ‘Supply Storm’ to Engulf Global Copper Market

A storm’s about to hit the global copper market, according to Goldman Sachs Group Inc., which forecasts that the price may slump to $4,000 a metric ton over 12 months as mine supply picks up, producers enjoy lower costs and demand growth softens.

“Company guidance and our estimates suggest that copper is entering the eye of the supply storm,” analysts including Max Layton and Yubin Fu wrote in an e-mailed report received on

Friday.

Copper has lagged gains seen in other raw materials so far this year, especially zinc and nickel, which have benefited from forecasts for global shortages. For copper, there’s been solid growth in global mine supply in the first half and that trend is expected to pick up in the coming quarters, according to Goldman.

“This ‘wall of supply’ is expected to translate into higher copper smelter and refinery charges and ultimately, higher refined-copper production, set against softening demand growth,”

Layton and Fu wrote.

Pipes and Wires

The metal used in pipes and wires has risen 3 percent this year, while zinc has surged 41 percent and nickel has advanced 21 percent. In July, Barclays Plc said supply may exceed demand every year through to 2020. The month before, Stephen Higgins, who heads Freeport-McMoRan Sales Company Inc., a division of the largest publicly traded copper miner, said more production has come on stream at a time demand growth in China has slowed.

For Goldman, the main expansion in mine supply through to the first quarter of 2017 is expected to come from the Grasberg mine in Indonesia, Escondida in Chile and Sentinel in Zambia, according to the report. Growth from Cerro Verde and Las Bambas in Peru may also contribute, it said. To gauge the outlook for supply, Goldman tracks 20 companies that account for about 60 percent of worldwide production, according to the report. These 20 raised output 5 percent on-year in the first half of 2016, and are expected to increase that to as much as 15 percent in the coming quarters, it said.

Antofagasta Plc, which owns and operates copper mines in Chile, has lost 15 percent in London over the past 12 months, while Rio Tinto Group, the mining giant that produces iron ore and aluminum as well as copper, fell 5.7 percent. In the U.S., Freeport-McMoRan Inc. has gained 13 percent in the period, aided by asset sales and other measures to reduce debt.

Wednesday, August 17, 2016

If Billionaire Oil Traders Are Right About $80 Oil, Buy This Dip

Worth a read for all crude oil traders.This article was published on 3Aug 2016 by BRYAN RICH (Opinions expressed by Forbes Contributors are their own.)

As we’ve said, oil has been quietly sliding over the past three weeks. It closed yesterday more than 20% off of the highs of the year.

And we looked at this chart and said, this divergence has hit an extreme, something has to give.

Source: Forbes Billionaire’s Portfolio, Reuters

Yesterday it was stocks. Today it was a sharp bounce in crude–up 4%. The oil “sharp bounce” scenario is the safer bet to close the gap on the chart above.

Alternatively, oil under $40 puts it in the danger zone for the global economy and broad financial market stability. With that, we had a close in the danger zone, under $40, yesterday. But it may turn out to be just a brief visit.

If we look at the longer term chart, the 200-day moving average comes in right in this $40 area ($40.67). Again, we had a close below yesterday, but a close back above the 200-day moving average today.

Sources: Forbes Billionaire’s Portfolio, TradingView

For technicians, two consecutive closes below the 200-day moving average would create some concern for this post-oil price bust recovery.

In that case, many companies in the struggling energy sector would be back on bankruptcy watch. But the global economic recovery can’t afford another bout with weaker oil prices, and the ugly baggage that comes with it (oil company defaults, which would lead to financial system instability and sovereign defaults).

Two of the best oil traders in the world billionaire hedge funders Andy Hall andPierre Andurand have said they think oil will trade to $80 by next year. Andthey’re beginning to get a lot of company (big time oil guys) with similar forecasts. Billionaire energy trader Boone Pickens, also a big oil bull who thinks we see $80 by next year, recently interviewed the former President of Shell Oil, John Hofmeister.

Hofmeister thinks all of the drilling and production shutdowns and layoffs will soon drain the oil surplus, and give way to a sudden surge in oil prices, while oilcompanies scurry to hire up and reverse course on the retrenchment that’s taken place across the industry. He thinks we see $80 oil this year.

If the best billionaire oil traders in the world are right about oil, and we see $80 in the next year, this dip is a great buying opportunity (for the underlying commodity and energy stocks).

Tomorrow, we hear from the Bank of England. The expectations are that the BOE will cut rates to support economic activity in the face of Brexit uncertainty. But there’s also a decent bet being wagered that the BOE will return to QE, a second post-global financial crisis bond buying program. History tells us that, in this environment, central banks like to save bullets for the moments when crisis and fear is peaking. With that, the BOE may disappoint tomorrow. If so, it could pour some gas on the nascent rise in market rates that started yesterday in Japanese, German and American ten-year yields.

Subscribe to:

Posts (Atom)