Once the wildest of emerging markets, Thailand is ageing fast. Its economic policymakers need to change course

TWENTY years ago Thailand was the most torrid of emerging markets. After a spell of overheated growth and wide current-account deficits, it had exhausted its foreign-exchange reserves and lost its currency’s peg to the dollar. In the aftermath, inflation approached 10% and the Bank of Thailand (BoT) struggled to restore confidence in the baht. In a widely cited paper by Romain Rancière of the University of Southern California and two co-authors, Thailand was used as a stark illustration that dynamism and danger, fast growth and occasional crises, went hand in hand.

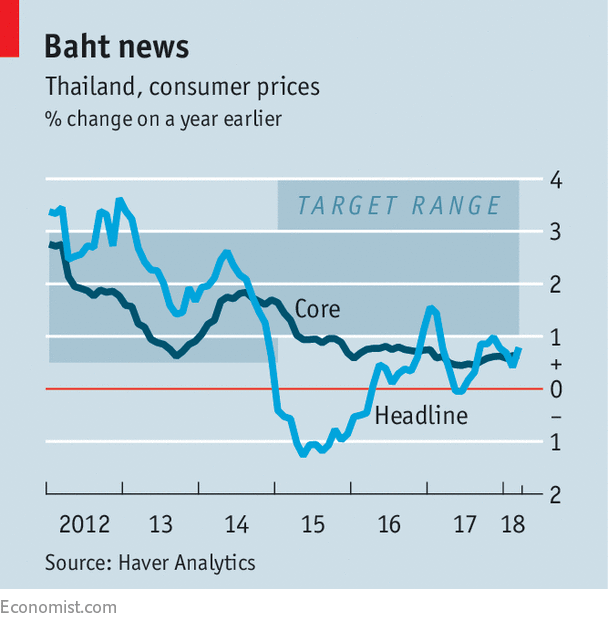

A few of today’s emerging markets can still set the pulse racing—Turkey, for example, has combined breakneck growth with double-digit inflation and a worrying slide in the lira. But Thailand is not one of them. Private investment expanded by only 1.7% last year. Thailand’s sovereign bonds yield less than America’s. Inflation is once again a worry, not because it is too high, but because it is so stubbornly low. Consumer prices rose by only 0.8% in March, according to figures released this week. Inflation has remained below the BoT’s target range of 1-4% for 13 months in a row. Core inflation, excluding raw food and energy, has been below 1% for almost three years.

“It’s Japan,” says one veteran observer of Thailand’s economy. “It’s got Japan’s demographics from 25 years ago, [and] it’s on the Japanese path of zero inflation, very low interest rates and a big current-account surplus.” By 2022 Thailand will be the first developing country to become an “aged” society, according to the BoT, with more than 14% of its population over 65. The proportion of elderly is rising faster in Thailand than in China.

But a grey future is no excuse for a sedentary present. Thailand’s demography should instead impart a sense of economic urgency. The country should be investing in infrastructure and machinery to ensure that tomorrow’s smaller workforce is well equipped to provide for a large population of pensioners.

Unfortunately, Thailand’s economic policymakers also exhibit some of the macroeconomic passivity that once paralysed Japan. The BoT has not cut interest rates since April 2015. At the BoT’s most recent meeting one member even voted for an increase, lest people grow too accustomed to easy finance.

This conservatism runs deep. The BoT was founded in 1942, shortly before wartime hyperinflation that left a lasting impression on Thai policymakers. The central bank’s first governor liked to cite Weimar Germany as an example of what could go wrong if price stability were neglected. The bank’s longest-serving boss, Puey Ungphakorn, believed that the money supply should not, as a rule, grow more than two to three percentage points faster than GDP. “In his view, economic stability was more desirable than rapid growth,” write Peter Warr and Bhanupong Nidhiprabha in “Thailand’s Macroeconomic Miracle”, published in 1996.

Thailand might be worried about America’s response to further monetary easing, which would help reverse the baht’s recent strength. America will decide this month whether to label any of its trading partners “currency manipulators”. Thailand is the only country in Asia that meets all three of its criteria (a $20bn trade surplus with America, a big current-account surplus overall and sizeable reserve accumulation), points out Capital Economics, a consultancy. But Thailand is probably too small to attract much interest, let alone ire, from Washington.

In the absence of monetary easing, Thailand must rely on more expansive fiscal policy. Unfortunately public investment, which shrank by 1.2% last year, has been beset by backtracking and delays. Only in December did workers break ground on a long-awaited high-speed rail project linking Thailand, Laos and China.

Thailand is also moving a little closer to Japan in its growing antipathy to immigration. The government last year imposed tough penalties on illegal migrants, many of them from Vietnam and Myanmar, who are viewed as stealing jobs, not rejuvenating an ageing workforce.

Thailand is keener to import spenders. Receipts from foreign tourists rose by 11.7% in 2017, boosting growth against a backdrop of weak domestic demand. The country is justly famous for sparkling beaches, pulsating nightlife and beguiling culture. Now the tourism authority wants visitors to discover its “new shades”. In economics, Thailand’s new shades are rather drab.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.