You need to own gold, and you need to own shares in companies that find and mine it. I’ll lay out seven reasons below in what I’m calling the “Seven Pillars of Gold.”

There’s some overlap between each of the pillars. In fact, it’s fair to say that many of the reasons to own gold actually segue back and forth, bumping into each other. But it’s possible to lay out seven distinct ideas. Here they are:

Pillar One:

Oil prices are rising. Doubtless, you’ve noticed it if you’ve filled the fuel tank in your car with gasoline in the past nine months. From 2015 to late 2017, we enjoyed a three-year respite from the olden days of $100 oil, but now oil has decided to get up off the mat. From a price in the $40 range a mere six months ago, we’re now into the $70s per barrel, and higher prices are forecast. Of course, oil means energy, which means that higher oil costs will translate into higher prices for just about everything, not just at the fuel pump.

More costly energy will be a core component of inflation throughout the economy. That is, it will cost more to drive your car, for farmers to grow food, truckers to transport that food, for businesses to buy supplies ranging from paint to roofing shingles. That, and it will cost more to move all the other goods that support the economy. You know that cost is always “passed along” to us, the consumer. That kind of “energy-based inflation” is nearly unconstrained.

Indeed, energy-based inflation will eventually work its way all through the economy. Rising energy costs are a type of inflation that we saw in the mid-2000s, during oil’s previous run-up to $130 per barrel in 2008. Then, though, energy costs were squashed by “importing deflation” from low-priced overseas goods. But that trick has played out. Americans haven’t experienced gut-ripping energy-based inflation in perhaps two generations, since the late 1970s and early 1980s. But when higher oil prices really pull into port, the ripple effect of inflation across every part of the economy will weaken the dollar’s purchasing power. We’ll see it in higher gold prices.

Pillar Two:

Interest rates are rising. According to the Congressional Budget Office (CBO), interest on the national debt is among the fastest-growing parts of the federal budget. In fact, by 2028 — just 10 years from now — the federal budget will spend more on interest payments (about $1 trillion per year) than on defense (currently about $800 billion total). Rising interest rates will crowd out most everything else in the federal budget, from defense to air traffic control to national parks. The budget money just won’t be there, because so much will go to pay interest. The only workarounds for Congress are less spending (ha!) or just open the spigots and roll with higher annual budget deficits.

Any way you cut it, the dollar — and the Federal Reserve’s unique powers of “money creation” — will surely be in play to wallpaper this mess. Again, we’ll see reduced purchasing power and higher gold prices.

Pillar Three:

The petro-yuan. China has begun trading for oil in yuan launching its so-called “petro-yuan.”. Here are the facts. China is working hard to abandon the dollar as an instrument with which to pay for oil. It’ll use its own currency, the yuan, where and when possible. Currently, China’s petro-yuan contracts are what are called “long-dated,” meaning they commence in September 2018. (Four months is “long” if you’re trading.) In this respect, the Chinese are taking things slowly at first; no surprises.

China’s ultimate goal is to convince Saudi Arabia — one of China’s top three oil suppliers — to take yuan in exchange for oil and thus to abandon the 45-year link of Saudi oil to the petrodollar. If the globally dollarized oil trade takes a hit, it means many more bad things for the purchasing power of those “dead presidents” in your wallet or bank account.

Here’s the good news in all this. If you understand the implications, you are already several months ahead of the broad market on this. You have time to buy in on gold and miners. The entire setup is overall favorable for gold.

Pillar Four:

Currency wars. We’re already in the midst of “currency wars,” along the lines of what Jim discussed in his 2010 book of that title, available here. We see daily skirmishes in this war. That is, the war is being fought via oddball valuations for trades like dollar-yuan, dollar-ruble and such. In fact Iran’s national currency all but collapsed. Why?

These types of monetary competitions are built around the very real understanding that nuclear-armed nations cannot afford to fight old-fashioned kinetic wars with each other. No battleships and bombers, but large, powerful nations can still play other games such as cyberwar and attacks on the other nation’s currency.

The currency war idea is ripe to hatch in the sense that Russia and China (among others) have accumulated immense amounts of gold over the past decade or so. Russia in particular is quite transparent about its national gold reserves, and Russian spokespeople make no secret that the gold is intended as a defense against dollar hegemony. We’ve visited this idea many times here in Gold Speculator, such as here and here.

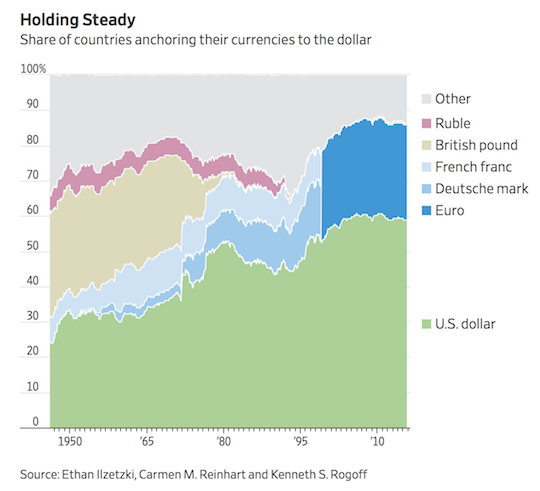

One of Jim’s theses in Currency Wars is that Russia and China could team up to combine their respective gold resources and create a rival currency to the dollar. If the world trading system had an alternative to the dollar, it’s hard to imagine that the scenario would favor the U.S. dollar. Usage would likely decline to some level from decades past, along the lines of the chart below.

In other words, per this chart, the dollar has had a run-up in its percentage of world trade over the past 45 years. Looking ahead, if the dollar loses even some of its status as the world’s “reserve currency,” we should definitely expect to see its value decline and gold prices to increase.

Pillar Five:

Tariffs, sanctions and potential trade wars. With global trade, it’s fair to say that everything is related to everything else. Lay a higher tariff on Chinese steel and China taxes U.S. soybeans. Ban exports of high-tech chips to China and China might ban exports of rare-earth magnetic powders to the U.S.

The “era of dollar supremacy is fast ending. We no longer live in a unipolar, post-Cold War world in which the U.S. reigns supreme.” Indeed, to a large degree, the U.S. owes its current global economic and political dominance to a unique, near-accidental correlation of forces at the end of World War II in 1945. It’s a long story. The short version is that the most destructive war in human history created the greatest economic engine that the world has ever seen. Post war, the U.S. was like the proverbial phoenix rising out of the ashes. It’s a massive, complex historical process, of course, but the point to keep in mind is that the postwar world — certainly that world for the U.S. — is coming to the end of its long, 73-year run.

In other words, we’re living through the decline of the U.S.-dominated globe. Other nations, and even entire regions of the rest of the world, are rising, new phoenixes from their own beds of ash. America’s share of global wealth is shrinking. By some estimates, the United States accounted for roughly 50% of global output at the end of World War II… It has fallen to 15.1% today.

Now President Trump is using tariffs, taxes, sanctions and policy changes to try to rearrange the global trading dynamic. But global trade has evolved over the past four generations. Trump may or may not succeed in his quest to rearrange the elements of the U.S. economy, to “Make America Great Again.” But if our nation is going to get into a trade war, you better have some gold in the vault..

Pillar Six:

War. We’re living in a time of risky geopolitics, right at the edge of true war. Wars cost much “silver,” as the ancient Chinese scholar Sun Tzu once noted. As he wrote, “if the campaign is protracted, the resources of the State will not be equal to the strain.”

Now, consider the global scale of current saber-rattling, from the Baltics to the Black Sea, from the Persian Gulf to the South China Sea, Korea and more. If you read the news, every one of these places ought to be familiar worrisome names. More specifically, consider how NATO has expanded right against Russia, drawing wrath from the latter. Or think about Ukraine, where recent fighting has killed tens of thousands of soldiers and civilians. I barely need mention the Middle East, from Libya to Syria to Afghanistan.

It’s fair to say that U.S. forces are already “fighting” against Russians, in a manner of speaking, via full-fledged electronic warfare in the skies over Syria. Meanwhile, on the other side of the globe, The National Interest reports that Adm. Philip Davidson, leader of the U.S. Pacific Command, says, “China has already taken control of the South China Sea.”

So the short point is that we’re living in a world that’s quite close to real war, not just “currency wars.” And gold prices tend to spike on rumors of war, let alone when the shooting begins. One way or another — near-war, fight a war, win a war or especially when a side “loses” a war — it’s not good for the dollar. Come war, and rumor of war, we’ll see the value of dollars decline and gold prices increase.

Pillar Seven:

Peak gold. In a world where demand for gold is likely to rise for a wide variety of reasons, there will be less of it available to buy. Longstanding problems with new gold discovery — namely, that fewer companies are spending the kind of funds required to make big impacts. The lack of investment and how large companies are spending big bucks simply to stand still in terms of output. Even large gold miners are actively planning to shrink output to focus on profitability.

We’re “there,” at the peak of gold production, for a while to come, barring some sort of technical revolution — which might happen, but we’re not there yet. When I look at the landscape for gold, I see the results of the lack of past exploration and development, and in consequence, few new mines coming online. Main line producers high-graded in years past to make numbers look good, and now they’re paying the price.

It’s accurate to say that gold output globally has plateaued just now; it’s likely declining in years to come. The result will be higher prices for gold and for companies that mine it.

So there you have it: Seven Pillars of Gold. Seven reasons why gold prices are geared to rise, benefiting metal owners and well-run miners that can pull yellow metal out of the ground.

Gold price has been dammed up for a while, via all manner of manipulations. But that golden dam is ready to break. All the debt, the bad policy, the war dangers, the lack of investment and new output… It’s a prime setup for buying power to rush into the precious metal space.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.