In practice, it is surprisingly hard

Jesse livermore earned his reputation as a talented speculator by pocketing a tidy sum during the Panic of 1907. Mindful that a scarcity of credit and a giddy stockmarket were a dangerous mix, he began to sell stocks short that autumn. When share prices crashed on October 24th, Livermore was up by $1m ($27m in today’s money). He then changed course. He started to buy stocks, which were now a lot cheaper. The market rallied. By the end of the year Livermore had made $3m.

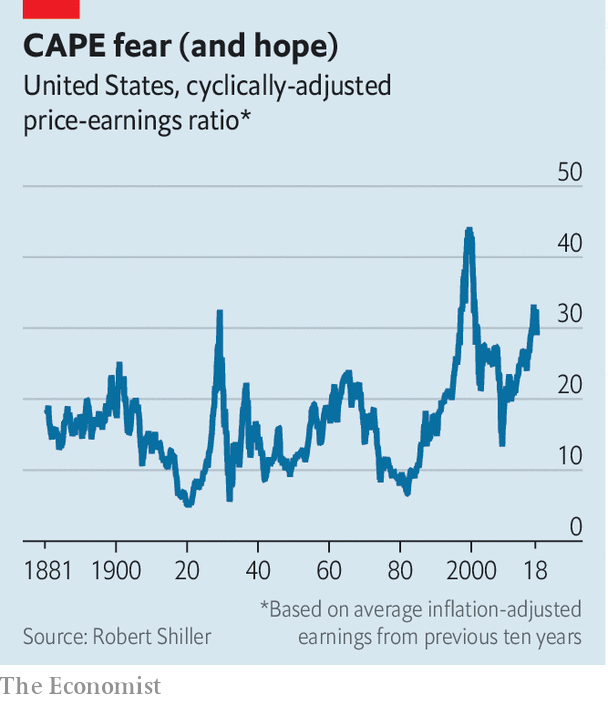

Anyone who has ever invested in stocks has at one time fancied that they can time the market as exquisitely as Livermore did. Very often, they hope that a benchmark of fair value, such as the cyclically-adjusted price-earnings ratio, or cape, will be their guide. History shows that when stock prices rise a lot faster than profits—as they did in the 1920s, 1960s and 1990s—they tend subsequently to fall back (see chart). So the market-timer will sell when the cape is high and buy them back when it is low.

It seems simple. In practice, it is surprisingly hard to use valuation gauges to time the market. Investors who try often sell far too early. As a consequence, they miss out on some of the richest returns. Selling stocks when everyone is still buying may actually be the easy bit. It is harder to find the nerve to buy stocks when others are selling them in a panic.

The purist view is that market timing is a mug’s game. It says stocks are a random walk: their past indicates nothing about their future path. In the 1980s academics questioned this creed. Since stock prices tend to revert to a mean value, they must be somewhat predictable. They deviate from this fair value only because investors over-react to news. When profits are strong and stocks are rising, there will be keen buyers almost regardless of value. The reverse is true in recessions. This herding—or, if you prefer, this rational pricing of risk—creates the opportunity for market timing.

There is a drawback. What is “cheap” or “dear” is defined by reference to the full history of prices. But an investor active in any period could not have known this in advance. Nor is it obvious at the time whether the cape is close to a peak or trough. Without the benefit of hindsight, timing produces disappointing results.

A study in 2017 by Cliff Asness, Antti Ilmanen and Thomas Maloney of aqr Capital Management tested a timing strategy. Their gauge was a rolling 60-year average of the cape. When the cape was below its historical median—that is, below fair value—the strategy would borrow to buy stocks. When it was above fair value, it would lighten up on stocks in favour of cash. Over the whole period (1900-2015), returns to the market-timing strategy were scarcely better than to a buy-and-hold portfolio with a constant 100% stockholding. And over the latter half (1958-2015), returns were no better at all.

A big failing was that the strategy was under-invested in stocks for too much of the time. The average cape has trended upwards since the 1950s. Too often stocks were deemed dear based on historical valuations. Timing works no better in countries other than America. A study in 2013 by three academics, Elroy Dimson, Paul Marsh and Mike Staunton, found no consistent link between valuation and subsequent returns in 23 stockmarkets.

Value is too weak a signal to be much use. But it can be improved upon. The aqr researchers found that combining the value benchmark with a “momentum” signal of the underlying trend in stock prices yields better results. This is intuitive. The problem with value benchmarks is that prices drift away from them for long periods. But a blend of value and momentum represents “value with a catalyst”, as the authors put it.

This strategy is too complex for ordinary investors to profit reliably from it. But there is a simpler form of market timing, which has some empirical support: rebalancing. It requires investors to decide first how they want to divide their investments. It could be, say, an equal split between American and non-American stocks. The precise weights matter less than that they are stuck to. That requires regular rebalancing to restore the original weights. It means shedding assets that have risen a lot in favour of those that have gone up by less.

The virtue of rebalancing is that it is simple. You are less likely to make a costly mistake than if you follow a more complex strategy. The drawback is that you must give up the delusion that you can time it like Livermore. To do what he did takes nerve and a rare feel for markets. You may think you have such talents. You almost certainly don’t.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.