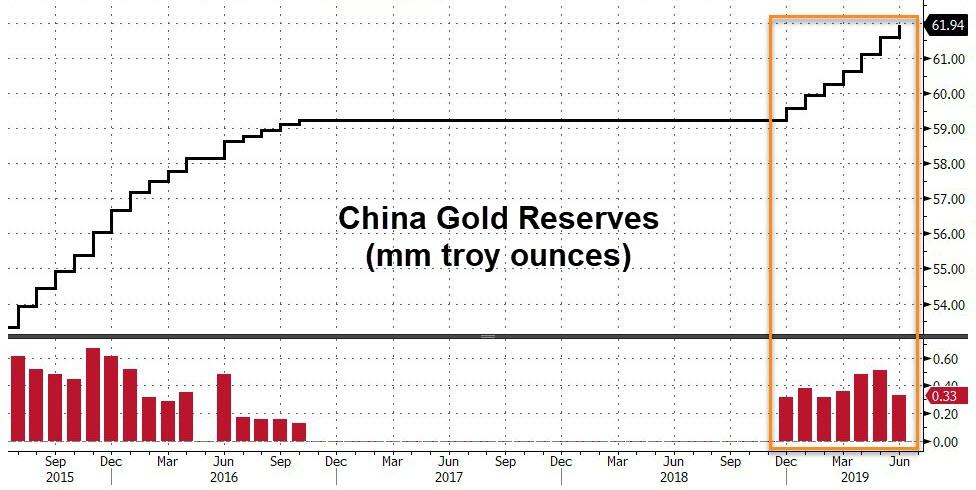

China continued its renewed (public) gold-buying spree in May adding another 10 tons of the precious metal to its reserve - the seventh month of buying in a row.

“It’s a diversification away from the U.S. dollar, particularly given the trade tensions and the potential technology cold war that’s evolving,” said Bart Melek, global head of commodity strategy at TD Securities.“We have to remember that gold is nobody’s liability.”

While this figure is hotly contested as being an underestimate of Chinese State’s actual gold holdings, its the only figure available, and whatever the real number, its notable that the Chinese government has revived the trend of announcing physical gold purchases each and every month.

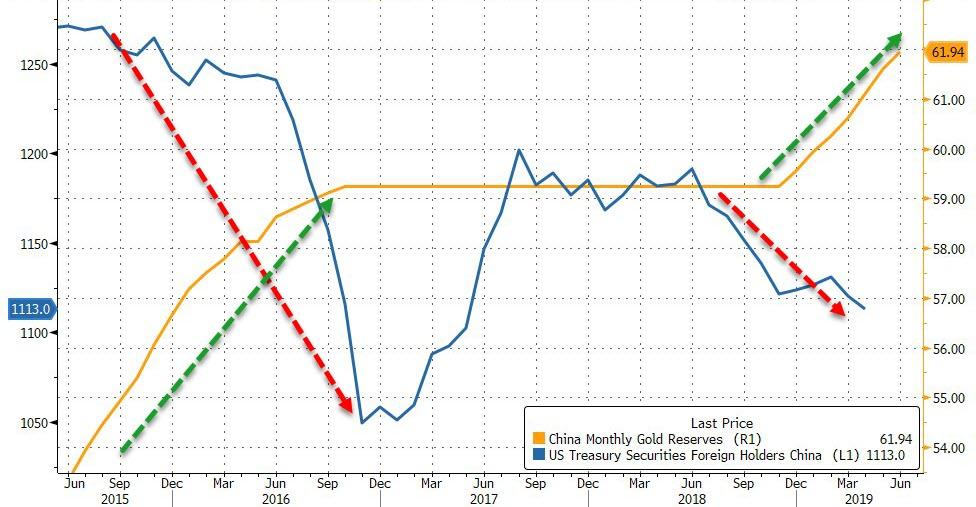

“Given the U.S.-China tensions, it is little surprise that China is attempting to diversify away its holdings of the dollar and Treasuries,” Howie Lee, an economist at Oversea-Chinese Banking Corp. in Singapore, said in an email, adding that it’s likely to continue adding in the coming months as its reserve holdings still lag countries such as the U.S. and Germany.“Aside from its attempt to diversify its holdings of dollars, owning more gold reserves is also an important strategy in China’s rise as a superpower,” Lee said.

The People’s Bank of China raised reserves to 61.94 million ounces in June from 61.61 million a month earlier, according to data on its website on Monday. In tonnage terms, last month’s inflow was 10.3 tons, following the addition of almost 74 tons in the six months through May.

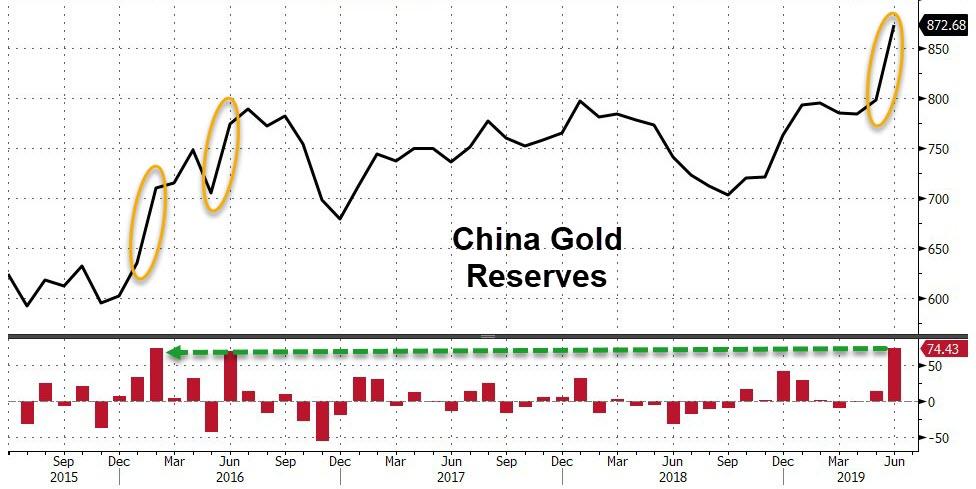

In fact, thanks in larger part to the surge in gold prices in the last month, the value of China's gold reserves rose by the most in at least 4 years...

Pointedly this occurred as the trade war erupted and China 'allowed' the yuan to devalue against the dollar...

As Bloomberg previously reported, the rise in reserves reflects the government’s “determined diversification” away from dollar assets, Argonaut Securities (Asia) Ltd. analyst Helen Lau said, adding that retail demand has also picked up. At this rate of accumulation, China could buy 150 tons in 2019, according to Lau.

One wonders if Alasdair Macleod is on to something when he notes that if the yuan is to replace the dollar for China's trade, officials will have to back it with gold...

It is hard to see how the US can match a sound-money plan from China. Furthermore, the US Government’s finances are already in very poor shape and a return to sound money would require a reduction in government spending that all observers can agree is politically impossible. This is not a problem the Chinese government faces, and the purpose of a gold-linked jumbo bond is not so much to raise funds; rather it is to seal a price relationship between the yuan and gold.Whether China implements the plan suggested herein or not, one thing is for sure: the next credit crisis will happen, and it will have a major impact on all nations operating with fiat money systems. The interest rate question, because of the mountains of debt owed by governments and consumers, will have to be addressed, with nearly all Western economies irretrievably ensnared in a debt trap. The hurdles faced in moving to a sound monetary policy appear to be simply too daunting to be addressed.Ultimately, a return to sound money is a solution that will do less damage than fiat currencies losing their purchasing power at an accelerating pace. Think Venezuela, and how sound money would solve her problems. But that path is blocked by a sink-hole that threatens to swallow up whole governments. Trying to buy time by throwing yet more money at an economy suffering a credit crisis will only destroy the currency. The tactic worked during the Lehman crisis, but it was a close-run thing. It is unlikely to work again.Because China’s economy has had its debt expansion of the last ten years mostly aimed at production, if she fails to act soon she faces an old-fashioned slump with industries going bust and unemployment rocketing. China offers very limited welfare, and without Maoist-style suppression, faces the prospect of not only the state’s plans going awry, but discontent and rebellion developing among the masses.For China, a gold-exchange yuan standard is now the only way out. She will also need to firmly deny what Western universities have been teaching her brightest students. But if she acts early and decisively, China will be the one left standing when the dust settles, and the rest of us in our fiat-financed welfare states will left chewing the dirt of our unsound currencies.

Is China's "signal" an explicit warning of the end to the dollar era that has existed since August 1971, when gold as the ultimate money was driven out of the monetary system.

Now that's a trend that is nobody's friend.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.