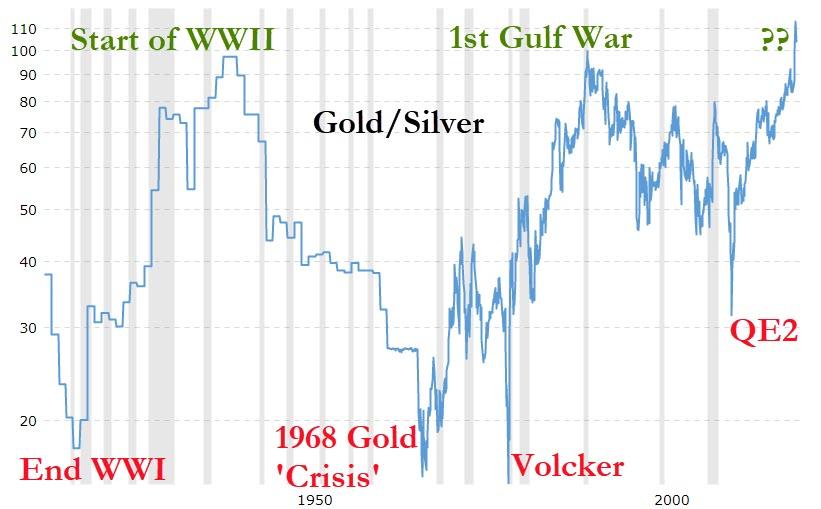

There’s a debate in gold bug circles over whether the price difference between gold and silver – the gold/silver ratio – tells us anything useful.

Some skeptics, for instance, view the original gold/silver ratio of 15 - from America’s 18th century bi-metallic system – as just a political number pulled more-or-less out of thin air by Alexander Hamilton and therefore useless today. Others note that gold is a purely monetary metal and silver is part industrial, part monetary, and conclude that it’s apples to oranges - and therefore not an indicator of future prices.

Both points are factually defensible, sort of. But they’re also irrelevant. The real reason the gold/silver ratio has tended to fluctuate within a broad but well-defined range is that humans have a vivid visual imagination.

Here’s how it works:

Early in a precious metals bull market, people are skeptical of the need for safe-haven assets, so the money that flows into the sector goes mostly to the big-name, super-safe choice, which is gold. Gold goes up relative to silver, and the gold/silver ratio expands.

Gold keeps rising and new money – much of it attracted by the metal’s newfound price momentum rather than an understanding of the nature of money – flows in, pushing gold even higher.

The early gold investors register big gains and begin to feel smart and therefore more willing to take on a bit of extra risk in return for potentially even bigger gains. They look around for “the next gold” and find silver, the other monetary metal, languishing at a relatively low price.

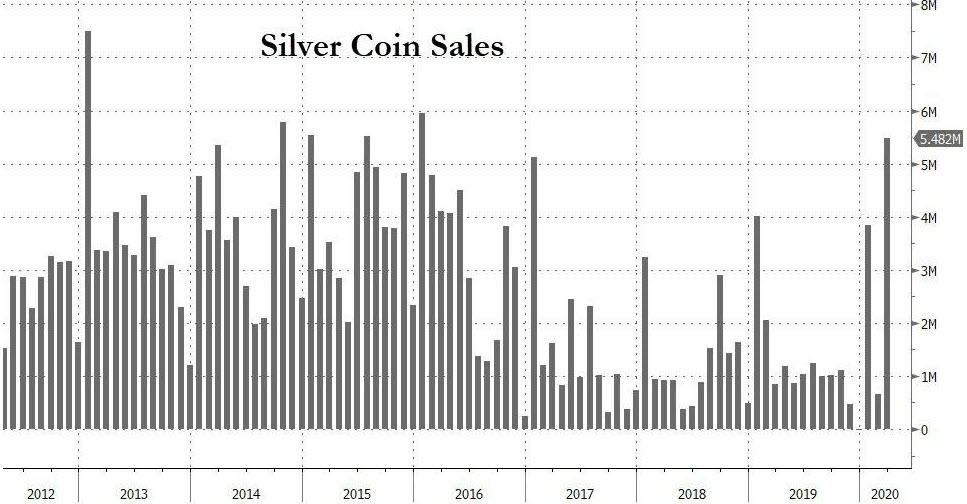

Then they start thinking in images. First, they picture a single one-ounce gold coin and consider what it would cost. At gold’s new, higher price, this seems like a lot of money for such a small, though admittedly pretty, thing.

Next, they consider the price of silver and envision how many – also very pretty – one-ounce coins they can buy for the price of a single ounce of gold. And their imagination conjures up something like this:

Suddenly, silver looks extremely cheap. For the price of a single Gold Eagle, one can get two heaping handfuls of shiny, heavy silver ounces.

A bit more consideration reveals that in a SHTF scenario, silver coins are actually more useful than gold because their smaller denominations allow them to function as $20 bills rather than gold’s illiquid $1,000 +. You can buy groceries and bullets with silver coins.

Suddenly aware of silver’s advantages, investors conclude that at current relative prices, the choice is a no-brainer. Silver is the precious metal to load up on.

Adjust this thought process for the global pandemic’s distortion of most markets and convert it into a chart, and you get the past two months’ gold/silver ratio, which depicts a bout of hair-on-fire panic followed by a trend back towards traditional norms:

So what happens now? Historically, both precious metals keep rising, with silver rising faster than gold until the imagined pile of silver required to buy a single ounce of gold looks something like this:

Then the process shifts into reverse, with a single gold coin looking better in the mind’s eye than a paltry few bits of silver.

We are nowhere near that point, so expect investor imaginations to work in silver’s favor for years to come.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.