There is something rotten in the state of Denmark. And we are not talking just about the hapless socialist utopia on the Jutland Peninsula——even if it does strip assets from homeless refugees, charge savers 75 basis points for the deposit privilege and allocate nearly 60% of its GDP to the Welfare State and its untoward ministrations.

In fact, the rot is planetary. There is unaccountable, implausible, whacko-world stuff going on everywhere, but the frightful part is that most of it goes unremarked or is viewed as par for the course by the mainstream narrative.

The topic at hand is the looming implosion of China’s Red Ponzi; and, more specifically, the preposterous Wall Street/Washington assumption that it’s just another really big economy that overdid the “growth” thing and is now looking to Beijing’s firm hand to effect a smooth transition. That is, an orderly migration from a manufacturing, export and fixed investment boom-land to a pleasant new regime of shopping, motoring, and mass consumption.

Would that it could. But China is not a $10 trillion growth miracle with transition challenges; it is a quasi-totalitarian nation gone mad digging, building, borrowing, spending and speculating in a magnitude that has no historical parallel.

So doing, It has fashioned itself into an incendiary volcano of unpayable debt and wasteful, crazy-ass overinvestment in everything. It cannot be slowed, stabilized or transitioned by edicts and new plans from the comrades in Beijing. It is the greatest economic trainwreck in human history barreling toward a bridgeless chasm.

And that proposition makes all the difference in the world. If China goes down hard the global economy cannot avoid a thundering financial and macroeconomic dislocation. And not just because China accounts for 17% of the world’s $80 trillion of GDP or that it has been the planet’s growth engine most of this century.

In fact, China is the rotten epicenter of the world’s two decade long plunge into an immense central bank fostered monetary fraud and credit explosion that has deformed and destabilized the very warp and woof of the global economy. But in China the financial madness has gone to a unfathomable extreme because in the early 1990s a desperate oligarchy of despots with machine guns discovered a better means to rule. That is, the printing press in the basement of the PBOC—-and just in the nick of time (for them).

Print they did. Buying in dollars, euros and other currencies hand-over-fist in order to peg their own money and lubricate Mr. Deng’s export factories, the PBOC expanded its balance sheet from $40 billion to $4 trillion during the course of a mere two decades. There is nothing like that in the history of central banking—–nor even in economists’ most febrile imagings about its possibilities.

The PBOC’s red hot printing press, in turn, emitted high-powered credit fuel. In the mid-1990s China had about $500 billion of public and private credit outstanding—hardly 1.0X its rickety GDP. Today that number is $30 trillion or even more.

Yet nothing in this economic world, or the next, can grow at 60X in only 20 years and live to tell about it. Most especially, not in a system built on a tissue of top-down edicts, illusions, lies and impossibilities, and which sports not even a semblance of financial discipline, political accountability or free public speech.

To wit, China is a witches brew of Keynes and Lenin. It’s the financial tempest which will slam the world’s great bloated edifice of central bank fostered faux prosperity.

So the right approach to the horrible danger at hand is not to dissect the pronouncements of Beijing in the manner of the old Kremlinologists. The occupants of the latter were destined to fail in the long run, but they at least knew what they were doing tactically in the here and now; it was worth the time to parse their word clouds and seating arrangements at state meetings.

By contrast, and not to mix a metaphor, the Red Suzerains of Beijing have built a Potemkin Village. But they actually believe its real because they do not have even a passing acquaintanceship with the requisites and routines of a real capitalist economy.

Ever since the aging oligarch(s) who run China were delivered from Mao’s hideous dystopia by Mr. Deng’s chance discovery of printing press prosperity, they have lived in an ever expanding bubble that is so economically unreal that it would make the Truman Show envious. Any rulers with even a modicum of economic literacy would have recognized long ago that the Chinese economy is booby-trapped everywhere with waste, excess and unsustainability.

Here is but one example. Somewhere near Shanghai some credit-crazed developers built a replica of the Pentagon on 100 acres of land. This was not intended as a build-to-lease deal with the PLA (People’s Liberation Army); its a shopping mall that apparently has no tenants and no customers!

One of the more accurate things I have ever said is that the USA’s Pentagon was built on a swampland of waste. That is, I do take my anti-statist viewpoint seriously and therefore firmly believe that the Warfare State is every bit as prone to mission creep and the prodigious waste of societal resources as is the Welfare State and the bailout breeding backrooms of Washington.

But our Pentagon at least has a public purpose and would return some benefit to society were its mission shrunk to honestly defending the homeland. By contrast, China’s “Pentagon” gives waste an altogether new definition.

Projects like the above—–and China is crawling with them—–are a screaming marker of an economic doomsday machine. They bespoke an inherently unsustainable and unstable simulacrum of capitalism where the purpose of credit is to fund state mandated GDP quota’s, not finance efficient investments with calculable risks and returns.

Accordingly, the outward forms of capitalism are belied by the substance of statist control and central planning. For example, there is no legitimate banking system in China—just giant state bureaus which are effectively run by party operatives.

Their modus operandi amounts to parceling out quotas for national GDP and credit growth from the top, and then water-falling them down a vast chain of command to the counties, townships and villages below. There have never been any legitimate financial prices in China—all interest rates and FX rates have been pegged and regulated to the decimal point; nor has there ever been any honest financial accounting either—-loans have been perpetual options to extend and pretend.

And, needless to say, there is no system of financial discipline based on contract law. China’s GDP has grown by $10 trillion dollars during this century alone——-that is, there has been a boom across the land that makes the California gold rush appear pastoral by comparison. Yet in all that frenzied prospecting there have been almost no mistakes, busted camps, empty pans or even personal bankruptcies. When something has occasionally gone wrong with an “investment” the prospectors have gathered in noisy crowds on the streets and pounded their pans for relief—-a courtesy that the regime has invariably granted.

Indeed, the Red Ponzi makes Wall Street look like an ethical improvement society. Developers there built an entire $50 billion replica of Manhattan Island near the port city of Tianjin—– complete with its own Rockefeller Center and Twin Towers—– but have neglected to tell investors that no one lives there. Not even bankers!

Stated differently, even at the peak of recent financial bubbles in London, NYC, Miami or Houston they did not build such monuments to sheer economic waste and capital destruction. But just consider the case of China’s mammoth steel industry.

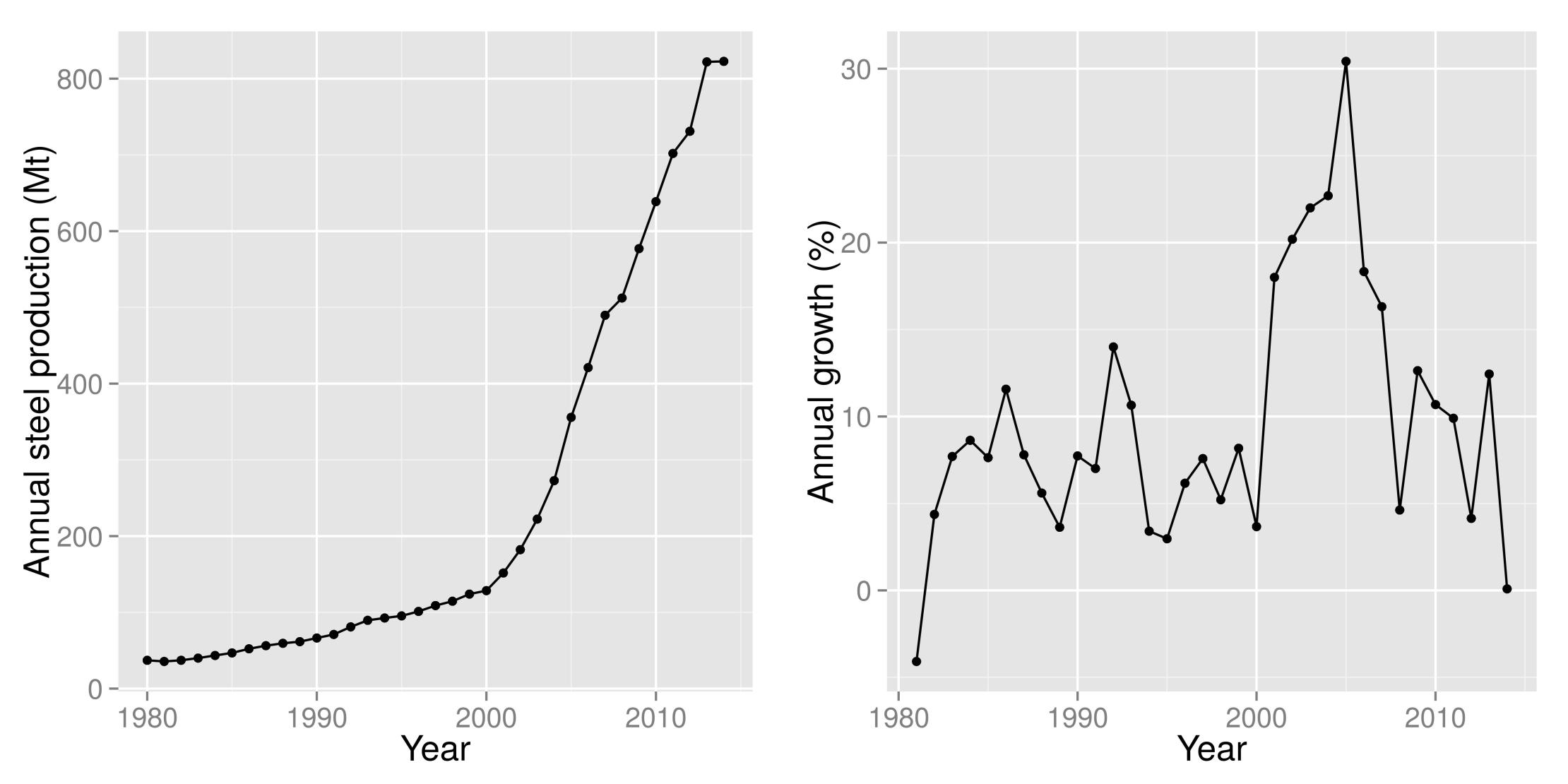

It grew from about 70 million tons of production in the early 1990s to 825 million tons in 2014. Beyond that, it is the capacity build-out behind the chart below which tells the full story. To wit, Beijing’s tsunami of cheap credit enabled China’s state-owned steel companies to build new capacity at an even more fevered pace than the breakneck growth of annual production. Consequently, annual crude steel capacity now stands at nearly 1.2 billion tons, and nearly all of that capacity—-about 65% of the world total—— was built in the last ten years.

Needless to say, it’s a sheer impossibility to expand efficiently the heaviest of heavy industries by 17X in a quarter century.

This means that China’s aberrationally massive steel industry expansion created a significant increment of demand for plate, structural and other steel shapes that go into blast furnaces, BOF works, rolling mills, fabrication plants, iron ore loading and storage facilities, as well as into plate and other steel products for shipyards where new bulk carriers were built and into the massive equipment and infrastructure used at the iron ore mines and ports.

That is to say, the Chinese steel industry has been chasing its own tail, but the merry-go-round has now stopped. For the first time in three decades, steel production will be down 2-3% from 2014’s peak of 825 million tons and is projected to drop to 750 million tons next year, even by the lights of the China miracle believers.

The fact is, China will be lucky to have 500 million tons of true sell-through demand—-that is, on-going domestic demand for sheet steel to go into cars and appliances and rebar into replacement construction once the current pyramid building binge finally expires—- or just 40% of its massive investment.

And it is also already evident that it will not be in a position to dump its massive surplus on the rest of the world. Already trade barriers against last year’s 110 million tons of exports are being thrown up in Europe, North America, Japan and nearly everywhere else.

This not only means that China has upwards of a half-billion tons of excess capacity that will crush prices and profits, but, more importantly,that the one-time steel demand for steel industry CapEx is over and done. And that means shipyards and mining equipment, too.

That’s why on Sunday the Beijing State Council made a rather remarkable announcement. To wit, it will close 100 million to 150 million tons of steel-making capacity. That would mean cutting capacity by an amount similar to the total annual steel output of Japan, the world’s No. 2 steel maker, and nearly double that of the US.

These are not simply gee whiz comparisons. It took the fastidious Japanese nearly five decades to erect the world leading steel industry on the back of tens of thousands of engineering and operational improvements. China created the same tonnage each and every year after the financial crisis, but it was all based just on a great pell mell field of dreams endeavor.

Nor is its own tail the only loss of market. Even more fantastic than steel has been the growth of China’s auto production capacity. In 1994, China produced about 1.4 million units of what were bare bones communist era cars and trucks. Last year it produced more than 23 million mostly western style vehicles or 16X more.

And, yes, that wasn’t the half of it. China has gone nuts building auto plants and distribution infrastructure. It is currently estimated to have upwards of 33 million units of vehicle production capacity. But demand has actually rolled over this year and will continue heading lower after temporary government tax gimmicks—– that are simply pulling forward future sales—–expire.

The more important point, however, is that as the China credit Ponzi grinds to a halt, it will not be building new auto capacity for years to come. It is now drowning in excess capacity, and as prices and profits plunge in the years ahead the auto industry CapEx spigot will be slammed shut, too.

Needless to say, this not only means that consumption of structural steel and rebar for new auto plants will plunge. It also will result in a drastic reduction in demand for the sophisticated German machine tools and automation equipment needed to actually build cars.

Stated differently, the CapEx depression already underway in China, Australia, Brazil and much of the EM will ricochet across the global economy. Cheap credit and mispriced capital are truly the father of a thousand economic sins.

China’s construction infrastructure, for example, is grotesquely overbuilt—— from cement kilns, to construction equipment manufacturers and distributors, to sand and gravel movers, to construction site vendors of every stripe. For crying out loud, in three recent year China used more cement than did the United States during the entire 20th century!

That is not indicative of a just a giddy boom; its evidence of a system that has gone mad digging, hauling, staging and constructing because there was unlimited credit available to finance the outpouring of China’s runaway construction machine.

The same is true for its ship-building, solar and aluminum industries—to say nothing of 70 million empty luxury apartments and vast stretches of over-built highways, fast rail, airports, shopping mails and new cities.

In short, the flip-side of the China’s giant credit bubble is the most massive malinvesment of real economic resources—-labor, raw materials and capital goods—ever known. Effectively, the country-side pig sties have been piled high with copper inventories and the urban neighborhoods with glass, cement and rebar erections that can’t possibly earn an economic return, but all of which has become “collateral” for even more “loans” under the Chinese Ponzi.

China has been on a wild tear heading straight for the economic edge of the planet—-that is, monetary Terra Incognito— based on the circular principle of borrowing, building and borrowing. In essence, it is a giant re-hypothecation scheme where every man’s “debt” become the next man’s “asset”.

Thus, local government’s have meager incomes, but vastly bloated debts based on stupendously over-valued inventories of land. Coal mine entrepreneurs face collapsing prices and revenues, but soaring double digit interest rates on shadow banking loans collateralized by over-valued coal reserves. Shipyards have empty order books, but vast debts collateralized by soon to be idle construction bays. Speculators have collateralized massive stock piles of copper and iron ore at prices that are already becoming ancient history.

So China is on the cusp of the greatest margin call in history. Once asset values start falling, its pyramids of debt will stand exposed to withering performance failures and melt-downs. Undoubtedly the regime will struggle to keep its printing press prosperity alive for another month or quarter, but the fractures are now gathering everywhere because the credit rampage has been too extreme and hideous.

It is downright foolish, therefore, to claim that the US economy is decoupled from China and the rest of the world. In fact, it is inextricably bound to the global financial bubble and its leading edge in the form of red capitalism.

Bubblevision’s endlessly repeated mantra that China doesn’t matter because it only accounts for only 1% of US exports is a non sequitir. It does not require astute observation to recognize that Caterpillar did not export its giant mining equipment just to China; massive amounts of it went there indirectly by way of Australia’s booming iron ore provinces.

Likewise, the US did not export oil to China, but China’s vast, credit-inflated demand on the world market did artificially lift world oil prices above $100 per barrel, thereby touching off the US shale boom that is now crashing in Texas, North Dakota, Oklahoma and three other states. And the fact is, every net new job created in the US since 2008 is actually in these same six shale states.

Similarly, US exports to Europe have tripled to nearly $1 trillion annually since 1998, while European exports to China have more than quintupled. Might there possibly be some linkages?

In short, there is an economic and financial trainwreck rumbling through the world economy called the Great China Ponzi. In all of economic history there has never been anything like it. It is only a matter of time before it ends in a spectacular collapse, leaving the global financial bubble of the last two decades in shambles.

Like Mao’s gun barrel, the printing press has a “sell by” date, too

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.