Which emerging markets are most in thrall to America’s central bank?

OUTSIDE the Federal Reserve’s imposing building in Washington, DC, water cascades from two fountains shaped like chalices. Inside, the Fed’s decision-making generates equally prodigious spillovers, channelling the flow of capital around the world. The consequences, especially for emerging economies, can be monumental but they are rarely elegant.

Until last week many emerging economies had been bracing themselves for an imminent rise in the Fed’s benchmark interest rate, perhaps as early as this month. Higher rates could draw more money into America from emerging markets, weakening their currencies and raising their bond yields. Even the expectation of tighter money can be enough to cause trouble. In such circumstances, central banks far from the Fed often feel compelled to raise rates too, even if economic conditions at home do not entirely warrant it. In 2014 Arvind Subramanian, now the chief economic adviser to India’s government, complained of “dollar imperialism”.

On June 3rd, however, the emperor granted a reprieve. Surprisingly bad jobs figures released that day ended all talk of a Fed rate hike this month (see article). American bond yields duly fell and the dollar weakened; emerging markets rallied. The numbers provided a useful test of the Fed’s sway. Normally, this is hard to measure, since expectations of a rate rise cannot be observed directly and tend to evolve only gradually. The shift on June 3rd, however, was unusually stark.

Which emerging markets benefited the most? The Turkish lira and Brazilian real ended June 3rd over 1.5% stronger than the day before; the Russian rouble gained over 2%; and the South African rand climbed by over 3%. The impact was surprisingly weak, by contrast, on Mexico’s peso and India’s rupee. Nor was there much effect on China’s currency, which does not float freely, although China may yet benefit from a slower flow of capital out of the country.

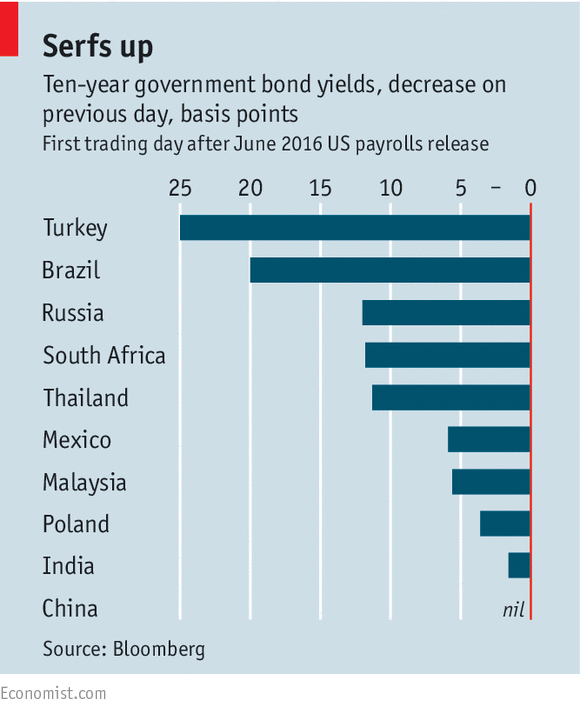

The ranking of emerging-market thraldom was broadly similar for government-bond yields (see chart). Yields fell by about 0.2 percentage points on June 3rd in Brazil and Turkey. They narrowed by about half that in Russia and South Africa, as well as in Thailand when its markets opened on June 6th. China again remained in splendid isolation. And India was strangely unmoved. Its central-bank chief, Raghuram Rajan, is among the most prominent critics of the Fed’s unilateral monetary power, along with his compatriot, Mr Subramanian. Yet India, on the basis of this small experiment, seems newly immune to it.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.