The Investment Management industry is fixated on short term performance.

Oaktree's Howard Marks has said "short term performance is an imposter - "The investment business is full of people who got famous for being right once in a row.”

Unlike most professions, a rookie investor can do better than a professional over the short term. You'd never expect an amateur to beat Roger Federer in a tennis match but plenty of amateur's portfolios will outperform Warren Buffet over the short to medium term. It's only over the longer term that you can ascertain the skill of each investor.

"In the short term, there will always be winners and losers. But in the long term, there are very few winners. " Li Lu

The majority of investment managers, asset consultants and investors obsess over short term performance. As many individuals cannot access their pension funds until retirement it would make more sense to analyze a style of investing or an asset class that outperforms over the long term.

“If you know one style does best in the long run, maybe you shouldn’t care about short term performance comparisons” Chris Browne

Investment Managers that underperform the market over short periods are vulnerable to having their funds taken away.

"Many mainstream portfolio managers, judged as they are on short-term performance, feel they must be swinging all the time. They must focus on the present, on survival. If they don't meet the relentless present demands, they'll have no corner office from which to build a great long-term track record" Frank Martin

"Most of our competitors feel intense pressure from their clients to generate short term performance and have trouble maintaining a truly long-term perspective, whether in bad or good markets" Seth Klarman

“It’s still true that the biggest players in the public markets – particularly mutual funds and hedge funds – are not good at taking short-term pain for long-term gain. The money’s very quick to move if performance falls off over short periods of time" Jeffrey Ubben

Having permanent capital or investors with a long-term mindset allows investment managers to focus their attention on longer term opportunities or 'time arbitrage' which tend to be less crowded.

“That is the secret sauce: permanent capital. That is essential. I think that’s the reason Buffett gave up his partnership. You need it, because when push comes to shove, people run" Bruce Berkowitz

No investment style can guarantee outperformance all the time. Even the Investment Masters, who are renowned for their long term investment performance, have short to medium term periods where they have underperformed or lost money.

“I’m 76 years of age. I've been through a number of down periods. If you live a long time, you’re going to be out of investment fashion some of the time” Charlie Munger

“To capture superior long-term results you have to be willing to endure short-term underperformance” CT Fitzpatrick

“We expect to have negative years on occasion (and our record makes that point clear!). Those who take a longer term perspective – and their shorter term fluctuations in stride – tend to be amply rewarded in the long run (our record makes that clear as well)” Frank Martin

Francois Rochon has beaten the index by 6.1%pa since 1993 (Remember a few extra percentage points compounded over a long period leads to significant outperformance). Yet Francois historically has, and expects to, underperform the index on average every three years.

"Over the 22 years of its track record, our US portfolio has underperformedthe S&P 500 on six occasions (or 27% of the time). This is in line with our "Rule of Three" which stipulates that we accept to underperform the index one year out of three on average. This average, if we can maintain it, would be far superior to the overall performance of portfolio managers. It is a difficult task to maintain outperforming the S&P 500 but it is our mission. We must accept the fact that we will sometimes underperform the index over the short term when our investment style or specific companies are out of favor with mainstream thinking. And we try to welcome rewarding periods of portfolio outperformance with humility." Francois Rochon

"To be aware of this fact ['Rule of Three'] is vital so we can be psychologically prepared for the inevitable periods when we will have results that are worse than average. We have to accept from the start that it is impossible to be always the best in that field even if one is competent and loaded with motivation and efforts." Francois Rochon

The key is to ensure any negative returns reflect short term volatility rather than the permanent loss of capital due to deteriorating underlying business fundamentals.

"In my view, the biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital." Li Lu

When evaluating an investment manager it is important to analyze long term performance to ensure it wasn't a result of luck.

“Short term results often benefit from luck and have no connection with skill. For example, take a short period, not even one or two years long. At any time, even one or two weeks, there will always be some rock stars." Li Lu

"Since a multitude of variables move stock prices around, particularly in the short run, it is virtually impossible to distinguish skill from luck without a large sample size, i.e., a long record." Tweedy Browne & Co

"In a bad year, defensive investors lose less than aggressive investors. Did they add value? Not necessarily. In a good year, aggressive investors make more than defensive investors. Did they do a better job? Few people would say yes without further investigation. A single year says almost nothing aboutskill, especially when the results would be expected on the basis of the investor's style" Howard Marks

Short term outperformance doesn't imply a well constructed and low risk portfolio.

“Any asset class or strategy can have its moment in the sun, yet as time passes we learn what risks were employed to achieve those periods of outperformance” Christopher Begg

Investment consultants and investors have a tendency to place excessive emphasis on past results. More often than not, short term out performance is followed by a period of subpar performance.

“Most people seem to think outstanding performance to date presages outstanding future performance. Actually, it’s more likely that outstanding performance to date has borrowed from the future and thus presages subpar performance from here on out.” Howard Marks

So funds can have good performance for the long run yet still be a dangerous investment. A brilliant long term track record of returns will turn to nothing if the portfolio suffers a zero or significant loss.

“And never forget that anything times zero is zero. No matter how many winners you’ve got, if you either leverage too much or do anything that gives you the chance of having a zero in there, it’ll all turn to pumpkins and mice” Warren Buffett

"In business and also investment, success is measured through the compounding of a series of returns. Mathematically, the biggest risk to a compounded series of returns is large negative numbers or even a single negative number, if large enough. Take however many spectacular annual outcomes and multiply them by just one zero and the answer is of course, zero" Marathon Asset Management

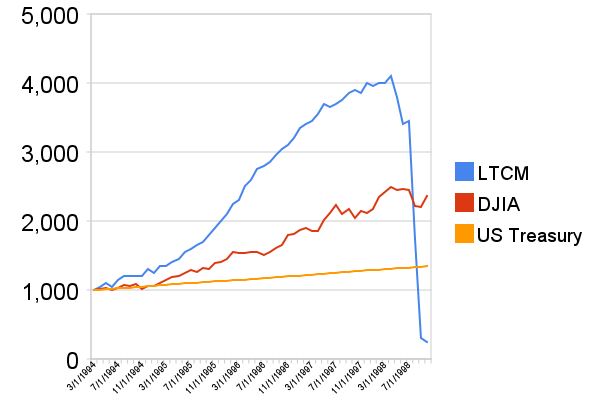

A classic example of this was the hedge fund Long Term Capital Management. The fund, managed by legendary traders, a former vice chairman of the Federal Reserve and two Nobel prize winning economists, delivered exceptionally stable positive returns with low volatility until it all came crashing down.

Source: Wikipedia

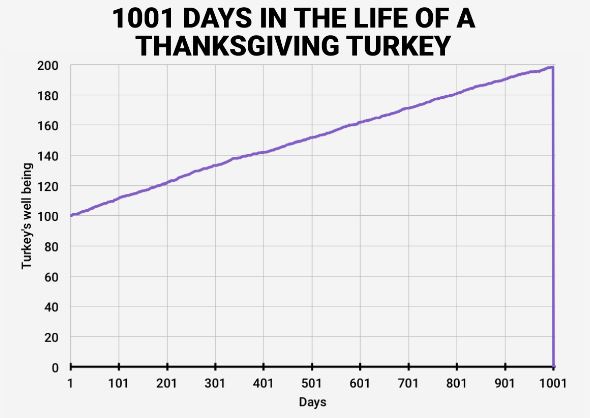

LTCM's performance is analogous to the 'Thanksgiving Turkey' in Nicholas Taleb's book 'Fooled by Randomness'.

"A turkey is fed for a thousand days by a butcher, every day confirms to its staff of analysts that butchers love turkeys "with increased statistical confidence". That is until Thanksgiving. It is mistaking absence of evidence (of harm) for evidence of absence."

Similarly, the absence of volatility and losses in Madoff's Ponzi scheme was not evidence the strategy was a sound investment. LTCM and Madoff highlight that an impressive long track records does not shelter you from the risk of terminal destruction. It's paramount to understand the risks behind the returns.

As Buffett has long said he would not take any risk of permanent loss of capital.

“We will never play financial Russian roulette with the funds you’ve entrusted to us, even if the metaphorical gun has 100 chambers and only one bullet. In our view, it is madness to risk losing what you need in pursuing what you simply desire.”

The Investment Masters acknowledge the folly of being focused on short term performance.

“We think fixating on short-term results is bound to harm investment managers and investors alike. High scores are rarely shot while being critiqued mid-swing on each and every hole” Allan Mecham

“We place no weight on short-term results, good or bad, and neither should you. In fact, we have and will continue to willingly make decisions that negatively impact short-term performance when we think we can lower risk and improve our long-term returns.” CT Fitzpatrick

"While it’s not always easy, we try to remain unaffected by short term results, both good and bad." Francois Rochon

"We never take the one-year figure very seriously. After all, why should the time required for a planet to circle the sun synchronize precisely with the time required for business actions to pay off? Instead, we recommend not less than a five year test as a rough yardstick of economic performance" Warren Buffett

Instead of focusing on short term performance the Investment Masters tend to focus on the underlying performance of the companies they own.

"The best way to track the development [of the fund] is through the development of the earnings of the underlying businesses. Share prices can do pretty crazy things from time to time. The earnings by contrast provide a reliable indication of progress after taking into account the overall economic picture." Robert Vinali

"We do not evaluate the quality of an investment by the short term fluctuations in its stock price. Our wiring is such that we consider ourselves owners of the companies in which we invest. Consequently, we study the growth in earnings of our companies and their long term outlook" Francois Rochon

Don't forget successful investing is hard work and Long term outperformanceis difficult.

“Preserving private capital for long periods of time is the exception, not the rule, in history” Paul Singer

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.