New Delhi Television Limited (NDTV), its lobbyists and apologists call the Central Bureau of Investigation (CBI) raid on the residence of Mr and Mrs Prannoy Roy a “blatant political attack on freedom of press.”

But as skeletons tumble out of the closets, it has come to the light that NDTV has committed an unending fraud and the CBI is finally doing its duty, though late, as per the due process of law.

S Gurumurthy, a former associate and confidante of Indian Express founder Ramnath Goenka who is also known to have exposed misdeeds by Reliance in mid 80s through his reports and columns in Indian Express, has been among those in the forefront insisting the that case against NDTV is purely of financial fraud and the channel is hiding behind ‘press freedom’.

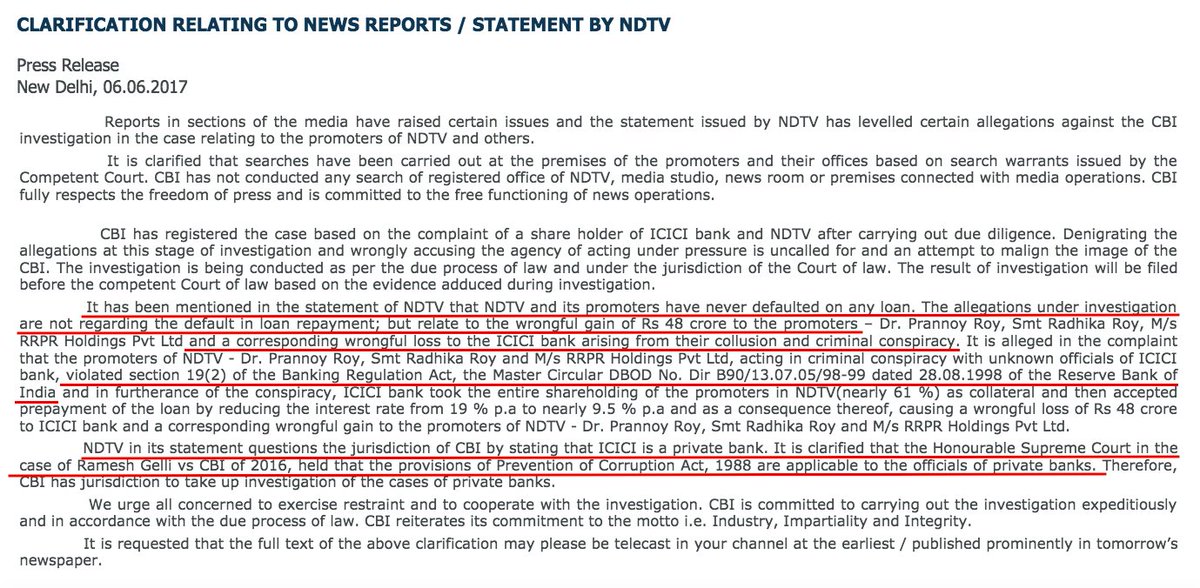

CBI too issued a statement yesterday and clarified that the raids were entirely as per legal provisions.

The CBI case against NDTV is related to a Rs 375 crore loan from ICICI Bank and a corresponding wrongful loss of Rs 46 crore to the bank. But behind this, there is a chain of borrow, repay and borrow when Roys took a series of loans in 2008 as they sought to buy back a large chunk of NDTV shares from the market.

ICICI Bank loan interest fraud

In December 2007, Roys had bought 7.73 per cent of NDTV shares from General Atlantic. Minority shareholders of NDTV were made an open offer to sell shares. To fund the purchase of shares that the minority shareholders wanted to sell, Roys created a company called RRPR Holdings Private Limited. RRPR borrowed Rs 501 crore from India Bulls Ltd.

To repay part of the India Bulls loan, RRPR borrowed Rs 375 crore from ICICI Bank in October 2008. In August 2009, RRPR found another lender called Vishvapradhan Commercial Private Limited (VCPL) to repay the ICICI loan. VCPL agreed to pay Rs 350 crore to RRPR in July, 2009.

RRPR’s balance sheets – filed before the Registrar of Companies in March, 2009 – however, showed that it had a loan of Rs 349,26,14,485 from ICICI Bank and an interest of Rs 17,21,80,697 on that loan. Between 31 March and 7 August, 2009 — when RRPR repaid ICICI after receiving the money from VCPL — an additional interest was accumulated and the bank therefore suffered a loss to the tune of Rs 48 crore.

Money laundering

It is not just the ICICI Bank loan interest fraud, NDTV’s story of deceit dates back to 2004. It was in that year, Prannoy Roy-led company suffered a huge loss of Rs 248 crore. Its shares were trading abysmally weak. This was at a time when the Congress-led UPA took the reins and there was a turnaround in NDTV’s fortunes.

NDTV raised funds by floating a galaxy of shell companies. S Gurumurthy, in a cogent article in New Indian Express, has written that between 2006 and 2010, NDTV India had floated 20 wholly-owned subsidiaries in different parts of the world. While seven were based out of Mauritius, eight subsidiary companies were based in India, two were located in Netherlands, one each in London, UAE, and Sweden.

These “letter-box companies”, which were wholly resting on the valuation of NDTV Ltd, together had raised $417 million. Of the $417 million, $267 million was invested by GE Corporation directly or indirectly. $310 million was raised through NDTV Network PLC UK and $117 million were raised via the sale of NDTV Imagine to GE Corporation.

Quoting references from the internal e-mail communications of NDTV, obtained by the Income Tax authorities, Gurumurthy’s article has established beyond doubt that Roys and other directors of NDTV were struggling to justify before the tax authorities the huge funds raised by the company through subsidiaries.

“The mails disclose a clear intent to camouflage the money. The fraud is self-evident, pre-meditated and exposed in their own mails. This opens the possibility of action for money laundering,” Gurumurthy wrote.

Immunity from UPA

During the UPA regime, the NDTV did not disclose the identity of the investors in its shell companies. It did not attach its foreign subsidiary firms’ balance sheets, thanks to the immunity from the Company Law Department of the then UPA government.

In the process, NDTV successfully hid funds to the tune of $417 million out of its balance sheet. This is plain and simple tax evasion and money-laundering. These all happened when P Chidambaram was the Finance Minister.

NDTV: A party to Aircel-Maxis scam?

BJP Rajya Sabha MP Subramanian Swamy had earlier written a letter to Prime Minister Narendra Modi requesting him to direct the CBI to file case against NDTV under Prevention of Corruption Act. Alleging that NDTV was a party to Aircel-Maxis scam, during the Congress-led UPA rule, Swamy had said it received illegal money from Maxis subsidiary Astro.

Swamy further said that the money, received by NDTV from Maxis, was “illegally approved” by then Finance Minister P Chidambaram to “benefit his son” Karthi Chidambaram.

How NDTV muzzled an honest tax officer

Gurumurthy hhas also highlighted the case of an honest Income Tax officer named SK Srivastava who unearthed the frauds committed by NDTV. Srivastava also sought to investigate the charges of pay-off involving Chidambaram. Following this, he faced sexual abuse charges by two lady officials and actions were recommended against him.

Husband of one of the lady officials was then working as a prime time anchor with NDTV. Srivastava had to face suspensions and a series of change sheets. Gurumurthy claims that this was purely a case of vendetta, which was dressed up as sexual harassment case.

The Ambani-Jindal connections

According to Gurumurthy, a Mukesh Ambani company gave a virtually interest-free loan to another company for acquiring 26 per cent of NDTV shares for Rs 403 crore. The zero-interest bond is transferred to another company belonging to Himachal Furturistic Group for Rs 50 crore, with the Ambani company incurring a loss of Rs 353 crore and claimed it as tax expense.

“While the Mukesh Ambani company purchased 26 per cent NDTV shares for Rs 403 crore after valuing NDTV at Rs 1440 crore, it sold the same to Nahata of Himachal Futuristic who bought the 26 per cent shares of NDTV for Rs 50 crore at a total valuation of Rs 192 crore,” Gurumurthy said.

“NDTV valued itself before the tax authorities at Rs 10000 crore. It was valued at $2 billion by GE Corporation USA for one investment and at $200 million for another. The Navin Jindal group and Agarwal Agro Tech group bought 15 per cent of NDTV shares for Rs 26 crore on a value of Rs 173 cr. NDTV valued itself before SEBI at Rs 367 crore,” he said.

Why NDTV ran away from Gurumurthy’s questions?

When S Gurumurthy wrote a note to senior Supreme Court advocate Ram Jethmalani, in 2013, explaining the entire case of alleged NDTV fraud, Jethmalani wrote a stinging charge sheet against NDTV and Chidambaram.

“Jethmalani had sent a copy of my note to Mr Prannoy Roy who contacted me through an editor friend of mine and said that he would like to respond to that with documents. When his response came I found that the documents he had enclosed in support of the investments were not reliable.”

And finally…

Finally, the law is catching up with NDTV. There are charges galore against NDTV. The law must take its own course. And media is not above the law.

But, why it took so many years for the CBI to act against NDTV?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.