As it gets easier to do business, it will get harder to earn huge profits

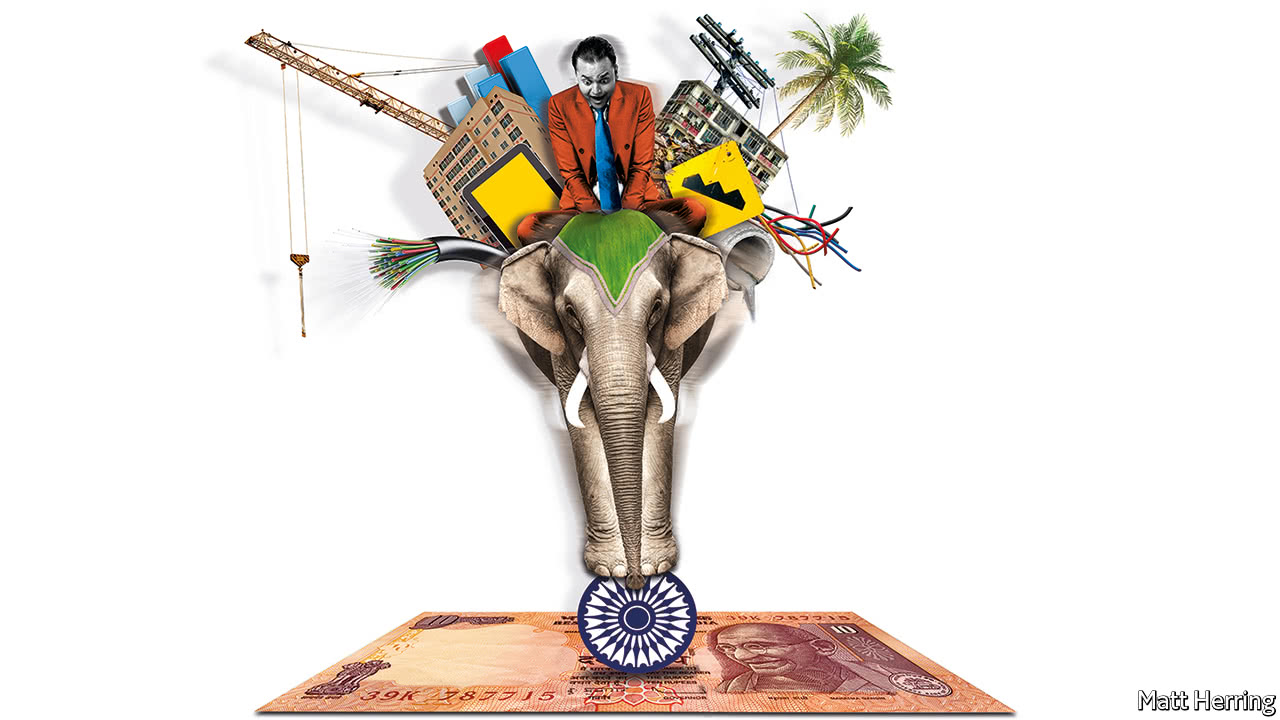

IF YOU run a big firm in India you must straddle different worlds. The country’s leading bosses can wax lyrical about artificial intelligence and debate returns on capital with foreign fund managers. But they have also mastered India’s poor infrastructure and huge informal economy. Shiny campuses sit beside open sewers. Millions of customers can be reached only by dirt tracks. Suppliers and distributors often operate in the shadows. In a typical month an Indian boss might have wheatgrass shots in Silicon Valley, slug bootlegged single malt with a local politician and sip masala chai from clay cups with villagers.

India’s gross domestic product (GDP) is the world’s seventh-largest and its stockmarket the ninth-biggest, but the country is like no other major economy. The informal sector accounts for about 50% of output, 80-90% of jobs and at least 90% of firms. Red tape and bad roads mean the country comes 130th in the World Bank’s ease-of-doing-business rankings.

However, firms that overcome these challenges are exceptionally profitable. Since 2001 the return on equity (ROE) of listed Indian firms has averaged 19%, eight percentage points above the figure for companies in rich markets and five percentage points above those in emerging ones.

India is a terrible and brilliant place to do business. Just as investors talk about a “Korea discount”, to describe chaebols’ lousy profits, so there is an “India premium”. The leading private lender, HDFC Bank, has an 18% ROE, ranking tenth among the top 100 global lenders. Hindustan Unilever, a consumer-goods firm, has a 77% ROE, over twice that of its parent, Unilever. Even in basic industries, such as cement, returns have been relatively high.

This record reflects good management: most firms know how to allocate capital well, unlike their profligate Chinese peers. But India’s informality and bad infrastructure also create obstacles for new entrants. Inputs such as capital, land and energy can be nightmarishly hard to secure. It takes 10-20 years to build dense national supply chains and distribution networks. For example, Maruti-Suzuki, the biggest car firm (with a 22% ROE), has over three times more dealerships than its nearest competitor.

Now, a quarter of a century after India first liberalised, the pace of formalisation is picking up. A breakthrough came in 2012, when the courts began to crack down on crony capitalists, especially firms that used graft to get access to natural resources and land. Now a new stage is in full swing, says Sanjeev Prasad of Kotak, a bank (14% ROE). A new value-added tax, known as the GST, requires firms to reconcile their tax returns with those of their suppliers and customers, forcing millions of companies into the tax net. The GST is complex but replaces a patchwork of local taxes, helping to create a single national market. A government decision to retire old bank notes at the end of 2016 has made it riskier to hoard illicit cash. E-commerce accounts for only 3% of retail sales but provides a new way to distribute products. New digital identities for all Indians mean that more can open bank accounts.

Measuring the share of economic activity that is informal is tricky. Still, the signs are encouraging. In the past year there has been a 13% increase in formal savings such as bank deposits, life-insurance policies and mutual funds. Cash in circulation has fallen from 12% of GDP to 10%. The value of digital payments have risen by over 40% and the number of taxpayers has almost doubled.

Make no mistake: parts of India are in a time warp. The north and east of the country lag behind. Courts have a backlog of 30m cases. Nonetheless, formalisation is happening. Firms of all sizes are responding to the GST: one fund manager recalls meeting a huge poultry business hidden away in Chhattisgarh, a remote state, which is planning to come into the tax net.

For tens of millions of informal firms—shoe factories, plywood manufacturers, drinks wholesalers supplying roadside stalls—tough times are ahead. If they stay in the shadows they will be cut out of formal firms’ supply chains. If they enter the formal economy, their tax costs will climb. Some will fail, causing unemployment to rise. Others will consolidate. For example, the fragmented haulage industry could merge into a few big firms that take advantage of a single national market. They may also take out more formal loans to lease trucks.

For big companies, formalisation could boost profits in the short term. They may take business from smaller firms: at least 40% of India’s tea, 85% of its jewellery and 70% of its dairy products are sold in the grey economy. Tata Steel, a metals producer, has said it expects to gain market share from informal smelters.

However the risk is that the “India premium” eventually crumbles along with long-standing barriers to entry. The assault on crony capitalism, along with lower commodity prices, has already reduced the ROE of listed Indian firms from 26% in 2006 to 13% (this is still well above the 11% global average). At least half of this fall is due to a slump at firms with reputations for graft, which often operate in the basic-materials, infrastructure, property and energy sectors—and the state-owned banks that financed them.

An uncomfortable seat in the premium economy

In most consumer-facing industries, returns remain high. But in the long run big Indian firms may be hurt by better-functioning markets for capital, land and natural resources, as well as more efficient supply and distribution chains. The advantages that they have assembled over years could be eroded. To maintain high profits, they may have to spend more on innovation.

Investors don’t seem to be thinking about this much. India’s stockmarket is valued at three times book value. That makes it the dearest big market in the world and implies, roughly, that long-term ROEs will be 17-20%. India’s consumer-facing firms trade on higher multiples of their profits than Facebook or Alibaba, and its best banks are not far behind. Formalisation is a giant step forward for India’s economy, but investors could be in for a shock.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.