A sudden reversal in the commodity markets

ONLY one thing spooks the oil market as much as hot-headed despots in the Middle East, and that is hot-headed hedge-fund managers. For the second time this year, record speculative bets on rising oil prices in American and European futures have made the market vulnerable to a sell-off. “You don’t want to be the last man standing,” says Ole Hansen of Saxo Bank.

On November 15th, the widely traded Brent crude futures benchmark, which had hit a two-year high of $64 a barrel on November 7th, fell below $62. America’s West Texas Intermediate also fell. The declines coincided with a sharp drop across global metals markets, owing to concern about slowing demand in China, which has clobbered prices of nickel and other metals that had hit multi-year highs. (In a sign of investor nervousness after a sharp rally this year in global stock and bond markets, high-yield corporate bonds also weakened significantly last week.)

The reversal in the oil markets put a swift end to talk of crude shooting above $70 a barrel, which had gained strength after the detention in Saudi Arabia of dozens of princes and other members of the elite, and increasing tension between the Gulf states and Iran over Yemen and Lebanon. The International Energy Agency (IEA), which forecasts supply and demand, said on November 14th that it doubted $60 a barrel had become a new floor for oil. It did note, however, that geopolitical risk had become a salient factor in the market. Since Iraq seized back Kirkuk from Kurdish forces in October, shipments of Iraqi oil have fallen sharply. Mr Hansen says such tensions have added a $10 risk premium to a barrel of crude recently, but these can evaporate as quickly as they build.

Geopolitics aside, the two factors behind the volatility are familiar. Ever since prices crashed below $30 a barrel in early 2016, they have been most influenced by the strength of shale production in America; and the level of global inventories targeted by OPEC, the producers’ cartel, and non-OPEC sovereign producers like Russia.

Those bullish on oil prices say shale production is moderating as cash-strapped American producers tighten their belts. Wall Street has become less willing to supply equity to finance their expansion, unless they can produce oil profitably.

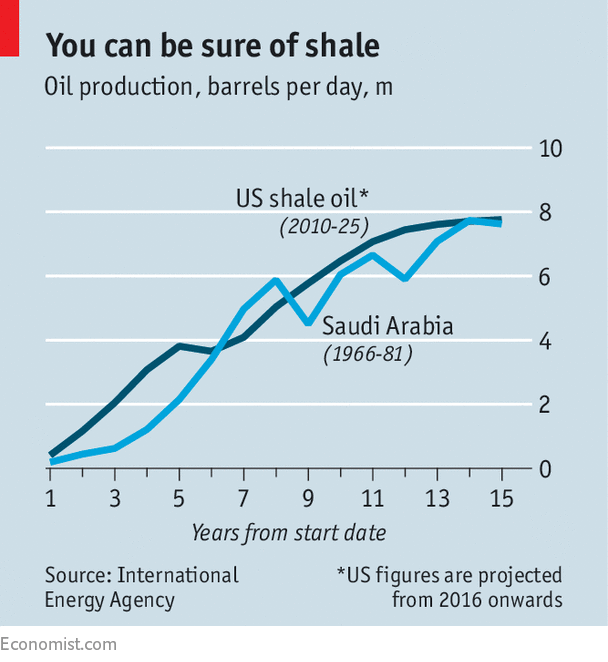

But the bears note that last week there was a rise in the rig count calculated by Baker Hughes, an oil-service provider, indicating that higher prices and more hedging activity is encouraging producers to ramp up again. And the IEA forecast this week that shale-oil production by 2025 will exceed that of even the biggest oilfield in Saudi Arabia (see chart). If true, that is a glaring long-term sell signal.

As for inventories, bears say the data suggest stocks of crude and petroleum products in America are still excessive. That puts pressure on OPEC and non-OPEC producers, which meet in Vienna on November 30th, to extend supply cuts that were due to expire in March 2018. As usual before the meeting, those participating—especially Russia—are arguing over the pros and cons. It may take bigger cuts than anticipated, or a genuine geopolitical crisis, to make the hedge funds bullish again.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.