Venezuela is the exception to the rule

VENEZUELA is an unusual country. It is home to the world’s largest reserves of oil and its highest rate of inflation. It is known for its unusual number of beauty queens and its frightening rate of murders. Its bitterest foe, America, is also its biggest customer, buying a third of its exports.

In defaulting on its sovereign bonds last month (it failed to pay interest on two dollar-denominated bonds by the end of a grace period on November 13th), Venezuela is also increasingly unusual. The number of governments in default to private creditors fell last year to its lowest level since 1977, according to the Bank of Canada’s database. Of the 131 sovereigns tracked by S&P Global, a rating agency, Mozambique is the only other country in default, having missed payments on its Eurobond (and failed to make good on guaranteed loans to two state-owned enterprises). Walter Wriston, a former chairman of Citibank, earned ridicule for once declaring that “countries don’t go bust”. But they don’t much anymore.

This dearth of distress is surprising, given the turmoil emerging economies have endured in recent years. The collapse in commodity prices that undid Venezuela was accompanied by a sharp reversal of capital flows to emerging economies that began in 2011 and gathered pace during the “taper tantrum” of 2013. There have been 14 such capital “busts” in the past 200 years, according to Carmen Reinhart of Harvard University, Vincent Reinhart of Standish Mellon Asset Management and Christoph Trebesch of the Kiel Institute for the World Economy. The most recent bust was the second-biggest of the lot. But it led to less distress than usual. If past patterns had held, such a severe setback would have resulted in 15-20 more defaults than actually transpired, the three scholars calculate.

What explains these “missing” defaults? Some may be hidden. China, for example, may have rescheduled or replenished some of its sizeable loans to emerging economies without ever declaring them bad. Indeed, China’s willingness to roll over its loans to Venezuela delayed, even if it did not ultimately prevent, the Bolivarian republic’s default on some of its other debts.

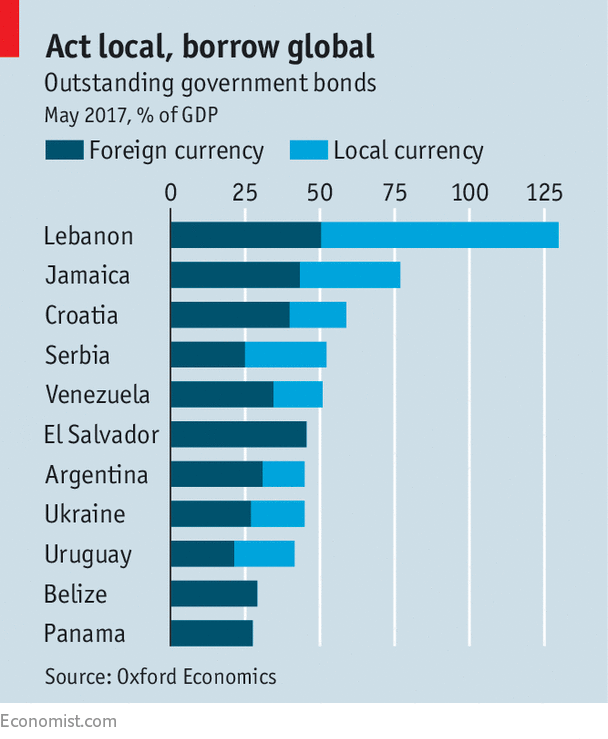

Distress also now manifests itself in other ways, points out Gabriel Sterne of Oxford Economics, a consultancy. The governments of emerging economies increasingly borrow in their own currencies. These are no longer tightly pegged to the dollar, as many were in the 1980s and 1990s, or to gold, as in the 19th century. Of 54 emerging markets Mr Sterne has examined, only 11 have foreign-currency bonds worth more than 20% of their GDP (see chart). So defaulting on hard-currency debt is neither as necessary nor as helpful as it was. Even if a sovereign were to forswear a big chunk of its dollar obligations, imposing a steep loss on creditors, it would only save a large percentage of a small amount.

The costs of default, on the other hand, are somewhat fixed. Default is, in legal terms, a discrete event. Reneging on debt worth 10% of GDP may be just as damaging to a country’s reputation as reneging on debt worth twice as much. And the costs are not just financial. “You have to negotiate with the creditor committees. You’re going to get all the hedgies (hedge funds) potentially ganging up on you. And that’s a pain in the backside,” notes Mr Sterne. In a growing number of emerging markets, including past offenders like Brazil, Mexico and Peru, default on foreign-currency debt is no longer imaginable, he says.

What about the local-currency securities that have grown in importance? Since governments have the power to print the money they owe on these bonds, default is never technically necessary. Currency depreciation and inflation offer a more surreptitious way to erode creditors’ claims: less discrete, more discreet.

Ukraine offers one instructive example, argues Mr Sterne. The holders of its foreign-currency debt emerged largely unscathed from its wartime wobbles (generous coupon payments more than offset a 15% cut in the net present value of their claims). On the other hand, those unlucky enough to hold bonds or deposits denominated in Ukrainian hryvnia suffered a 30% loss in dollar terms, by his calculations.

Although default on local-currency bonds is never technically necessary, is it nonetheless possible? The rating agencies think so, reserving triple-A ratings for only a small fraction of such bonds. And even the financial markets perceive some danger of default. The yield they demand on this government paper is higher than the implicit “risk-free” rate that can be calculated from currency swaps, point out Wenxin Du of the Federal Reserve and Jesse Schreger of Columbia Business School.

In some cases, the two economists argue, a government may prefer default to the alternatives of depreciation and inflation. Suppose, for example, that the country’s companies have borrowed heavily in dollars, even if the government itself has not. In such scenarios, a falling currency may wreak more economic havoc than a formal breach of government obligations.

Venezuela again provides a cautionary example. It has so far kept up payments on its local-currency debt, retaining a stronger credit rating on these liabilities than on its dollar paper. Meanwhile the country is going to ruin. Much of the population cannot afford enough food, medicines must be smuggled in from Colombia, and the currency lost 60% of its value last month. The republic may not have defaulted on its local debt. But it has defaulted most violently on its social contract.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.