Bad things don't happen to good banks. Or that's the carefully crafted image projected by the world's priciest lender.

Assiduously shielding its loan book from the flying debris of India's $207 billion bad-debt crisis, HDFC Bank Ltd. has kept its balance sheet in a near-pristine condition. The aura of invincibility bestowed by a 1.26 percent soured-loan ratio -- compared with almost 10 percent for State Bank of India and 25 percent for IDBI Bank Ltd. -- also explains why HDFC Bank has a price-to-book multiple of 5.2. Among lenders with at least $50 billion in market value, anywhere, none is as expensive.

So it was a surprise last month when HDFC Bank reported a hefty provision against an unnamed corporate account that it said wasn't a nonperforming asset, then one day later marked the loan down to NPA because the Reserve Bank of India, the regulator, had told it to do so.

The matter would have rested there, were it not for an independent banking analyst, Hemindra Hazari. In a note on Smartkarma, a research website, Hazari reproduced last week a letter from the bank to Jindal Steel & Power Ltd., allowing it to sell and lease back its oxygen plant, provided the proceeds were “utilized towards clearing overdues to make our account absolutely regular.”

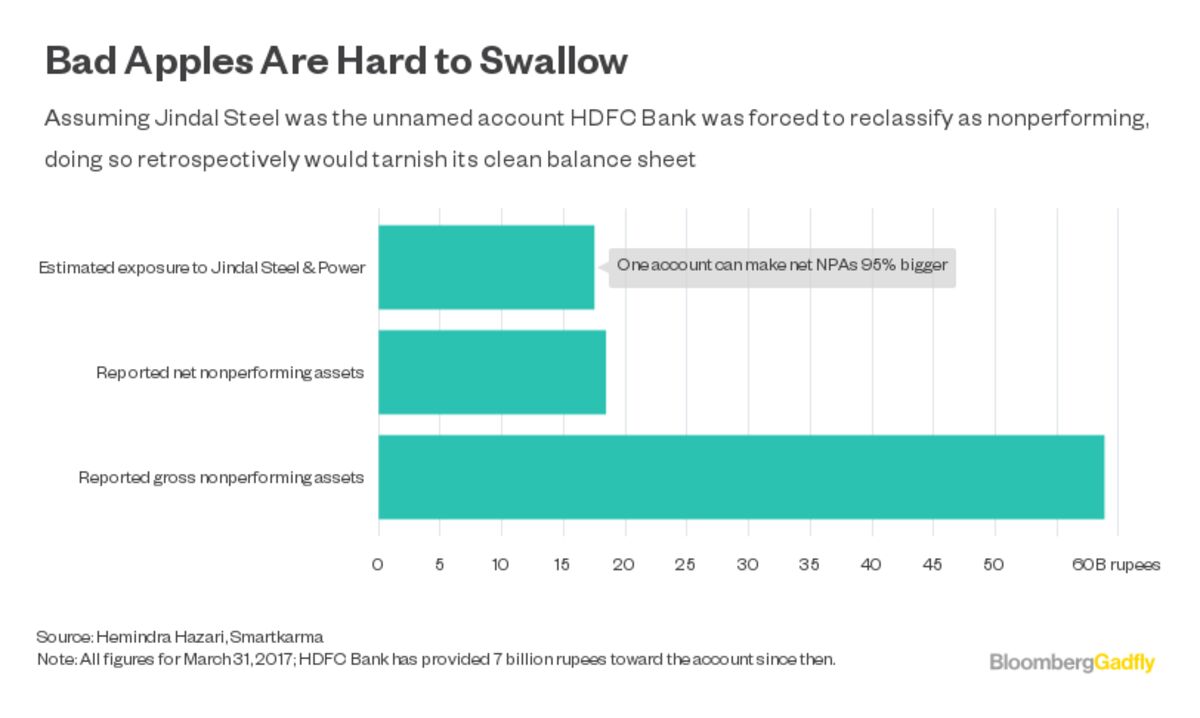

This opens a Pandora’s Box. Jindal Steel had net debt of 440 billion rupees ($6.8 billion) at the end of September. Was the steel company indeed the unidentified shaky account? If so, was HDFC Bank on the hook to that borrower for more than 15 percent of its reported nonperforming assets on March 31, the end of its financial year? Hazari believes so.

In that case, the correct thing to do would be for HDFC Bank to acknowledge the “divergence” between its self-reported and RBI-assessed NPAs. But doing so would also mean admitting that those soured loans, net of provisions, were 95 percent more than disclosed in the full-year accounts.

Its halo would thus slip, and the charge of being less than truthful that I've leveled at other non-state Indian lenders -- Axis Bank Ltd., ICICI Bank Ltd. and Yes Bank Ltd. -- would apply equally to HDFC Bank.

Questions might also arise about the RBI. Axis Bank CEO Shikha Sharma told the Economic Times that she was compelled by the central bank to reclassify standard borrowers as NPAs, and did so because "we are obedient children." Jindal Steel has been named by local media as one of those accounts. The RBI can't arbitrarily force some lenders to appear less than truthful, while sparing others the humiliation of a mea culpa.

The fairness of the RBI's assessment is one thing, its correctness is another. For now, India's bloated steelmakers are enjoying an uptick in domestic demand and operating profitability. But they aren't out of the woods.

Suppose sometime after March next year, Jindal Steel struggled to pay rentals on its expensive sale-and-leaseback deal with Srei Equipment Finance Ltd., and the latter dragged it to the insolvency tribunal. By then the firm would have been an NPA for a year, and India recently prohibited borrowers with nonperforming loans overdue a year or longer -- or parties connected to such debtors -- from bidding for assets in bankruptcy.

Not only would Naveen Jindal, chairman of Jindal Steel, stand to forfeit the firm; even his brother Sajjan Jindal's JSW Energy Ltd., which is already bailing out the sibling's company by buying one of its power plants, would be unable to help him win it back because it's a connected party.

With the stakes this high, the RBI needs to crack the whip of asset classification with a steady hand -- one that treats creditors fairly and borrowers correctly. Meanwhile, HDFC Bank must present a more accurate picture of its soured loans. After all, bad things can happen even to great banks.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.