It is giving new opportunities to entrepreneurs and forcing Silicon Valley's best to stay relevant.

HERMAN NARULA named his company Improbable for a business plan so outlandish and fraught with computing problems that only two outcomes are plausible. As the British entrepreneur tells it, the result will be outright failure or success unmatched. He wants to create virtual worlds as detailed, immersive and persistent as reality, where millions of people can live as their true selves, earn their main income and interact with artificially intelligent robots. If that happens, it will be partly because Mr Narula drew the attention of a similarly improbable, wildly ambitious technology fund. The Vision Fund has put close to $500m into Improbable, which had previously raised only $52m.

An outsize investment in an unconventional business is typical of a fund that itself is both vast and resistant to definition. It is the brainchild of Masayoshi Son, an unusually risk-loving Japanese telecoms and internet entrepreneur. It is too big to be considered a conventional venture-capital firm, which would typically manage much smaller sums. It eschews many of the practices of private-equity funds, such as shaking up management and applying plenty of debt. Yet this impressive-but-puzzling experiment is having an impact on everyone who invests in technology. At a recent gathering of financiers in New York, Bill Gurley of Benchmark, a venture-capital firm that has invested in numerous well-known tech firms, called the Vision Fund “the most powerful investor in our world”.

Even amid the hyperbole and fervour of tech Mr Son stands out. This is partly because of his belief in mind-boggling futuristic scenarios such as the “singularity”, when computer intelligence is meant to overtake the human kind. But it is also because Mr Son’s method is to do things rapidly and on a scale other investors would shy away from. Whether backing founders lavishly, so they can roll out new business models and technology as quickly as possible, or encouraging consolidation among the world’s giant ride-hailing companies, including Uber and Singapore’s Grab, he thinks bigger than most.

Silicon Valley insiders are sceptical, saying that Mr Son is force-feeding young firms with more capital than they deserve or need and that his fund will further inflate a bubble in technology valuations. His investors may well discover how hard it is to earn high returns on huge sums invested in relatively mature firms. But entrepreneurs, some of whom regard Mr Son as superhuman, are delighted. “If he came in and levitated one day I would not be surprised,” says Mike Cagney, co-founder of SoFi, an American financial-technology company in which Mr Son has invested.

Those doubting his grand visions have been proved wrong in the past. In 1981 he founded SoftBank to distribute personal-computer software in Tokyo with two part-time employees. On the first day the diminutive Mr Son stood on two apple cartons and announced to those befuddled workers that in five years the firm would have $75m in sales and be number one. They thought “this guy must be crazy”, Mr Son later told the Harvard Business Review, and quit the same day. But Mr Son’s drive and ambition saw SoftBank eventually distributing 80% of PC software in Japan.

Rising Son

SoftBank subsequently grew into a global conglomerate with stakes in hundreds of web firms, including Yahoo. As tech valuations soared in 2000 Mr Son’s personal wealth even briefly overtook that of Bill Gates. The dotcom crash of 2001 wiped out 99% of SoftBank’s market value. But one investment—$20m sunk into Alibaba—is regarded as one of the best in history. The Chinese internet titan went public in 2014 in the world’s biggest IPO. SoftBank’s 28% stake in the firm is now worth $140bn.

Many old hands of the tech industry snootily dismiss his bets on Yahoo and Alibaba as flukes. Mr Son is bent on proving them wrong. He spent a decade focusing on SoftBank’s Japanese telecoms and internet-infrastructure businesses and on trying to turn around struggling Sprint, an American mobile-phone operator acquired in 2013 (on April 29th Mr Son beat a retreat, agreeing to merge it with T-Mobile to create an enterprise worth $146bn). Now Mr Son has returned to investing. Since reaping the riches of Alibaba’s IPO Mr Son has been using SoftBank’s capital for a series of large tech investments, including $2.5bn in Flipkart, an Indian e-commerce site which on May 9th Mr Son said he was selling to Walmart for $4bn (see article). He has also put money into Grab and SoFi. And in 2016 SoftBank bought Arm Holdings, a British chip firm, for £24.3bn ($31.9bn).

The appetite of Mr Son and his main lieutenant, Rajeev Misra, a well-connected former derivatives trader from Deutsche Bank, was far from sated. But Mr Son’s grand dreams were not matched by the depth of SoftBank’s pockets. Its acquisitions had left the firm weighed down by debt. So the two men beat a path to the Middle East. The timing was handy. Muhammad bin Salman, now Saudi Arabia’s crown prince, was preparing to launch a programme to wean the country off oil and diversify the economy. Mr Son’s sales pitch on how he could use the kingdom’s wealth to grab a stake in future technologies, rather than buying the usual Western trophy assets, saw him leave with a pledge of $45bn.

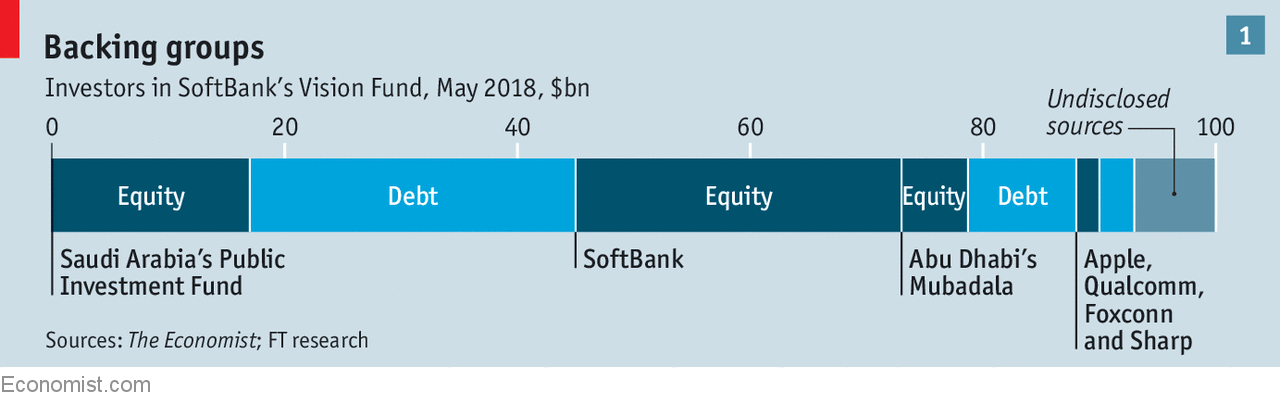

That vast sum, from Saudi Arabia’s Public Investment Fund, is the biggest chunk of the $100bn that the Vision Fund has now raised. It has also raised $28bn from SoftBank itself, $15bn from Mubadala, Abu Dhabi’s sovereign-wealth fund, $5bn from Apple and other corporate sources, and $7bn from other sources as yet unnamed (see chart 1).

Raising the stakes

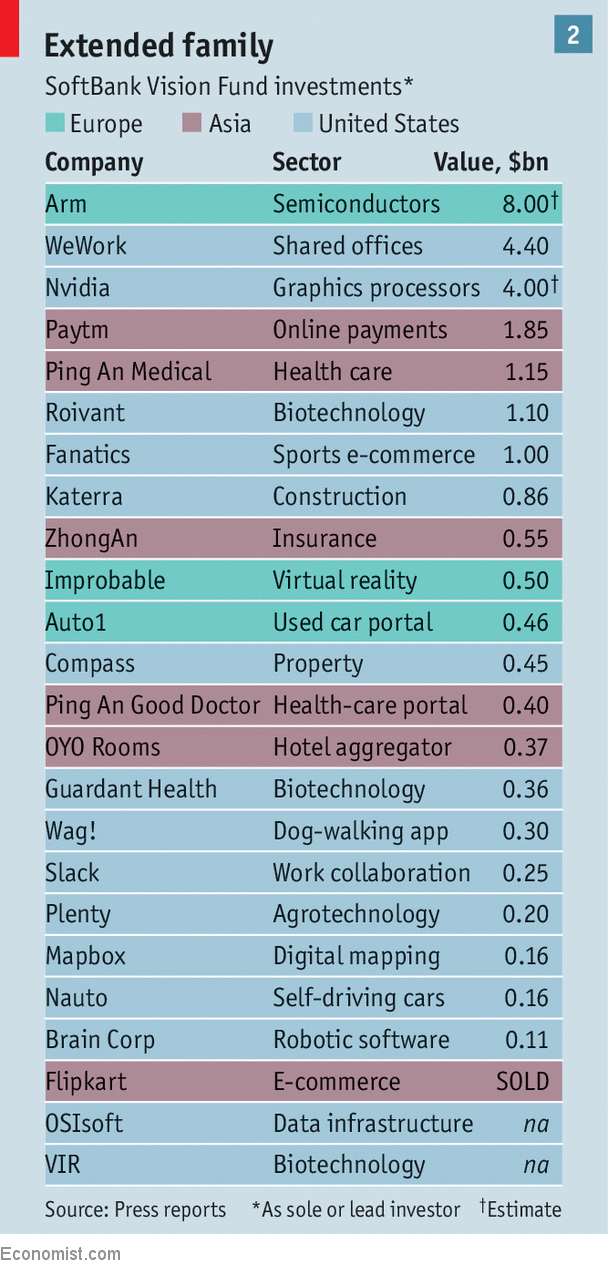

Having amassed the wherewithal, Mr Son set about collecting stakes. After a year the Vision Fund boasts a family of 24 companies (see chart 2). SoftBank’s holdings in ride-sharing firms—Uber, Didi, Grab and Ola—will reportedly move into the fund within months. Other stakes are expected to move later, such as those in SoFi and OneWeb. All future investments of $100m or more that Mr Son makes will go into the Vision Fund, which plans to have invested in as many as 100 firms within five years.

Its sheer size has transfixed potential investment targets and rival funds alike. The $30bn it has already invested nearly equals the $33bn that the American venture-capital industry raised in 2017. It will not stop there. If the fund performs well, versions two, three and four could be in the offing, says Mr Son.

In some ways the Vision Fund operates like any other technology fund. It has welcomed pitches from a couple of hundred hopeful young companies. Founders visit its offices in San Carlos in San Francisco’s Bay Area or its opulent town house in London’s Mayfair, in both places greeted at the door by Pepper, a cheery robot made by SoftBank’s robotics arm. Less than 5% of the entrepreneurs who seek funding receive it, which is slightly more generous than most VC firms. When Mr Son has chosen his targets, he believes in the power of capital and the potential for synergies between his firms to help reap rewards.

The recipients of cash fall into three main areas. First there is the “frontier”—bets backing Mr Son’s instincts about revolutionary technologies in areas such as the internet of things, robotics, artificial intelligence (AI), computational biology and genomics. The internet of things was his rationale for the purchase of Arm, which Mr Son says can design the chips to enable what he believes will be a trillion connected devices by 2035. NVIDIA, another chip-design firm in which SoftBank recently bought a big stake, will provide processors for AI services. SoftBank’s interest in an American 5G network (via Sprint’s tie-up with T-Mobile) and in OneWeb, a satellite startup, will help with the connections.

Second comes investments designed to bring new tech to old industries such as transport, property and logistics. Ride-hailing falls into this category (see article). And the third area is technology, media and telecoms, where SoftBank has been investing for nearly 25 years. Its stakes here stretch from Fanatics, an online sports-merchandise retailer, to Wag!, an on-demand dog-walking service.

But alongside the futuristic vision runs a hard-nosed, opportunistic appreciation of the power of capital to create winners. Mr Son recently said that, if Steve Jobs brought to Apple an understanding of technology and art, his own formula is technology plus finance. Time and again he has cajoled and bullied founders and chief executives into accepting his money, often handing out much more than they were asking for.

Fundraising pitches are atypical of the tech world. A videoconference call to Tokyo with an awkward audio delay makes for stilted dialogue. After ten minutes Mr Son often interrupts, as one founder tells it: “Stop, I know. I’ve heard enough, how much do you want?” He then offers up to four or five times what the entrepreneur suggests. Any questions over what the firm would do with that much money and Mr Son threatens to put the cash into a rival, usually leading to capitulation. During talks with Uber, he threatened to invest in Lyft. SoFi, Didi, Grab and Brain Corp, which builds machine brains for robots, all got variations of the treatment.

Money is not the only thing that the fund offers; so is the privilege of joining the “family”. Once the Vision Fund has invested in 70-100 or so companies, it will have the world’s biggest collection of young tech firms. They will create an ecosystem where they will be each other’s customers, will merge with each other, and swap help and advice, says Mr Misra.

The idea is that such ties will help firms grow more quickly. Mr Son is intent on taking American and European startups into Asia, and vice versa, and Asian ones into nearby countries. SoftBank will act as a guide—its network in Japan, for example, is a boon to Slack, a messaging company in which it has a sizeable stake, as it expands there. SoftBank sometimes makes it a condition of investing in a young Western firm that it must enter a joint venture in Asia.

OYO Rooms, an Indian startup that overhauls and brands small, local hotels, provides another example of collaboration. It is preparing to enter Europe and is moving into China, where Mr Son’s connection to Alibaba and other firms has helped, says Ritesh Agarwal, its founder. In Shenzhen, now one of OYO’s big markets, it ran a joint ad campaign with Didi with the tagline “ride comfortably with Didi, stay comfortably with OYO”.

Mentoring is also sold as a benefit of clan membership. Executives from Grab and Ola often visit Didi to learn from its mistakes, says Mr Misra. “As the number of portfolio companies increases, the possibilities for synergies will be unlimited,” says Mr Son. “The Vision Fund is a platform where portfolio companies can stimulate and collaborate with one another.”

When the bill comes due

Mr Son’s pitch does not convince everyone. Analysts have marked down SoftBank’s shares in large part because they fear Mr Son’s big bets on the future, notes Chris Lane of Bernstein, an equity-research firm. In recent years SoftBank has traded at a 30% discount to the value of its assets, which include its holding in Alibaba. This gap has widened lately.

Some wagers in particular raise eyebrows. His investments in ride-hailing firms attract criticism because their business models are easy to copy, and because his injection of cash may, in the short-term, encourage them to burn even more of the stuff battling each other. Putting $4.4bn into WeWork, a provider of shared workspaces, valuing it at $20bn, is another risky bet. The firm leases office space, redesigns it to create a hip vibe and sublets it to startups, freelancers and some big firms. The worry is that WeWork is little more than a commercial-property company that is unjustifiably trading on a tech valuation and will soon be rumbled.

SoftBank’s shareholders are firmly on the hook when it comes to the Vision Fund. It is the only investor to contribute nothing but equity and would lose its $28bn first if the fund falls steeply in value. Of the money contributed by known outsiders, just over 60% is in the form of debt, which will receive a 7% coupon, to be paid every six months. According to people familiar with the fund, it will move in and out of investments but it will always keep a buffer of around $20bn to make follow-on investments in existing portfolio firms and to pay the coupon each six months. (That cushion underlines that the headline figure of $100bn is partly a marketing strategy.) The flipside of this structure is that SoftBank’s returns from the Vision Fund are leveraged, because it holds only equity, so it would profit handsomely if things go well. It also gets an annual management fee and a performance bonus if the fund surpasses expectations. A rough estimate is that if the underlying investments return only 1% a year for the fund’s life of 12 years, SoftBank’s annual internal rate of return (IRR) would be -4%, whereas if they returned 20% a year, the annual IRR would be 27%.

What, then, would count as success after the fund has run its course? Mr Son has repeatedly said that even without Alibaba, his investments have produced a remarkably high IRR of 42% (with Alibaba included, it rises to 44%). But IRR is a fuzzy concept with no standard measure and can be manipulated. The discrepancy between the figure of 42% and the poor relative performance of SoftBank shares may be more telling.

It seems certain that the Vision Fund is aiming high. But the bigger a fund is, the harder it is to make high returns. Success in venture capital in particular is based on the idea of making a range of bets with returns that are likely to diverge sharply. Out of a portfolio of, say, 50 investments, the chances are that 20 will fail and 20 might produce a middling return. The real money comes from the few that generate an extraordinary windfall, such as Accel achieved with its early investment in Facebook or Sequoia with Google.

Achieving such a distribution is harder when investing huge sums, in the range of $100m to $5bn. In the case of a $5bn investment, it would not be enough for the Vision Fund to exit even at $50bn; it would need an exit at $100bn or more, and such outcomes are extremely rare. Perhaps, as the portfolio is tilted heavily towards later-stage investments in more tried-and-tested businesses, the answer is that there will be fewer failures, so big wins are not as essential. But the Vision Fund has lots of early-stage bets too, such as Improbable or Plenty, an indoor-farming startup. It may require a firm such as Uber, Didi or Arm to end up worth over $500bn for the fund to meet Mr Son’s definition of success.

The complexity of the relationship between the Vision Fund and SoftBank is another potential vulnerability. Despite a strong alignment of interest, the two sets of shareholders might disagree about which firms should go where. Or Mr Son might spread himself too thin. He seldom sees anything but upside, says a person close to him. That may make him unrealistic about the need for him to stay closely involved in all the Vision Fund’s investments. He is probably the only one who fully understands the jigsaw puzzle of AI, satellites, data and so on that it comprises.

Mr Son will also run up against limits on his ability to influence founders and find synergies. The fund’s stakes are usually below 30%, so it has few formal levers to force chief executives into deals or alliances they find unappetising. And where he presses for long-term growth and advances in frontier technologies, other investors may prefer near-term profits.

Unaugmented reality

Even success would have its complications. As some firms get bigger and more dominant, regulators are casting a warier eye. In ride-hailing, the most high-profile part of the portfolio, antitrust watchdogs are stirring. It was a shock to regulators in Singapore, Vietnam and the Philippines when, after Grab merged with Uber, the latter prepared to wind down, leaving Grab as the monopoly operator. Competition reviews have begun in all three places.

Mr Son’s connections in China may also be double-edged. They could benefit firms looking to enter the local market. But amid rising nervousness in Washington, DC, about China’s clout in tech, they are also attracting attention from America’s powerful Committee on Foreign Investment in the United States. Its pending review of SoftBank’s acquisition of its stake in Uber, for example, means that Mr Misra has yet to take his seat on the firm’s board.

As for the Vision Fund’s broader impact on startups, the most controversial question is whether stuffing balance-sheets with too much capital encourages indiscipline. Startups perish more often from indigestion than starvation, runs a Silicon Valley saying. Too much money can create unrealistic expectations and lead to waste, inefficiency and sloppiness. Mr Gurley, who has long warned about a bubble, notes that the cash-burn rate of the top 200 private tech firms is now probably five times faster than in 1999, and the Vision Fund is adding to the risk.

Mr Son’s broad aim in giving out such massive cheques is to ensure that founders can focus on their businesses rather than spending time preparing for their next funding round. “Too much money has a bad effect,” he says, “but turbocharging the firms that have a great formula stimulates founders’ thinking and gives them stamina.” It seems clear, however, that smaller firms, once they get the money, are elevated above their rivals. Having lots of capital is in itself a shield against competitors. Patricia Nakache of Trinity Ventures, has dubbed Vision Fund companies “untouchable” or “super haves”.

Some founders do say “no”. One such was David Rosenberg, who set up AeroFarms, an indoor vertical-farming startup, in upstate New York in 2004. The firm is well-established and operates nine indoor farms (the most recent is the world’s largest) using its patented aeroponic system to grow many different types of leafy greens and herbs. When Mr Rosenberg found out the Vision Fund’s minimum cheque size was $100m, he turned it down. “I did not think at the time that we could spend that money in a responsible way,” he says.

Such self-denial is rare, and the wider effects of such massive sums are already being felt. The Vision Fund intensifies an existing trend for ever-greater wads of money to pour into startups, pumping up valuations. That in turn reinforces a tendency for highly valued private companies to shun the public markets for longer. Some founders now even speak of “doing an IPO to the SoftBank market”.

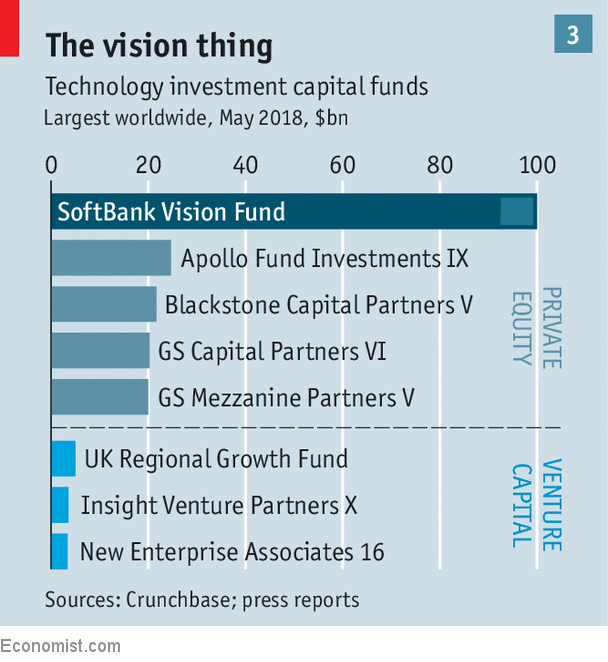

It also brings disruption to those who have themselves mercilessly backed upstarts in established industries (see chart 3). The fund’s reach and heft has stoked intense jealousy among American private-equity and venture-capital bosses, notes one New York-based financier close to Mr Son. The next three biggest growth funds of venture-capital firms add up to a mere $12bn, and all but the biggest are now often priced out of later-stage funding rounds.

In response, investment firms in Silicon Valley are attempting to up the ante—Sequoia, for example, is raising a new $8bn global growth fund. Some of them have taken to warning startups against accepting funding from Saudi Arabia which, despite its new and more liberal instincts, is still a deeply repressive country. But few entrepreneurs will turn down the largesse. As one quips, not all money can come from the blue-chip Rockefeller Foundation.

As a result the fund is swinging the tech pendulum a little away from Silicon Valley. Money is gushing from farther-flung places. Only around a third of the Vision Fund’s cash comes from American, Japanese and Taiwanese firms; 60% hails from Saudi Arabi and Abu Dhabi. And its money is also flowing to places where capital is in shorter supply. The beneficiary should be Europe, which has struggled to attract the sums that routinely get invested in startups in America and China.

The risks, however, are huge. Determined to invest in indoor farming, but unable to back AeroFarms, Mr Son last year put $200m in Plenty, which was founded in 2014. The firm has not yet started selling produce to customers; it plans to do so in San Francisco very shortly. Its founder, Matt Barnard, a Steinbeckian character who grew up on a cherry-and-apple farm in Wisconsin, reckons that indoor farming could help the global fruit-and-vegetable industry quintuple from $500bn today to $2.5trn. Without having sold a single lettuce, Plenty is planning expansion into China and Japan. Like the Vision Fund itself, such a firm will either fail dramatically or succeed beyond all expectations—regardless, it will happen on a grand scale.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.