A motive of the financial industry is to blur the lines between investor and trader. I’m convinced it’s to make investors feel guilty for taking control of their portfolios. After all, Wall Street firms ares the experts with YOUR money.

How dare you question them?

Sell to take profits, sell to minimize losses, purchase an investment that fits into your risk parameters and asset allocations; it’s all enough to brand one as ‘trader’ in the buy & forget circles that are paid to push the narrative that markets are on a permanent trek higher and bears are mere speed bumps. Wall Street has forgotten the financial crisis. You can’t afford such a luxury.

And, if you’re a reader of RIA, you’re astute enough to know better.

“You’re a trader now?”Broker at a big box financial shop.

A planning client called his financial partner to complete two trades. Mind you, the only trades he’s made this year. His request was to sell an investment that hit his loss rule and purchase a stock (after homework completed on riapro.net). His broker was dismayed and asked the question outlined above.

Investors are advised – Be like Warren Buffett and his crew: You know, he’s buy and hold, he never sells! Oh, please.

From The Motley Fool:

Here’s what Berkshire sold in the third quarter:

During the third quarter, Berkshire sold some or all of five stock positions in its portfolio:

- 750,650 shares of Apple.

- 31,434,755 shares of Wells Fargo.

- 1,640,000 shares of Sirius XM.

- 370,078 shares of Phillips 66.

- 5,171,890 shares of Red Hat.

What Do Paul Tudor Jones, Ray Dalio, Ben Graham, and even Warren Buffett have in common?

- A strict investment discipline.

- Despite mainstream media to the contrary, all great investors have a process to “buy” and “sell” investments.

Investment rules keep “emotions” from ruling investment decisions:

Rule #1: Cut Losers Short & Let Winners Run.

While this seems logical, it is one of the toughest tenets to follow.

“I’ll wait until it comes back, then I’ll sell.”

“If you liked it at price X, you have to love it at Y.”

It takes tremendous humility to successfully navigate markets. There can be no such thing as hubris when investments go the way you want them; there’s absolutely no room in your brain or portfolio for denial when they don’t. Investors who are plagued with big egos cannot admit mistakes; or they believe they’re the greatest stock pickers who ever lived. To survive markets, one must avoid overconfidence.

Many investors tend to sell their winners too soon and let losers hemorrhage. Selling is a dilemma. First, because as humans we despise losses twice as much as we relish gains. Second, years of financial dogma have taken a toll on consumer psyche where those who sell are made to feel guilty for doing so.

It’s acceptable to limit losses. Just because you sell an investment that isn’t working doesn’t mean you can’t purchase it again. That’s the danger and beauty of markets. In other words, a stock sold today may be a jewel years from now. I find that once an investor sells an investment, it’s rarely considered again. Remember, it’s not an item sold on eBay. The beauty of market cycles is the multiple chances investors receive to examine prior holdings with fresh perspective.

Rule #2: Investing Without Specific End Goals Is A Big Mistake.

I understand the Wall Street mantra is “never sell,” and as an individual investor you’re a pariah if you do. However, investments are supposed to be harvested to fund specific goals. Perhaps it’s a college goal, or retirement. To purchase a stock because a friend shares a tip on a ‘sure winner,’ (right), or on a belief that an investment is going to make you wealthy in a short period of time, will only set you up for disappointment.

Also, before investing, you should already know the answer to the following two questions:

At what price will I sell or take profits if I’m correct?

–Where will I sell it if I am wrong?

Hope and greed are not investment processes.

Rule #3: Emotional & Cognitive Biases Are Not Part Of The Process.

If your investment (and financial) decisions start with:

–I feel that…

–I was told…

–I heard…

–My buddy says…

You are setting yourself up for a bad experience.

In his latest tome, Narrative Economics, Yale Professor Robert J. Shiller makes a formidable case for how specific points of view which go viral have the power to affect or create economic conditions as well as generate tailwinds or headwinds to the values of risk assets like stocks and speculative ventures such as Bitcoin. Simply put: We are suckers for narratives. They possess the power to fuel fear, greed and our overall emotional state. Unfortunately, stories or the seductive elements of them that spread throughout society can lead to disastrous conclusions.

Rule #4: Follow The Trend.

80% of portfolio performance is determined by the underlying trend.

Astute investors peruse the 52-week high list for ideas. Novices tend to consider stocks that make 52-week highs the ones that need to be avoided or sold. Per a white paper by Justin Birru at The Ohio State University titled “Psychological Barriers, Expectational Errors and Underreaction to News,” he posits how investors are overly pessimistic for stocks near 52-week highs although stocks which hit 52-week highs tend to go higher.

Thomas J. George and Chuan-Yang Hwang penned “The 52-Week High and Momentum Investing,” for The Journal of Finance. The authors discovered purchasing stocks near 52-week highs coupled with a short position in stocks far from a 52-week high, generated abnormal future returns. Now, I don’t expect anyone to invest solely based on studies such as these. However, investors should understand how important an underlying trend is to the generation of returns.

Rule #5: Don’t Turn A Profit Into A Loss.

I don’t want to pay taxes is the worst excuse ever to not fully liquidate or trim an investment.

If you don’t sell at a gain – you don’t make any money. Simpler said than done. Investors usually suffer from an ailment hardcore traders usually don’t – “Can’t-sell-taxes-due” itis.

An investor which allows a gain to deteriorate to loss has now begun a long-term financial rinse cycle. In other words, the emotional whipsaw that comes from watching a profit turn to loss and then hoping for profit again, isn’t for the weak of mind. I’ve witnessed investors who suffer with this affliction for years, sometimes decades.

Rule #6: Odds Of Success Improve Greatly When Fundamental Analysis is Supported By Technical Analysis.

Fundamentals can be ignored by the market for a long-time.

After all, the markets can remain irrational longer than you can remain solvent.

The RIA Investment Team monitors investments for future portfolio inclusion. The ones that meet our fundamental criteria – cash flows, growth of organic earnings (excluding buybacks), and other metrics, are sometimes not ready to be free of “incubation,” which I call it; where from a technical perspective, these prospective holdings are not in a favorable trend for purchase.

It’s a challenge for investors to wait. It’s a discipline that comes with experience and a commitment to be patient or allocate capital over time.

Rule #7: Try To Avoid Adding To Losing Positions.

Paul Tudor Jones once said “only losers add to losers.”

The dilemma with ‘averaging down’ is that it reduces the return on invested capital trying to recover a loss than redeploying capital to more profitable investments.

Cutting losers short, like pruning a tree, allows for greater growth and production over time.

Years ago, close to 30, when I was starting out at a brokerage firm, we were instructed to use ‘averaging down’ as a sales tactic. First it was an emotional salve for investors who felt regret over a loss. It inspired false confidence backed up by additional dollars as it manipulated or lowered the cost basis; adding to a loser made the financial injury appear healthier than it actually was. Second, it was an easy way for novice investors to generate more commissions for the broker and feel better at the same time.

My rule was to have clients average in to investments that were going up, reaching new highs. Needless to say, I wasn’t very popular with the bosses. It’s a trait, good or bad, I carry today. Not being popular with the cool admin kids by doing what’s right for clients has always been my path.

Rule #8: In Bull Markets You Should be “Long.” In Bear Markets – “Neutral” or “Short.”

Whew. A lot there to ponder.

To invest against the major “trend” of the market is generally a fruitless and frustrating effort.

I know ‘going the grain’ sounds like a great contrarian move. However, retail investors do not have unlimited capital to invest in counter-trends. For example, there are institutional short investors who will continue to commit jaw-dropping capital to fund their beliefs and not blink an eye. We unfortunately, cannot afford such a luxury.

So, during secular bull markets – remain invested in risk assets like stocks, or initiate an ongoing process of trimming winners.

During strong-trending bears – investors can look to reduce risk asset holdings overall back to their target asset allocations and build cash. An attempt to buy dips believing you’ve discovered the bottom or “stocks can’t go any lower,” is overconfidence bias and potentially dangerous to long-term financial goals.

I’ve learned that when it comes to markets, fighting the overall tide is a fruitless endeavor. It smacks of overconfidence. And overconfidence and finances are a lethal mix.

We can agree on extended valuations; or how future returns on risk assets may be lower because of them. However, valuation metrics alone are not catalysts for turning points in markets. With global central banks including the Federal Reserve hesitant to increase rates and clear about their intentions not to do so anytime in the near future, expect further ‘head scratching’ and astonishment by how long the current bullish trend may continue.

Rule #9: Invest First with Risk in Mind, Not Returns.

Investors who focus on risk first are less likely to fall prey to greed. We tend to focus on the potential return of an investment and treat the risk taken to achieve it as an afterthought.

Years ago, an investor friend was excited to share with me how he made over 100% return on his portfolio and asked me to examine his investments. I indeed validated his assessment. When I went on to explain how he should be disappointed, my friend was clearly puzzled.

I went on to explain how based on the risk, his returns should have been closer to 200%! In other words, my friend was so taken with the achievement of big returns that he went on to take dangerous speculation with his money and frankly, just got lucky. It was a good lesson about the danger of hubris. He now has an established rule which specifies how much speculation he’s willing to accept within the context of his overall portfolio.

The objective of responsible portfolio management is to grow money over the long-term to reach specific financial milestones and to consider the risk taken to achieve those goals. Managing to prevent major draw downs in portfolios means giving up SOME upside to prevent capture of MOST of the downside. As many readers of RIA know from their own experiences, while portfolios may return to even after a catastrophic loss, the precious TIME lost while “getting back to even” can never be regained.

To understand how much risk to consider to achieve returns, it’s best to begin your investor journey with a holistic financial plan. A plan should help formulate a specific risk-adjusted rate of return or hurdle rate required to reach the needs, wants and wishes that are important to you. and your family.

Rule #10: The Goal Of Portfolio Management Is A 70% Success Rate.

Think about it – Major League batters go to the “Hall Of Fame” with a 40% success rate at the plate.

Portfolio management is not about ALWAYS being right. It is about consistently getting “on base” that wins the long game. There isn’t a strategy, discipline or style that will work 100% of the time.

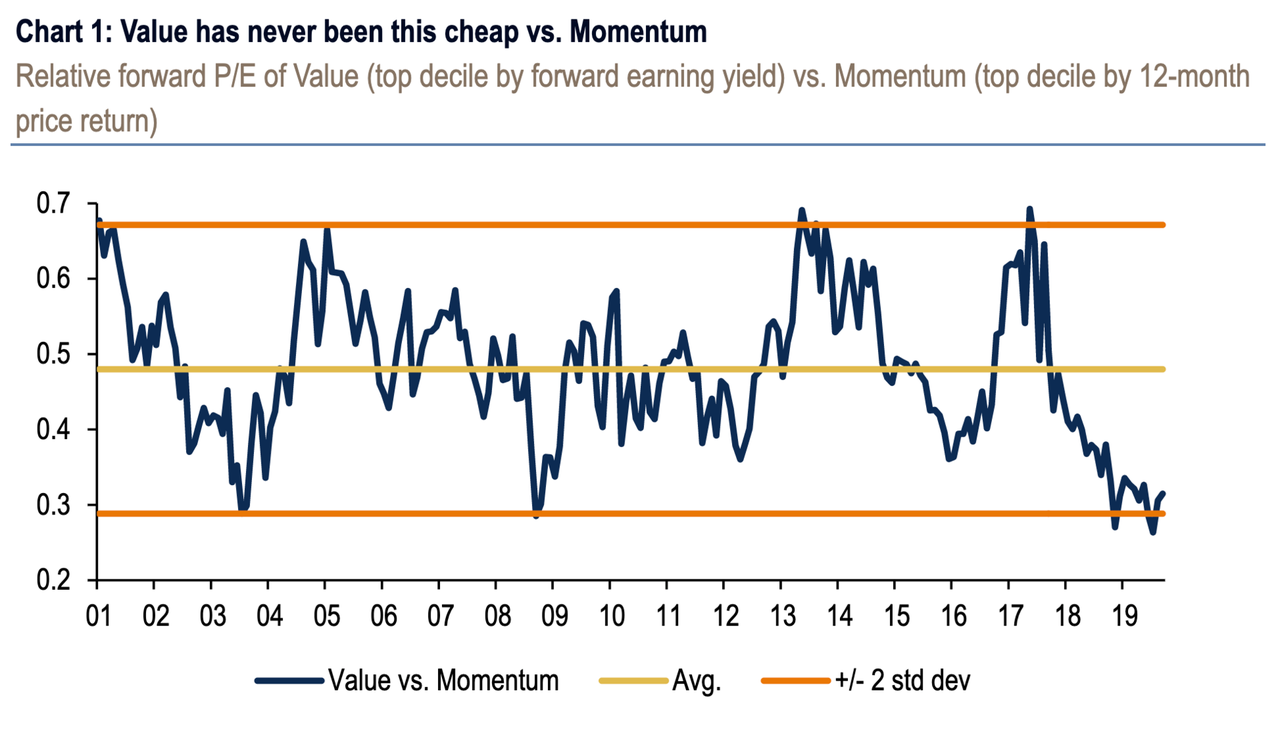

As an example, the value style of investing has been out of favor for a decade. Value investors have found themselves frustrated. That doesn’t mean they should have decided to alter their philosophy, methods of analysis or throw in the towel about what they believe. It does showcase however, that even the most thorough of research isn’t always going to be successful.

Those investors who strayed from the momentum stocks such as Facebook, Amazon, Netflix and Google have paid the price. Although there’s been a resurgence in value investing since October, it’s too early to determine whether the trend is sustainable. Early signs are encouraging.

Chart: BofA Merrill Lynch US Equity & Quant Strategy, FactSet.

A trusted financial professional doesn’t push a “one-size-fits-all,” product, but offers a process and philosophy. An ongoing method to manage risk, monitor trends and discover opportunities.

Even then, even with the best of intentions, a financial expert isn’t going to get it right every time as I outlined previously. The key is the consistency to meet or exceed your personalized rate of return.

And that return is only discovered through holistic financial planning.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.