Now that Dennis Gartman's daily recos can no longer be faded, algos are feeling just a little confused: after all, with no 100% guaranteed way to make money, some risk has to be taken and that just won't stand. So what is a good alternative to the "Gartman Letter"? Here Goldman's sellside recos certainly come to mind. And while nobody can ever come close to the uncanny Gartmanity of Goldman's former FX strategist, Thomas Stolper, Goldman's research desk does have a peculiar habit of advising its clients to do precisely the opposite of what Goldman's own prop desks are doing at any one moment.

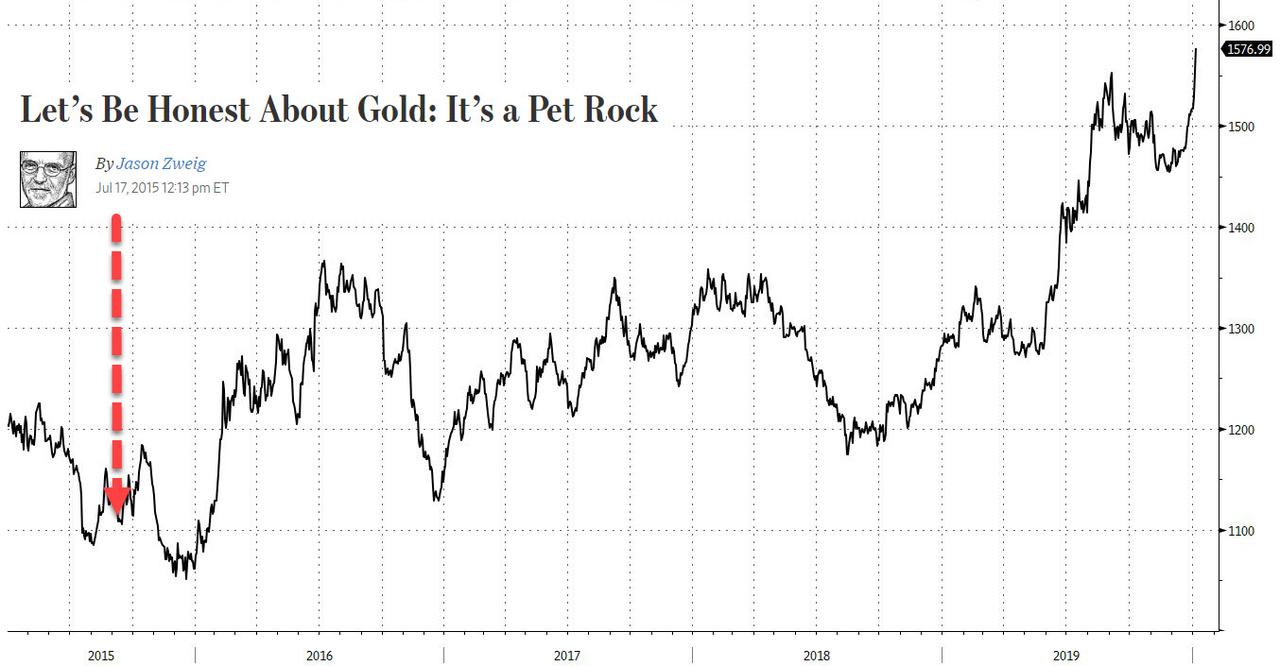

Which is why we have some bad news for gold longs, who have enjoyed a tremendous surge in the price of pet rock in the past year, and which is now up about 40% higher than when some WSJ hack decided to mock gold back in July 2015...

... for the simple reason that overnight, Goldman decided to present its "thoughts" on what it thought was a better hedge to geopolitical crises such as Iran - gold or oil - and the answer is...

Of course, this is the kiss of death for gold, and it means that Goldman's own traders are now seeking clients to dump their gold holdings to. This is how Goldman laid out its bullish case:

We found that spikes in geopolitical tensions lead to higher gold prices when they are severe enough to cause currency debasement. This most often happens during wars or military escalations. Accordingly, we found that gold performed well, even controlling for real rates and dollar weakness, during the beginning of both Gulf wars and during the events of September 11, 2001. Therefore, additional escalation in US-Iranian tensions could further boost gold prices. All in all, we stick with our 3, 6 and 12m forecast of $1,600/toz but see upside risks if geopolitical tensions worsen.

Translation: while gold will inevitably soar since it is just a matter of time before central banks and governments launch helicopter money, the next short-term move in gold is most likely lower as Goldman now dumps inventory.

Or maybe not: perhaps we are being too cynical and maybe gold is set to hit $2k next. For the benefit of more naive, innocent and gullible readers, here is Goldman's take on why it urges its clients to buy more gold (from Goldman), while selling oil (to Goldman):

- Fears around rising US-Iran tensions and potential for retaliation from Iran pushed oil and gold prices sharply higher on Friday, January 3. This is on top of a strong macro-driven end-of-year finish that pushed all commodities higher. While tensions in the Middle East have undeniably escalated with Iran reportedly committing to retaliating, we believe that the current risk premium embedded in Brent prices (through timespreads) is already elevated, with an actual supply disruption now necessary to sustain oil prices near current levels of $69/bbl. Although the rally in oil suggests the market attaches a significant probability to current tensions leading to an oil supply disruption, we would argue that assessing such specific consequences is difficult at this time. The range of potential scenarios is very large; spanning oil supply shocks or even oil demand destruction — which would be negative to oil prices. In contrast, history shows that under most outcomes gold will likely rally to well beyond current levels. This is consistent with our previous research which shows that being long gold is a better hedge to such geopolitical risks.

- Fears of a potential Iran retaliation on oil assets pushed oil prices to their highest levels since the attack on Saudi Arabia’s Abqaiq facility last September. Absent a major supply disruption, we therefore believe that price risks are skewed to the downside in coming weeks, with oil prices already trading above our fundamental fair value of $63/bbl ahead of the recent events, buoyed by an over-enthusiastic December risk-on rally in the face of limited evidence of a material acceleration in global growth. A similar pre-emptive – and ultimately unsustainable – move occurred ahead of both the expected loss of Iran supplies in October 2018 as well as in the immediate aftermath of the Abqaiq attack.

- Specifically, Friday’s move higher in prices was nearly entirely driven by a steepening backwardation with spot prices outperforming long-dated prices by $2.6/bbl. Based on our pricing model, which leverages the historical link between such relative moves and shifts in oil fundamentals, this move can be interpreted as the market immediately and pre-emptively pricing in an outage of 800 kb/d for three months or a 30% chance of a much larger 2.7 mb/d outage for three months. Therefore, this move already reflects a large risk premium with, for example, total Iraq exports from the Southern port of Basra being only 3.2 mb/d in December. Further, it is not a given that any potential retaliation by Iran would target oil producing assets; the recent incident at the US embassy in Iraq occurred while there was no disruption to neighboring oil fields. We note that the US is becoming less sensitive to oil disruptions and price spikes, as the country became a net petroleum exporter in September for the first time in modern history.

- The precedent set by the Abqaiq attack showed that the oil market has significant supply flexibility starting when Brent is at $70/bbl, even before shale production needs to ramp up, suggesting only moderate upside from here, should an attack on oil assets actually occur. As we argued following the Abqaiq attack: (1) there is significant OPEC product spare capacity of nearly 2.0 mb/d immediately available, which was successfully deployed in the fall of 2018, (2) EM crude inventories are much higher than they have been historically, especially in Saudi and China, with both countries already demonstrating their willingness to use these to stabilize supply and prices in the past two years, (3) global oil demand has become more elastic to prices given the steady decline in EM subsidies with current weak global economic growth particularly sensitive to higher prices, and (4) DM strategic stockpiles remain very large – especially in the US – with governments showing a willingness to use these when prices reached $75/bbl. Finally, even if US shale producers have become more disciplined, WTI prices at $70/bbl would allow them to both deliver strong returns to shareholders and increase production as well.

- Over the past month gold has rallied by $100, reaching $1,550/toz, which is almost at our 3-month target of $1,600/toz. The initial part of the rally occurred alongside a weakening USD and rising inflation expectations combined with still weak economic growth, signaled by our economists’ December US CAI running at 1% yoy. A weaker dollar boosts gold through the “wealth effect”, raising the dollar purchasing power of main gold consumers, as well as through gold speculative positions which are highly sensitive to trends in the US Dollar Index (DXY). Higher breakeven inflation and weak growth data also likely helped gold, as they add to concerns of a potential late cycle inflation overshoot. As we have argued before, such an overshoot is the economic environment in which gold historically does best as investors become concerned over debasement risks. The final leg of the rally on Friday was triggered by a negative surprise in the US manufacturing ISM and escalation in the US-Iranian geopolitical tensions.

- We found that spikes in geopolitical tensions lead to higher gold prices when they are severe enough to cause currency debasement. This most often happens during wars or military escalations. Accordingly, we found that gold performed well, even controlling for real rates and dollar weakness, during the beginning of both Gulf wars and during the events of September 11, 2001. Therefore, additional escalation in US-Iranian tensions could further boost gold prices. All in all, we stick with our 3, 6 and 12m forecast of $1,600/toz but see upside risks if geopolitical tensions worsen.

- Base metals rallied strongly into year-end, helped by slightly better China PMI data, monetary policy loosening in China, de-escalation of trade tensions and weak Chinese supply in copper and aluminium. Most recently they were hit by the escalation in US-Iran tensions and subsequent market risk-off. For copper, signs that physical copper demand in China returned to positive growth in Q3, on improving property completions, has likely further boosted sentiment and led to a reduction in short spec positions. Going into 2020 we continue to expect the old economy recovery to be lacklustre, which was recently reaffirmed by a weak US manufacturing ISM. This means that supply differentiation and micro demand drivers will be key to each metal’s performance. Therefore, we remain bullish copper, where smelters suffer from depressed margins, and nickel, where supply uncertainty from the Indonesian ore ban remains high for 2021, and bearish aluminium and zinc where smelters enjoy very healthy margins. On the demand side, copper and nickel also benefit from positive exposure to EVs and renewable energy, which have picked up momentum recently, particularly in Europe. Still, we acknowledge that further escalation of geopolitical tensions has the potential to dampen economic activity and weaken base metals demand.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.