The Seat Belt mystery

In early 1970s, when the use of seat belts were made mandatory in the US to improve driver safety, something strange happened.

Instead of road accident deaths coming down they actually went up!

While the regulators were perplexed by this phenomenon, an economist by the name Sam Peltzman came up with a controversial answer.

He argued that though the drivers had lower risks due the additional safety that a seat belt provides, many drivers actually compensated for the additional safety by driving more recklessly (driving faster, not paying as much attention, etc.) under the comfort of the added safety.

“The safer they make the cars, the more risks the driver is willing to take”

This meant that bystanders – pedestrians, bicyclists etc – would receive no safety benefit from the seat belts but would rather suffer as a result of increased recklessness.

He termed this effect “risk-compensation” but it is popularly known as the Peltzman effect.

Although the study has had its fair share of criticism, the Peltzman effect has been observed in a number of different settings.

Condoms and HIV prevention

In the late 1980s, Thailand and the Philippines had roughly the same number of HIV/ AIDS cases at 112 and 135 cases, respectively.

In the early 1990s, the Government of Thailand enforced the “100% Condom Use” program in its booming commercial sex industry while the Philippines was characterized by its very low rate of condom use and the firm opposition of church and government to condoms.

In 2003, almost fifteen years later, the number of HIV/ AIDS cases in Thailand had risen to 750,000while the number in the Philippines remained low at 1,935 cases despite Philippines population growing to more than 30 per cent that of Thailand. Thailand ranks as the country with the highest HIV prevalence in Asia.

Source: Link

Mike Roland, editor of Rubber Chemistry and Technology states that wearing a condom reduces the risk of AIDS by a factor of 3 but simply choosing your partners wisely reduces the risk factor by 5,000.

While it is obvious that wearing condoms during promiscuous sexual activity reduces the risk of HIV, counter intuitively the lower risk of HIV can actually have the effect of tricking people into blindly engaging in more risky promiscuous sexual activity.

Its our peltzman effect at play 🙂

Titanic – The ship even god cannot sink

All of us know what happened to the Titanic. I would rather let the below picture do the talking.

Yep, its peltzman effect, yet again!

Olympic Boxing – Good bye Head Guards

Did you know this – the Olympics ditched boxing headgear in 2016 for the first time since 1984!

The decision, according to the International Boxing Association, or AIBA came down to safety.

Several studies, including one commissioned by the association, found that the number of acute brain injuries declined when head guards were not used.

The studies pointed out that

Headgear creates a false sense of safety and boxers take more risks.

By now, you know what is happening 🙂

Our behavior adapts to perception of risk

Now while all this goes against our intuition – the underlying point is that

When our perception of risk reduces, we usually adapt our behavior by taking higher risks

Indian Investor and the Peltzman effect

What does this have to do with the Indian investor?

Based on the Peltzman effect, if investor perception of risks in the equity market reduces, then it means that investors will respond by taking additional risks.

Let us evaluate the current investor perception of risk.

From a purist point of view – risk is the probability of permanent loss of capital.

However, when there is a market decline, most of us at that juncture do not know if it is permanent or temporary. (and unfortunately a lot of us give up and jump out at the bottom).

So for the purpose of this post, I will assume that investor perception of risk will depend on the intermittent declines in equity market that he/she has witnessed in recent times.

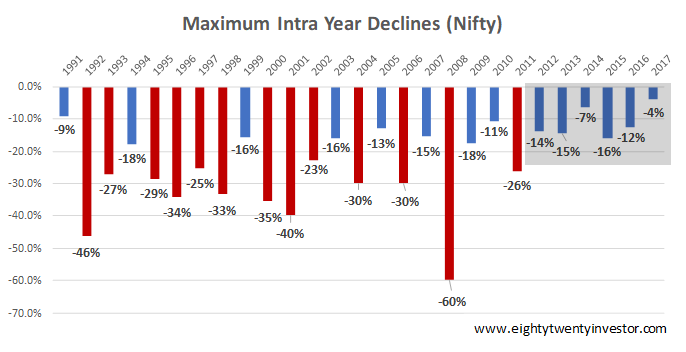

Here is an interesting chart which shows the intra-year declines which an investor in Indian equity markets would have witnessed in the last 27 years.

An interesting thing to notice is that, the 20 year period from 1991 to 2011 has witnessed significant declines each year and 20% declines or more (indicated by the red bars) were a common occurrence.

So any investor who invested in equities during that period, eventually had to go through these significant but temporary declines year after year.

However, if you notice the recent 5-6 years, the declines have been significantly lower.

In fact the intra-year decline for 2017 is the lowest ever!

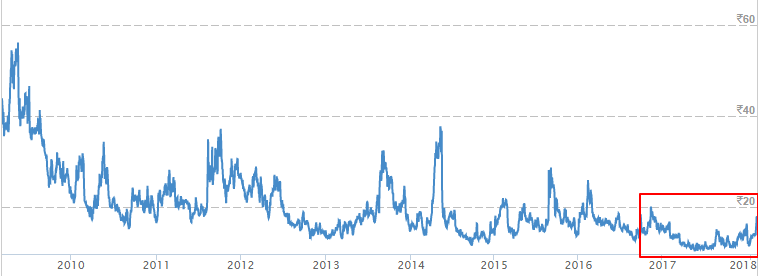

The other way to confirm this thesis is to look at the index which indicates volatility – Nifty VIX index (It measures the degree of volatility or fluctuation that active traders expect in the Nifty50 over the next 30 days).

The Nifty VIX index is also close to its all time lows!

Thus the first takeaway is:

Takeaway 1: Indian Equity Market fluctuation is extremely low in recent times (leading to a perception of lower risks in equity markets)

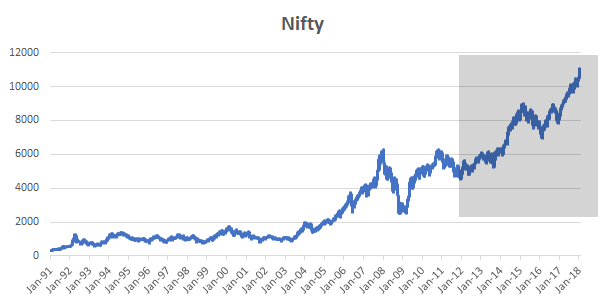

Further the markets have also rallied since 2013.

Takeaway 2: Indian Equity Market Returns have been awesome in recent times

Further real estate returns have been poor in recent times and are showing initial signs of a decline (see here)

Gold returns have also been very dismal over the last few years.

Bank FD rates and debt fund returns have also significantly dropped due to lower interest rates.

Takeaway 3: Real Estate, Gold, Bank FD – all fall down!!

Now if we combine the above three takeaways, it’s a deadly combination where equity returns are high, equity volatility is low (read as – perception that risk is also low) and none of the alternatives are performing.

Now if we apply the Peltzman effect, this means Indian investors will adjust their behavior to take on more risk!

Is this true? Let us see if Indian investors have increased their risk..

Equity Mutual Fund Industry – Unprecedented Flows!

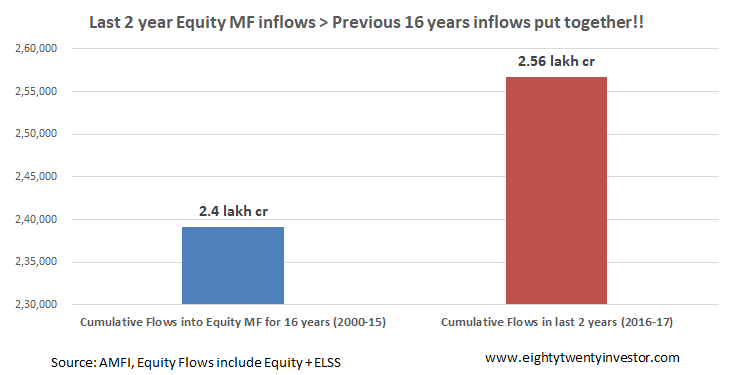

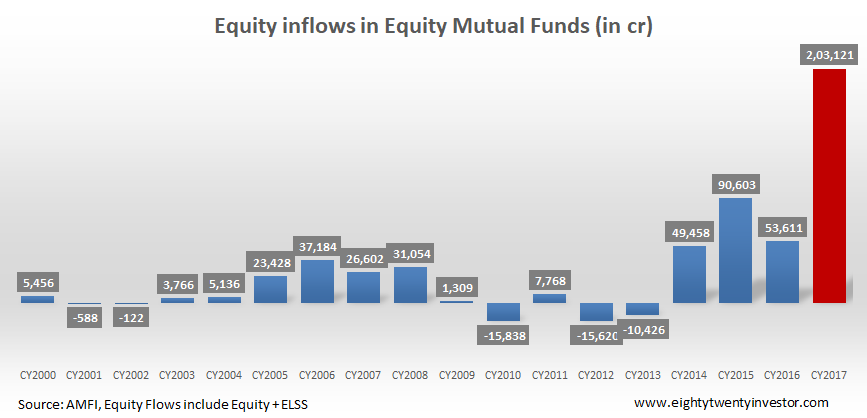

You read that right – In the last 2 years, the money that we Indians invested in Equity Mutual funds is more than the earlier 16 years put together!

If you further drill down, the largest amount of money came in the last year (more than previous 3 years put together)

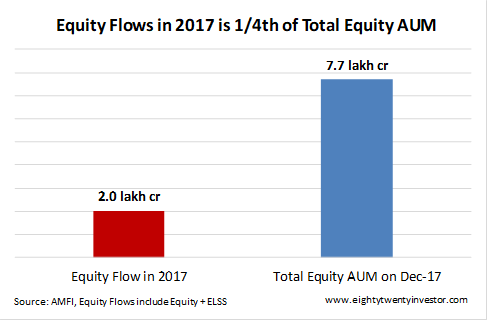

And here is the scary part – the flows for 2017 currently represent 1/4th of the entire equity AUM – and investors who have brought in this money have never witnessed true equity declines (20% and below which was the norm a few years back) as they have come at a point where the volatility is at its historical lows.

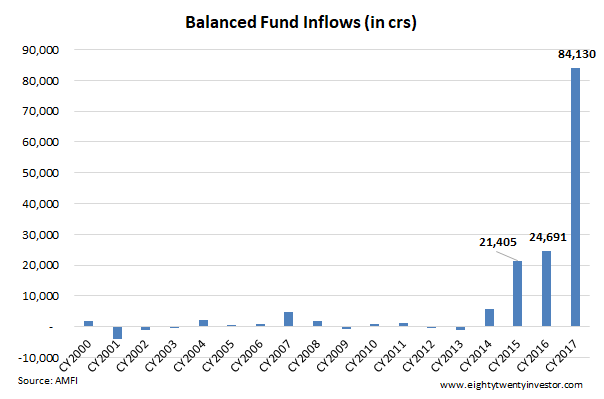

Balanced Funds are the new FD replacement – WTF?

In every bull market, there is always some product which is mis-sold.

This time it is the balanced funds – a category of funds where equity is around 70% of the portfolio and the remaining in debt instruments.

Unfortunately, this equity heavy product is being mis-sold as a 1% every month dividend productwhich will give you 12% tax-free returns every year and as a FD replacement.

This is clearly reflected in the staggering growth of inflows witnessed in 2017

Here is an interesting article which explores this further – Link

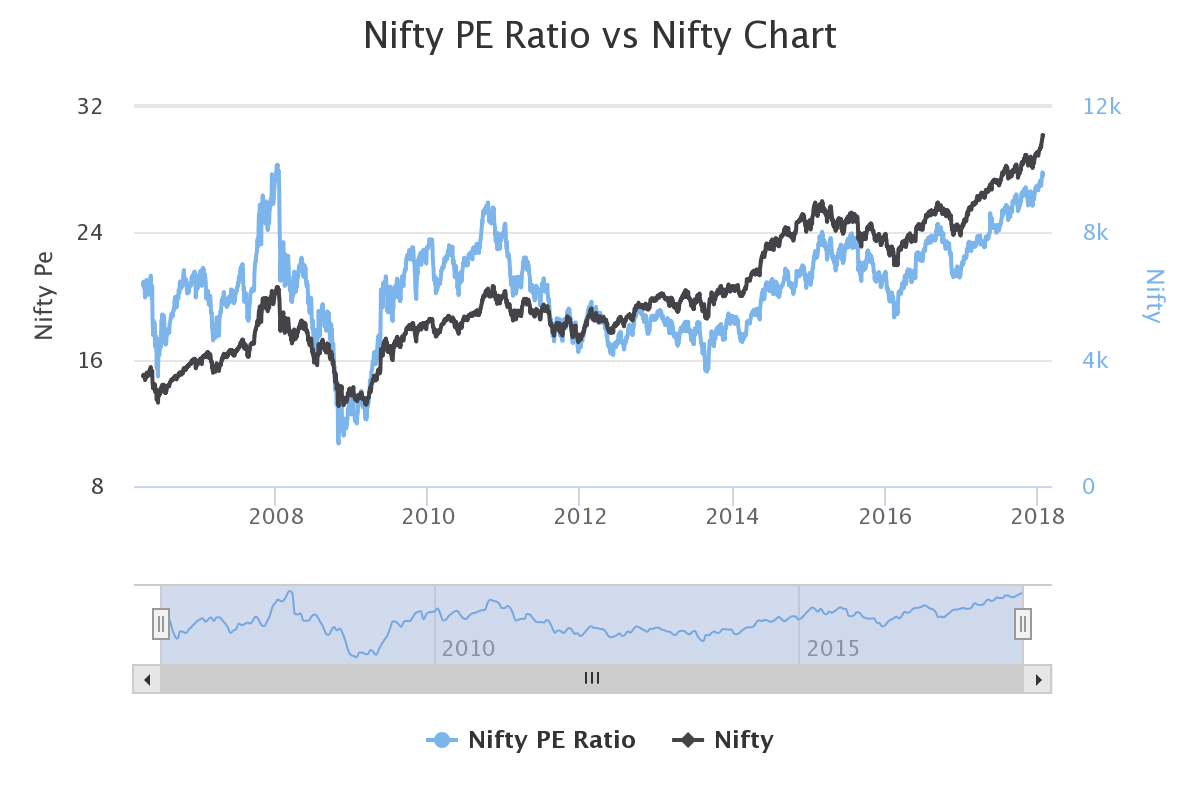

Equity Market Valuations have moved up significantly led by flows

Source: www.equityfriend.com

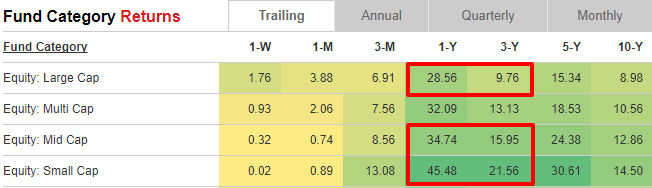

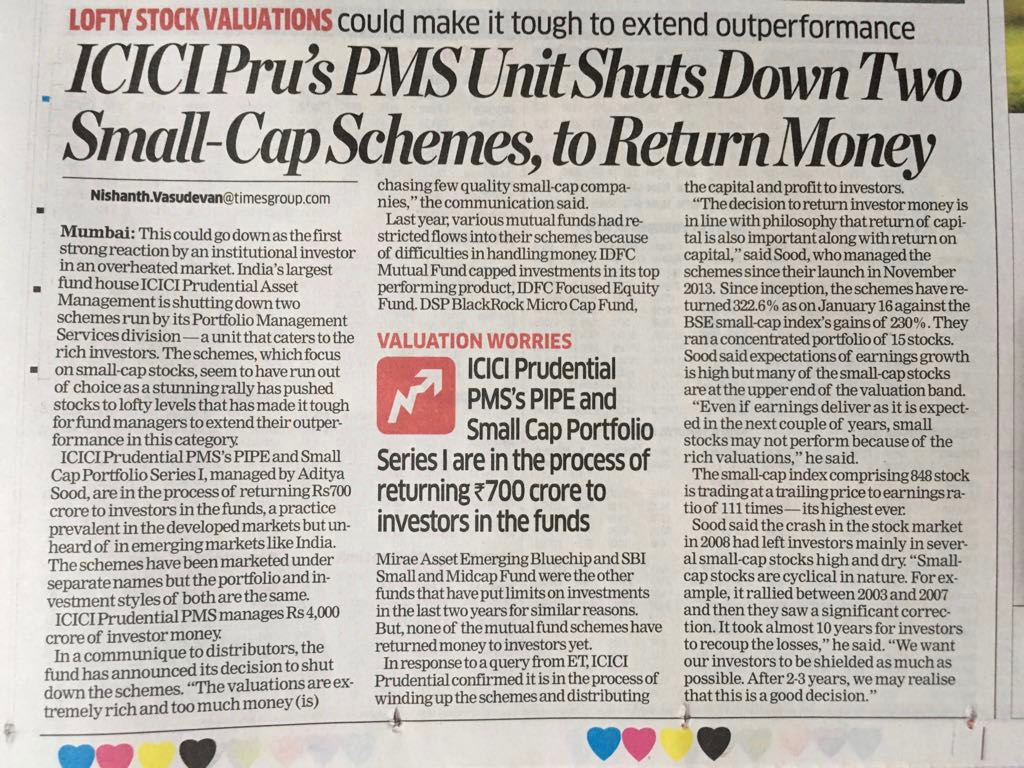

Small Cap funds & PMS signalling “Enough! We can’t take more”

Given the whopping out-performance of small and mid cap funds over large caps recent money has been chasing this segment leading to insane valuations for most of the companies in this segment.

Source: Value Research

To the extent that certain funds have shut down their funds and returned their money back to investors.

Source: ET, Read the entire article here

Some other funds which have restricted their funds for new money – DSP BlackRock Micro Cap Fund, Reliance Small Cap, Mirae Asset Emerging Bluechip and SBI Small and Midcap Fund.

Peltzman effect at play – Time to be cautious and focus on risk

At this point, it seems pretty clear that the perception of equity risk is currently very low amongst investors and this has clearly manifested in higher risk taking behavior across Indian investors.

Everything at this juncture is about returns as risk has taken a backseat.

Hence we as investors must remain cognizant of the exuberant expectations being built into the current market. While earnings growth cycle is yet to begin, lofty valuations imply the possibility ofsharp intermittent declines if in case something goes wrong. (and usually something always does go wrong in the interim)

So, at the current juncture the key is to focus on risk. Also

- Pare down return expectations

- Stay away from mid and small caps

- Stick to your asset allocation plan

If you don’t have an advisor to help you out with asset allocation, then dynamic equity allocation products can be a good option for incremental money allocation.

In a nutshell

- Peltzman effect – Introduction of safety belts in cars increased accidents as drivers compensated for the additional safety by reckless driving

- Observed in several settings such as HIV prevention via condoms, Titanic, Olympic boxing etc

- Peltzman effect visible in current equity markets

- Deadly Trio: Indian Equity Volatility at all time lows + Great returns in equities + Alternative investments (Real Estate, Gold, FD) not doing well

- This lower perception of risk in equities leading to risky behavior in Indian investors

- Signs visible in 1) Unprecedented Equity MF inflows 2) Balanced Funds being sold as FD replacement 3) High Valuations 4) Small Cap funds restricting flows

- Time to be cautious and shift focus on risk (rather than returns)

- Things to do: Pare down return expectations, Avoid mid & small caps and stick to asset allocation

Happy investing 🙂

If you loved what you just read, share it with your friends and don’t forget to subscribe to the blog along with the 1800+ awesome people. Look out for some free super interesting investment insights delivered straight to your inbox. Cheers 🙂

Disclaimer: These are view of individual and not personal advice.Kindly do your due diligence before investing.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.