“Just when I thought I was out, they pull me back in!”

It’s one of the most famous quotes in movies, as Michael Corleone rages in Godfather III over the assassination he narrowly avoided and his inability to steer the family into legit businesses.

Michael is what I like to call a coyote, someone who is VERY smart and VERY strategic. Actually, too smart and too strategic for his own good, what a Brit would call too clever by half.

That’s in sharp contrast to his father, Vito Corleone, who is no less smart and no less strategic, but is somehow far less conniving and far more beloved.

You see this difference in character most clearly in the deaths of Vito and Michael.

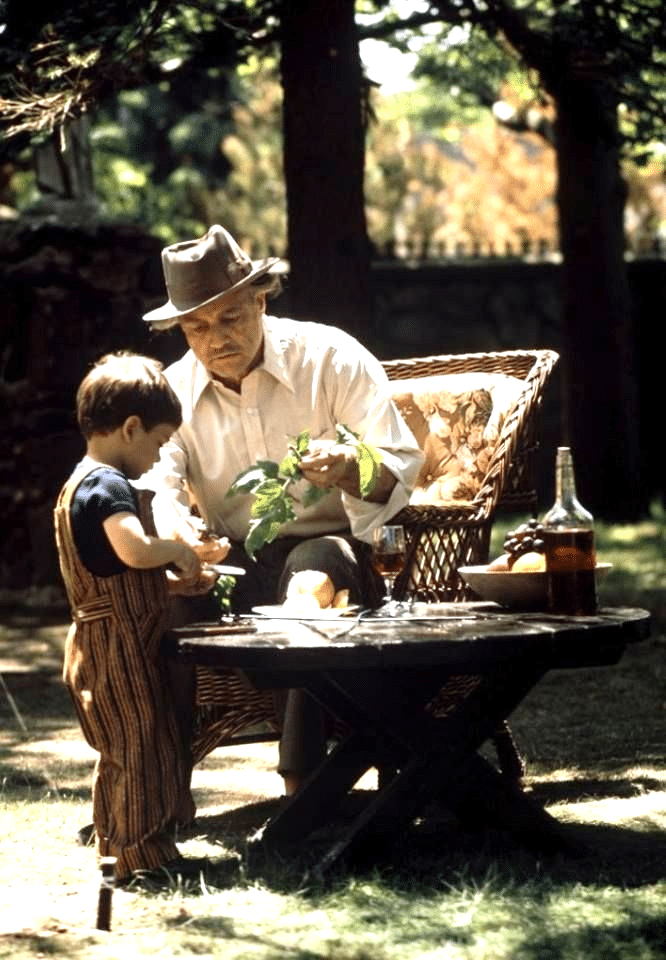

How does Vito Corleone die? Playing in his vegetable garden with his grandson. At home. Surrounded by life and laughter and plenty of bottles of Chianti.

Vito got out.

How does Michael Corleone die? Sitting in a stony Sicilian courtyard as two skinny dogs scurry around. Struggling to peel an orange. All dressed up and no place to go. Alone. Utterly alone.

For all his smarts and strategy and cleverness, Michael NEVER got out.

How did Vito get out, while Michael failed? I think it’s the whole too-clever-by-half coyote thing. Michael never trusted ANYONE in the way that Vito did. Michael was obsessed with finding the Answer, an impossibility in the game of organized crime. Or the game of markets.

Michael was a maximizer.

Which is another way of saying that, like most coyotes, he wasn’t very good at the metagame.

Do you want OUT from the game of markets?

I do.

Am I good at the game? Yeah. Do I enjoy it? Not really. I used to. But ever since Lehman it’s been mostly a drag. And that’s okay! The game of markets is a means to an end. It’s a really big, important game, but it’s only one of several big important games within the larger metagame of life and doing.

My goal in doing is to have a happy ending. I want the Vito ending, not the Michael ending.

How do we get there? We keep our eye on the prize – the happy ending – and we work backwards. We maintain our vision on the metagame and its outcome even while we play the immediate game.

My goal as an investor is NOT to maximize my investment returns or to maximize my personal wealth. That’s myopic thinking. That’s coyote thinking. That’s the sort of thinking that ruined Michael.

My goal as an investor is to minimize my maximum regret in the metagame. What is that maximum regret? Dying alone. Failing to protect and sustain my pack, both at the most personal level of family and the broadest level of humanity. Minimizing the risk of THAT is what drives my doing, in both politics and in markets. I want enough wealth to avoid the bad ending, not the most wealth I can possibly achieve, because going for the most wealth I can possibly achieve actually increases the chances of the bad ending.

You will NEVER get out of the immediate game, whether it’s the mafia game or the markets game, if you play that game as a maximizer. You will ALWAYS be pulled back in.

And yet, all of our dominant ideas about financial advice – ALL OF THEM – are based on the assumption that we are maximizers. Every bit of Modern Portfolio Theory – ALL OF IT – is based on assumptions of maximization. All of those Big Bank model portfolios that are handed down from on high every month – ALL OF THEM – are based on the assumption that we are maximizers. Worse, all of these ideas about economics and investing aren’t just based on the assumption that we ARE maximizers. All of these core ideas about financial advice are based on the narrative that we SHOULD BE maximizers.

The business of financial advice is hurting. We all know that. It’s hurting for its practitioners and it’s hurting for its clients. I think it’s hurting because the narrative of maximization, in both its descriptive and its normative forms, gives particularly poor outcomes when Things Fall Apart. It gives particularly poor outcomes when the gravity of a Three-Body System makes the ground beneath our feet quiver and shake.

In order to survive … in order to do better for clients … the business of financial advice needs a new narrative, one based on what truly matters for practitioners and clients alike in a world of profound uncertainty.

What is the new narrative for financial advice?

I think it’s regret minimization in the metagame rather than reward maximization in the immediate game.

I think it’s Clear Eyes and Full Hearts.

A new narrative isn’t just possible. It’s necessary. And it’s happening.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.