An epic gold bull market is on the menu for 2019.

I’m not talking about a garden-variety cyclical gold bull market, but rather one of the biggest gold manias in history.

This gold mania will be riding the wave of an incredibly powerful trend… the re-monetization of gold.

The last time the international monetary system experienced a paradigm shift of this magnitude was in 1971.

Then, the dollar price of gold skyrocketed over 2,300%.

It shot from $35 per ounce to a high of $850 in 1980. Gold mining stocks did even better.

Today, gold is still bouncing around its lows. Gold mining stocks are still very cheap. I expect returns to be at least as great as they were during the last paradigm shift.

So let’s get right into it, starting with the first four catalysts that will send gold prices higher…

No. 1: Basel III Moves Gold Closer to Officially Being Money Again

The Bank for International Settlements (BIS) is located in Basel, Switzerland. It’s often referred to as “the bank of central banks.” Its members consist of 60 central banks from the world’s largest economies.

It facilitates transactions – notably gold transactions – between central banks, the biggest players in the gold market.

The BIS also issues Basel Accords, or a set of recommendations for regulations that set the standards for the global banking industry.

On April 1, 2019, Basel III went into effect around the world.

Buried among what was mostly confusing jargon was something of huge significance for gold:

A 0% risk weight will apply to (i) cash owned and held at the bank or in transit; and (ii) gold bullion held at the bank or held in another bank on an allocated basis, to the extent the gold bullion assets are backed by gold bullion liabilities.

What this means in plain English is that gold’s official role in the international monetary system has been upgraded for the first time in decades.

Banks can now consider physical gold they hold, in certain circumstances, as a 0% risk asset. Previously, gold was considered riskier and most of the time could not be classified in this way. Basel III rules are making gold more attractive.

Central bankers and mainstream economists have ridiculed gold for going on 50 years now.

They’ve tried to downplay its role in favor of fiat currencies like the U.S. dollar. They’ve tried to trick people into believing it isn’t important.

The fact is gold is real money… a form of money that is far superior to rapidly depreciating paper currencies. This is why central bankers don’t want to acknowledge how important it is.

And this is precisely why Basel III is important. It signifies the start of a reversal in attitude and policy.

Basel III is giving gold more official recognition in the international financial system. It represents a step towards the re-monetization of gold… and the recognition of this powerful trend in motion.

No. 2: Central Banks Are Buying Record Amounts of Gold

Countries are treating gold as money for the first time in generations…

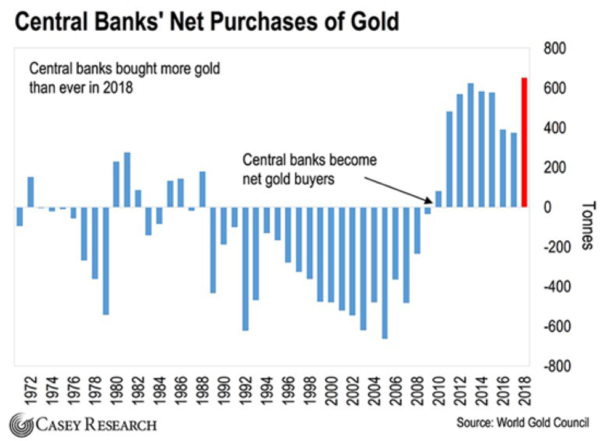

In 2010, something remarkable happened. Central banks changed from being net sellers of gold to net buyers of gold. Remember, central banks are by far the biggest actors in the global gold market.

This trend has only accelerated since…

The World Gold Council reports that in 2018, central banks bought a record 651 tonnes of gold. This is the highest level of net purchases since 1971 when Nixon closed the gold window. And it’s a 75% increase from 2017.

Russia Was the Biggest Buyer

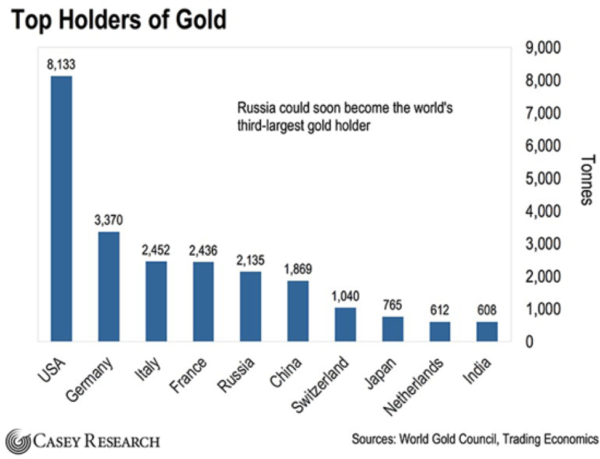

Russia’s gold reserves have quadrupled in the last decade, making it the fifth-largest holder of gold in the world.

Last year, Russia notably dumped nearly $100 billion worth of U.S. Treasuries, and, according to the World Gold Council, replaced much of it with gold.

If this trend continues, and I expect that it will, Russia will soon become the third-largest gold holder in the world.

A major reason for Russia’s gold purchases is to reduce its reliance on the U.S. dollar and exposure to U.S. financial sanctions.

It is providing a template for others to do the same, using gold as money.

For example, in 2016, news broke that Turkey and Iran were engaged in a “gas for gold” plan. Iran is under U.S. sanctions. Through the plan, Turkey can pay for gas imported from Iran with gold.

Russia, Iran, Venezuela, and others are proving they don’t need the U.S. dollar. They are conducting business and settling trade with gold shipments, which aren’t under the control of the U.S. government.

This is how gold will benefit from the U.S. government using the dollar as a financial weapon.

No. 3: Oil for Gold – China’s Golden Alternative

In 2017, when tensions with North Korea were rising, Trump’s Treasury secretary threatened to kick China out of the U.S. dollar system if it didn’t crack down on North Korea.

If the threat had been carried out, it would have been the financial equivalent of dropping a nuclear bomb on Beijing.

Without access to dollars, China would struggle to import oil and engage in international trade. Its economy would come to a grinding halt.

China would rather not depend on an adversary like this. This is one of the main reasons it created what I call the “Golden Alternative.”

Last year, the Shanghai International Energy Exchange launched a crude oil futures contract denominated in Chinese yuan. For the first time in the post-World War II era, it will allow for large oil transactions outside of the U.S. dollar.

Of course, most oil producers don’t want a large reserve of yuan.

That’s why China has explicitly linked the crude futures contract with the ability to convert yuan into physical gold – without touching the Chinese government’s official reserves – through gold exchanges in Shanghai and Hong Kong. (Shanghai is already the world’s largest physical gold market.)

Bottom line, China’s Golden Alternative will allow oil producers to sell oil for gold and completely bypass any restrictions, regulations, or sanctions of the U.S. financial system.

With China’s Golden Alternative, a lot of oil money is going to flow into yuan and gold instead of dollars and Treasuries.

CNBC estimates that the amount of redirected oil money will eventually hit $600-$800 billion. Much of this will flow into the gold market, which itself is only $170 billion.

Consider this…

China is the world’s largest importer of oil.

So far this year, China has imported an average of around 9.8 million barrels of oil per day. This number is expected to grow at least 10% per year.

Right now, oil is hovering around $60 per barrel. That means China is spending around $588 million per day to import oil.

Gold is currently priced around $1,330 an ounce.

That means every day, China is importing oil worth over 442,105 ounces of gold.

If we’re conservative and assume that just half of Chinese imports will be purchased in gold soon, it translates into increased demand of more than 80 million ounces per year – or more than 70% of gold’s annual production.

This shift hasn’t been priced into the gold price. When it happens, the increased demand for gold from China’s Golden Alternative is going to shock the gold market.

The bottom line is, China’s Golden Alternative is a big step towards gold’s re-monetization.

No. 4: The Fed’s Dramatic Capitulation

In the wake of the 2008 crash, the Federal Reserve instituted several emergency measures. The chairman at the time, Bernanke, promised Congress they would be temporary.

This included money-printing programs euphemistically called “quantitative easing” (QE). Through QE, the Fed created $3.7 trillion out of thin air.

That newly created money was used to buy mainly government bonds, which sat on the Fed’s bloated balance sheet.

The Fed also brought interest rates to the lowest levels in U.S. history. The Fed artificially brought rates down to 0% and kept them there for over six years.

Capitalism’s Most Important Price

Remember, interest rates are simply the price of borrowing money (debt). They have an enormous impact on banks, the real estate market, and the auto industry, among others.

In 2016, the Fed began its attempt to “normalize” its monetary policy by raising interest rates and reducing the size of its balance sheet to more historically normal levels. By doing so, the Fed was reversing the emergency measures put in place after the 2008 crisis.

Interest rates have risen from 0% to around 2.5%, and the Fed has drained over $500 billion from its balance sheet, or about 11% from its peak.

But then, the stock market tanked…

The S&P 500 peaked at 2,930 in late September 2018. By late December, it had crashed over 19% and appeared to be headed sharply lower.

It was the worst December in stock market history, except for December 1931, which was during the Great Depression.

That spooked the Fed into its most abrupt change in monetary policy in recent history.

Instead of normalizing monetary policy and removing the so-called “temporary” and “emergency” measures in place since 2008 – as it had long planned to do – the Fed capitulated.

Earlier this year, the Fed announced it would not raise interest rates in 2019.

The Fed also announced it would phase out its balance sheet reduction program in the fall.

Previously, the Fed was slowly winding down its balance sheet by about $30 billion a month. At such a snail’s pace, it would have taken the Fed over 10 years to drain its balance sheet back to its pre-crisis normal level.

Hooked on Easy Money

This whole charade is indicative of how utterly dependent the U.S. economy has become on artificially low interest rates and easy money.

If the Fed couldn’t normalize interest rates when the debt was $22 trillion, how is it ever going to raise rates when the debt is $30 trillion or higher?

The Fed couldn’t shrink a $4.5 trillion balance sheet. How is it going to shrink, say, a $10 trillion balance sheet or higher?

The answer is it can’t and won’t. It’s impossible for the U.S. government to normalize interest rates with an abnormal amount of debt. The Fed is trapped.

After nearly six years of 0% interest rates, the U.S. economy is hooked on the heroin of easy money. It can’t even tolerate a modest reduction in the Fed’s balance sheet and 2.5% interest rates, still far below historical averages.

In other words, this monetary tightening cycle is over. The next move is a return to QE and 0%, and perhaps negative, interest rates. These moves would, of course, weaken the dollar and be good for gold.

By flipping from tightening to signaling future easing, the Fed has turned a major headwind for the gold market into a tailwind.

Now, let's dive deeper into what’s going to trigger this revival…

No. 5: Takeover Frenzy in the Gold Mining Industry

2019 is on track to be a record-breaking year for gold mergers and acquisitions (M&A).

The world’s largest mining companies are pouring billions of dollars into mergers and acquisitions.

Three blockbuster deals contributed to this result:

- Newmont Mining completed a $10 billion takeover of Goldcorp on April 18.

- Barrick Gold acquired Randgold Resources in a $6 billion transaction that closed on January 1.

- Barrick Gold has also announced a joint venture with Newmont after a hostile bid from Barrick failed. (Barrick and Newmont are the top two gold-producing companies in the world.) The joint venture in Nevada will create the largest gold-producing complex in the world.

What these mega deals prove is that the biggest companies in gold mining think gold and gold stocks are cheap.

They show a preference to grow by buying out other companies rather than discovering and developing new resources.

If this trend continues, 2019 will go down as a record-breaking year for gold M&As.

It’s another major tailwind for gold.

No. 6: President Trump Is Pro-Gold

President Trump is a big fan of gold.

For one, he’s made a killing as a gold investor. He’s called investing in gold “easier than the construction business.”

But Trump’s affinity for gold goes much deeper. He once said:

The legacy of gold as a precious commodity has transcended to become a viable currency and an accepted universal monetary standard. Central Banks around the world are holding gold as a reserve asset.

And Trump is a fan of the gold standard… in other words, the re-monetization of gold.

While running for president, he said:

Bringing back the gold standard would be very hard to do, but boy, would it be wonderful. We’d have a standard on which to base our money.

And he’s acting on his pro-gold instincts in a big way. Let me explain…

Trump has been able to wield more influence over the Federal Reserve than any other president since the Fed was created in 1913.

He’s had the chance to fill five out of the seven seats on the Board of Governors of the Federal Reserve.

In other words, Trump gets to stack over 70% of the whole Fed board with people of his choosing.

And so far, he’s nominated several pro-gold candidates, including Herman Cain and Stephen Moore. They’re both on record as supporting a gold standard.

For example, in 2012, when Cain was running for president, he wrote an editorial for The Wall Street Journal titled “We Need a Dollar as Good as Gold.” He wrote:

Gold is kryptonite to big-spending politicians. It is to the moochers and looters in government what sunlight and garlic are to vampires.

Cain and Moore have since withdrawn their nominations, but one replacement is widely suspected to be Judy Shelton, who is also an advocate of the gold standard.

Regardless, the fact that Trump nominated them in the first place shows he is willing to act on his pro-gold instincts.

Here’s the bottom line…

Having a U.S. president who favors gold and is looking to stack the Fed with pro-gold people is unprecedented in recent history. It’s a positive development for gold – and the trend of gold’s re-monetization.

But gold is going to get a boost, no matter which party is in power…

No. 7: Socialism Is on the Rise

Socialism is on the rise in the U.S. And it’s about to be entrenched in U.S. politics.

A recent poll from the Victims of Communism Memorial Foundation, a D.C.-based nonprofit, showed that one in two millennials now favors socialism and communism over capitalism.

It’s why Bernie Sanders, Elizabeth Warren, Kamala Harris, Alexandria Ocasio-Cortez (AOC), and other socialists are skyrocketing in popularity.

This is no small problem.

Millennials are now the largest demographic group in America. And sometime this year, they are expected to surpass baby boomers as the nation’s largest living adult generation.

In other words, demographics alone guarantee more socialism ahead. And as we’ve seen again and again, when asked, “How are you going to pay for this?” socialists have the same answer: “Tax the rich!”

Simple arithmetic shows that even if the rich were taxed to the limit, it wouldn’t put a dent in the bills for the socialists’ government programs. But to this, the socialists respond: “We’ll just print money!”

In comes Modern Monetary Theory (MMT). It’s the latest buzzword coming out of Washington, D.C.

Contrary to its name, MMT is neither new nor “modern.” And adding the word “theory” to something doesn’t make it scientific or credible.

MMT is the same economic quackery that’s brought misery to Argentina, Venezuela, Zimbabwe, and countless other places. Now, left-leaning U.S. economists, politicians, and policy wonks are taking it seriously, too. They see it as a sort of “QE for the people.”

For example, AOC and Stephanie Kelton, Bernie Sanders’ former chief economic adviser, are leading advocates of MMT.

In short, America’s embrace of socialism will lead to more money-printing and currency debasement, just as it has everywhere else it’s been tried.

But this time, it won’t be the Argentine peso or the Venezuelan bolívar that is debased. It will be the U.S. dollar… the world’s premier reserve currency.

Gold is the primary competitor for the U.S. dollar’s top role. And as the American socialists inflate the value of the dollar away, it will make gold all that more attractive.

That’s why this trend will be a big positive for the re-monetization of gold.

No. 8: Gold-Backed Cryptos – A Monetary Revolution

The last catalyst for gold is cryptocurrencies backed by gold.

There are dozens of gold-backed cryptos sprouting up.

Peter Grosskopf, the CEO of Sprott, recently called gold-backed cryptocurrencies “the most important thing to happen to the gold market in the last several decades.”

Soon after, Sprott launched a gold-backed crypto it developed with its partners.

When Sprott – a leader in the natural resources industry – makes a big move into the gold-backed crypto space, it’s a definitive sign of where things are headed.

Gold-backed cryptos combine the best attributes of gold and cryptos. I can’t think of two other asset classes that have as many synergies. In other words, the whole is worth much more than the sum of the parts.

With cryptos redeemable for gold, we can now instantly send anyone anywhere in the world small or large amounts of gold – reliably and without interference. It’s nothing short of a monetary revolution.

Gold-backed cryptos are going to make using gold as money even more convenient for the average person and business. Anyone with a cell phone now can use gold in a way that was not possible before.

This is another big reason why I think gold is coming back as money.

Putting It All Together…

When you take a step back and look at the big picture, the implications for gold are clear:

- Basel III moves gold toward officially being money again.

- Central banks are buying record amounts of gold.

- Excessive U.S. sanctions have pushed countries to use gold.

- China’s “Golden Alternative” allows for large-scale, oil-for-gold trades.

- The Fed’s dramatic reversal and the return of easy money bode well for gold’s strength against the dollar.

- The takeover frenzy in the gold mining industry is bullish for the price of gold.

- President Trump favors returning to the gold standard and is stacking the Fed with pro-gold people.

- The Democrats’ embrace of socialism guarantees more currency debasement.

- Gold-backed cryptos make owning and using gold easier than ever.

Any one of these catalysts alone would be great news for gold.

But the fact they are all converging at the same time means an epic gold bull market is on the menu for 2019. And the time to get positioned is now…

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.