Name the US trade-war adversary in the following real-life scenario:

- Trade tensions were precipitated by a large bilateral trade imbalance and a perception of an “unfair” advantage, which were exacerbated by new US administrations that pursued tax cuts even as the Federal Reserve was in tightening mode.

- Targeted US trade actions have failed to significantly reduce the US trade imbalance with this nation

- As the US trade deficit with this country has continued to grow, so has bipartisan political pressure to do something about it.

- Dollar depreciation coincided with a fading fiscal boost and more accommodative monetary policy that was directionally consistent with the political aim of boosting exports.

- Under growing bipartisan support, the US pushed this nation to take more sweeping action such as pledging to increase imports, and significantly cut its trade surplus, or potentially face a 25% tariff on all of its exports.

If you said the nation in question is China, and the year is 2019, you are wrong (well, partially), because the events described above represent Ronald Reagan's bilateral trade dispute with Japan in the early 1980s.

The fact that the biggest geopolitical conflict of modern times is running off a 35-year-old script This has profound implications for not only how Trump's own trade war with the world's second most powerful nation will conclude, but also for the dollar, because it was against the above-described backdrop that authorities signed the historic "Plaza Accord" in 1985, and according to Goldman, a similar outcome may be coming, one which would result in "choppy dollar downside in the months ahead."

But let's back up.

As Goldman's Michael Cahill writes today, there is never anything really new under the sun, and trade negotiations between the US and China "have so far followed a strikingly similar pattern to the bilateral US-Japan trade dispute" in the early 1980s: in both cases, talks were precipitated by a large bilateral trade imbalance and a perception of an “unfair” advantage, which were exacerbated by new US administrations that pursued tax cuts even as the Federal Reserve was in tightening mode. In another parallel, what began as trade negotiations ultimately sprawled into other areas including market access, government subsidies and currency policy.

However, there are also important structural differences, first and foremost among them is that the US and Japan have been strategic allies for decades (and Japan depends heavily on the US for its national security), and this likely explains why Japan ultimately acquiesced to a number of US demands—including the “Plaza Accord” to dramatically strengthen its exchange rate. These differences help explain why so far the Yuan’s behavior has been very different from the Yen’s dramatic appreciation in the late 1980s, and prompt the question if Trump isn't making a huge gamble in assuming that China will fold, just like Japan did three and a half decades ago.

For those who were too young, or too stoned, to remember, here is a brief recap of the US-Japan trade conflict.

In the 1970s, the US had been targeting Japanese exports of specific industries, using a “trigger price mechanism” on steel products and “voluntary export restraints” (VERs) on color TVs, which Japan introduced to avoid steep tariffs. But things intensified in the early 1980s. As a Presidential candidate, Ronald Reagan (whose chief economic advisor, Martin Feldstein passed away today at the age of 79) pitched himself as a free-trader, but said there was room for the government to be “legitimately involved” in certain industries—specifically autos—where US companies faced stiff (and potentially unfair) competition from abroad. In May 1981, Japan introduced VERs on autos to set a positive tone ahead of the Prime Minister’s trip to Washington to meet the new president. This pattern repeated itself a number of times over the next few years; bilateral talks led to a gradual reduction in Japan’s trade barriers or new restrictions on exports to the US.

Nevertheless, in another early echo of events taking place today, the US trade deficit continued to grow, causing intense scrutiny from across the US political spectrum. At the end of Reagan’s first term (December 1984), US Trade Representative Bill Brock wrote that “it is not unreasonable to ask if we have wasted four years.” Brock said that, given the political climate, it was “vital” that Japan committed to double imports from the US and cut the bilateral trade deficit in half, or he feared things were approaching a “flash point.”

By late summer 1985, those predictions looked prescient. As Goldman recalls, the US Congress had drafted over 200 pieces of trade-related legislation, including a prominent one that would have required Japan to reduce its trade surplus or face a 25% tariff on all exports (sound familiar?). Congress pledged to take action by mid-October unless there were clear signs of progress.

And yet something is missing from this historical comparison: against this backdrop, global authorities signed the historic “Plaza Accord” in late September 1985, one which sent the dollar plunging over the next few years.

Is another Plaza accord in the cards? According to Goldman, the answer is yes.

But if Goldman is right, and the fate of the dollar and yuan are about to be thrown for a major loop, that means learned from the fate of the yen in the 1980s.

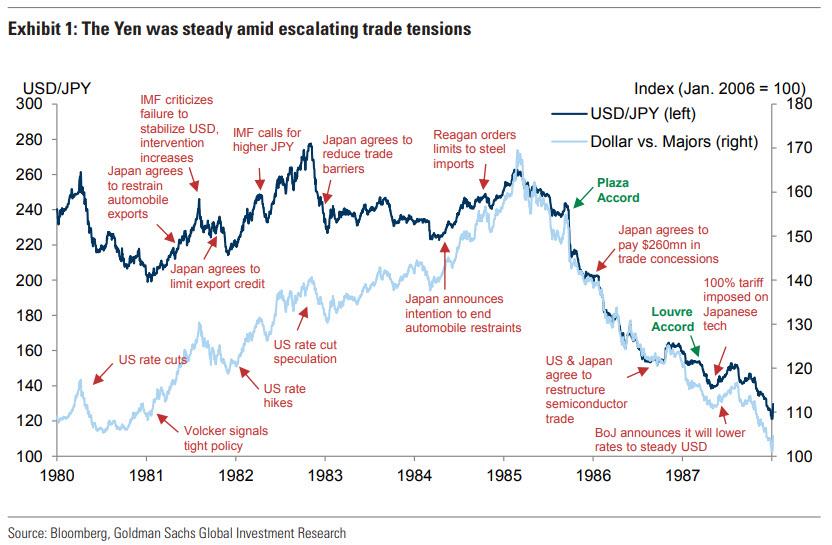

Sure enough, in the years before the Plaza Accord, USDJPY was roughly stable against an appreciating Dollar. There were a few concentrated cases of Yen appreciation in response to lower trade barriers, such as when Japan agreed to limit export credits (effectively hiking some domestic interest rates). But, in general, the Yen did not depreciate in response to escalating trade tensions. Even in early 1985, when pressures were particularly intense, JPY depreciated less than other major currencies, according to Goldman's Cahill who charts the value of the yen and the dollar in the chart below:

To be sure, it wasn't just trade tensions that help send the dollar surging in the early 1980s: Early in the decade, the combination of tax cuts and the hawkish policies of the Federal Reserve boosted the Dollar against most trading partners: just like much of 2018.

And just like now, growth in the US rose sharply, while growth in the rest of the world picked up only moderately.

Later, the Fed was engaged in a cutting cycle around the time of the Plaza Accord, and the Accord’s success is widely attributed at least in part to the alignment of monetary and currency policy.

So is a Plaza Accord 2.0 imminent, and if so, is the yuan, just like the yen, set to appreciate much higher as the dollar slides? According to Goldman, there are three reasons why the experience with the Yuan has so far been very different to that of the Yen in the 1980s, despite the obvious parallels between the two trade conflicts.

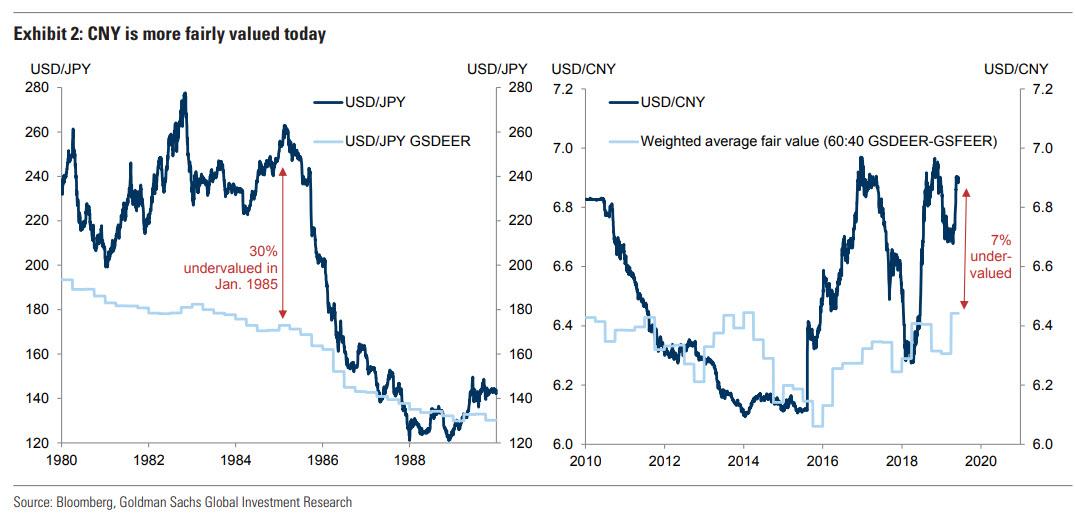

- First, from a valuation standpoint, it was generally accepted that the Yen was exceptionally cheap before the Plaza Accord was implemented. By contrast, Goldman's FX strategists think CNY is only slightly undervalued at present levels, so the currency might need to react more to offset new trade barriers.

- Second, while broad tariffs were occasionally threatened in the 1980s, the “tools of choice” were generally narrow export restrictions against specific industries. In that regime, currency moves cannot directly offset protectionist trade actions, and should be smaller due to their concentrated nature.

- Finally, and most importantly, the US and Japan were strategic allies even during the trade conflict (especially because Japan relies on the US for military defense). While trade tensions strained the relationship at times, markets likely perceived only a small risk of serious escalation, and Japan often acquiesced to US demands (most prominently in the Plaza Accord itself).

By contrast, the US and China are seen as chief rivals in many ways, and the strategic ties do not run nearly as deep. As a result, markets might more readily price that trade tensions will escalate and sprawl into other policy areas, and China appears less willing to accommodate US requests to change domestic policy. In addition, while Japanese companies were able to offset new trade measures by moving production to the US, Chinese companies would not be able to do this as easily because of security concerns.

It is also is likely that Chinese policymakers might view Japan’s experience with the “lost decade” as a cautionary tale for what might happen if it makes sweeping changes too quickly, and that is setting Goldman's trading strategy today. Taken together, China seems unlikely to be as accommodating as Japan was in the 1980s, and even speculation about potential currency agreements in the now-stalled trade negotiations fell well short of the Plaza Accord.

And yet, as Goldman concludes, there are a number of notable parallels between now and trade tensions in the 1980s, with several key takeaways.

- First, the US focus on trade deficits—both then and now—is ultimately about competitiveness. The last time around, political pressure on Japan grew, and even prominent “free traders” eventually supported interventionist policies. There is evidence that this is also becoming the case today.

- Second, while trade policies had some impact, the Dollar traded mostly with economic fundamentals. In the late 1980s, Dollar depreciation coincided with a fading fiscal boost and more accommodative monetary policy that was directionally consistent with the political aim of boosting exports.

So while a Plaza Accord 2.0 may not be imminent - mostly because China would never concede to a treaty that Japan did in the 80s for a very specific set of reasons - Goldman believes that same environment today could result in even more FX volatility, one where the race to the bottom is not contained to an international "accord", but a chaotic race of every man for himself, leading to "choppy Dollar downside in the months ahead."

One final observation: the US trade feud with Japan, and the subsequent Plaza accord, all resulted in the build up of systemic imbalances that eventually culminated with in 1987's Black Monday. What will happen to today's hyperfinancialized world if one Monday morning the market drops 20%, wiping out almost $20 trillion in value in minutes?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.