Eight years and three bail-outs later, as Greece prepares to leave its final programme on August 20th, Mr Papandreou’s remarks seem laden with pathos. He directed his ire at the “speculators” who had sent Greek bond yields soaring, more than at the successive governments that had overspent, under-reformed and fiddled the national accounts. Yet, he vowed, with a “common effort” Greece would “reach the port safely, more confident, more righteous and more proud.” He called this the “new Odyssey”.

Odysseus faced great hardships, but his travails culminated in a happy homecoming. After so many years of servitude, it would be nice to think that Greece’s journey will reach a similar conclusion. There are indeed signs of recovery, led by strong tourist numbers on islands like Kastellorizo. Growth has returned, albeit in nugatory form. But the scars are everywhere. It is now not unusual to see a dozen men shooting up in broad daylight in the middle of a central Athens street. As Greeks know only too well, after the emigration of hundreds of thousands and a near-25% drop in GDP since 2008—almost half as much again as war-torn Ukraine—no one can mistake their country for a success story. Mr Papandreou’s predictions were precisely wrong. That is the lesson of Greece’s eight years of pain, and one that offers this columnist, shedding Charlemagne’s robes for a new posting after four years, a chance for some parting thoughts.

A good case to be made for the tedious procedures of the European Union is that they transmute inflammatory political arguments into technical matters to be smoothed away by anonymous, apolitical bureaucrats. Where countries once fought over resources or territory, their membership of a club with a common rulebook channels disputes into lengthy negotiations that result in communiqués nobody reads. Deathly dull, and perhaps a trifle undemocratic. But better than what came before.

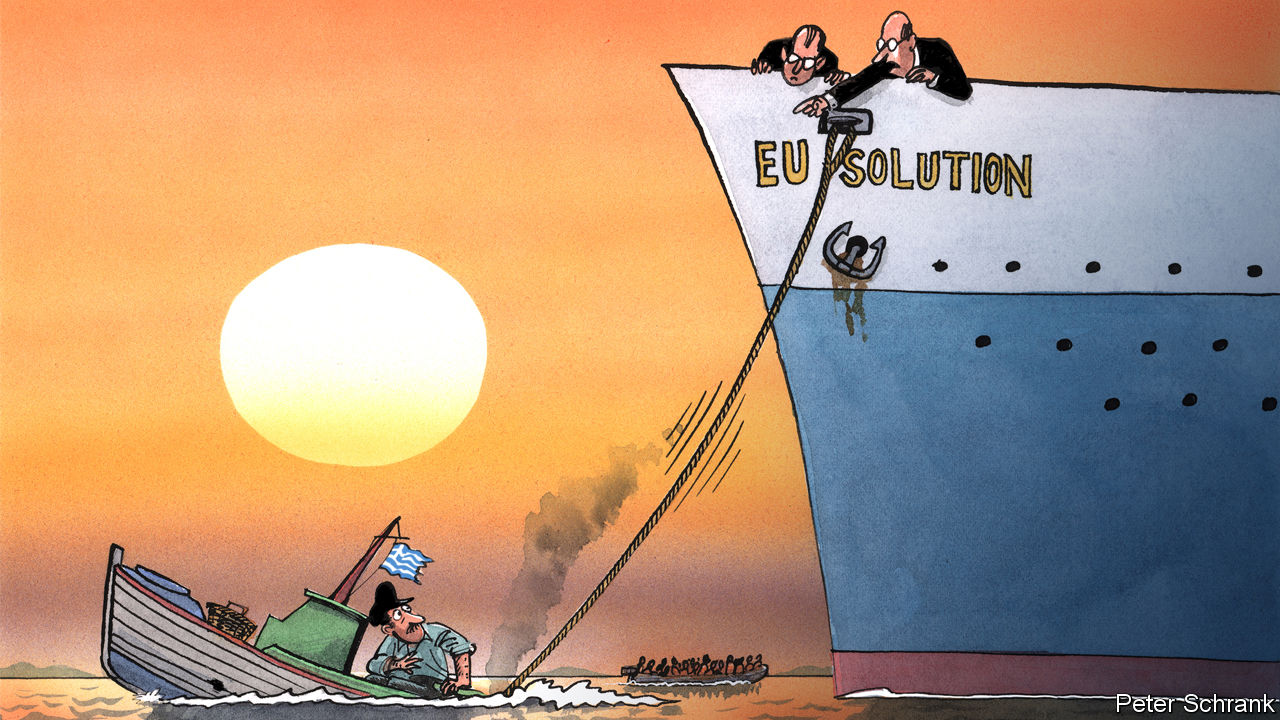

Yet there is something self-serving about this narrative. Greece created its own problems, but was largely a bystander while “solutions” were imposed by others. The rules of its bail-outs reflected the installation-by-stealth of austerity as official euro-zone dogma. And it was the victim of bad policy as well as power politics. Other governments regularly promised Greece jam tomorrow in exchange for hardship today. But projections for its recovery consistently proved wildly optimistic, as the austerity visited on the country, wholly predictably, deepened its recession and made its debts ever more unpayable. It was the most ruinous way imaginable to make a point. Now Greece, left with threadbare public services, eye-watering tax rates, weak institutions and appalling demographics, is supposed to run large primary surpluses (ie, before interest payments) for the next four decades.

This is magical thinking masquerading as policy. Too often in today’s Europe, acute problems are not dissolved by silvery diplomats but rather transformed into chronic ailments that remain bearable, until they are not. True, banking reforms and institutional changes have made the euro zone more resilient. That was why Syriza, an amateurish bloc of ex-communists and elbow-patched professors elevated to power by desperate voters in 2015, saw its own brand of anti-austerity magical thinking quickly squashed. (The collateral damage was capital controls that have not yet, as Kastellorizo’s hoteliers and builders grumble, been fully lifted.) Greece turned out to have a simple choice: a devastating Grexit, or capitulation to the punishing terms its creditors required to keep it inside the euro.

But the euro zone’s failure to collapse bred complacency. In the past six months, amid unusually benign political and economic conditions, governments have failed to muster the will to build up the euro zone’s defences against the next shock. Nor have they used the space afforded by smaller numbers of Mediterranean crossings to produce a long-term asylum strategy, indulging instead in pointless squabbles over quotas. The sticking-plaster solutions in Turkey and Libya cannot last for ever.

These issues bubble away for years, corroding trust within, and between, countries. Odd as it may seem, governments are taking the easy way out. It is simpler to squabble and delay than to break taboos, like writing down Greek debt or forging a unified asylum policy. One lesson, then, of Greece’s crisis is that the single currency is harder to fracture than critics predicted. Another is that the EU will go to considerable lengths, including the impoverishment of its own members, to avoid taking hard decisions.

Wobbly but still upright

The EU’s ability to defer hard decisions—the legendary fudge—once testified to its resilience, or at least its ability to manage disagreements. But in a more unpredictable world, where Europe is battling instability from outside its borders and populism within, it risks becoming a liability. Alternative models, from Chinese state capitalism to Russia’s resentful nationalism, are available, and gaining adherents where voters are losing faith in the European model. You feel this especially strongly on Kastellorizo, just 20 minutes from Recep Tayyip Erdogan’s authoritarian Turkey. But the warning should resonate across the continent.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.