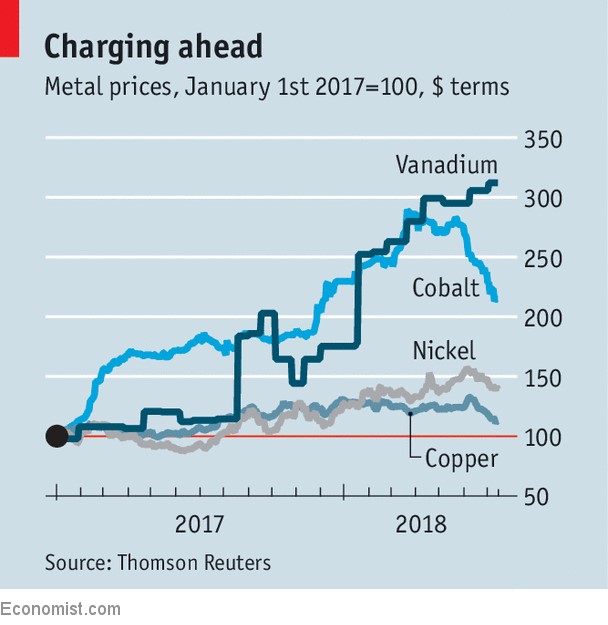

When one thinks of battery metals, the mind naturally drifts to lithium, cobalt, copper and nickel, but attention is slowly shifting to vanadium because prices have skyrocketed 300 percent, and it helps that vanadium redox batteries (VRBs) are just … well … sexy.

For now, vanadium is predominately used to strengthen steel, but it’s on its way to becoming a critical element of clean-energy batteries. And its strength is key.

So when the price of a metal whose current global use of supply is only 1-2 percent starts soaring by hundreds of percentage points, it means that its growth potential has already set off investor radar significantly. Perhaps too much …

While the Li-ion energy storage market has seen unprecedented growth, it now appears that vanadium has a shot at taking the lead in energy storage for grid-connected applications and large-scale energy storage operations.

Pittsburgh-based industry analyst Terry Perles of TTP Squared told the Mining Journal that the market is ripe for an estimated 23,000-tonne deficit by 2025 due to divergent vanadium supply and demand dynamics.

Indeed, the craze has begun. A case in point is what happened that week when a legendary investor (Leon Cooperman) told CNBC’s Halftime Report that he added Canadian-based Largo Resources—a vanadium pentoxide miner--to his personal fund. Investors immediately started piling into the stock, causing it to jump 50 percent in seconds, even though Cooperman warned that it was highly speculative because of the “narrow range of their revenue base”.

That’s what happens with sexy metals. So, how is Largo Resources doing a week later? Not too shabby:

China was the top vanadium producer in 2017 by a long shot, followed by Russia and South Africa. World vanadium production totaled 80,000 MT last year, up slightly from 79,000 MT in 2016, according to data from the US Geological Survey.

The next wave of vanadium demand is likely to come from VRBs, which are expected to grow from $230.2 million in 2018 to $946.3 million by 2023 at a CAGR of 32.7 percent during the forecast period, according to an ADS Report.

The vanadium market has been fairly quiet in recent years, with China’s tightening of environmental rules holding it back, but that started to change in 2017.

The higher demand for this metal comes again from China due to an increase in vanadium flow batteries used for large-scale energy storage, and with Beijing planning to launch multiple pilot projects with vanadium flow batteries by the end of 2020.

Indeed, Largo Resources’ Mark Smith says this alone should increase demand for the metal by up to 15,000 tones in 2018-19.

He may be right. China has recognized the significance of vanadium especially for stationary storage. It’s even built the world's most powerful 200 MW battery.

In the past year and a half, the Chinese vanadium spot price has tripled from US$5/lb to $15.80/lb, largely because of China’s drive to increase vanadium content in steel rebar, as well as speculation that we’re headed for a supply crunch.

The question is: Are these prices sustainable? Maybe—if the renewable energy push gains quite a bit of momentum. It also helps that Glencore and VRB Energy billionaire Robert Friedland are backing the battery metal. Still, there should be some concern that prices this high for a metal that isn’t being used that much might make VRBs impossible from the start.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.