Sometimes machines are only as smart—or dumb—as the humans who program them.

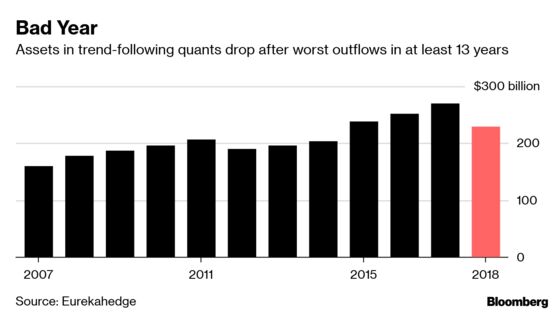

Hedge fund investors learned that the hard way last year when data-crunching computers that invest $220 billion based on historical price trends did worse than most other managers, robot or human. The losses were so bad that investors pulled billions of dollars out of an investment strategy that for years had, paradoxically, been regarded as a great way to protect portfolios from downside risks.

Turns out the algorithms behind so-called trend-following quants are rather primitive and suffer from many of the same weaknesses a mortal brain might. They've struggled to react fast enough to the unforeseen side effects of ending a decade of central bank stimulus, and even seem to get baffled by U.S. President Donald Trump.

“The models can’t move as fast as the tweets,” said Brooks Ritchey, senior managing director at Franklin Templeton’s K2 Advisors unit who oversees $3.6 billion and has exited all but one of the trend-following quants it used to invest in.

A lot has changed since systematic trend-following quants, known in the industry as Commodity Trading Advisors or CTAs, won a big following after gliding through the 2008 global financial crisis.

Around them, the community of quantitative investors—computers designed and encoded to identify trades and execute them—expanded exponentially and their algorithms grew more sophisticated.

Robotic traders now manage about $1 out of every $3 held in the world’s $3 trillion hedge fund industry, including models that use inputs like company’s profitability, trends in volatility or shifts in economic cycles to make trading decisions. Many are handing investors big returns and are lauded for preventing human emotion from clouding trading judgment.

But trend followers keep it simple, identifying when to enter and exit trades by back testing price trends against decades of data. When the algorithm determines it’s probable for a market to rise, automatic buy orders are placed for futures or derivatives contracts in anything from stocks and bonds to commodities and currency forwards. Alternatively, if the price forecast looks bleak, positions are taken in short futures, betting assets will fall.

Problem is, they aren’t very good at responding to surprises—and there have been plenty when central banks removing support from markets can trigger abrupt spikes in volatility or a 280-character tweet from Donald Trump can exacerbate tensions with China. Ultimately, the speed of markets these days can easily confound the historical price trends at the heart of the approach.

“It’s a strategy which in its pure terms is really probably obsolete,” said Robert Frey, whose been working in quantitative investing since it was still in its nascent stages of development in the early 1990s.

Frey, who has a doctorate in applied mathematics and statistics, previously worked with Jim Simons at Renaissance Technologies LLC as it grew into the world’s biggest quant-focused hedge fund, now with about $58 billion in assets. He started his own company, FQS Capital Partners, in New York in 2009 to invest in quants, and has gradually moved away from trend followers.

The turn against CTAs comes a decade after they rose to fame for rewarding investors with average returns of 21 percent in 2008. Seeing them as a way to guard their portfolios against unforeseen shocks, institutional investors piled in, sending assets soaring 69 percent to $270 billion in the decade to 2017, according to data provider Eurekahedge.

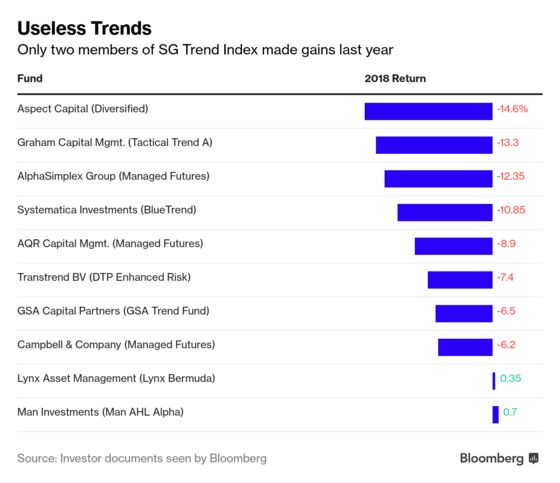

The strategy hasn’t really delivered. Between 2008 and 2018, Societe Generale’s main trend-following index made only 3.7 percent, compared with an average gain of 62 percent for hedge funds and a more than tripling in the S&P 500, including dividends.

It was the crash of early February 2018 that really exposed the limitations of CTAs. It happened unexpectedly after a rally in January, only for markets to bounce back days later. Unlike high-frequency traders that can get in and out of trades in milliseconds, CTAs are typically programmed to change holdings slowly, over several days or even months.

By the time they’d adjusted for the falling trend, CTAs were getting burned on the way up. Their net asset value slumped 9 percent in February, the worst drop in 15 years, and took another 4 percent beating during the abrupt market U-Turn in October.

Part of the problem, according to critics, is too much money now chases the same trends, undermining what traders call "alpha" — the outperformance possible relative to a benchmark.

Perhaps the biggest sign that CTAs are becoming archaic came when David Harding, the British theoretical physicist who popularized CTAs in the 1990s, said in July his Winton Fund would move away from trend-following quants. Winton’s flagship fund cut its allocation to the strategy to about 30 percent from 50 percent.

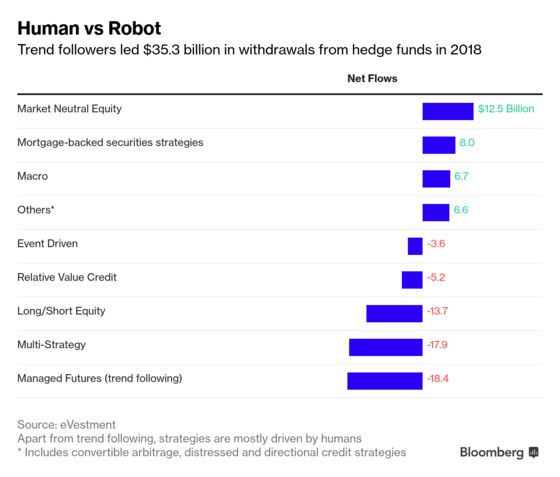

By year-end, investors had pulled $5 billion from Winton’s funds, bringing assets under management to $23.6 billion. Industry wide, a total of $18.4 billion left CTAs, the most of any hedge fund strategy anywhere, according to eVestment data.

Not everyone doubts the judgment of these more single-minded robots. When there is a clear trend in the market, like in December as the S&P 500 tumbled 9 percent over several weeks, CTAs actually work. The SocGen trend index gained 1 percent that month.

“I am not trying to become an apologist for the trend-following space, but market conditions in 2018 weren’t even close to a crisis,” said Douglas Greenig, whose firm Florin Court Capital in London focuses almost exclusively on trend-following strategies.

Even Greenig, a former chief risk officer at the quant unit at Man Group Plc, is adapting. In April 2017, Florin switched from following trends on the S&P futures, U.S. Treasuries and crude oil to focusing entirely on so-called exotic assets that don’t get as much attention, like cheese, sunflower seeds, rough rice, Chinese eggs and electricity.

Luring back skeptical investors like Ritchey from Franklin Templeton won’t be easy. He says the current geopolitical and economic environment is too volatile for CTAs to work, especially given the lack of clarity on issues like the U.S.-China trade war, the health of the global economy and Brexit.

“It’s almost like CTAs are clarity-trading advisors. They need clarity, not randomness,” Ritchey said. “The models are designed for a non-crazy-headline environment. Even the discretionary managers are having trouble keeping up.”

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.