After reinventing itself as a major power in the Middle East by force in Syria, Russia is now using its other strong suit, energy, to expand its influence across the region.

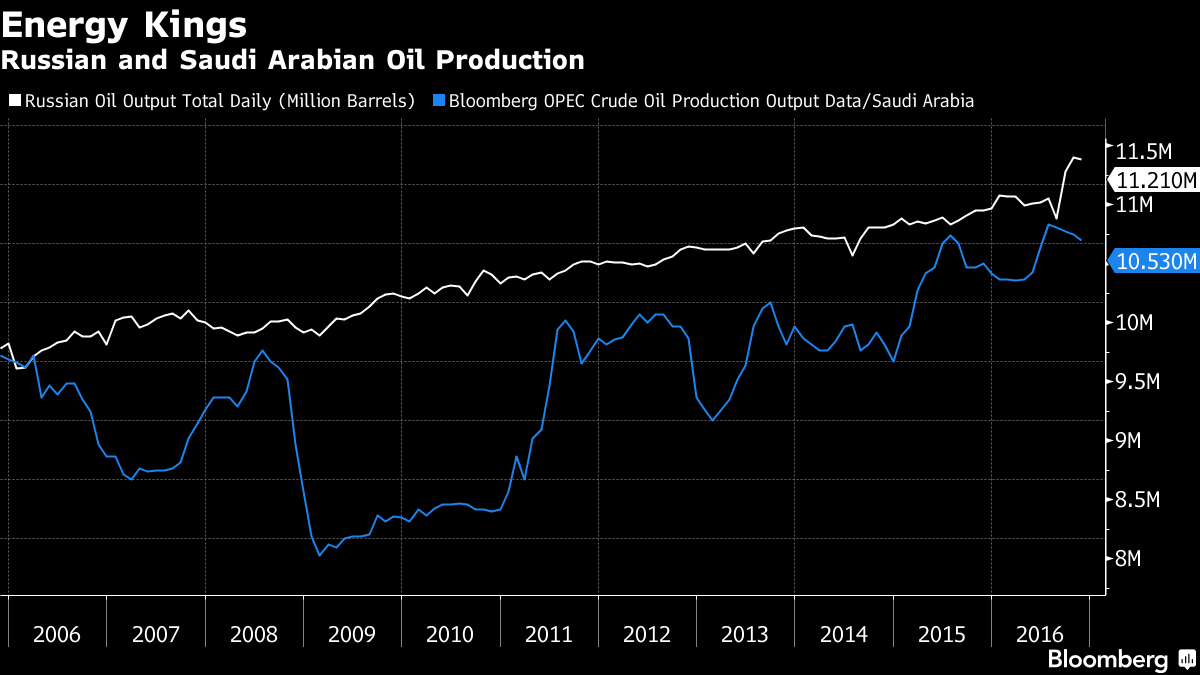

A series of agreements is allowing Russia and the Gulf states to cooperate in areas where their interests meet, looking beyond Syria where they have backed opposing sides in a brutal proxy war. Over the past month alone, Russia brokered the first deal between the Organization of Petroleum Exporting Countries and non-OPEC nations in 15 years to cut oil production, secured a $5 billion investment by Qatar in oil giant Rosneft PJSC, and then saw Rosneft agree to pay as much as $2.8 billion for a stake in an Egyptian gas field.

“Russia is really keen to increase leverage in the Middle East by every means,” said Fyodor Lukyanov, chairman of Russia’s Council on Foreign and Defense Policy.

It’s a reflection of how events in the region are combining in favor of Russian President Vladimir Putin as rarely before. A cooling of U.S. alliances in the Gulf in recent years, the havoc cheaper oil has wreaked in energy-dependent economies and a recognition that Russia can no longer be ignored on regional security issues mean Putin is pushing at an increasingly open door.

Soviet Sphere

Russian companies and diplomats are making most inroads in the Soviet-era markets of North Africa and Iran, as they revive political, arms trading and energy relationships that withered following the fall of the Soviet Union. Russia has also rebuilt a strong relationship with Egypt through President Abdel Fattah al-Sisi.

Ambitions in the Gulf remain limited because U.S. security and economic ties are so deeply entrenched, Lukyanov said. And while geopolitics played a significant role, the primary Russian motivations for cutting deals to stabilize the oil price and secure investment in Rosneft were financial, he said.

Diplomats involved in the agreement between Russia and OPEC saw the extensive oil diplomacy as an area of non-confrontation that both sides used to open up channels at the highest levels to secure a common goal, namely to bolster oil prices. The deal involved direct talks between Putin and his Saudi and Iranian counterparts, while the breakthrough came from a late night phone call between the Russian and Saudi oil ministers.

Similarly, when Qatar bought a 19.5 percent stake in Rosneft in a 10.2 billion-euro ($10.6 billion) deal that also involved Glencore Plc this month, one attraction for the tiny gas-rich emirate was geopolitical, according to a person familiar with the negotiations. Qatar saw the investment as a path to potential business and political links, said the person, who declined to be named due to the sensitivity of the issue.

Changing Picture

“What is occurring now is about the bigger picture,” said Theodore Karasik, senior adviser at Gulf State Analytics. He sat on Dubai’s Russian Business Council until this year. “It’s not just about Syria, but all of the Levant and, because of Egypt and Libya, North Africa too.”

The changes are likely to accelerate with U.S. President-elect Donald Trump’s more transactional approach to foreign policy, he said.

The deal with the Qatar Investment Authority is also notable because Russia and Qatar have had a particularly difficult relationship. Moscow sees the emirate as a sponsor of Islamist terrorist groups in Chechnya during the Russian republic’s long separatist war, and again now in Syria. Russian agents assassinated the Chechen rebel leader Zelimkhan Yandarbiyev in Doha, the Qatari capital, in 2004.

That made it all the more striking last week, when Emir of Qatar Tamim bin Hamad Al Thani called Putin to talk business, even as Russian aircraft were bombing Qatar-backed rebels into submission in Aleppo. According to a Kremlin statement, the two leaders discussed the Rosneft deal and how to “further promote political, trade, economic and humanitarian cooperation.”

There was no mention in the statement of Aleppo or Syria, where Putin has been supporting President Bashar al-Assad. Russia’s ambassador was shot dead in the Turkish capital on Monday in an assassination apparently linked to the civil war.

Rosneft and rival state energy giant Gazprom PJSC are both keen to expand their liquefied natural gas businesses in the Middle East, said Valentina Kretzschmar, principal corporate analyst at the natural resource consultants Wood MacKenzie. Qatar is the world’s biggest LNG exporter.

Long History

Russia has a long history in the Middle East, having fought numerous wars with Persia and the Ottoman Empire over centuries. It entered the Arab world during the Cold War, backing Egypt under President Gamal Abdel Nasser and post-colonial Algeria, as well as Syria, Iraq, Libya and what was then South Yemen. The U.S. secured Israel and the Arab monarchies. The Soviet hold in the region was always unsteady and largely collapsed with the end of communism.

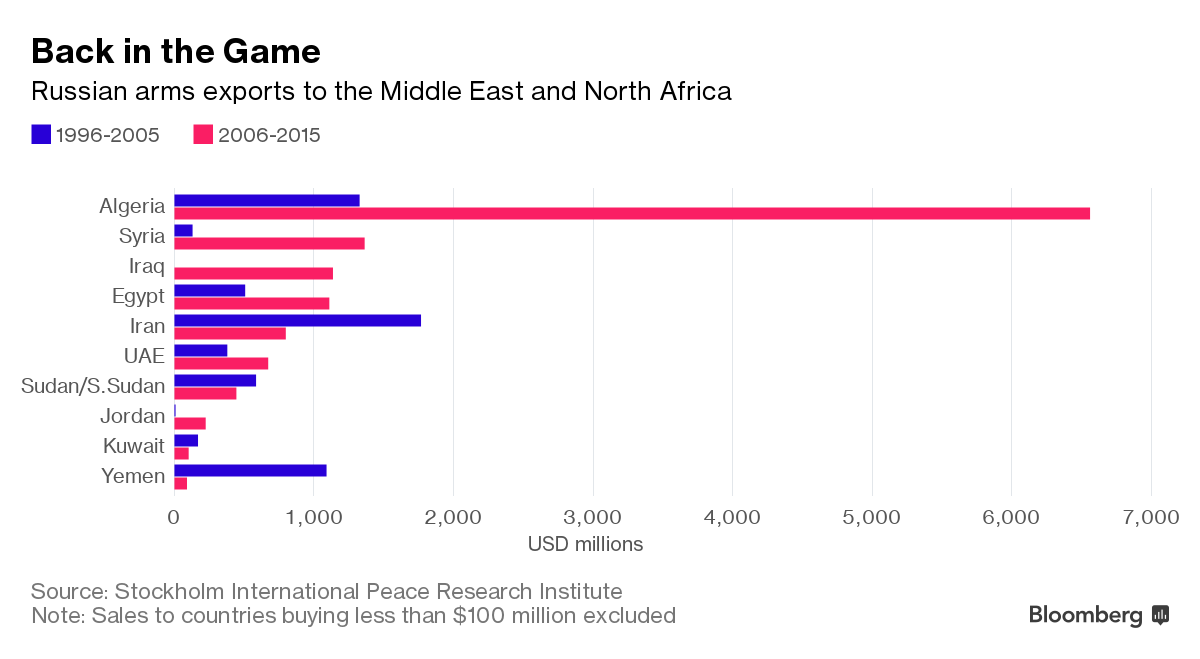

While Russia’s entry to the LNG industry is relatively new, the arms trade, is providing inroads for Russia to pick up where the Soviets left off. Between 2006 and 2015, Russia sold $12.7 billion worth of arms to the Middle East and North Africa, compared with $6 billion in the previous decade, according to figures from SIPRI, the arms trade watchdog.

Russia has benefited from an effective, if gruesome advertisement for its weaponry in Syria, as well as U.S. disengagement from the region, said Nikolay Kozhanov, a Russia-based academy associate of Chatham House. The six-nation Gulf Cooperation Council “is very tough and competitive market for Russia, but they are slowly getting in,” he said, citing a 2014 purchase of Russian anti-tank weapons by Bahrain.

For now, sales have picked up more strongly outside the GCC. Egypt signed a multi-billion dollar agreement to buy Russian aircraft and other weapons in 2014, while sales to Iraq are growing and post-sanctions negotiations underway with Iran promise a potentially large weapons market for the Kremlin. Algeria remains a huge consumer of Russian arms.

Libyan Prize

It’s Libya, though, that may prove to be Putin’s next big bet in the Middle East, after Syria, according to Kozhanov.

Putin has been forging ties with Libyan military leader General Khalifa Haftar, who visited Moscow twice in the past six months to request armed support. Haftar, already backed by the United Arab Emirates and Egypt, has been gaining ground against rivals supported variously by Qatar, Turkey and the West. If he wins, the reward for Russia could be significant.

Russia’s defense sales company, Rosoboronexport, lost at least $4 billion of contracts, and Gazprom lost several billion more in energy exploration and extraction deals signed with General Muammar Qaddafi before his 2011 overthrow. The Kremlin is looking for a way back.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.