From left: William Priest, Scott Black, Meryl Witmer Photo: Brad Trent

While stock market selloffs are painful, there is an upside to all that downside: a fresh profusion of bargain-priced shares. Just ask the three top-notch investors featured in this final installment of the 2016 Roundtable—Scott Black, William Priest, and Meryl Witmer. Value investors all, they suddenly see ample opportunities that didn’t exist a few months ago to invest in companies with attractive prospects, strong financials, and invitingly cheap shares.

Scott, the founder and president of Boston’s Delphi Management, told our Jan. 11 gathering of Wall Street savants that he’s on the hunt for companies with accelerating earnings growth. He appears to have found them in multiple and diverse industries, ranging from semiconductors to sneakers to generic drugs. Scott builds financial models the way Gaudi must have built his architectural models: piece by exacting piece. One could learn a lot from his process about how companies prosper and grow.

Bill, a new face at our annual confab, captains New York’s Epoch Investment Partners, which he co-founded after doing time, and doing well, elsewhere on the Street. At Epoch, he’s all about free cash flow—how companies generate it, and how they return wealth to shareholders. No raging bull, he recommends staying defensive in rock-solid issues, like CVS Health (ticker: CVS), one of his four favorite picks for the new year.

Meryl, a general partner at New York’s Eagle Capital Partners, is hungry for knowledge and contrarian to the core. Once she finds a company, typically little-known, whose outlook is appealing and stock mispriced, she burrows into the business and its financials until she understands them better than the boss. That could well be the case with her current recommendations, including a specialty-coatings company and a Belgian industrial conglomerate. Want to know about liquid-fertilizer production techniques? You have come to the right source.

As readers of earlier Roundtable issues know, the focus this year was on disquieting trends in the global economy that could halt the bull market’s advance. In the dictionary, opportunity precedes trouble, but as this issue’s stellar stockpickers remind us, in markets the opposite pertains.

Barron’s: Scott, what appeals to you in this crazy, mixed-up market?

Black: I have five stocks whose underlying theme is sustainable earnings power—rising earnings power, in fact. We are deep value investors; all five have low valuations on an absolute, not a relative, basis. Townsquare Media[TSQ], based in Greenwich, Conn., sells for $10.48 [closing price on Jan. 8]. There are 27.4 million shares, fully diluted, and the market capitalization is $287 million. The company doesn’t pay a dividend. Townsquare is the third-largest radio-station operator in the U.S., with 309 stations in small markets. The company also has more than 325 companion Websites.

Townsquare bought North American Midway Entertainment, the largest runner of state and local fairs in the U.S., last year, for $75.5 million, or 6.7 times Ebitda [earnings before interest, taxes, depreciation, and amortization]. North American Midway runs 650 live-music and non-music branded events, with more than 16 million annual attendees. It is the No. 1 provider of rides, games, and food at fairs and festivals. Townsquare’s CEO, Steven Price, is a finance person

.

Your kind of guy.

Black: Townsquare had $478 million in revenue last year, including North American Midway. This year, with the help of $10 million in political advertising and 12% growth in live events, we estimate revenue will rise to $520 million. We foresee radio Ebitda of $121 million, based on 30% margins, and Ebitda of $22 million in the rest of the business, based on margins of 18.5%. If operating income is $90 million and interest expense is $30 million, profit before tax would be $60 million. Taxed at 39.6%—although it doesn’t pay taxes, due to net operating loss carryforwards [a tax benefit stemming from prior losses]—Townsquare could earn $36.2 million, or $1.32 a share. The stock is selling for 7.9 times this year’s expected earnings.

Witmer: How long does the tax shelter last?

Black: It lasts through 2018. Townsquare has $606 million in net debt. Free cash could total between $1.82 a share and $2.19 this year, well above reported earnings. The stock is selling for 6.2 times estimated discretionary cash flow.

Management is aiming to deleverage the balance sheet. Gross debt currently equals 5.7 times Ebitda, and the company plans to reduce it to five times Ebitda this year. The goal is to get down to four times Ebitda in the next year or two. In the latest quarter, the Ebitda-to-interest ratio was 3.9 times. Townsquare also has a $50 million bank line of credit, which it hasn’t tapped.

Scott Black: 2016 Outlook, Plus 1 Stock Pick

The founder of Dephi management and long-time Roundtable member says analysts’ estimates are far too rosy, but he still sees a few opportunities for value investors.

Witmer: Has it been public for a long time?

Black: It came public about 18 months ago. Oaktree Capital Group [OAK] owns 45% of the stock. Because Townsquare’s stock is so cheap, Oaktree is likely to hold it long term, which means more than two picoseconds.

My second stock, Foot Locker [FL], is one of the few bricks-and-mortar retailers doing well. It is a leading seller of athletic running gear and apparel. The stock closed Friday at $62.70; there are 140.9 million fully diluted shares, and the market cap is $8.8 billion. The company pays a dividend of $1 a share, and the stock yields 1.6%. The store count has barely increased in the past four years, and stands at 3,432. Earnings have grown in that period at a compounded annual rate of 35%, from $1.07 a share to $3.56. Sales per square foot are up 8%, compounded, to $490 from $360.

The company generates about 70% of its sales in the U.S., and 30% overseas, mostly in Europe. Online growth has run at 12% of revenue, but will probably trend higher. Nike products represent 70% of revenue.

What will drive growth from here?

Black: By adding some new stores and remodeling others, Foot Locker plans to grow square footage by 2% to 2.5% in the next few years. It has set a goal to lift revenue to $10 billion by 2020 from $7 billion now. It wants to take sales per square foot up to $600, and Ebit [earnings before interest and taxes] margins from 11.4% to 12.5%. Management’s stated objective is to grow earnings by 10% or more per year.

Black: “It is hard to believe that a company [Lam Research] with so much proprietary knowledge sells for only 10 times expected earnings.” Photo: Jenna Bascom

Foot Locker will finish the January fiscal year with revenue of $7.41 billion and earnings per share of $4.27. These are my estimates, not the Wall Street consensus. I budgeted for 4% same-store sales growth in fiscal 2017, and 2% square-footage growth. Ebit could total just over $1 billion. Taxed at 35%, the company could earn $658 million in fiscal 2017, or $4.75 a share. It plans to buy back $300 million of stock, or five million shares. The stock sells for 12.1 times fiscal-2017 estimated earnings, excluding $5.31 a share in net cash.

Operating sources of cash could total $838 million next year. We’ve got capital spending at $275 million, including $50 million in expenditures to relocate corporate headquarters. That leaves free cash flow at $563 million. Return on equity is 20%; return on capital, 20%-plus.

How is the competition doing?

Black: Finish Line [FINL] has been struggling.

We have had few tech-stock recommendations today. One tech stock we like is Lam Research [LRCX]. The company is a semiconductor-equipment maker focused on front-end chip production. The stock is trading for $70.48. There are 174.4 million fully diluted shares, and the market cap is $12.3 billion. Lam pays an annual dividend of $1.20 a share, for a 1.7% yield. Lam is strong in two areas: wafer etch, where it has a 50% market share, and chemical vapor deposition, where it has a market share in the high-30% area. Lam also is involved in wet-clean and photoresist, another component of semiconductor manufacturing, in which it has a smaller market share. Lam is the only semiconductor-equipment manufacturer whose revenue and earnings grew last year.

Why was it such a standout?

Black: It serves faster-growing markets, and it has gained market share. The company is benefiting from 3-D NAND memory and finFET, or multilayer chip technology. Its current business mix is 72% memory, 18% foundry, and 10% logic. Lam reports in dollars, even though most of its sales are in Asia. In the latest quarter, Taiwan accounted for 28% of revenue; Japan, 18%; Korea, 17%; China, 16%; Southeast Asia, 8%; and the U.S., 9%. Lam struck a deal last year to buy KLA-Tencor [KLAC], a leader in chip-inspection tools.

In the year ended June 2015, Lam reported $5.26 billion in revenue. We expect revenue to rise 11% in the current fiscal year, to $5.86 billion. Operating profit could total $1.3 billion, and profit before taxes, $1.22 billion. The company has a low tax rate of 15%, yielding net income of $1.036 billion. Divided by 172 million shares, that’s $6.02 in earnings per share. The company has $11.30 a share in net cash, although that will disappear when the KLA deal is completed. Lam sells for 9.8 times fiscal-2016 estimates. Pro forma return on equity and return on capital are 18.5%.

What is your earnings forecast for 2017?

Black: After adding deal-related cost savings, deducting additional interest expense, and adding another 80 million shares that Lam will issue, we get earnings power of $7.60 a share in fiscal 2017, a dollar more than Lam was projected to earn before the deal. This is a smart, highly accretive acquisition, in a complementary business. It is hard to believe that a company with so much proprietary knowledge sells for only 10 times expected earnings. Many of Lam’s scientists have ties to Stanford University. Lam funds all sorts of research-and-development projects at Stanford. The CEO, Martin Anstice, has done an excellent job.

Like Abby, I like Mylan [MYL], a generic-drug company. [Cohen recommended Mylan in last week’s Roundtable issue.]

Give us your thoughts on the company.

Black: The stock closed Friday at $49.42. There are 514 million fully diluted shares; the market cap is $25.4 billion, and there is no dividend. Mylan has approximately 1,400 products. It has 40 manufacturing sites worldwide, and has more than 260 ANDAs pending.

Translate, please?

Black: It stands for abbreviated new drug applications. Mylan plans to seek approval for a generic version of Advair [a GlaxoSmithKline (GSK) asthma treatment] and Copaxone [a treatment for multiple sclerosis sold by Teva Pharmaceutical Industries (TEVA)]. Advair is an $8 billion drug; Copaxone is $3.3 billion. Mylan also sells the high-margin EpiPen [an epinephrine auto-injector used to treat life-threatening allergic reactions]. It has a 95% market share.

Last year, the company bought Abbott Laboratories ’ [ABT] generics business, primarily focused on Europe, for $5.3 billion. The unit’s earnings are a bit of a black box, but here are the numbers. In the past four years, Mylan grew revenue at a compounded annual rate of 9.1%. Operating income grew by 17%, and earnings per share climbed 36%, to $2.34, from 68 cents. In August 2013, Mylan detailed a new five-year goal of 13% annual revenue growth. It expects to earn a minimum of $6 a share in 2018. The company generates 48% of its revenue in North America, 28% in Europe, and 24% in the rest of the world.

One question we ask is, Will the government reduce the price paid by Medicaid and Medicare for generic drugs?

Meryl Witmer: This Stock Could Rise 60%

The Roundtable veteran makes the case for Axalta auto paint and coating company, an undervalued spinoff that could prove recession-proof.

How do you answer?

Black: It is unlikely, but the company has built up a huge reserve in the event this happens. It was $592 million at the end of last year. We expect Mylan to report revenue of $9.67 billion for 2015, rising 10%, to $10.64 billion, in 2016.

Priest: “In general, I would stay away from materials and most energy companies, and be wary of the industrial sector.” Photo: Jenna Bascom

Schafer: On what basis do you make estimates like this? I have never owned these companies because it is too hard to figure out how they are going to grow.

Black: Historically, Mylan has grown annual revenue between 9% and 10%. It is filing for all sorts of new drugs, and management has run the business well. Gross margins this year could be around 58%, producing $6.17 billion. We model pretax profit at $3.02 billion. The tax rate is only 18% because the company redomiciled abroad; it is headquartered in the United Kingdom. But this gets you to net income of $2.48 billion, or $5.02 a share. The Street is at $4.95 to $4.96. The stock trades for 9.8 times earnings. Return on equity is 24%.

My last name, U.S. Bancorp [USB], is based in Minneapolis. It is probably the most conservative big bank in reserving for loan losses. The stock trades for $39.70; there are 1.766 billion shares, and the market cap is $70 billion. The company pays a $1.02 dividend, for a yield of 2.6%. In 2014, U.S. Bancorp had the highest return on equity among the majors, at 14.7%. It had the highest return on assets, at 1.54%, and one of the best efficiency ratios, at 53.2%. As of third-quarter 2015, return on assets was 1.44% and the efficiency ratio, 53.9%.

Where does the bank rank in asset size?

Black: It is No. 5 in the U.S. in assets. The bank is targeting 5% to 7% annual growth in net interest income, 7% to 9% growth in noninterest income, and 3% to 5% growth in noninterest expense. It won’t meet those targets this year, due to the low interest-rate environment, although for every 50-basis-point [half-percentage point] uptick in rates, net interest income will increase by 1.7%, because assets reprice faster than liabilities. The bank aims to grow earnings per share by 8% to 10% a year, with an efficiency ratio in the low-50% range.

U.S. Bancorp operates in four business segments. Payment services and credit cards account for 30% of revenue, wealth management is 11%, consumer and small-business loans is 42%, and the wholesale banking and commercial real estate unit is 17%. The bank operates in 25 contiguous states from the West Coast to the Midwest. Net interest margins have been stable at 3.04%. The bank’s Tier 1 equity ratio is off the charts, at 9.2%. The most impressive fact is that U.S. Bancorp has the best reserve for loan losses to nonperforming assets of any major bank in the U.S., at $3.965 billion. The nonperforming assets, including other real estate loans, are $1.525 billion. The coverage ratio is 2.6 times.

Priest: What is the book value?

Black: Book value is about $23 a share. I have modeled a 4% increase in net interest income for 2016, to $11.5 billion. After provisioning for loan losses, it is $10.3 billion. Noninterest income is $9.6 billion. Noninterest expense could increase by 3.5%, to $11.5 billion. Profit before taxes of $8.4 billion, taxed at 27%, gets you to $6.13 billion in after-tax earnings. We assume the bank will spend $2 billion to buy back 50 million shares, which puts earnings per share at $3.52. The price/earnings ratio is 11.3—low for a quality bank.

Thank you, Scott. Bill, are you ready?

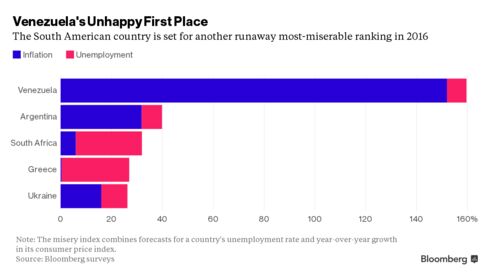

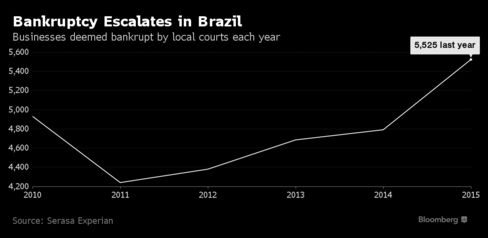

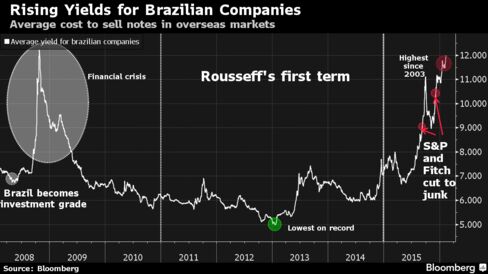

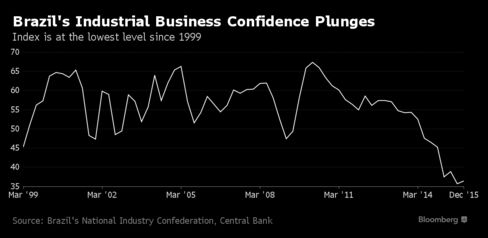

Priest: Sure! We put out a piece toward the end of last year, stating that we expect equity markets to struggle to post positive returns in 2016. Global growth is poor. There has been a modest tightening in monetary policy, which I don’t expect to last, and there is a real risk of a blowup in emerging markets, particularly China, which contributed 46% of the growth in the world economy in the past five years. Money managers focused on emerging markets are hemorrhaging assets, and the bottom in these markets isn’t near. Given this backdrop, investors need to be defensive. That means sticking with consumer-staples, health-care, and some technology stocks. In general, I would stay away from materials and most energy companies, and be wary of the industrial sector.

Our investment approach focuses on free cash flow. There are only five things a company can do with it: Pay a cash dividend, buy back stock, pay down debt, make an acquisition, or reinvest in the business. Most companies do a little of everything, but the key is generating a premium return in excess of your cost of capital. Companies that can do that usually trade at a premium. CVS Health is one we like.

Give us the details, please.

Priest: CVS sells for around $93. The market cap is a little over $100 billion. The company’s free cash flow and earnings are almost identical. CVS could report $5.20 a share in earnings for 2015, probably $5.80 in 2016, and $6.50 in 2017. Free cash flow could go from $5.30 to a range of $4.90 to $5.50. The company runs one of the largest retail-pharmacy chains in the U.S. Annual revenues are just over $150 billion. It is also one of the largest pharmacy-benefit managers.

2 Health Care Stocks for a Slow Growth World

Speaking at the Barron’s Roundtable, Epoch Investment Partners CEO Bill Priest makes the case for CVS and Teva Pharmaceuticals.

CVS is benefiting from several tail winds. One is the expansion of health-care insurance coverage under the Affordable Care Act, or Obamacare. Also, like many companies, it is benefiting from the aging of the baby boomers. Sales of specialty pharmaceuticals and generics are increasing, and, last year, CVS made two strategic acquisitions. It bought Omnicare, a leader in the institutional-pharmacy market, with a 40% market share; Omnicare probably took some business away from McKesson [MCK], which lowered its fiscal-2016 earnings guidance today [Jan. 11]. CVS also acquired 1,672 pharmacies from Target [TGT] for $1.9 billion in cash. That’s very cheap; they couldn’t build this business for that price.

Are you referring to the pharmacies within Target stores?

Priest: Yes. They will be rebranded as CVS pharmacies. CVS has provided 2016 guidance for revenue to be up more than 17%, and for adjusted earnings to come in between $5.73 and $5.88 a share. The company continues to return a large amount of free cash flow to shareholders. CVS generates close to a 6% shareholder yield if you combine a 4% yield from stock buybacks and a yield of almost 2% from a cash dividend.

Witmer: Do you mean the company is shrinking its share count by 4%?

Priest: On a net basis, yes, although this leads to another point. Some companies buy back their shares, but the impact on share count is offset by share issuance in connection with the exercise of employee stock options. That isn’t the case at the companies in which we invest. We are careful in measuring the net effect of buybacks.

My next stock, Synchrony Financial [SYF], was spun out of General Electric [GE]. It is the largest private-label credit-card company in the U.S. Synchrony has a little more than 800 million shares outstanding, and the stock sells for $29. Tangible common equity is just over $13 a share. The company could report $2.60 a share in earnings for 2015, and could earn $2.80 in 2016 and $3.10 for 2017. [Synchrony reported on Jan. 22 that it earned $2.65 a share in 2015.] Synchrony has a 40% share of the $100 billion private-label credit-card market.

Retailers like private-label cards because they bypass the networks and their costs are lower. They have access to more customer data than they receive from a general-purpose card used in their stores. Also, retail partners receive a portion of the profits of the card portfolio. Spending on Synchrony credit cards is growing at a faster rate than the industry. Account balances are also growing faster. Synchrony receivables are growing by double digits compared to a growth rate of 4% for private-label cards and 3% for the industry in general.

Gabelli: The company has its own clearing network.

Priest: Private-label cards at large merchants account for 70% of Synchrony’s revenue. The company also has a consumer-credit business at smaller merchants, which contributes 20%. And it provides financing for elective medical procedures and veterinary procedures. Synchrony is a pure play on the American consumer. The most troubling aspect of these sorts of companies is the percentage of receivables tied to borrowers with low FICO credit scores. Throughout the industry, it is about 20%. We would like to think Synchrony has a good handle on its borrowers, but if credit risk increases among consumers, these companies might feel it a bit. In short, with Synchrony, one has a highly liquid, well-capitalized balance sheet and a motivated management. We expect a share-buyback program and a cash dividend later this year.

NorthStar Realty Europe [NRE] is a tiny company with a $680 million market cap, about $1.8 billion of debt, and $320 million of cash. There are 63 million shares outstanding, and the stock yields 5.5%. NorthStar is a New York Stock Exchange–listed real estate investment trust. It invests exclusively in European commercial real estate, nearly all Class A space in the U.K. and on the Continent. It is trading at a large discount to net asset value. This portfolio was assembled before the European Central Bank embarked on its current, expansive monetary policy, which means all the properties are likely going to be revalued upward, given the lower discount rate that now exists.

David Hamamoto, the chairman of NorthStar Realty Finance [NRF], is the key executive behind this entity, as well. He is a smart guy who previously worked at Goldman Sachs. NorthStar Realty Europe is selling for $10.53 a share. Net asset value at cost is $16 per share, but at today’s value, it is closer to $20. One may receive meaningful price appreciation from the current price, plus a dividend.

Black: I owned NorthStar Realty Finance. It almost wound up in bankruptcy protection in 2007-08, due to a mismatch of assets and liabilities. How do you know that won’t happen again?

Priest: Hamamoto learned his lesson.

Rogers: A brush with bankruptcy is all it takes.

Priest: NorthStar Realty Finance spun off NorthStar Realty Europe last year. It has been transparent about what is happening at NRE.

Next, Vodafone Group ’s [VOD] Nasdaq-listed shares are trading around $32. The market cap is $85 billion. Vodafone is one of the top three wireless telecom providers. It is a low-risk, modest-total-return story, with upside of 10% to 12%. We don’t see much downside. The current yield exceeds 5%, and the company is transitioning from a negative free-cash-flow position to a positive one in the next few years. Capex growth peaked in 2014-15. It is going to trend down in the future. Growth, if it comes, will come from more 4G data consumption. Europe accounts for 70% of Ebitda, and the regulatory regime there is improving. India contributes 10% to 11% of revenue, and South Africa, 8%. Vittorio Colao, the CEO, owns 11 million ordinary shares, worth about 25 million pounds [$35 million]. Periodically, there are rumors they will link with another telecom company, which could produce significant synergies, depending on the terms.

Gabelli: Buying Liberty Global [LBTYA] would be a logical next step. Vodafone is a cheap stock and a good way to play currency movement between Europe and the U.S.

Thanks for your thoughts, Bill—and Mario. Meryl, we know the wait will be worth it.

Witmer: The market has fallen sharply and quickly, creating some good opportunities for us. Axalta Coating Systems [AXTA] is one. It trades for $25 a share and has about 245 million shares outstanding, including options. The company manufactures specialty paints for cars, trucks, and industrial machinery. The management team, together with Carlyle Group, bought the business from DuPont [DD] at the beginning of 2013, and took it public in the fall of 2014 at $19.50 a share. Our investment thesis begins with management, which has done an exceptional job in continuing to build the company. DuPont milked it for cash, but Axalta’s chief executive, Charles Shaver, and chief financial officer, Robert Bryant, transformed the business by bringing in top talent, implementing accountability across the organization, and investing for growth.

Meryl Witmer: “Different things spur us to look at potential investments. One is the sale of a company by DuPont.”Photo: Jenna Bascom

How fast is Axalta growing?

Witmer: Ebitda has increased by more than 30% since 2012, to an estimated $865 million last year, even with flattish revenue due to currency head winds. Management has undertaken initiatives to add another $100 million to pretax earnings in the next two years. The crown jewel is the automotive-refinishing business, which is No. 1 globally with a 25% market share. Barriers to entry are large, given its distribution, scale, technology, and relationships with key customers. Axalta provides both the paint and color-matching technology, and works with body-shop owners to move vehicles through quickly. It helps the owner manage productivity and profitability.

The auto-refinishing industry is consolidating in the U.S., and Axalta is well positioned, with a 44% share of the market supplying the top multisystem operators. As these operators buy more body shops, Axalta gets more business. The refinishing business is driven by collisions, which tend to increase as more miles are driven and more cars are on the road. It is an annuity stream.

The light-vehicle paint business has a 19% global market share. Since the LBO, the company has invested in new plants in Germany and China to expand production. It has won more than 30 new contracts with barely a loss. The contracts will continue to drive revenue in 2016 and beyond.

What do you figure Axalta is worth?

Witmer: We assume modest top-line growth of 3% to 4%, with profit-margin expansion just from cost-savings initiatives. We also assume most of the free cash flow in coming years is used to pay down debt, which enhances the value of the equity. We see earnings per share increasing from $1 a share in 2015 to about $1.95 in 2018. In addition, Axalta has $309 million in noncash depreciation and amortization expense. Capital-spending needs are about $80 million a year. The difference amounts to 94 cents a share, which we add to earnings, to arrive at $2.85 a share in after-tax free cash flow in 2018. A business of this quality deserves at least a 14 multiple of free cash flow. We have a target price of about $40 in two years.

Schafer: We also own Axalta. It has one of the best management teams I have ever seen. The company’s success also speaks to the poor job done by DuPont.

Witmer: Different things spur us to look at potential investments. One is the sale of a company by DuPont.

Gabelli: Ouch! In this case, management bought it for a cheap price and flipped it as an initial public offering.

Witmer: Management made a good return on the IPO because they increased profitability dramatically, not because they loaded the company with debt.

We started looking at my next recommendation, Tessenderlo Chemie, because it bought a small company from DuPont. It is controlled by an industrialist, Luc Tack. At the end of 2015, Tessenderlo [TESB.Belgium], based in Belgium, announced the acquisition of the industrial assets of Picanol Group [PIC.Belgium], another Belgian company controlled by Tack, for 26 million Tessenderlo shares. Pro forma, the combined company will have 69 million shares outstanding. At a current 25 euros a share, Tessenderlo will have a market cap of €1.8 billion [$2 billion]. Net debt is only €90 million, for an enterprise value of €1.9 billion. The combined company will have four segments. Agro will generate about half of Ebitda. A weaving-machine business acquired from Picanol will account for 30%. The other segments are Bio-Valorization and Industrial Solutions.

What is bio-valorization?

Witmer: The Bio-Valorization business buys animal hides and bones and processes them to make pharmaceutical-grade collagen and food-grade collagen. Another part of the business processes animal fats.

In the Agro business, Tessenderlo produces liquid fertilizers, mainly in the U.S., and other fertilizers in Europe. It also has a niche crop-protection business. We are particularly excited about the liquid-fertilizer business. The company combines sulfur, often sourced from the waste stream of oil refineries, with either nitrogen or potassium to produce a liquid fertilizer.

Sulfur is a major nutrient required by crops. Historically, sulfur supplementation was unnecessary because gasoline and diesel fuel released sulfur into the atmosphere, and it was deposited onto farmland by rain. Government regulations taking sulfur out of fuel diminished the amount of sulfur content in the atmosphere. Also, less coal being burned by power plants; that’s contributed to sulfur deficiency in the soil. A field deficient in sulfur might yield a much smaller crop.

Gabelli: Is this the business they bought from DuPont?

Witmer: No, that is in the niche crop-protection business. Interestingly, in China, there is no need for sulfur fertilization.

Schafer: Who else is in this business?

Witmer: Kugler, a privately held company. Also, Koch Industries is probably going to add 10% capacity to the industry by getting the sulfur from one of its owned refineries. That is the best and cheapest way.

Gabelli: If this is such a nice business, why would Tessenderlo’s controlling shareholder add a more mundane business, diluting its impact?

Witmer: It is possible the deal will get voted down because he is valuing one business at more than people think it is worth and the other at less. But it is possible he is combining these assets because he has his eye on a bigger deal and wants critical mass. There are other ways to achieve that. The shareholders I know are voting against the deal.

Tack has an exceptional track record as an investor and a business operator. He became CEO of Picanol in July 2009 after a rights offering. In 2008, Picanol reported €282 million of revenue. Ebitda was negative, and the company had €40 million of debt. He quickly cut costs, invested in research and development to improve the product pipeline, and used free cash flow to pay down debt and build up cash. By 2010, the business was profitable, and it probably generated €450 million in revenue and €89 million in Ebitda last year.

When did he get involved with Tessenderlo?

Witmer: In November 2013, Tack acquired the French government’s 27.5% stake in Tessenderlo for €192 million. Through a rights offering and open-market purchases, he has increased his stake to 33%. He became CEO in December 2013 and he has been working to improve and grow Tessenderlo’s businesses by reducing operating expenses, making smart capital expenditures, and changing the culture of the company.

To value the business, we normalize 2015 earnings, adding back some one-time charges. Then we add Piconal’s earnings, to get €2.11 in fully taxed pro forma earnings per share. Plant expansions could add around 40 euro cents per share, which puts future earnings at €2.50. The company deserves a multiple of at least 13 times earnings, as it is essentially debt-free. The Bio-Valorization unit didn’t make money last year, but could be profitable in 2016, adding €3 per share of value. Net operating loss carryforwards are worth a few euros per share. Add it up, and we get a target price of €37, and growing from there. If the merger with Piconal is voted down, using the same valuation criteria, our target price for Tessenderlo is €40. We are voting no. [On Jan. 25, the exchange offer for Piconal was withdrawn by Tessenderlo’s board.]

Black: Have you met with management?

Witmer: I haven’t met them, but we have spoken with them. That wasn’t so easy to do; we e-mailed them requesting a conversation several times, and they turned us down.

But we are excited to find a business of this quality run by a great operator, with no debt, and in a nice niche business.

My next pick is Navigator Holdings [NVGS]. The stock is trading for $12 a share. The company has 55 million shares outstanding and about $500 million of debt. It operates a fleet of 29 semi-refrigerated handysize ships [handysize vessels are of moderate size, with a capacity between 15,000 and 35,000 DWT, or deadweight tonnage], designed to carry cargo ranging from liquefied petroleum gases, or LPGs, such as propane and butane to ethane, ethylene, and ammonia. Compared with a large gas carrier, which is three times the size, a handysize ship is more flexible in terms of the cargo it can carry and the ports it can serve.

In addition to the high degree of technical competence required to handle its various cargos, Navigator has excellent operational and commercial capabilities, which allow it to run at more than 95% utilization and quickly adapt to changing circumstances. It has a great management team, with significant ownership of around 2.5 million shares, and discipline regarding capital allocation.

What drives the business?

Witmer: Navigator’s business is supply- driven. The more butane, propane, and such that needs to be moved over water, the more demand there is for its services. Drivers of supply are natural-gas drilling, which in turn is driven by U.S. gas fracking [hydraulic fracturing] and the global buildup of liquefied natural gas, and increased shipping of ethane and ethylene. The U.S. has access to extremely cheap ethane, which is used to produce ethylene. As the U.S. increases its supply of ethylene, and as the plants and ports required to move it come on-stream in the next few years, the opportunities for Navigator will continue to improve. Inexplicably, the stock trades with the price of oil. When oil was $80 a barrel, Navigator was generating about $1.60 a share in after-tax free cash flow and trading in the $20s. Since then, oil has fallen by more than 50%, and Navigator’s after-tax free cash flow has increased by more than 25%, to over $2 a share, and the stock is down, not up.

How do things look for the company next year?

Witmer: Navigator recently disclosed that it has already contracted a significant portion of its capacity for 2016 at rates higher than those in 2015. Navigator has nine ships ordered that will be delivered over the next year and a half. With those at current day rates, after-tax free cash flow could be about $3 a share. Even if shipping rates decline 20%, the company would still earn about $1.65, with all 38 ships. Based on announced export capacity expansions, we believe the supply of seaborne LPG, as well as ethane and ethylene, should keep the industry at a healthy utilization rate. We consider Navigator a real bargain, and have a price target of at least $25 a share.

Black: In the short term, the company will have negative free cash flow because it is spending $44 million per ship on new ships. Once they get to that steady state in a year and a half or so, they will generate free cash.

Witmer: They don’t have negative free cash from operations. It is because they are growing the fleet. To calculate maintenance capital spending, we take the replacement cost of the entire fleet, less scrap value, and divide by the average life of the ship. In 2016, we charge them for $30 million of capital spending when actual spending for anything beside new ships is $5 million.

Black: To me, that is operational.

Gabelli: I don’t see it as operational.

Black: As Warren Buffett said, the tooth fairy doesn’t pay for capital expenditures.

Gabelli: The stock is cheap. Buy it.

Black: I already own it.

Gabelli: Buy more.

Witmer: I’m going to stop here.

That sounds like a wise decision. Thanks, Meryl–and everyone