To fight the next recession, fiscal stimulus may matter more than monetary policy.

GOVERNMENTS do not always make the best budget managers. Assuming it avoids an accidental debt default, America will run a bigger budget deficit this year than the last, despite a booming economy. Germany runs a surplus—but scrimps on critical investments and annoys its euro-area neighbours in the process. Japan, cowering under a mammoth public-debt pile, is weighing raising its consumption tax, though the last rise strangled a tenuous economic recovery. It is awkward, therefore, that the role of fiscal policy as a recession-fighting tool is only growing. The next downturn will be a painful and dangerous learning experience for many politicians.

When that comes, at some point in the next few years, the initial policy response is easily foreseeable. Central banks, nimbler than parliaments, will again move first. But markets reckon that two years from now the Fed’s benchmark rate will remain below 2%, the Bank of England’s below 1% and the European Central Bank’s close to zero. Rates can only go so negative before people abandon the banking system for cash. So cuts to interest rates will be limited. By contrast, in the relatively mild recession of 2001 the Fed cut rates by more than six percentage points. Central-bank asset purchases will follow, assuming they are not already happening, as they might well still be in Europe and Japan. Their effects will be less powerful than in the past, however. When bond yields are low, as they are likely to be for the foreseeable future, bonds do not look much different from cash; giving banks cash for their bonds consequently does little to boost risk-taking.

If monetary measures do not quickly revive animal spirits, the pressure on governments to act will grow. Some doubtless will. Public spending and tax cuts are popular, after all. But politicians are kept from taking full responsibility for battling recessions by the intellectual baggage of past decades. Some cling to the notion that stimulus is unhelpful, risky and hard.

Such views need updating. Take the notion that fiscal stimulus is ineffectual. In the 1970s, before central banks focused so intently on inflation, efforts to boost the economy through borrowing often contributed more to rising prices than to growth. In the 1980s, the results were little better; hawkish central banks greeted any development likely to jolt prices with an expansion-squelching increase in interest rates. Economists of all stripes argued that the “multiplier” on stimulus—the amount by which a dollar of borrowing raises GDP—is usually low. Households save their higher incomes in expectation of offsetting future tax rises; omnipotent central banks cancel out the stimulative effects. But studies since the Great Recession tend to find that multipliers are substantially higher than once thought, particularly when monetary policy is constrained. Multipliers in such cases are often closer to two, ie, GDP increases by nearly twice the size of the stimulus.

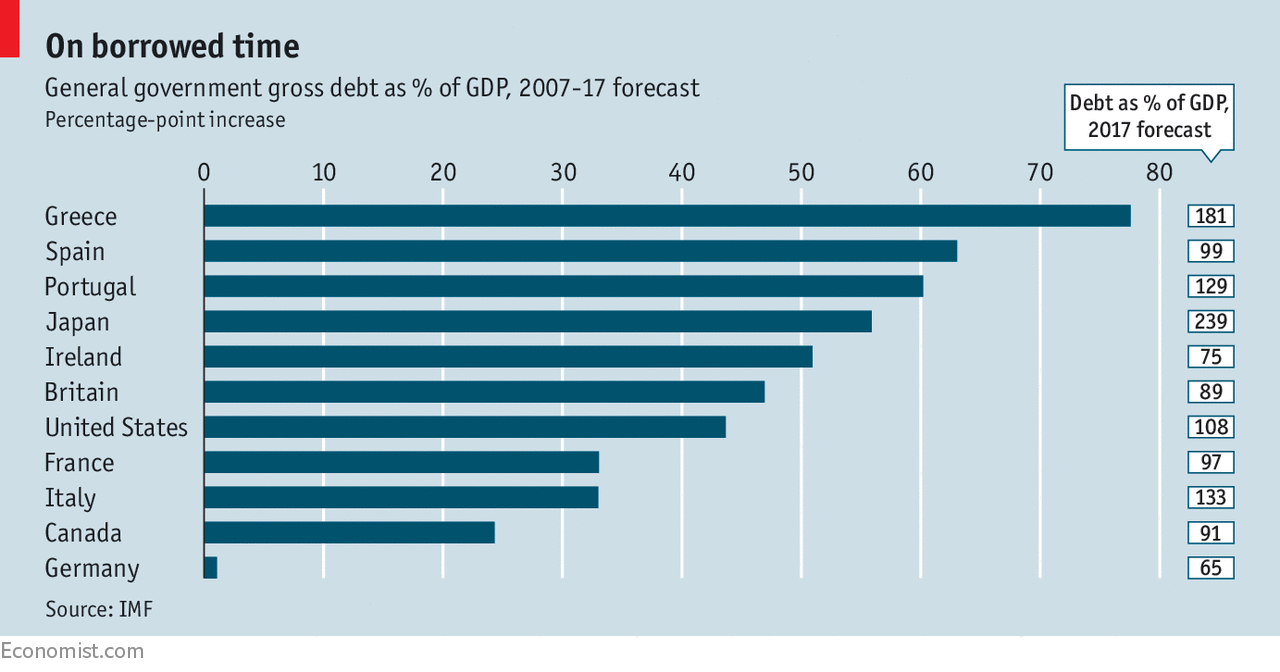

Nonetheless, big debt piles may heighten politicians’ caution about borrowing (see chart). If a borrower’s ability to repay is in doubt, he is forced to pay higher interest rates. That raises the cost of servicing debt, presenting governments with an excruciating choice between growth-sapping austerity and default. For many politicians, the financial crisis reinforced this lesson. In late 2009 bond yields on Greek debt began rising, after revisions to budget data revealed that the fiscal picture was bleaker than thought. Yields on the bonds of other peripheral euro-zone economies followed suit, spiking on several occasions between 2010 and 2012.

Yet that crisis has receded, and not because the euro area resolved its indebtedness problem. With the exception of Ireland’s, debt levels around the periphery are higher now than at the peak of the crisis in 2012. Yields instead fell as it became clear that the ECB would buy the bonds of troubled countries, either because the survival of the euro demanded it, or to battle deflation. In a world of low interest rates, central-bank asset purchases are likely to become a conventional policy tool, so the appetite for bonds is less likely to dry up. The risk of inflation remains. But in advanced economies higher inflation usually means that firms are operating at capacity; the job of recession-fighting is done. At that point, a dose of austerity is appropriate, if politically unappetising.

Debt comes for us all

Perhaps most important, recent experience suggests that an aggressive fiscal response to economic weakness can in fact be safer than a more cautious approach. In a paper presented to central-banking luminaries in August, Alan Auerbach and Yuriy Gorodnichenko of the University of California, Berkeley find that bursts of fiscal stimulus need not lead to higher debt-to-GDP ratios or to higher borrowing costs. In some cases, they note, markets revise down their worries about creditworthiness in response to large-scale stimulus. Their work echoes an argument made by Brad DeLong, also of Berkeley, and Larry Summers, of Harvard University. They reckon long periods of limp growth eat away at an economy’s productive potential, as investments go unmade, for instance, or as healthy workers drop out of the labour force. Averting such scarring raises GDP in perpetuity, covering the cost of the jolt needed to escape the doldrums.

A third argument about activist fiscal policy—that it is hard to get right—remains. Despite the financial crisis, governments have paid scant attention to the practicalities of fiscal stimulus; ideally, programmes should be automatic and proportionate to the severity of the downturn. Labour tax rates could be linked to unemployment figures, for instance, so that pay packets jump the moment conditions deteriorate. Funding to local governments could be similarly conditioned, to limit painful cutbacks by municipalities. To prevent a scramble for worthwhile, shovel-ready infrastructure projects, governments could make sure to have a ready queue, so spending could easily scale up in a downturn.

To use stimulus effectively, politicians must understand the risks they face and plan accordingly. Sadly, it seems likely to take more nasty recessions to drive the point home.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.