Upset that you missed the boat on the bitcoin craze last year?

Millionaires were minted overnight as bitcoin returned 1,700 percent in 2017, only to see prices crash by more than half since December. The bubble seems to have popped, and not everyone got out in time.

While we may be past the peak temporarily, the cryptocurrency trend is just getting started, and investor enthusiasm is still growing by the day.

(Click to enlarge)

While the bitcoin investment boat may have already set sail, it’s likely far from the last huge opportunity in the space. The cryptocurrency and blockchain market is expanding at a significant rate, and there is one unique and simple investment opportunity that could give investors access to a broad spectrum of the space.

The problem for would-be cryptocurrency investors is trying to figure out the next big thing. Now, a new Canadian investment company will figure that out for you, offering exposure to not just cryptocurrencies by also the entire blockchain ecosystem.

Global Blockchain Technologies Corp. (CSE: BLOC; OTC: BLKCF) is Canada’s first blockchain-focused investment company. Bitcoin captured the interest of the global financial industry last year, but it makes up just a fraction of the blockchain market. The recent collapse in bitcoin prices now has some investors nursing their losses and biding their time until the next big cryptocurrency coin emerges.

More importantly, the underlying blockchain technology is an even bigger story than mere crypto tokens.

Global Blockchain offers the best of both worlds. It offers investors exposure to a curated selection of cryptocurrencies, while also opening the door to investment in blockchain, before the next wave of money rolls into this booming market.

As investors search for profits amid the market disruption caused by cryptocurrencies, Global Blockchain plans to offer a unique solution. This comes in the form of a basket of holdings that:

• Definitively answers massive demand from investors

• Will be one of the first ways to find and gain exposure to a wide breadth of cryptocurrencies and blockchain companies

• Is packaged in a publicly listed security accessible in the U.S., Canada and Europe, with Asia and Australia to follow

• Access to ICOs that investors would never be able to secure on their own

• Is led by major crypto-pioneers who are ready to make the crypto world a lot less cryptic

Here are 5 reasons to keep a close eye on Global Blockchain (CSE: BLOC; OTC: BLKCF), an investment company hoping to become the first-ever vertically integrated originator and manager of startup blockchains and investor in top-tier digital currencies:

1.) Blockchain To Impact Every Major Sector of the Global Economy

Blockchain is automation and collaboration on steroids, with market growth predictions headed into trillion-dollar territory. The technology is the backbone of the exploding crypto-currency market, worth a pretty $333 billion today.

There’s likely no industry that’s isolated from being disrupted by blockchain technology.

- Banking: Seven major global banks have partnered with fintech companies to develop new blockchain technologies, because blockchain and cryptocurrencies simplify so many things in the banking world, from fees for sending payments through middlemen, privacy threats, and security risks to cumbersome lending in the $134-trillion global banking industry.

- Global Logistics: Blockchain technology is already being used to track global trade and shipments in this $8-trillion-plus industry.

- Real Estate: This $7.4-trillion industry is also a major beneficiary of blockchain tech. Look no further than the real estate mecca of Dubai, which is putting its entire land registry on a blockchain.

- Healthcare: The global healthcare IT market, valued at $134 billion last year, is publicly seeking IT solutions from Blockchain.

- Crowdfunding: Even this $96-billion market is embracing blockchain.

And the list goes on …

“Blockchain solutions in finance are virtually endless … any centralized marketplace that is dominated by a few middlemen is likely to be taken over by blockchain technology,” says BLOC Chairman Steve Nerayoff. The opportunities are mind-boggling.

2.) BLOC Offers Exposure to Blockchain Ecosystem

Global Blockchain (CSE: BLOC; OTC: BLKCF) has plans to invest in a basket of holdings within the blockchain space, offering investors a slice of profits from the entire shift towards blockchain tech. This innovative strategy would make Global Blockchain the first global investment company with exposure to a wide cross-section of the blockchain ecosystem — all backed by startup equity and token diversification.

The investment strategy also benefits from diversification, lowering risk for investors by balancing more established companies with hand-picked, high-growth potential small-caps. Global Blockchain also plans to diversify portfolios by balancing cryptocurrencies by category.

You can buy it right now from an online broker, and even add it to your IRA or 401K.

(Click to enlarge)

Here are Global Blockchain’s planned investments:

But it’s not just about a basket of currencies to speculate on; it’s about the potential of building an investment portfolio based on the token economy — one of the first of its kind.

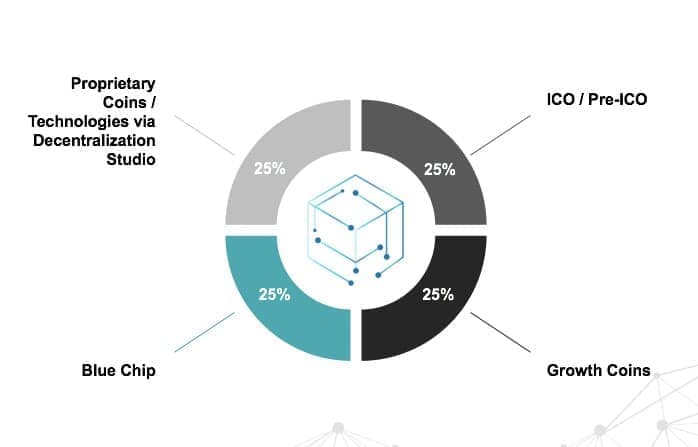

Here is Global Blockchain’s projected Asset Allocation:

(Click to enlarge)

3.) BLOC Led by Cryptocurrency Pioneers

The team behind Global Blockchain (CSE: BLOC; OTC: BLKCF) isn’t comprised of a bunch of financiers new to cryptocurrencies.

Remember the Ethereum ICO? It’s risen over 220,000 percent. Global Blockchain’s Chairman and CEO, Steve Nerayoff, was not only a senior advisor to Ethereum leading up to its ICO, but was the architect of the Ethereum crowdsale, the way the project was funded. He also was a senior advisor to the Lisk Cryptocurrency project, which now has a $1.8-billion market cap. Nerayoff is an early leader of the blockchain industry, and one of its most important pioneers.

But Global Blockchain’s knowledge base doesn’t stop with Nerayoff.

• Rik Willard: Cryptocurrency and ICO veteran, co-founder of the Silicon Valley Blockchain Society, and an advisor to Luxembourg and other countries’ blockchain initiatives.

• Shidan Gouran: Cryptocurrency and ICO expert with a long track record.

• Kyle Kemper: Executive director of the Blockchain Association of Canada.

• Jeff Pulver: Has consulted and invested in 350 startups.

• Michael Terpin: Co-founder of BitAngels, the world’s first angel network for digital currency startups. Managing partner of bCommerce Labs, the world’s first blockchain incubator fund. Founded Marketwire, one of the largest company newswires, which was acquired in 2006 by NASDAQ for $200 million.

And it’s not just their blockchain successes and expertise that investors will harness — it’s also their exclusive access to assets that investors would have difficulty investing in otherwise.

4.) Just The Beginning

If and when the U.S. Securities and Exchange Commission (SEC) approves crypto ETFs for listing on public markets, digital currencies will likely push even higher. Some projections show that as much as $300 million could pour into a bitcoin ETF in its first week, Bloomberg reports.

We’re looking at a potential total current market cap of tokens at $34 billion, and more than $2 billion has already flowed into ICO (initial coin offering) token sales. This is where Global Blockchain (CSE: BLOC; OTC: BLKCF) comes into play, with their expertise to make knowledge-based decisions on which ICOs may have what it takes to be winners, and how to play the futures. They also intend to balance large-cap holdings with small-cap and emerging cryptocurrencies so investors can benefit from the relative stability of one and the growth potential of the other at the same time.

Global Blockchain plans to become an incubator for new crypto technologies, which means that investors are not just investing in assets — they’re investing in innovation.

5.) Global Blockchain Cryptocurrency Incubator

Global Blockchain (CSE: BLOC; OTC: BLKCF) also plans to create additional value with its own incubator for new tokens, taking advantage of a major gap in the token world.

Most new ICOs have poor execution after they are developed. This is where Global Blockchain sees an opportunity. They won’t just help new blockchain companies build; they’ll help brand and distribute, taking equity stakes in the cryptocurrency in return.

While the major cryptocurrencies garner the most attention, sometimes the smaller tokens offer vastly more upside. Verge, for instance, with a market cap of $640 million, has offered a return on investment in excess of 200,000 percent. DigitalNote, a small token with a market cap of just $97 million, have offered investors a return on investment higher than 13,000 percent.

Global Blockchain will find and incubate upstart cryptocurrencies so you won’t have to try to discover them yourself.

Guided by a team with extensive real-world experience and backed by the world’s top blockchain programmers, this venture holds great promise as the next phase of maturity in an industry that lacks development. With Global Blockchain providing investors access to a basket of holdings within the blockchain space, and managed by a team of industry early adopters and pioneers, investors have a chance to access a market of huge proportions, since blockchain is poised to affect every industry.

New waves of money continue to enter the market, and the next wave could be Wall Street hedge funds. After that, possibly ETFs. And then everyone else. Getting ahead of the wave could be possible with Global Blockchain’s investment and incubator strategy.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.