“The greatest companies in lousy industries share certain characteristics. They are low cost operators and penny pinchers in the executive suite. They avoid going into debt. They reject the corporate caste system that creates white-collar Brahmins and blue-collar untouchables. Their workers are well paid and have a stake in the companies’ future. They find niches, parts of the market that bigger companies have overlooked. They grow fast – faster than many companies in the fashionable fast-growth industries.”

This is going to sound like blasphemy to most but I only very recently became a Costco (COST) member- several months ago to be exact. In fact, I didn't really know much about Costco for the many years that I lived in New York and Philadelphia. I guess there wasn't much reason to. In New York, Gristedes and Duane Reade covered all my needs. But moving to the west coast, people were shocked that I wasn't a Costco member. “What do you mean you're not a Costco member?” Fervently loyal Costco member friends and co-workers offered to take me there just to show me around and get an absurdly cheap lunch to persuade me that I needed to join. In fact I've never seen people so loyal to anything else, especially a retail store. What gives? It made me curious. So I went.

Upon my initial visits, I came back somewhat unimpressed, so friends went on to sing the praises that I am sure you already know:

“I love their return policy...I don't need a receipt. Just take it back anytime. That’s why I buy all my electronics there”

“I love that I can know that everything there is going to be the best quality because they've selected and screened only the best products. They’ve done the work for me and I trust them.”

Me: “I don't really have a need for a 50 pack of whatever item. It's just three of us in my family. Maybe if I had a big family.”

Friend: “Well I mostly just like the finds [she's referring to the treasure hunt environment which we will get to] and buying really good wine there”

Friend: “I don't think I spend much there. Last year I got back $195 through the 2% back on purchases on the exec membership”

Me: “Dude, that means you spent about $10k there.”

Friend: “Oh shoot, I guess you're right. I didn’t realize”

So I decided to check it out a few more times. What was I missing that Target, Trader Joes, Safeway and Whole Foods wasn’t already providing me with. Why would I pay for the privilege to shop at a store? Why does everyone wait in such long lines and fight through crowded parking lots even first thing in the morning? It’s a pain in the butt.

Then, happening upon a long line of cars outside, I discovered the COSTCO gas station and their incredibly low prices and I was sold. I shelled out the $55 for a Gold Star membership and never looked back. The frugal in me rejoiced as I realized that the gas savings more than covered the membership price after only a few months. In fact, I started going in the store every now and then (only first thing in the morning when I could beat the crowds) and started discovering stuff that I never knew I needed! I’m sure this last part rings familiar for many people.

Let’s take a step back though and figure out how I got here waiting amidst a sea of people at 9:50am for Costco to open its doors. The reality is that there isn’t that much new I can add to the Costco conversation given all that has already been written about it and that many value/GARP investors already own or have owned the stock. Also – based on their ~48 million membership households, more than half of you readers out there are probably already members so you already know the story whereas I am playing catch up. Although I was a skeptical consumer for a long time (not necessarily a skeptical investor), I’ve been thoroughly impressed by Costco’s business model and their members first philosophy. Let’s delve a bit deeper to review the dynamics of the industry and the business. And buckle up because there's a lot I have to say.

INDUSTRY OVERVIEW

RETAIL, HOW I HATE THEE

I’ve never been much of a fan of the retail industry. The competition is tough, differentiation is lacking, margins are razor thin, the returns on capital tend to be low and the competitive advantages are non-existent or difficult to maintain. Generally, competing retailers are selling the same products attracting consumers primarily on the basis of promotional deals or sales that further drive down margins. Even in the case of vertically integrated retailers (think clothing retailers like GAP or J Crew), that sell exclusive products, the business is challenging because retailers are forced to make large upfront commitments for inventory on fashions that may not play out well with fickle consumers months down the line. We don’t need to look far to find the retail behemoths of the past that are basically irrelevant today. Sears was once the Amazon (AMZN) of its day- selling pretty much anything one could desire from a catalog. Just check out this Sears catalog from 1897 – they had even cracked groceries! AmazonFresh could learn a few things.

And K-mart was the original mass/discount retailer with nearly 2,200 stores at their peak. Today, ask anyone under 20 what Sears or K-mart is and you’ll get some puzzled looks. It’s obvious why when you see this K-mart in pictures.

Despite these inherent challenges of the retail business, there are some retailers that have been successful – TJ Maxx, (TJX), Walmart (WMT) and Dollar Tree (DLTR) to name a few. They’ve done this primarily by focusing on providing value and savings to the end consumer versus competitors. Amazon (AMZN) has also been successful by providing value (and convenience) to its consumers. In fact, Costco is probably the prototype that Bezos has followed for Amazon Prime (more on that later). Amazon is Costco’s Washington state neighbor. I’m sure the proximity didn’t hurt.

MEMBERS ONLY - INTRODUCING THE CLUB CHANNEL

Costco sells all types of general merchandise, so in effect, they compete with nearly all other retailers whether that is mass market retailers like Walmart (WMT) or Target (TGT), grocery chains like Kroger (KR) or in some cases hardware stores like Home Depot (HD).

More directly, though, Costco operates in a niche of the retail industry called Warehouse Clubs, Wholesale Clubs or the Club Channel. There are some notable differences between warehouse clubs and traditional retail stores:

- The key differentiating aspect of these warehouse clubs versus other retailers is that you must be a member to shop there. They charge an annual membership fee in exchange for lower prices.

- The warehouse clubs predominantly sell items in large quantities/pack sizes at higher tickets. Many items are not stocked on shelves, but rather sold right off the wooden pallets they come in on to limit operational costs.

- Limited variety. Given the larger pack sizes, varieties for a given product tend to be very limited at club stores. You want ice cream – you get vanilla ice cream and you’ll like it. Moving volume is the name of the game at Club so companies will typically offer the most popular flavor or variety for a given product given that niche flavors or varieties typically don’t have the same broad appeal. Sometimes companies will develop products, flavors or unique pack sizes that are exclusive to the Club Channel. This is driven partly by a desire to limit price comparisons and price transparency between clubs and traditional retailers.

- The footprint of the club stores tends to be much larger than a typical retail store – ranging from 100k to 150k square feet.

Over the last several years, the club channel has experienced strong growth and taken share from other channels of trade like grocery and mass. This share shift has been driven partly by very competitive pricing. Most items sold at club are sold at a decent discount as compared to other retailers as long as you’re willing to buy it in a larger pack size and ok with limited varieties/assortment.

As a result of this large opportunity in club, consumer products companies and other companies have continued to place a greater emphasis on the club channel, which can be a great volume driver (but potentially at the expense of margin).

A CAST OF THREE- KEY PLAYERS IN THE CLUB CHANNEL

There are three major players that operate in the US Club channel – Costco, Sam’s Club and BJs.

Costco is by far the largest of the three club competitors when it comes to members and revenue and operates 723 warehouses across the US and eight international markets as of December 2016. However, the US is by far Costco’s largest market and they have only cautiously tiptoed into international markets. Costco’s primary category is food (food comprised over 40% of sales in 2015), but it also sells many other items across many other categories including hardware, appliances and electronics.

Sam’s Club is owned by Walmart and named after the original founder, Sam Walton. Sam’s Club operates 655 stores predominantly in the US. As Walmart tried to leverage its clout with real estate developers, they built many Sam’s Club’s stores in very close proximity to Walmart stores (in the same exact shopping center in many cases). This puts Sam’s Club at a competitive disadvantage relative to Costco in that many of these Walmart neighborhoods have less desirable demographics (lower HH income). The average HH income of a Sam’s Club member is $80k/year, lower than that of a Costco member. Sam’s Club’s recent strategy has focused on repositioning itself to attract more affluent members by changing its assortment and also building stores in more affluent areas. The former includes revamping the Sam’s Club private label brand to better compete with the goliath that is Costco’s Kirkland Signature brand.

BJs Wholesale Club is a distant third competitor in the club channel. BJs has a much smaller footprint of ~200 stores predominantly located on the eastern seaboard of the US. BJs operations aren’t very different from Costco or Sam’s Club – many of the locations sell gas and offer many ancillary services like optical and discounts on car rentals and vacations. As of 2014, BJs is fully owned by Leonard Green & Partners, a private equity shop.

See chart below for how the three compare on some basic metrics.

A wonderful in-depth comparison of Costco and Sam’s Club from a consumer perspective can be found here. The net-net: Costco seems to have the edge versus its club competition in terms of product quality for the price but it seems like Sam’s Club may be catching up.

THE BUSINESS AND STRATEGY OF COSTCO

“My ‘secret’ is so simple that I’m reluctant to speak openly about it for fear of appearing stupid. I sell things as cheaply as I can.”

WAREHOUSES

Costco operates 723 membership warehouse clubs across the US and eight international markets (Canada, Mexico, UK, Japan, Korea, Taiwan, Australia, Spain) as of December 2016. The majority (500+) of the company’s warehouses are in the US with the highest concentration in the state of California (~122). In 2016, the Company opened 29 net new warehouses and relocated 4 warehouses in the US and several other markets. The plan in 2017 calls for 30 new openings and expanding into two new markets – France and Iceland. Costco expects to end 2017 with approximately 745 warehouses worldwide.

The warehouses sell general merchandise ranging from fresh food to appliances. Costco's sales mix leans food-heavy and broke down as follows in 2016:

- Foods (including dry foods, packaged foods, and groceries): 22%

- Sundries (snack foods, candy, beverages, and cleaning supplies): 21%

- Hardlines (appliances, electronics, health/beauty, hardware, and garden/patio): 16%

- Fresh Foods (including meat, produce, deli, and bakery): 14%

- Softlines (including apparel and small appliances): 12%

- Other (including gas stations and pharmacy): 15%

MERCHANDIZING STRATEGY

Costco’s merchandising strategy is unique and provide the company with key competitive advantages. The core tenets of their merchandizing strategy involve a very thorough merchandise selection/evaluation process, limited merchandise assortment but a broad set of categories (mile wide/inch deep), robust private label business in Kirkland Signature, high inventory turnover and also carrying unique items (in limited quantities) and ‘fresh’ to drive trip frequency.

Costco sells general merchandise ranging from fresh food to appliances. Costco's sales mix leans food-heavy and broke down as follows in 2016:

- Foods (including dry foods, packaged foods, and groceries): 22%

- Sundries (snack foods, candy, beverages, and cleaning supplies): 21%

- Hardlines (appliances, electronics, health/beauty, hardware, and garden/patio): 16%

- Fresh Foods (including meat, produce, deli, and bakery): 14%

- Softlines (including apparel and small appliances): 12%

- Other (including gas stations and pharmacy): 15%

Costco buyers go through a rigorous process to ensure that the limited set of products that they put on the shelf across these categories are the highest quality among their competitive set and offered at the best price relative to their retail competition. The CNBC documentary, The Costco Craze, demonstrates this process well as buyers spend many months evaluating the limited number of holiday toys that they will offer on store shelves. This steadfast focus on filtering for only the best products serves a few purposes: it helps solidify consumer trust in the retailer and also helps minimize costly returns, especially when you have the most liberal return policy in the retail industry. Basically you can return anything at Costco pretty much any time. In fact, like much of its retail competition (especially super markets) Costco doesn’t charge product makers slotting fees to get on shelf. If it’s on a Costco shelf, Costco members know that a manufacturer wasn’t able to pay their way there but rather had to get there by offering a really good product – the Costco shelf is a meritocracy of sorts.

Costco’s merchandizing strategy is very focused on limiting merchandise assortment for a number of reasons. Limited assortment simplifies the inventory process, limits operational complexity, simplifies the consumer shopping experience by limited choice paralysis and allows for better purchasing power by way of scale. The typical Costco carries about 4,000 SKUs versus a grocery or mass retailer that might carry about 40,000. They primarily carry large, well-known brands that are known for high quality and limit alternatives for a given product category to maybe 1 or 2 and in some cases none. This is unlike a typical grocery store that carries 10-20 SKUs and varieties for a given product – like ketchup. Limited assortment combined with the “sell it right off the pallet” approach keeps product stocking and labor costs down. Stock people don’t have to de-palletize and stock shelves. This also enables higher inventory turnover as product can be put on the floor as soon as it comes in from the distribution center.

A picture I snapped during a recent visit to Costco. Nothing stocked on shelves. Buy it right off the pallet.

Costco is also focused on driving sales of its private label or store brand of Kirkland Signature. Costco has managed to turn what was once seen as the “cheap generic” store brand product at other retailers into a strong signal of quality for many of its members. In many cases, Costco hires the branded maker to manufacture their private label products (unbeknownst to the consumer) and in other cases, it is a co-branded partnership between Costco and the branded product. The Kirkland Signature products allow Costco to earn higher margins versus similar branded products they sell while also differentiating their offerings from other retailers. In recent years, an increasing percentage of Costco’s total merchandise sales are derived from their Kirkland Signature products with a strategy of increasing penetration of Kirkland Signature sales, given higher margins on these products versus other branded products. By delivering high quality at a competitive price with the Kirkland Signature brand , Costco has made believers out of its members. Just check out this recent review of Costco golf balls versus the elite Titleist golf ball. The net net, Costco makes better golf balls than the branded competitor.

A key facet of Costco’s merchandising strategy also involves getting their members to visit the store regularly and frequently. Management is well aware that a physical presence is one of their key competitive advantages versus e-commerce competition so they get consumers to come to their stores and spend in a few key ways. They employ clever Jedi mind tricks of retail that I think would never work on me but somehow they do, despite knowing what they are:

- Costco has embraced what they often call the “Treasure Hunt” – stocking a unique assortment of items in limited quantity and for a limited time to surprise and delight consumers. About 25% of Costco’s products in a given store are so called “treasures”. These items can be anything like Louis Vuitton handbags to seasonal items like Margarita machines. The idea is providing a fun experience that can only be provided through destination shopping and breaking the monotony of shopping for staples like toilet paper and canned corn.

- Part and parcel with the Treasure Hunt is the encouragement of discovery and exploration. Costco wants shoppers to roam its aisles to find that item that they never knew they needed, so aisles are intentionally not labeled – forcing members to explore a bit more than they normally might.

- Costco increasingly stocks more fresh items – fruits, vegetables, meat, etc. Groceries and fresh items drive frequency and frequency drives increased spend. While a 200oz laundry detergent or 50 count of toilet paper are items that consumers appreciate being able to purchase at a great price at Costco, these items can be stored and stocked without a need to visit a store to restock for several months. Fresh items, on the other hand, need to be replenished every week or two, increasingly diverting trips from what once would have been the super market to Costco.

THE BUSINESS OF MEMBERSHIPS

Costco’s success has been partly driven by providing incredible value to its members. But Costco’s success can also be attributed to something else – it isn’t really in the retail business. Remember how the retail business stinks – the margins are lousy and all. Costco isn’t in the retail business; it is primarily in the membership business. Sure, Costco sells stuff and sells a lot of stuff but they only made a ~1% operating margin (intentionally mind you) on the nearly $116 billion of merchandise that they sold in 2016. In fact, only 30% of Costco’s operating profit was derived from selling merchandise. ~70% of Costco’s operating profit was derived from hawking memberships at $55 a pop or $110 a pop. Costco’s primary business is memberships. Sure, they don’t move any memberships if they don’t also sell merchandise to those members at great prices, but memberships are the ultimate driver of Costco’s business, revenues and profits. So driving membership growth is the name of the game and Costco knows this. They have a member centric philosophy when it comes to all decisions.

But here’s the part I really love about the membership model. It’s the psychological phenomenon or the characteristic of consumer behavior that I refer to as the “recouping effect” (I’m sure there is a more official name for this concept). The recouping effect is essentially an aspect of human behavior that goes like so: once you shell out $55 for a Costco membership, the more inclined you are to shop there to recoup your investment in the membership – sometimes even if you can find a lower price elsewhere. Members easily forget that the membership fee is what the fancy economists call a sunk cost. REI and Amazon Prime have similarly leveraged the “recouping effect” to their immense benefit. The effect is even more pronounced when members shell out $110 for an Executive membership, which is why these Executive members spend significantly more – we’ll get to that.

Over the last 10 years (’07-’16), Costco has managed to grow paid members by a CAGR of ~6% (while the store count grew at ~4%). In order to grow memberships, Costco relentlessly focuses on providing compelling value to its members in the form of low prices and high quality. The more compelling the value proposition, the more likely it becomes that new customers join and existing members renew their memberships. The incredibly high renewal rate reflects this – 90% in the US/Canada and 88% worldwide. These are very high renewal rates for any product or service and reflect the fervent loyalty of Costco’s consumers. Consistently high renewal rates make Costco’s membership fees a highly dependable revenue stream and we at Scuttlebutt love dependable revenue streams – we can forecast them with some degree of confidence.

The conversations I have had with Costco members make it clear how they have been able to sustain such high renewal rates. Costco members are a different breed – I call them "face painters". They generally hold Costco in very high regard and view shopping there as a fun trip to snag savings, discover interesting finds or even just snack on some free and abundant food samples. I’ve heard Costco referred to as “Disneyland for Adults” and people aren’t joking. Costco is generally thought of as putting its members first and selling very high quality products at the lowest prices – this breeds fervent loyalty from its members.

Costco also sets itself apart from most retailers and its club brethren because its member base is very affluent. The average HH income of a Costco member is ~$120,000 - they have much higher discretionary income than the average US household, which means that Costco members have money to spend at its stores.

As of FYE 2016, Costco had 86.7mm cardholders and 47.6mm members. The explanation – each membership comes with up to two cards for a household so most households have 2 cards but not all. 47.6mm is the more important number though because this is the number from which the membership fees are derived.

The membership options at Costco. It is a little misleading because both Gold Star and Business memberships can be upgraded to the Executive tier.

Of the 47.6mm paying members, ~37mm (or 77%) hold a Gold Star or individual membership and ~11mm (or 23%) are business members – largely small business owners that purchase items in bulk for their stores or businesses. This Gold Star or Business membership can be upgraded to a higher tier of membership called “Executive”.

63% or about 30mm members have a Standard membership (Gold Star or Business) for which they shell out $55 per year. The remaining 37%, or about 17.4mm of Costco’s 47.6mm members are Executive Members (Gold Star or Business) - a higher tier of membership that provides a 2% reward on all purchases (and some other benefits) for the premium membership price of $110 per year.

Note: Costco reports Executive membership penetration of 39% because it is a penetration rate of members that are eligible to upgrade to Executive, which excludes Business Add-on members. The 37% represents the percentage of their total member base that is Executive tier.

MEMBERSHIP PRICING

The compelling value that a Costco membership provides is evidenced by its membership pricing power over the last ~20 years. Costco is priced at a premium of $5-$10 relative to its club competitors and over the years, they have raised prices with very little impact to their renewal rates which still exceed 90% in the US and Canada and 88% Worldwide.

It’s worth noting that Costco has only conservatively raised prices over the last several years. The standard membership price has been increased in increments of $5 every ~6 years from $45 to $50 in 2006, and $50 to $55 in 2012. It’s likely that they raise the price again in 2017 or 2018. For Executive Memberships, Costco has demonstrated even more restraint. The price remained at $100 for nearly 14 years until it was raised to $110 in 2012.

DRIVING LOYALTY AND FREQUENCY WITH THE EXECUTIVE MEMBERSHIP

Costco has been very successful in upselling many of its members to the Executive Membership as the penetration of their executive memberships among their member base has increased considerably since they launched it back in the early 2000’s, although the growth in penetration has leveled off in recent years. Executive members are incredibly valuable to Costco because while they comprise only ~1/3rd of the member base, they comprise ~2/3rds of all spend.

What’s most interesting to me though is that Costco doesn’t actually make much more in membership revenue from an Executive Member than it does from a standard member even though the price of membership is double - $110 for Executive Membership versus $55 for a standard membership. Average membership revenue per paid member inclusive of Executive Memberships was only about $56 in 2016 ($2.6bn membership revenue/47.6mm total members=$55.60) and has been at this level for a long time.

Essentially, Costco pays all of this upcharge in Executive membership fees back to the members by way of the 2% reward savings (it is accounted for as a reduction in sales). What then is the point of charging more you ask? Good question. Even though Costco pays this higher membership fee back to members, Executive Members: 1) are even more stickier or loyal than a standard member because of what I earlier referred to as the recouping effect; 2) Visit more often and spend much more in a given year. This makes even more sense when you think about the decision process for consumers. The breakeven point on an executive membership for consumers is $2,750 (=$55 incremental cost/2% rewards) of annual spend at Costco. Less than $2,750 and it doesn’t make much sense to shell out an additional $55 for an executive membership but greater than $2,750 and it makes a lot of sense. Even though consumers aren’t calculating the breakeven cost down to the exact number, you have to imagine that the average consumer is doing some back of the envelope math before they upgrade to an executive membership and they only do it if the rough numbers make sense – i.e. the savings are greater than or equal to the incremental cost.

THE SECRET SAUCE: COSTCO’S SELF-REINFORCING BUSINESS MODEL

If you’re only skimming through this article (and I don’t blame you!), this is the part to start paying attention, because it’s the part where I give away the secret behind Costco’s success. Costco has a self-reinforcing business model that runs like a well-oiled machine and it gets better as it grows. Every facet of the business model supports the other facets and in aggregate supports its larger mission of providing members with an incredible value proposition and continuously improving upon it. This is the powerful moat of Costco - the virtuous cycle of its business model. Let me explain.

Note that the numbers aren’t necessarily process steps but rather to better explain the key facets of the model.

1) Costco’s business model is predicated on providing its members the lowest prices for high quality goods. This doesn’t mean the cheapest or lowest priced products in a given category. You can find cheaper unbranded toilet paper or laundry detergent elsewhere. Rather it means providing the lowest relative price for a name brand or high quality item. For example, a member can purchase name brand Tide detergent for the lowest price on a per ounce basis at Costco. In fact, the prices are so good that Costco essentially breaks even on the merchandise they sell to their members and makes their money on the memberships. Costco has a steadfast adherence to its “~14% margin mantra” on the products it sells, meaning that Costco never charges more than a 14% retailer margin on the products its sells (with some minor exceptions). The 14% number is essentially the margin required to cover all the fixed overhead costs, which allows all of the membership fees to drop to the bottom line. (Note: Kirkland Signature product margins are allowed to get up to ~15%)

2a) The low prices on merchandise can’t really be matched by competitors because competitors need to actually make money on selling the merchandise while Costco doesn’t really have this “problem”. The incredible value drives very high membership renewal rates among existing members and persuades new members to join so they too can benefit from the low prices. In recent years Costco has sustained renewal rates ranging from 88% to 90% - very high for any industry especially retail.

2b) At the same time, Costco continues to add more verticals and categories that members can save on if they purchase it from Costco. In addition to the more traditional categories that any mass merchant carries, members can buy a whole host of things at great prices at Costco. Over the years Costco has added gas stations, optical, photo processing, pharmacy, hearing aid centers, travel, tires, insurance, mortgages, the list goes on and on. The membership becomes more valuable to consumers and stickier as they migrate more and more of their household spend to Costco. And the more valuable the membership becomes, the less likely they are to cancel it and the more likely they are to renew it – in other words, the switching costs become higher as consumers buy more stuff and thus derive more value from their Costco membership.

3) The combination of 2a) more members/retention of existing members and 2b) more verticals/categories provides Costco with immense scale.

4) The greater scale helps Costco negotiate better prices from suppliers that are in turn passed back on to their members.

Costco knows what it does well and has refined the model over several hundred stores. It executes this same model over and over again as it builds new stores. Management doesn’t stray too far out of its comfort zone and stays within its circle of competence. They also stay disciplined when it comes to delivering cost savings to the consumer. Retailers are repeatedly tempted to “take price” or “extract margin” from Wall Street and elsewhere. While this could drive profits in the short term, the shrewd management team knows that their business lies in selling memberships and their memberships depend on continuing to deliver a compelling value proposition to consumers.

This is a powerful self-reinforcing business model or virtuous cycle. It’s what a corporate strategy guy would call strong internal fit (or what I’ve heard referred to as the Flywheel in reference to Amazon) and Costco is the poster child.

OPERATING AND FINANCIAL PERFORMANCE

Costco has fired on all cylinders in terms of financial performance over the last 9 years (2007-2016). For Costco, all success stems from membership and Costco has been very successful in signing up new members and retaining existing members, which has resulted in continued growth in revenue, operating income and cash flow.

Membership growth

Member growth has been robust and grew at a 6.3% CAGR over the last 9 years (2007-2016) driven by more warehouses and also by a higher rate of membership productivity per warehouse (i.e. each warehouse signing up more members). Growth of executive memberships has been even stronger with a CAGR of ~12% over the same period – a reflection of increasing penetration of the executive membership, which was at 39% penetration (17.4mm members) as of FYE 2016.

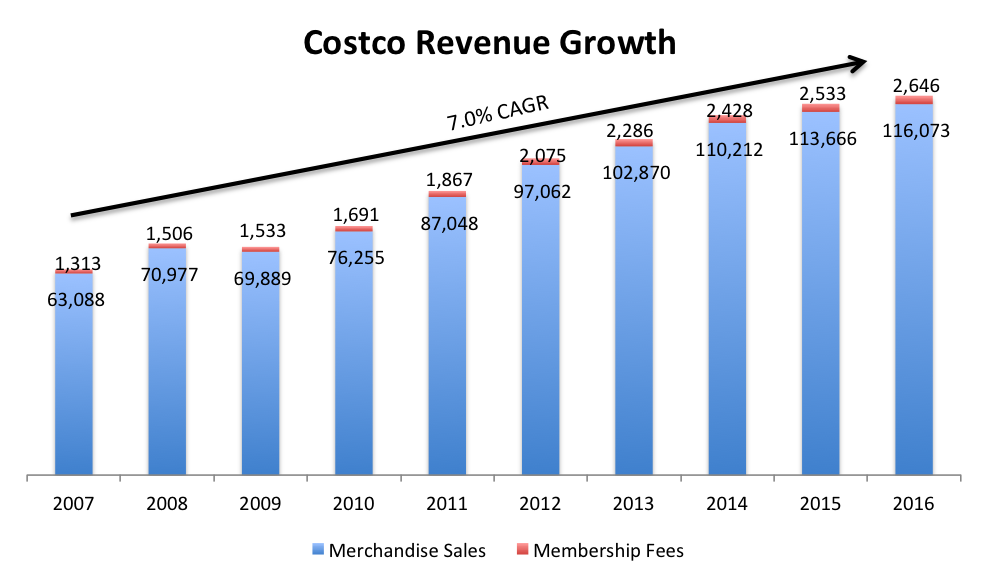

Revenue

Revenue growth has followed in lockstep with membership growth. Revenue grew at a 7.0% CAGR over the last 9 years (2007-2016). Membership fees grew a little faster at an 8.3% CAGR over the same period. While membership fees comprise a much smaller portion of the total revenue, they are very high margin and drop to the bottom line.

Merchandise Revenue per Average Warehouse

Costco is a wonderful operator and continues to steadily and consistently increase the productivity of its warehouses. Merchandise revenue/average warehouse was ~$133mm in 2007 and grew to $166mm in 2016. This has been driven by a combination of larger warehouses with more offerings that can accommodate more members and greater warehouse productivity/efficiency. Surprisingly, the average merchandise spend per member has stayed relatively constant during this period - $2,520 per member in 2007 and $2,518 per member in 2016 (there’s been some ups and downs in the interim years).

Note: This is calculated slightly differently than Costco's metric of Average Sales per Warehouse but the trendline is generally consistent.

Membership Revenue / Paid Member

Membership revenue growth has been pretty ho hum with 1.7% CAGR over the last 9 years as Costco’s modestly increased membership prices have been partly offset by the 2% savings to a larger pool of executive members. .

Operating Income

As previously discussed, a little more than 2/3rds of operating income is derived from membership fees with the balance coming from merchandise sales. This has been fairly consistent over the last several years although the proportion derived from membership fees has historically gotten as high as 84% and as low as 69%. This has largely been driven by volatility of merchandise operating income. Operating Income grew a bit faster than revenue at a 9.5% CAGR over the same period resulting from increasing operating leverage driving operating margin expansion from 2.5% in 2007 to 3.1% in 2016. Merchandise operating income expectedly took a dip in 2009 and 2010 as Costco was compelled to deliver more value to its struggling consumers during the recession. It’s very interesting to note that membership fees remained very stable during that entire period as Costco continued to sign up new members and members continued to pay their membership fees. After all, consumers look for even more value (that Costco delivers) during tough times and this seemed to be the case during the Great Recession.

Free Cash Flow

Costco churned out nearly $900mm in free cash flow in 2016 which was a decrease from recent years as Costco ramped up its capex to $2.6bn to build out 33 warehouses (29 net new as 4 warehouses were shuddered/relocated). Management guidance for 2017 is for 31 net new openings and $2.6-$2.8bn in capex to support those openings.

Return on Invested Capital (ROIC)

Costco has averaged returns on capital of ~14% over the last 10 years. While these aren’t stellar returns on their own and compared to some other more asset light industries, they are respectable and stronger than the retail industry average of ~10%. More importantly, returns have been sustainable over that long time horizon and have even increased in more recent years (5 year avg = ~16.5%).

Note: ROIC not adjusted to capitalize leases given that Costco owns the majority of its real estate

A SLIGHT DETOUR: THAT PESKY LITTLE COMPANY CALLED AMAZON

No conversation about the retail industry is complete without a mention of the elephant in the room that is Amazon. The more I analyze Costco’s business model, the more and more it starts to look like the prototype that Jeff Bezos followed in developing Amazon Prime.

Both companies have a very dedicated focus on growing their membership base while essentially breaking even on selling merchandise and in the case of Amazon- potentially even losing money on selling merchandise in the short term. It’s estimated that Amazon has somewhere around ~60 million Prime members growing at double digits (not too far off from Costco’s ~48 million paying members) – although Amazon has managed to build up this base in only ~10 years versus ~40 years for Costco.

Both are focused on diversifying their offerings and services to make their value proposition more compelling and their memberships stickier (and thereby increase switching costs) to ultimately drive greater willingness to pay for a membership. As previously mentioned, Costco has added travel, optical, gasoline, etc. over the years. Similarly, Amazon Prime started with free two day shipping and over the years, added additional services like Prime Music, Prime Video (unlimited streaming of movies and TV), cloud storage for photos, access to the Kindle Library, etc. Every additional benefit added to the membership, makes it slightly more compelling and stickier when members adopt some of those services. The key to creating stickiness is adoption of new services– which is why Amazon often goes extra lengths to remind Prime members of their existing and new benefits – not to mention Prime Day (a special sale day for Prime members).

- Once all of your pictures are loaded to Amazon’s cloud, the hassle tax of switching to another service goes way up and you are much less likely to cancel Amazon Prime. And the incremental costs to Amazon of providing this benefit are minimal given all of the sever capacity that the company maintains for its Amazon Web Services business. I wouldn’t be surprised if Amazon and Costco both had employees dedicated to sitting around all day and coming up with new benefits that they can add for their respective members.

Similar to Costco, Amazon Prime also benefits from latent pricing power due to strong loyalty. Amazon raised prices by ~25% in 2014 (from $79 to $99) and members still grew (we believe significantly but Amazon doesn’t report Prime membership counts).

Amazon has been incredibly successful when it comes to ecommerce retailing. There are a lot of metrics out there but Amazon is estimated to represent somewhere between 30% and 40% of all online commerce. Amazon’s ambitions are grand so I wouldn’t be surprised if they have Costco in their sights. But both Amazon Prime and Costco have managed to grow their membership base significantly over the last several years. In fact, we wouldn’t be surprised if there is a high degree of overlap with households that maintain both an Amazon Prime membership and Costco membership. This poses a few important questions as we think about the future of Costco’s business:

Is Costco un-Amazonable?

- In other words, is Costco competitively insulated from Amazon or Amazon proof? After all, Costco has managed impressive growth despite the rapid growth and increasing encroachment from Amazon. I think that both Costco and Amazon would say no – Costco is not un-Amazonable. In fact, Costco CEO Craig Jelinek recently addressed this directly on their Q4 2016 earnings call.

- “ I read the reports that some of you have written about that we and maybe one or two other retailers out there that are unique are Amazon proof or Internet proof. We don’t buy that for a minute. We do believe that we do rely and we do expect we are going to be impacted. We also don’t believe we have to go crazy on the other side, but we want both. But our value proposition is best served for us when it’s in-store getting members to come in and buy when they can see everything there that we have."

- It becomes abundantly clear to even the casual observer, that the two companies will increasingly find each other in their respective cross-hairs over the coming years as they seek to grow their footprint in retail. While many households today maintain both an Amazon Prime membership and a Costco membership, will this continue to be the case five or ten years from now? The answer will largely be predicated on Costco’s ability to continue to provide value to its members in ways that they desire and ways that are differentiated from Amazon. There is an argument to be made that people/consumers will still want to go into stores to shop and discover. Also, perishable food remains Amazon’s Achilles’ heal. They have cautiously expanded AmazonFresh to just a handful of markets over the years and recently announced brick and mortar convenience/grocery stores but they haven’t quite perfected the model or the economics. After all, grocery isn’t a very profitable business. My hunch is that Amazon has no interest in making its money on the groceries – they want to make their money from the AmazonFresh memberships and potentially make the Amazon Prime membership even stickier.

- Part of Costco’s defense will rely on its ability to extend the Costco value proposition to e-commerce- something they’ve struggled with in the past. While an improvement from their previous iterations, even the recently revamped website suffers from an imperfect layout and lacks the speed of delivery/convenience that Amazon can provide across many of its items. Costco could look to expand its membership tiers further to provide a level with free shipping of all its items, but the economics could be tough to justify in the short term.

Can Costco’s strong growth continue even though family formation is happening later with younger generational cohorts like Millenials?

- Costco’s growth may slow as family formation is delayed. The value proposition of a Costco membership is much more compelling for families and far less compelling for single person households that are buying less quantity or living in denser urban areas without easy access to a store. As Costco has done in the past to attract new consumers, it may need to find a way to extend the value proposition to a younger consumer – e-commerce and a different assortment come to mind. Today, an Amazon Prime membership makes far more sense for a young, urban consumer.

Does the addition of services like Google Shopping Express and Instacart defend Costco against the Amazon Prime threat?

- Google Shopping Express and Instacart (and some others that Costco now partners with) are third-party solutions to get goods delivered from Costco. They are good interim solutions to compete with Amazon Prime, but ultimately Costco needs to control its own destiny when it comes to e-commerce. They can’t be dependent on incomplete solutions (everything can’t be delivered) from third parties that add significant additional cost to the membership. Delivery/free shipping needs to be part of the value proposition of membership. This benefit may cost more than a standard membership and may be a loss generator in the early years, but there is likely a willingness to pay for some portion of the customer base.

Do online retailers like Boxed that combine some of the benefits of Costco with the benefits of Amazon pose a threat to Costco?

- Today, Boxed seems too small to pose a serious threat to Costco, but the model seems directly targeted at taking share from the warehouse clubs. They provide free delivery on orders over $50, charge no membership fees and as their slogan implies, they seek to solve one of the main consumer gripes with the warehouse clubs: “Don’t waste your weekends stuck at the warehouse club.” In fact, Boxed looks like it could be an acquisition target by one of the clubs looking to build out a better e-commerce presence (similar to how Wal-Mart recently acquired Jet.com)

INVESTMENT MERITS AND CONSIDERATIONS

I’ve mostly covered what I really like about Costco, but I always like to do a rehash of the merits of the business/investment and also the risks to my thesis. Laying it out this way forces me to confront my thought process in a very rational way divorced from confirmation bias.

INVESTMENT MERITS

Strong internal fit with a focus on continuously increasing the switching costs of memberships (sticky memberships)

- Costco’s self-reinforcing business model provides it with a very defensible moat. Every element of Costco’s business model is aimed at one thing – increasing and improving the value proposition of a membership. This is a done through both improving prices on existing products and services and providing new products and services at great prices. This ultimately makes switching costs higher and the membership stickier.

Membership business model

- While Costco is a retailer operating in the retail industry, its business model is structured very differently than most other retailers. As previously discussed, retail is a low return industry where success is elusive. Costco makes money from selling products but the majority of its profits are derived from annual membership fees that its members pay for the privilege to shop at Costco. We like membership fees because they don’t have a cost of goods associated with them. They drop straight to the bottom line.

Fervent Loyalty of its Membership Base provides a reliable revenue stream

- Not only do Costco’s members pay a membership fee to shop there, but they do so with consistency year over year. One of the primary investment merits of Costco is its fervently loyal customer base that views Costco as a way of life and derives an immense amount of value from their membership. It’s rare that a company in any industry renews ~90% of its customers or members from year to year and especially in the case of Costco where customers are not contractually obligated and have relatively low financial switching costs. This is a testament to the incredible brand love for Costco and the compelling value proposition that Costco provides to its members.

- On the surface, this seems like a very superficial competitive advantage, but the loyalty of the membership base provides a recurring and reliable revenue stream making the company less susceptible to recessions and volatile retail sales as was evidenced by resilient membership revenue in 2009. Putting my Warren Buffett hat on, high membership renewal rates make the stock of Costco more like a bond with a predictable earnings stream stemming from membership fees.

Strong management team focused on the long term

- The management team of Costco is adept at retail and has a long-term orientation. Key elements of Costco’s operating strategy make it clear that they aren’t interested in juicing earnings to hit a given number in a given quarter– sustainable new store builds, restrained membership price increases, consumer oriented shopping, liberal return policies and a hot dog/soda combo that has been priced at $1.50 for over 30 years.

- The management team has a clear understanding of the retail business and what its members want and has historically delivered. They aren’t your typical ivory tower elites but rather folks that have been in the retail trenches and uniquely understand their business. Current CEO, Craig Jelinek started his career at FedMart, working as a box boy in Lancaster, Calif., during high school and joined Costco in 1983. Jelinek and Costco management is relentless about costs and frugal to a fault so they can provide their products at the best possible prices to their members. The trait of frugality is indoctrinated into the Company’s culture from the top-down.

- Having Charley Munger on the board of directors doesn’t hurt either.

Happy employees

- Costco treats its employees well and definitely better than any other company in the retail industry. They pay the highest wages in the retail industry and promote from within. Many warehouse managers started out as cart pushers. They generally have good working hours- stores usually open at 10am and close by 6pm or 7pm and are still closed on holidays. And the numbers prove it - the attrition rate is 5 percent among employees who have been there over a year – this is unheard of in retail. Happy employees make for productive and loyal workers. I refer you to the quote by Peter Lynch at the top of this post.

International business has a lot of potential

- International warehouses represent ~30% of the store count but generate 39% of the operating profit so they contribute more than their fair share. Despite being a smaller part of the footprint and a general inability of retail concepts to translate across borders, Costco’s warehouses in international markets have been very productive at driving memberships and sales. While most companies generate losses and move too quickly when they expand abroad, Costco has approached it in a very measured way that has likely enabled greater success.

INVESTMENT CONSIDERATIONS/RISKS TO THE THESIS

Costco’s undefined e-commerce strategy amidst a consumer shift to e-commerce

- If Black Friday sales over the last few years are any indication, consumers are shifting their spending online in a big way. E-commerce is easier and more convenient for consumers and Amazon has been a big driver of this secular shift. Yes, to be clear, it is secular – consumers are permanently changing their shopping behavior to online channels. Does this mean that consumers won’t go into physical stores anymore? No, it will be a long time before that happens so Costco still has some runway. How much runway is the question that is difficult to answer? Nevertheless, the majority of growth in retail will be driven by e-commerce and retailers that don’t adapt will be left behind. I give Costco a C in this department of adapting to e-commerce. Only 4% of sales are currently derived from from e-commerce. I understand why they have lagged- when you’re so good at doing one thing (operating physical stores), it becomes difficult to shift that thinking to something that is viewed as siting outside of the circle of competence. The same strong internal fit that benefits its store based business model in some ways is a detriment to its e-commerce ambitions. Simply having a website with merchandise for sale and partnering with third parties (Google Shopping, InstaCart, Dolly) isn’t enough in a rapidly shifting retail landscape. Ecommerce needs to be deeply integrated into the business model. It seems like they are starting to get the hint as they expand their merchandise selection on e-commerce, improve the UX and improve upon the logistics to speed up delivery times. Nevertheless, e-commerce is a long-term risk and existential threat to Costco and one that I’m sure keeps the guys in Issaquah (Costco HQ) up at night.

Amazon

- Just in case you haven’t heard the A word enough already, it’s worth mentioning once more here. We don’t often talk about just one competitor when it comes to reviewing risks. In the case of retail though, we would be remiss if we didn’t mention the elephant in the room head on. Amazon and Amazon Prime pose a definite and foreseeable threat to Costco’s business model in the long term. Even if Costco evolves its e-commerce strategy, you can bet that Amazon will continue to be a thorn in Costco’s side seeking to siphon off as much consumer spend as possible.

Long-term demographic changes in the US

- The younger generation cohorts (Millenials/Generation Z) are having families later, having smaller families and more likely to live in urban centers with less space. The value proposition of Costco is not as compelling for these smaller families with less space that may not want to purchase in bulk quantity or have the storage space to do so.

Store capacity/congestion limits store productivity growth

- Anyone that has gone to a Costco warehouse on the weekend thrills in the free samples but also dreads the congestion at every turn of the shopping cart. Costco attracts shoppers in droves on the weekends and certain peak times during the weekdays but the crowds inevitably result in revenue left on the table as the crowds discourage shoppers. This limits the productivity of stores if they are super congested during peak times and not as active during off-peak times. As many of Costco’s warehouses mature, they have significantly increased their sales over the years, but the sales productivity of these stores will plateau as the store size limits the capacity and sales. Costco may need to invest to either relocate or expand these stores to accommodate increasing demand or better manage capacity utilization. This could require capital, which may depress returns.

Subscription/Membership pruning

- Costco’s profits are derived primarily from membership fees. Their ability to maintain strong member loyalty rates or increase membership rates over the longer term may be hampered by encroachment of other memberships and subscription type services. As services like Amazon Prime and other membership services proliferate, consumers may be forced to revisit their memberships and prune where necessary to save costs where they aren’t getting incremental value. For example, why do I need a Spotify subscription if Amazon can provide me with the music I already listen to as part of my Amazon Prime membership. Or do I need a Costco membership if Boxed can provide me with what I need. It’s difficult to assess the severity of this threat but Costco is an annual/monthly expense and its value will ultimately be judged by consumers versus their other alternatives. Costco could become a casualty if it doesn’t continue to deliver the differentiated value proposition that it historically has. We haven’t seen any evidence of this yet in the renewal rates but it’s worth acknowledging the risk to remain vigilant for signs of it.

Growth will continue to be capital intensive if the current playbook is followed

- The majority of Costco’s growth has come from building new stores in new markets or adjacent markets. Building new stores requires significant capital. I can’t say exactly how much because I can’t find specific numbers around it but I estimate that a new Costco store build costs anywhere from $50mm to $80mm depending on the market and the size of the store.

Retail brands have historically been unable to stand the test of time

- If Sears and K-mart are any clue, retail is a tough business. Even when you are on top for a long time, you can just as soon be forgotten. Wal-Mart is the biggest retailer today but I’m already starting to see the signs of stagnation and playing catch up with their business. Can Costco beat the odds? Hard to say for sure but it is a definite that new retail models will inevitably disrupt existing ones. How much is the question and how quick can Costco adapt to changing consumers and preferences.

CATALYSTS FOR GROWTH

As I have spent time analyzing Costco’s business in depth, the key strategies that will drive Costco’s growth and earnings into the future have become clearer. A few of these build on the existing playbook that management has used for the last several years and a few of these can further accelerate that growth (new playbook). I don’t usually include a section like this in my write-ups but in the case of Costco, I thought it could be an interesting exercise.

Opening up more stores in the US and International markets (Existing Playbook)

- With several hundred stores in the US, Costco seems pretty saturated on the mainland. But I think management would contend that there is still plenty of opportunity. More of the opportunity though seems to lie with international markets where Costco still has a nascent presence. Costco has been very measured about its international growth to make sure it is getting the formula right and not over-expanding. I am ok with measured growth. However, at a macro level, earnings growth driven by building more stores is growth that requires capital investment and I much rather prefer growth that doesn’t require significant capital investment.

Capturing a greater portion of HH spend by adding more categories and more verticals; Can they move up-market to higher ticket items or items that currently provide a poor customer experience? (Existing Playbook)

- Costco has been doing this for years – adding gas stations, optical, photo centers, insurance, etc. The playbook is to 1) make the membership stickier; 2) generate some additional operating margin (albeit slim) on the additional items sold. As a trusted retailer, Costco has tremendous opportunity to basically sell anything to its members and we have seen them do this – occasionally selling cars and other items. Costco has the ability to become a one-stop shop for anything consumers want to buy. Auto maintenance (outside of just tires) and healthcare are just two categories that are ripe to provide a more transparent consumer experience. Furthermore, there is the opportunity to add categories that could more specifically attract a younger demographic.

Raise membership prices- historically, they have done this every ~6 years (Existing Playbook)

- Costco last raised prices in 2012 so they are due for a price increase in the next ~1 year or so. Costco does demonstrate that rare thing that Charley Munger loves: “untapped pricing power” so they do have the power to raise prices but this power is partly mitigated by the fact that it is a retailer with significant competition – club and otherwise. Costco demonstrates some modicum of pricing power versus these club peers by way of a $5 membership price premium so the ability to raise prices indefinitely or significantly is held in check. However, a $5 membership price increase could contribute something like ~$215mm in additional revenue (=48mm members x $5 x ~90% renewal rate) that drops straight to the bottom line.

Better capacity utilization of over-crowded stores (New Playbook)

- Go to a Costco store on the weekend and it is jam-packed. So packed in fact that it dissuades consumers from shopping there, shopping as much as they might or leads to a degraded shopping experience. Costco needs to figure out a way to smooth out this demand a bit to maximize revenue. There are a lot of ways to achieve this: Open the stores earlier, provide benefits for shopping at off-hours on weekdays, better delivery options, etc.

Drive more e-commerce spend- both directly and through partnerships like Google Shopping and Instacart // Free shipping membership tier (a la Amazon Prime) (New Playbook)

- As discussed, younger consumers are becoming accustomed to the ease and convenience of shopping online. Costco needs to serve this target market with an offering of its own and it doesn’t have to be free. They can monetize this service with a new tier of membership and it seems like there is a willingness to pay.

Better target younger demographic (New Playbook)

- Related somewhat to the previous two points but if Costco does believe that its value proposition is best delivered in-store, is there some opportunity to provide this to a younger consumer who may not want to visit a warehouse in the suburbs. Target (TGT) is approaching this through smaller format stores but there may be other ways to skin the cat.

THE REALLY REALLY

Net net, Costco is a wonderful business- as wonderful as they come. It is a diamond in the rough that is retail. Costco is a disciplined operator that is intensely focused on providing its members with a compelling value proposition on whatever they buy. Every facet of its business model is tightly integrated and self-reinforcing to serve this broader mission. Members have returned the favor with their fervent loyalty over the years. The business model of memberships and loyal memberships to boot provides some inherent level of predictability and insulation from economic cycles and provides Costco with a defensible moat.

As with all companies that I analyze I like to run it through my most basic filter and see if it checks the boxes on my 3 most important questions for investment analysis:

1) Is it a good company that benefits from a competitive advantage? For all the reasons above, unequivocally-Yes. Check.

2) Is what makes the company good sustainable or durable for the long term? This is where it gets more difficult for me and I should say very difficult. High membership renewal rates and the mobs of people in the stores should have me believe that Costco is here to stay forever. But I can’t say with 100% confidence that what Costco benefits from today is sustainable for the very long term. Retail is notorious for lacking competitive advantage. Costco’s key competitive advantage is its loyal members and their willingness to pay for their memberships. I think they are fine for the near and intermediate term- ~5-7 years. But I am looking for businesses that will be around 20 years from now. The model of retail is going to evolve considerably and look meaningfully different in even 10 years, not to mention 20 years. As we have articulated, Amazon will make sure of this. And it’s possible that Costco’s strategy of building up its store footprint may no longer be relevant even 10 years from now. Unless they are able to shift their strategy and maybe find a way to leverage this real estate in additional ways – perhaps as fulfillment or distribution centers for e-commerce. This sustainability or durability is actually the part that keeps me up at night about Costco. I do have some faith that consumers will want to continue to shop in stores in the future because shopping can be entertainment as much as errand but the nature and assortment may have to change to accommodate this. Ultimately, as with many businesses, I put some faith in management’s ability to successfully execute as they have historically done. I think Costco will continue to find ways to do this even if the landscape changes meaningfully. They have continued to drive membership growth using clever tactics like fuel stations and I think they should be able to continue to do this even as the landscape changes. So Check #2.

3) Is it reasonably priced? This is where I can say with conviction that Costco is overpriced relative to intrinsic value at its current price. I couldn’t look myself in the mirror and call myself a value investor if I bought the stock of Costco at current prices. Costco has definitely outperformed its retail peer set and generated strong comps as of late. This combined with their more stable and reliable membership fees justify a price premium relative to other retailers. However, that premium is too high right now at a share price of ~$175. My DCF yields a fair value estimate of $115-$130 and I would be willing to pay at the high end of this. I should note that my forecast reflects new store and member growth that is more or less in line with their historical performance. If Costco can consistently outperform on these metrics (as they did with Jan comp sales), then a higher valuation could be justified. Inevitably as with happens with many businesses, Costco will underperform on comps for a quarter or two relative to the forecasts of the “smart” prognosticators on Wall Street and a buying opportunity will present itself. I love Costco but we can’t be blinded by love. I’ll just remain a Costco member for now; the current stock price doesn’t provide the compelling value proposition that a membership does. I’ll keep it on the shopping list until it does.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.