If you fret about the euro’s survival, Italian bonds might be the last asset you sell.

A SHREWD observer of London’s after-work drinking culture once offered the following bit of mathematical heterodoxy to explain it: “There is no number between two and six.” If you go out with colleagues and stop at two drinks, you will be able to summon the will to go home at a reasonable hour. After a third drink, another will seem like a good idea—and another, and another. You will be on course for a hangover.

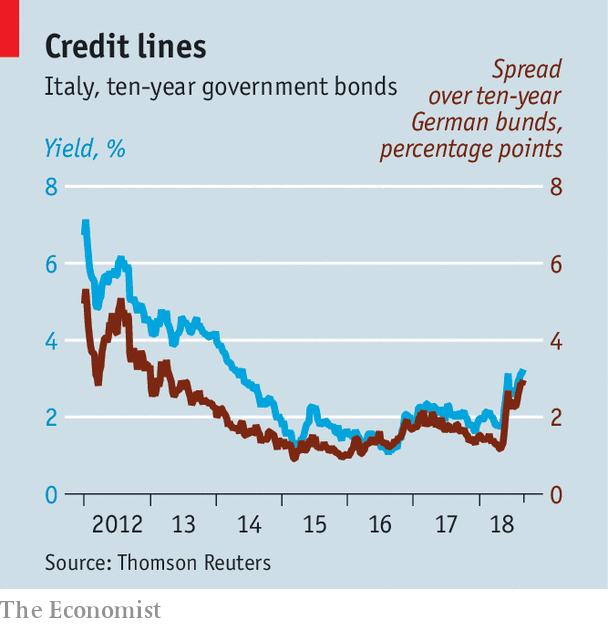

A modified version might apply to Italy’s bond market. As long as yields are two-point-something or lower, they are sustainable. At that level, the bonds are safe. Italy’s public finances are stable. As yields rise above 3%, they may become unmoored. The bonds start to look like speculative instruments. The stability of public finances is in question. Yields might plausibly spike to 6% or more.

It is thus a source of anxiety that Italy is on its metaphorical third pint, with yields on ten-year government bonds hovering around the 3% mark. In part this reflects lingering concerns that Italy’s coalition government will table a budget for 2019 that breaks the euro zone’s fiscal rules. More generally, investors are asking themselves what is the right price for Italian risk. The wiser among them admit that they simply do not know. For Italy’s bonds come with a set of implicit options attached that make them tricky to price.

To make sense of Italy’s bond markets, it helps first to make a distinction between safe assets and credit securities. An American Treasury bond is the archetypal safe asset. Yields are largely determined by the interest-rate policy of the Federal Reserve. Bondholders do not worry much about the federal government’s ability to service its debts, which are, after all, in the currency it issues. The typical credit security is a dollar bond issued by a company, such as GM or Apple, or by a country, such as Brazil or Mexico. Its yield will vary with that of a Treasury of the same maturity, with an interest-rate premium, or “spread”, to compensate bondholders for the risk that the borrower might not earn enough dollars to pay its debts.

Neither IPA nor lager

It is hard to draw a line between safe bonds and credit in the euro zone. In contrast with America, there is no unique issuer of the currency. The European Central Bank (ECB), a sort of joint venture, prints the euros. German bunds are treated as the benchmark safe asset, simply because Germany is the zone’s largest economy and has a reputation for thrift.

Which other countries might qualify is a subject of lively bar-room debate. The ECB’s quantitative-easing programme gave the appearance of safety to all euro-zone government bonds, even Italy’s. The ECB in effect covered Italy’s net bond issuance over the past three years, says Lorenzo Codogno, of the London School of Economics. But QE is coming to an end. Other buyers must be found. It is not a coincidence that anxieties about Italy’s public debts, sickly economy and fractious politics have resurfaced.

To make matters worse, Italy’s bonds are not a straightforward credit in the way that, say, Mexico’s dollar bonds are. They come with more implicit options. How should investors, for instance, treat the pledge made in 2012 by Mario Draghi, the ECB’s boss, to do “whatever it takes” to save the euro? When push comes to shove, the ECB might decide that an Italian default would be fatal to the single currency and start buying bonds again. Or it might not. This kind of vague, embedded option is difficult to value. Andrew Balls of PIMCO draws a parallel with the mortgage-backed bonds that were central to the global financial crisis. They once seemed safe. But they became so complex and opaque that they could not be priced.

Bonds are supposed to be simple. Italy’s are not. They are not an investment to buy for your widowed aunt. But some investors do not have the luxury of steering clear. Euro-zone insurers are all but compelled to own sovereign euro bonds and Italy’s market is the largest. The country thus looms large in the bond indices that are a benchmark for many asset managers. If you fret about the euro’s survival, Italian bonds might nonetheless be the last asset you sell. At least you are getting a higher yield in return for the risks. You are paid for your discomfort. That is not true of French bonds, which trade at only a small premium to Germany’s.

Think of the euro-zone bond market as an after-work drinks party. Germany dislikes buying drinks for others, and so has gone home. Italy is on its third trip to the bar. France, which is nursing its first drink, insists that it is leaving soon. But if a fight breaks out, it will get drawn in.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.