Summary

The U.S. walked away from the Iran agreement.

Brent and WTI crude oil make new highs.

Iran and Saudi Arabia remain at each other’s throats.

Sanctions take effect on Nov. 4; the Strait of Hormuz is a flashpoint.

BNO is a bet on Iranian retaliation.

The U.S. walked away from the Iran agreement

Earlier this year, U.S. President Donald Trump walked away from the Iran nuclear nonproliferation agreement. The move came as no surprise as on the campaign trail, and during the first year of his administration, he called the agreement the worst deal he had ever seen.

The relationship between the United States and Iran has been tense, to say the least, since the theocracy took power in the late 1970s and the revolution started with the seizing of U.S. hostages from the embassy in Teheran. The 2015 agreement was an attempt to stop Iran from attaining a nuclear weapon, but the Trump Administration believe that it fell short of the goal while providing Iran with funding and investment to pursue their nuclear program and support terrorists in the Middle East and around the world. When the U.S. leader walked away from the deal, he told the world that he would put harsh sanctions on the theocracy in Teheran.

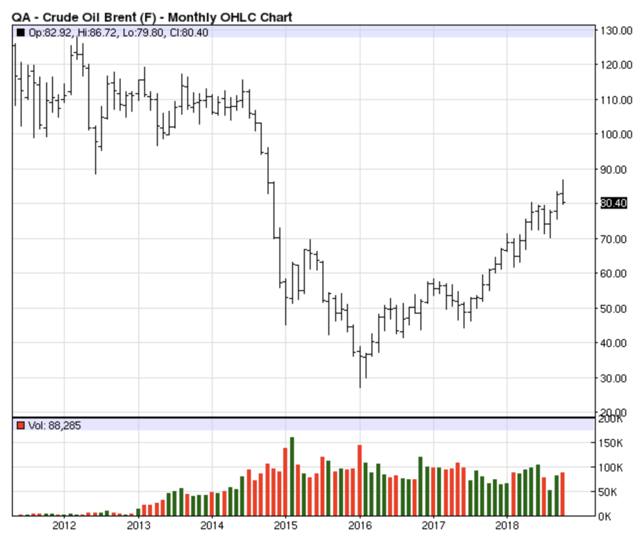

Brent and WTI crude oil make new highs

The two benchmarks for crude oil prices around the world are Brent and WTI. Approximately two-thirds of the world, including the Middle East, prices their crude oil on the Brent price.

Over recent weeks, the prices of both crude oil futures market have risen to their highest levels since 2014.

Source: CQG

The monthly chart of NYMEX WTI crude oil futures highlights that the price rose to its highest level since June 2014 at $76.90 per barrel during the first week of October. The next level of technical resistance stands at $107.73 per barrel, $30.83 or 40% above the most recent peak.

Source: ICE/RMB

Meanwhile, Brent nearby futures traded to a high of $86.72 during the first week of October and resistance on the upside is at the June 2014 high at $115.69 per barrel, $28.97 or 33.4% above the most recent high.

Iran and Saudi Arabia remain at each other's throats

The Middle East has always been one of the most politically turbulent regions in the world. Over recent years, the rising tensions between the theocracy in Teheran and the Saudi Royal Family has resulted in hostilities across the region. The ongoing proxy war in Yemen has caused rockets to fly into Saudi sovereign territory. Meanwhile, the Saudi blockade of Qatar has been a direct strike at Iran's rising influence in the region.

The Saudis have U.S. support while Iran counts on Vladimir Putin and Russia as their allies. Therefore, the issues facing the region have taken on a geopolitical risk that threatens peace not only in the Middle East but around the world. The Saudis have been cheerleaders when it comes to President Trump's hard line towards Iran.

Sanctions take effect on November 4- The Strait of Hormuz is a flashpoint

The new and severe sanctions on Iran will take effect on November 4, and the U.S. has warned companies and countries around the world against doing any business with the theocracy. Iran exports 2.7 million barrels of crude oil to the world each day, and if President Trump has his way, they will not be able to sell that oil to consumers around the globe.

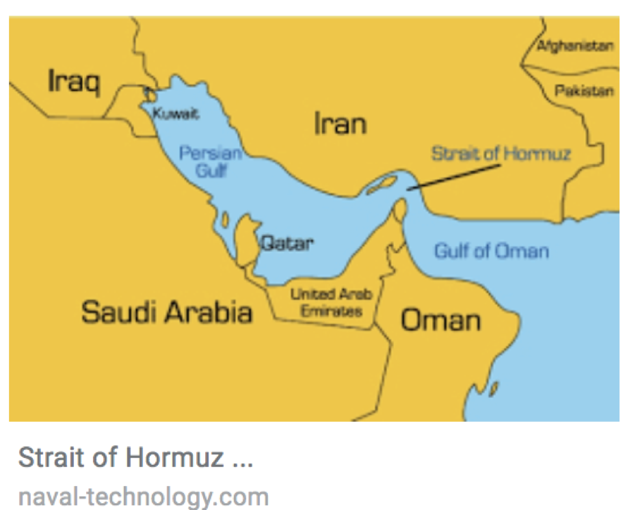

Iranian President Rouhani warned that if Iran cannot export its oil to destinations around the world, they will make sure that no other exporter in the region can supply the energy commodity to their customers. The 2.7 million barrels of Iranian crude oil flows through a narrow seaway that separates the Persian Gulf from the Gulf of Oman each day. The Strait of Hormuz is a passage that is twenty-one nautical miles long at its most narrow point.

Source: Naval-Technology.com

As the chart shows, the Strait borders on Iran. Moreover, 19 million barrels of crude oil or 20% of the world's daily supplies flow through the seaway each day. Fellow OPEC members and producing countries in the Middle East including Iran, Iraq, Kuwait, Saudi Arabia, Qatar, the UAE, and Oman all are within striking distance of the Strait and most transport their exports through the passage. Therefore, any retaliation to U.S. sanctions could cause the Strait to become a tense and dangerous area in the coming days and weeks. Any hostilities that impact the production, refining or logistics of supplying crude oil to the world could cause the price to spike to the upside and challenge the 2014 highs above the $100 per barrel level. The last time we witnessed a price spike on military actions in the Middle East was in 1990 when Saddam Hussein marched into Kuwait. The price of crude oil doubled from $20 to $40 at that time. Almost all of the gains were in the nearby future contract as the supply concerns caused the backwardation to widen to a level that is nearly equal to the entire price of deferred futures contracts.

BNO is a bet on Iranian retaliation

If Iran decides to retaliate against sanctions, the most significant impact will likely hit the Brent futures contract because it is the pricing mechanism for oil from the Middle East. Additionally, the most significant price volatility could come in the front end of the forward curve and the active month futures contract on the Intercontinental Exchange. For those who do not trade or invest in the futures arena, the United States Brent Oil ETF product (BNO) offers an alternative. The fund summary for the ETF states:

The investment seeks the daily changes in percentage terms of its shares' per share net asset value ('NAV') to reflect the daily changes in percentage terms of the spot price of Brent crude oil. The Benchmark Futures Contract is the futures contract on Brent crude oil as traded on the Ice Futures Europe Exchange that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire.

BNO holds contracts on the nearby the Brent futures contract. Therefore, the ETF is highly correlated with the price action in the ICE Brent crude oil futures market in the front position futures contract.

Source: Barchart

As the chart illustrates, BNO was trading at $22.64 per share on Friday, Oct. 12. In 2014, when Brent traded at over $115 per barrel, the ETF rose to a high of $46.68, over 100% higher than its current price level. A long position on the BNO ETF is a bet on Iranian retaliation to the sanctions that will begin to bite the theocracy in less than one month.

The Strait of Hormuz has the potential to become a flashpoint for Iranian retaliation if the OPEC member cannot sell their crude oil production to customers around the globe. While U.S. military power would undoubtedly prevent Iran from stopping traffic through the seaway, even a whiff of a threat of hostilities could prove explosive for the price of the energy commodity that powers the world.

This article is an expression of an opinion by Andrew Hecht

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.