This failed IPO proves the market efficiently digests information.

Creative destruction is a part of the life cycle of a commercial society. That’s a good thing.

Bad ideas, or even good ideas with bad implementation should be held to account by investors and the marketplace.

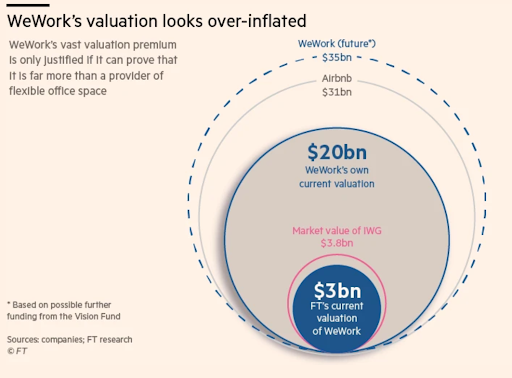

WeWork is one of the most high profile examples of a once high-flying organization that was first humbled, and then dragged back to earth due to internal issues that eventually came to light. The saga of WeWork has been discussed and documented constantly since the organization filed its S-1 and had planned to go public with a valuation of $47 billion. Following the disclosure of details related to how the company was operating, including governance issues connected to its CEO, the sheer volume of long-term debt on its balance sheet, and the details of its revenue and obligations, the valuation of the organization plummeted.

From $47 billion the valuation dropped to approximately $20 billion, only slightly more than it had raised in the private markets.

From $20 billion the conflagration continued, the IPO was shelved for the time being, and it looks like there is a management shakeup in the making.

Even more importantly, it’s always worth pointing out that even though retail investors want to invest in IPOs, most of the wealth has usually been captured by earlier investors, and the dynastic wealth creation possibilities are far lower.

Source: https://www.ft.com/content/87c43322-755e-11e8-b6ad-3823e4384287

Investors, including large financial institutions and the $100 billion Vision Fund, are underwater on investments, and stand poised to continue suffering millions (if not billions) in paper losses while the roiling continues.

Why is this a good thing?

It’s a good thing because this is what should happen to ideas that are over-hyped, have valuations that do not make sense, or that otherwise seem to be operating by their own sets of rules. No matter how much money is available, or how cheaply organizations can be financed, i.e. how easily they can borrow, the rules of profit and loss inevitably reassert themselves. Every organization, even those that provide customers with chic spaces, cold brew coffee, and beer on tap need to adhere to the rules of the marketplace.

To succeed, any company must create more resources than it consumes, and WeWork simply has not met that requirement. There are areas that this failure, no matter how temporarily painful for investors, will improve and serve as an example for future organizations.

Governance matters, and the connection between how the organization is managed, and the financial ramifications of questionable self-dealing need to be accurately assessed. Whether the company is public or private, transparency and accountability need to be a priority. Stripping value from an organization by leasing intellectual rights or physical assets back to the entity should not, and is not, being tolerated.

There is not an infinite supply of money. With unicorns becoming commonplace since the Great Recession, the allure of staying private and being subsidized by venture capital can be difficult to resist. Recent stumbles by organizations such as Lyft and Uber, and the postponement of the WeWork IPO shows that the market will not wait forever for organizations to establish a path to profitability.

Business models and profitability are a must. Customers will always choose a low-cost or free option versus a more expensive one. If the service is flexible, on-demand, it will attract more customers. Neither higher volume nor customer acquisition matter if the company loses money on each one.

Source: https://www.ft.com/content/87c43322-755e-11e8-b6ad-3823e4384287

In other words, the business actually has to function as a business creating value for both customers and the organization.

The laws of the market are unyielding. While policies and politics may temporarily suppress these laws, they always reassert themselves when valuation or business models run amok.

The WeWork IPO will assuredly be analyzed, discussed, featured in case studies for years to come, and will likely be categorized as a failed IPO that destroyed value for nearly every party involved. Even though this proposed IPO did destroy value, and will most likely be classified as a failure, in hindsight it may be celebrated as a reality check and acknowledgment that financial market rules apply to every organization.

Celebrating the free market, and the expectations it sets for organization, is a good thing.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.