As the Chinese economy continues to be disrupted by the outbreak of the novel coronavirus and parts of China’s economy come to a virtual standstill, it would be unrealistic to expect that the Chinese gold market, the world’s largest, will not be adversely impacted.

From quarantined cities to lower consumer demand, from reduced flight traffic to closed frontiers and boarders, the economic shock to diverse sectors of the economy, including the domestic gold market, should not be underestimated.

The World's Largest Gold Market

As a reminder, China is the world’s largest importer of gold, the world’s largest gold mining producer, and the country hosts the world’s largest physical gold bourse in the form of the Shanghai Gold Exchange (SGE), an exchange based in Shanghai but which has hundreds of domestic member companies across the country as well as a nationwide network of more than 65 certified vaults across 36 Chinese cities. Add to this a whole range of refineries and Chinese banks that are also heavily involved in the domestic gold market and a Chinese population known for its voracious appetite for investment gold bars, coins and jewelry, and you can see that there are a lot of moving parts that could go wrong amid a slowdown.

Although gold is a safe haven asset whose price performs well in times of crisis, the slowdown referred to here is in terms of the infrastructure of the market and its smooth and normal functioning. From a purely logical perspective, quarantined cities that resemble ghost towns will not be conducive for employees to return to work, and consumers are not consumers if they cannot leave their houses.

Industrial demand for gold in China could also be effected by a slowing economy. On the supply side, air freight into China is now being affected with less cargo plane traffic and a more of less absence of passenger flights which often carry ‘belly cargo’. This could obviously could have an impact on gold import volumes. Likewise, China's port, the the gateways for imported gold bearing mineral material which contributes to China's gold mining output, are now too being adversely affected.

Staff at their desks in the Shanghai Gold Exchange, early February. Source: SGE

However, as with any rapidly changing situation, it’s still too early to assess what the exact adverse impacts on the Chinese gold market will be, in the same way that no one can quantify at this point what the impact of the virus will be on China’s economic growth, or China’s supply chains, or China’s consumer behavior.

Will the coronavirus turn out to be a Q1 2020 phenomenon, or linger on into Q2 or the second half of the year? At this point in time, no one knows, so we will just have to wait and see. The same goes for the data coming out of China’s gold market, metrics such as gold imports, gold mining production, wholesale gold demand (Shanghai Gold Exchange gold withdrawals), and consumer gold demand. The market will just have to digest this data for January, February and March as it gradually becomes available. That is of course if Chinese data becomes available on a timely basis and is not, for various reasons (face saving or otherwise) delayed. This is not just an academic concern, as data delays have already started, with for example, China just having announced that the release of January 2020 trade data was being delayed from its previously scheduled date of 7 February, and will now be bundled in with February trade data, to be released at some point in March.

But in a nation famous for saving face and obsessed with the stability and control of its society, these data delays might be compounded and roll on for months, before the Chinese authorities deem it safe to again release data that is free of any sign of economic weakness. The data will also need to take into account that the extended Chinese New Year period, which this year ran on for 10 later more, and is only coming to an end now.

So while we can't examine much from the Chinese gold market about what's happening right now, except anecdotally, we can review Chinese gold market activity up to the end of 2019, i.e. just before news of the coronavirus outbreak began to take hold. This will be a benchmark for comparative data when it eventually starts coming in and later on for the full year 2020.

Chinese Gold Mining - The World´s Number One

The China Gold Association (CGA), the representative organisation of Chinese gold mining companies and refiners and which promotes the Chinese gold market, recently announced that during 2019, domestic Chinese gold mining output totalled 380.23 tonnes. While this was a 5.2% reduction compared to 2018, China still remained at the top of the country rankings for annual gold production in 2019 for the thirteenth year running, ahead of Australia and Russia. Note that as well as a decline of domestic gold mining output to 380 tonnes in 2019, Chinese gold mining output also dropped between 2017 and 2018, falling from 429 tonnes to 404 tonnes.

In addition to domestic gold mining, China also 'produces' gold output from imported raw materials and in quite large volume. According to the China Gold Association, for 2019 the gold content of imported gold smelting materials into China was 120.19 tonnes, up 6.57% compared to 2018. Adding these two figures together means that last year, China in an overall sense ‘produced’ a total of 500.42 tonnes of gold, which was just 2.62% lower than in 2018. Again according to the China Gold Association, as the supply of gold from domestic mines has tightened due to factors such as tougher environmental regulations, these imported gold bearing raw materials are “becoming an important supplement to China's gold production.”

Shuttered mines, lower operating rates at mines, transport obstacles for returning mine workers, lower base metal prices including copper, all of these things are bound to have an impact on Chinese domestic gold mining levels, at least in Q1. Given the unclear outlook for a resolution of the coronavirus, it appears that Chinese gold output will continue its downtrend in 2020, and be somewhere under 380 tonnes by year end.

Gold Imports into China

In late 2018, the Chinese customs authority began publishing monthly gold import and export data on its website, while also backdating this data to the beginning of 2017, thus providing a full three years of monthly data to analyse. Note, this is non-monetary gold, i.e. gold that is not central bank gold. Central bank gold, or 'monetary gold' flown into the country by the People's bank of China is exempt from trade statistics reporting.

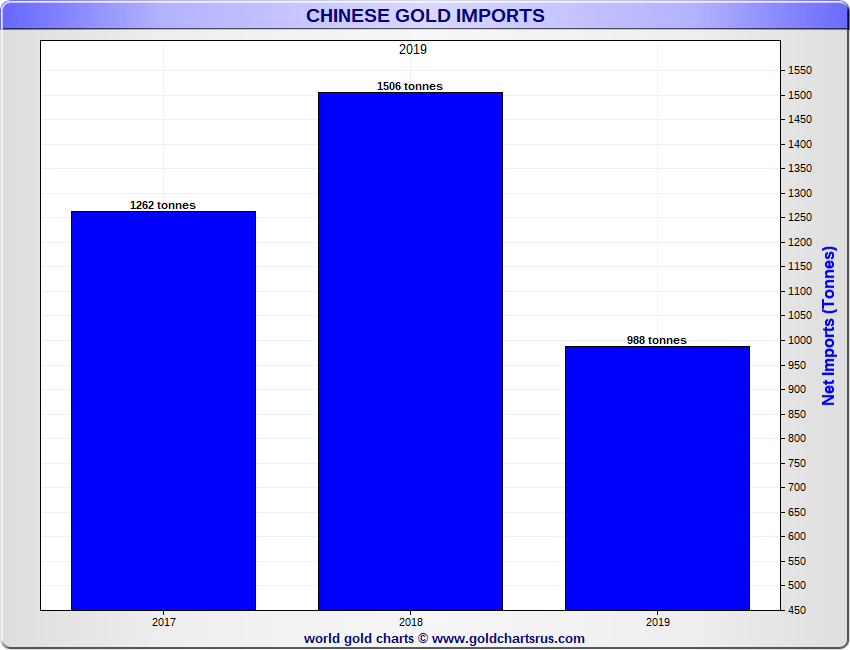

With the December 2019 gold import data now released, we can see that China imported 988 tonnes of gold in 2019. This was a huge 34% drop on the record 1506 tonnes of gold which China imported in 2018, but also 22% lower than the 1262 tonnes of gold which China imported in 2017.

Chinese gold imports, annual figures 2017 – 2019. Source: www.goldchartsrus.com

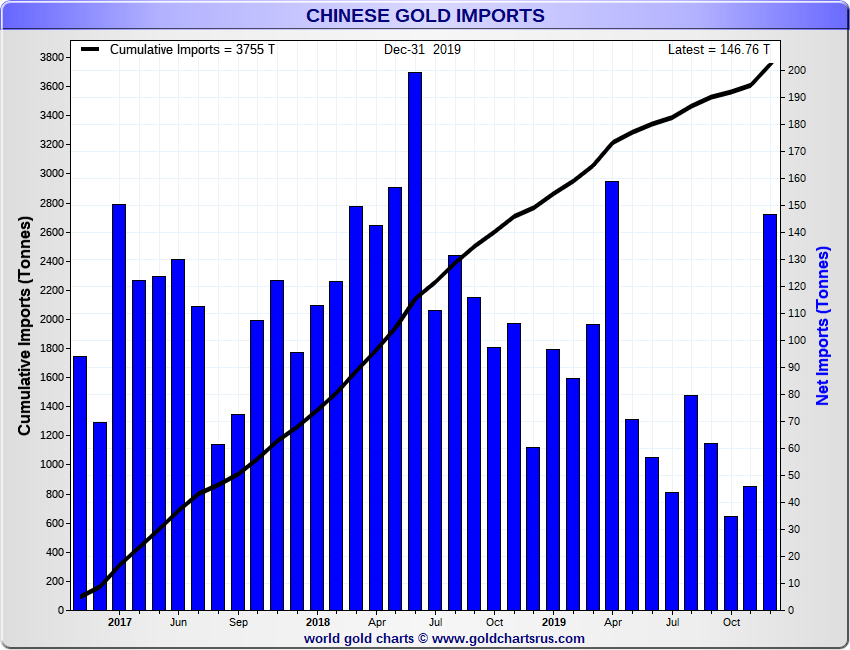

This much lower import total, coming in at less than 1000 tonnes, was despite a robust monthly gold import total for December 2019, when China’s gold imports surged to 146.7 tonnes. See chart below.

Monthly Chinese gold imports, January 2017 – December 2019, Source: www.goldchartsrus.com

From the above chart you can see that monthly gold imports for the seven months between May and November 2019 were far lower than usual. For example, China imported more gold in the 4 months from January to April 2019 (448 tonnes) than it did over the 7 months from May to November (393.5 tonnes). In fact, monthly average gold imports over January to April (112 tonnes per month) were exactly twice the monthly average over the May to November period (56 tonnes per month). While the surge in December gold imports to 146.7 tonnes boosted the monthly average over the 12 months to 82.3 tonnes, it was a case of too little, too late.

As to why gold imports into China fell sharply between May and November, the answer, as we covered last August, was attributed as being due to lower gold import quotas that the Chinese government issued to importing banks over that time. See “Chinese gold imports – Better data, lower inflows, unanswered questions” for details.

Gold bar imports into China (HS 71081200) mainly arrive in to one of four places, namely Beijing (the capital), Guangdong Province (adjacent to Hong Kong), Shanghai (the financial capital), or to a lessor extent Fujian Province. For example, during December, the breakdown was Beijing (32%), Guangdong Province (38%), Shanghai (16%), Fuijan Province (9%), and others 5%. For semi-manufactured gold in December, where imports were only 4.3 tonnes, the majority of this came into Guangdong.

Beijing, Shangahi, Guangdong and Fuijan are all major business hubs and all have been affected by the coronavirus and all are under various limitations to normal business activity. It will be interesting to see how much lower gold imports are into these hubs will be during January February and into March, as they will certainly be lower.

SGE Gold Withdrawals – A Barometer of Chinese Gold Demand

Physical gold withdrawals from the Shanghai Gold Exchange (SGE) are a suitable proxy for overall wholesale gold demand in the domestic Chinese market. This can be explained as follows. In the Chinese gold market, nearly all gold supply flows through the SGE. This includes mined gold, imported gold, and scrap gold, and is related to a combination of incentives (VAT exemption rules on Standard gold,) and the high liquidity of SGE trading. Correspondingly, with nearly all physical gold supply flowing through the SGE, the SGE has to meet nearly all gold demand in the Chinese market. Therefore, the volume of gold withdrawn from the SGE gold vaults (SGE gold withdrawals) is a suitable proxy for Chinese wholesale gold demand. This includes both institutional and consumer gold demand. See “Mechanics of the Chinese Domestic Gold Market” in BullionStar Gold University for more details of Standard gold, and the supply-demand equations of the Chinese gold market.

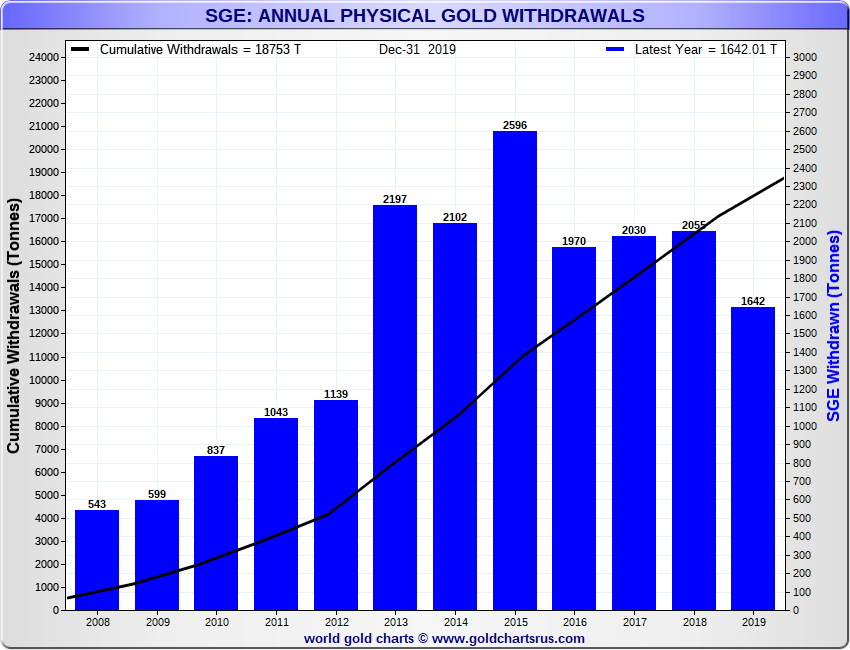

In 2019, physical gold withdrawals from the nationwide network of SGE gold vaults totaled 1642 tonnes. This was 20% less than the 2055 tonnes of gold withdrawn from the SGE in 2018. The 2019 figure was also substantially lower than all annual gold withdrawals from the SGE since 2013. See chart below.

Annual gold withdrawals from the Shanghai Gold Exchange, 2008 – 2019. Source: www.goldchartsrus.com

With China’s infrastructure now under pressure across multiple sectors and many parts of the country, the upcoming monthly data on SGE gold withdrawals will be interesting to watch, assuming that it is released on time, which is usually at mid-month for the previous month’s withdrawal activity. With 65 vaults across 36 Chinese cities, it would be foolish to think that it has been business as usual for these vaults at the current time with many Chinese cities under some type of quarantine or travel restrictions.

Preventative Controls in a Political Framework – SGE and CGA

The various main entities of the Chinese gold market are, to their credit, taking coronavirus prevention and control very seriously, but all under total subservience to the country´s political apparatus and the need for societal stability. Why this is worrying is that like the coronavirus data itself, will those with the power in these organisations seek to make the public image of the Chinese gold market in coming months look better than the reality on the ground?

Staff using masks at the Shanghai Gold Exchange, early February, Source: SGE

On 30 January, the China Gold Association, which again as a reminder represents the Chinese gold mining sector, issued an advisory memorandum on coronavirus epidemic prevention and control. The advisory, titled ´China Gold Association’s Proposal for Prevention and Control of New Coronavirus Infection and Pneumonia´ , is heavy on language about party loyalty, stability of society, and adherence to the central Party and government mandates but light on what actually constitutes epidemic prevention and control. It begins as follows:

"At present, a new era of prevention and control of pneumonia infection caused by new coronavirus enters a critical period. Under the strong leadership of the Party Central Committee with Comrade Xi Jinping as the core, all localities and industries have mobilized in an all-round way and engaged in the severe battle of epidemic prevention and control."

Recommendations of the CGA include:

"Take effective measures to effectively strengthen epidemic prevention and control. There are many labor-intensive enterprises in the gold industry."

"Further strengthen the management of large-scale events such as meetings, reduce gathering activities, and strictly prevent group infections"

"Employees who have fever or respiratory symptoms should be reminded to seek medical treatment in a timely manner, be isolated from the rest, avoid sick work, cross-infection, and inspect and observe employees who have returned to their workplaces from areas with severe epidemics"

"do not believe or spread rumors, …and resolutely maintain the stability of the overall society"

Likewise, a Circular from the Shanghai Gold Exchange sounds even more Orwellian, saying little about what the SGE is actually doing to combat the coronavirus. Titled "The Shanghai Gold Exchange earnestly strengthens the party’s leadership and does its best to prevent and control epidemic" it begins as follows:

"In order to thoroughly implement the important directive spirit of General Secretary Jinping’s work on the prevention and control of pneumonia epidemic of new coronavirus infection and the relevant deployment of the Party Central Committee, the People’s Bank of China Party Committee, the Shanghai Municipal Party Committee, and the Municipal Government, on 3 February, the Shanghai Gold Exchange Party Committee issued the “About The Notice on Strengthening the Party’s Leadership and Effectively Doing a Good Job in Epidemic Prevention and Control (hereinafter referred to as the “Notice”) requiring the entire system to always adhere to the “two strengthenings”, strengthen party leadership, and strengthen party discipline;

….strive to achieve the “four guarantees”, ensure that the organization is strong, the order is forbidden, the office is orderly, the management is smooth, the mind is stable, [and lastly that] the employees are healthy, the transactions safe and the market is stable."

Passing the headquarters of the Chinese central bank, People´s Bank of China, Beijing

Another circular from the SGE, dated 30 January, is more practical. Titled "Grasp prevention and control plans to stabilize the market", it addresses such things as improving emergency plans and remote disaster recovery for technical systems as well as factors such as:

- launching a warehouse emergency plan

- establishing emergency exit and entry procedures

- setting up international operating equipment and venues

- a backup network with the International Depository Bank to ensure smooth settlement of funds

- setting up a 7×24-hour technical emergency line

- initiating manual deposit and withdrawal procedures in extreme cases

Ominously it also says that:

"In view of the fact that the epidemic situation will continue for some time, the various business departments of the Shanghai Institute of Physical Education have practiced how to take a multi-pronged approach in various emergencies to ensure that the comprehensive needs of physical enterprises such as physical gold, capital allocation and technical support are met.

Also, as per the whole country, SGE employees need to wear masks:

"The Shanghai Institute of Health has established a daily report system for employees’ health conditions, issued emergency procurement masks to all employees, sanitized workplaces, notified employees to wear masks, encouraged online or telephone conferences to replace face-to-face communication, and reduced the risk of aggregation and transmission."

The communique ends with the goal of gold market infrastructure stability in the context of political compliance:

"At the moment of the epidemic, the Shanghai Institute of Finance will take a firm political stance and bear strong responsibilities to firmly safeguard the financial infrastructure of the gold market."

Conclusion

During 2019, trading volumes on both the Shanghai Gold Exchange (SGE) and and Shanghai Futures Exchange (SHFE) reached new record highs. Total trading volume on the Shanghai Gold Exchange (SGE) in 2019 (for all gold contracts) hit record 68,600 tonnes (counting bilateral trades), which is 34,300 tonnes one way. Total trading volume of all gold contracts on the Shanghai Futures Exchange (SHFE) was 92,400 tons (bilateral) or 46,200 tonnes one way.

While trades can be conducted electronically as long as exchanges are open, the physical gold market is another matter. From gold mining to gold imports, and from SGE gold withdrawals to end consumer gold demand, the gold metrics data coming out of the Chinese gold market in the months ahead will be interesting to watch.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.