he longer oil languishes, the more pressure builds on Saudi Arabia to abandon its currency peg.

Contracts used to speculate on the riyal’s exchange rate in the next 12 months climbed to a 13-year high on Thursday, before trimming the increase a day later, according to data compiled by Bloomberg. Six-month agreements rose to near the highest in seven years on Friday.

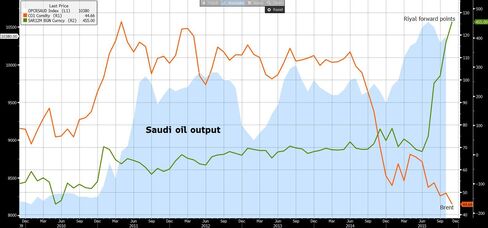

The decoupling of oil prices and Saudi production has fueled speculation of a riyal devaluation

Saudi Arabia is pumping oil at a record level this year, leading OPEC’s effort to defend market share even as oil trades near the lowest level in six years. That’s forced the kingdom to tap savings and sell debt to make up for a plunge in revenue and defend its 30-year-old peg to the dollar. For Bank of America Corp., the country may face a choice next year: cut production to help boost prices or adjust the riyal’s rate to stem a decline in foreign reserves.

“A depeg of the Saudi riyal is our number one black-swan event for the global oil market in 2016, a highly unlikely but highly impactful risk," BofA strategists led by Francisco Blanch in New York wrote in a Nov. 19 report. “It is a lot easier politically to implement a modest supply cut at first than allow for a full-blown currency devaluation."

One-year forward points for the riyal jumped 167.5 points to 525 on Thursday, before falling to 455 a day later. That reflects expectations for the currency to weaken about 1.2 percent to 3.7962 per dollar in the next 12 months. Six-month agreements rose on Friday to 152.5, near the highest level since 2008.

Weak global growth and inflation as well as a strong dollar will remain a “huge" headwind for dollar-based commodity prices, BofA said. Brent crude closed last week at $44.66 per barrel, down 44 percent from a year earlier.

Robust Reserves

Still, Saudi Arabia’s reserves are hardly depleted. While net foreign assets fell to a near three-year low in September as the government drew down financial reserves accumulated over the past decade, they’re among the highest in the region at $646.9 billion.

The country’s peg survived low oil prices in the 1990s and revaluation pressure resulting from surging prices in the late 2000s, Shaun Osborne, the Toronto-based chief foreign-exchange strategist for Scotiabank wrote last week.

Pressure may also build on the Chinese yuan amid declining reserves at central banks across the world and with expected U.S. interest-rate increases, BofA said. A meltdown of the yuan may ultimately force Saudi Arabia’s hand because of the “very high sensitivity" of commodities to the currency, the bank said.

Saudi Arabia produced more than 10 million barrels of oil a day in each of the past eight months and pumped a record 10.57 million barrels a day in July, according to data compiled by Bloomberg.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.