Summary

Due to aggressive accounting practices, EROS' reported earnings are significantly overstating the economic reality of its business model.

EROS' subsidiary financials reveal a lack of free cash flow and raise many questions about the company’s accounting.

The company has enriched its controlling family at the expense of shareholders through a series of related-party transactions.

Eros Now is poorly positioned to win the battle for streaming media in India and appears to have made meaningful misstatements to investors.

Based on the company's persistent negative free cash flow and growing debt and share count, we believe the stock is worthless.

Eros International PLC (NYSE:EROS) ("Eros PLC") is a leading distributor of Indian language films. The company also operates a nascent streaming business known as Eros Now. While the company claims it has grown revenue and operating income, its consistent lack of free cash flow tells a different story. Digging into the company's foreign subsidiaries and accounting policies reveals that the reported numbers are a mirage and that the company has misled investors about its financial results and financial health. Finally, we believe the company has lied to investors about the content available on Eros Now and its user metrics. Our research suggests Eros Now is late to enter the streaming market, which already has numerous competitors. The competitive position of Eros Now is only likely to worsen once Netflix launches. We believe EROS is most likely worthless or worth only a small fraction of its current market value, and our analysis shows that:

- Due to aggressive accounting practices, EROS' reported earnings are significantly overstating the economic reality of its business model. 80% of its COGS and 57% of its total operating expenses are the amortization of its film library. EROS' accounting policy for amortization is more aggressive than its U.S. peers despite the fact that piracy more meaningfully impairs the longer-term value of the company's assets. Also, we believe that EROS' policy is counter to the matching principle; there is very little revenue earned from these assets beyond the year of theatrical release. We think economic profits are significantly lower than reported profits.

- EROS' subsidiary financials reveal a lack of free cash flow and raise many questions about the company's accounting. More than 100% of the revenue growth, representing about one third of total revenue now, is being earned in the United Arab Emirates. In addition, while the British Virgin Islands, Singaporean, and Mauritian subsidiaries show significant revenue growth, the growth in accounts receivable reveals that the company generates no cash despite its reported profitability. Furthermore, the company appears to be capitalizing costs. There has been a rapid and unexplained increased in capex in the last year. The company has only been able to stay afloat by issuing stock and taking on debt. This is not sustainable.

- The company enriches its family management team through related-party transactions and by appointing numerous family members to management positions. We believe a tangled web of inter-related companies has enabled related-party transactions and high salaries for family members. In order to fund the related-party transactions, the company has repeatedly raised equity. Put simply, the controlling family is enriching itself at the expense of shareholders.

- EROS has numerous warning signs of poor financial controls, such as employing a tiny auditor for its most important subsidiaries. An auditor consisting of what appears to be only a few people with no visible website and a Gmail email address has been auditing at least 9 subsidiaries in places as disparate as Mumbai, BVI, Mauritius, Singapore, and the Isle of Man. It recently quit as the auditor for at least one subsidiary. Furthermore, EROS already had its NYSE admission delayed one and a half years due financial reporting and control issues. In addition, the CFO of Eros PLC resigned May 2015 and the CFO of Eros International Media Ltd ("EIML") resigned November 2014.

- Eros Now is losing the battle for streaming movies in India and its position will only get worse because Netflix (NASDAQ:NFLX) plans to launch in India. The bull case regarding EROS revolves around the concept that Eros Now will be the Netflix of India. We think this is a pipe dream due to well-funded competitors, an abundance of available low-cost pirated content, and a poor broadband infrastructure. In reality, there are already other streaming services that are more popular than Eros Now, and Netflix is coming to India soon. Eros Now has misrepresented key facts to investors, is already losing the battle for relevance to competing sites, and lacks the brand, financial resources, and technical expertise to compete with Netflix.

Conclusion: We believe that EROS is mostly accounting fiction and that both its revenues and profits have been vastly overstated. The growth in accounts receivable indicates that the company has been unable to collect its reported revenue and aggressive accounting policies have flattered the company's reported profits, which would be much lower if the company had kept its prior accounting policies in place.

EROS' Aggressive Accounting: Film Costs

The profitability for EROS depends on how much revenue can be generated from a given film relative to the cost EROS incurs to gain control of that content. According to the Accounting Standards Codification for Film Entertainment (ASC 926), an entity should amortize the capitalized film costs on an individual-film-forecast-computation method. The costs should be amortized at the same ratio as the current-period actual revenue to the expected ultimate revenue. Ideally, the amortization results in a constant yield at the individual film level. If there is a negative change to the expected ultimate revenue, a write-down of the unamortized asset should occur immediately.

Accordingly, all U.S. peers disclose a breakdown of the asset in terms of Released Films, Films in Production, Films in Development, and Product Inventory. Once a film is released, the company begins to amortize the asset. The companies typically provide clear guidance as to their planned amortization. For example, DreamWorks (NASDAQ:DWA) anticipates amortizing 50% of its Released Films asset during the first 12 months, and 83% over the following 3 years. MGM Studios (OTC:MGMB) anticipates amortizing 85% of its Released Film asset over the first 3 years. Twenty-First Century Fox (NASDAQ:FOX) (NASDAQ:FOXA) anticipates amortizing 64% of its Released Film asset during the first 12 months, and 90% over the next 3 years.

During the first year, EROS claims that it amortizes 50% of high-budgeted films' costs and 40% of medium- and low-budgeted films' costs. In contrast to U.S. peers, EROS amortizes the portion of its film costs that are not amortized in the first year over a nine-year period (from years 2-10). By stretching out the amortization period from three years to nine years, EROS is able to significantly reduce the expenses it flows through its income statement. It also inflates the assets and equity line items on its balance sheet. Interestingly, the company changed its amortization policy in fiscal 2010 to be more aggressive and to show higher earnings. At the time, there was no explanation given for the decision to adopt such an aggressive new accounting policy. Prior to fiscal 2010, after the year of a film's release, the remaining capitalized film content costs were amortized evenly over a maximum of four years (Source, see Page 55 of 20-F/A, section: Intangible Assets).

It is important to consider the differences between the US film industry and the Indian film industry when determining the amortization policy that is most appropriate for EROS. Notably, pirated content is ubiquitous in India, which significantly shortens the life cycle of films when compared to films in the US. In India, it takes as little as 12 weeks after a film is released in theatres for high-quality black-market copies to become widely available. As a result, very few parties will pay a significant amount of money for rights to a title 6-8 months post-release, much less years later. This means that a film production company needs to amortize its film development costs quickly in order to accurately reflect the value of a film on its balance sheet. It also means that a company like EROS should have an amortization policy that is even more front-loaded than a typical US company. Even the company's pre-2010 policy of amortizing the remaining balance after year one over four years may have been too aggressive because revenues after year one are often insignificant.

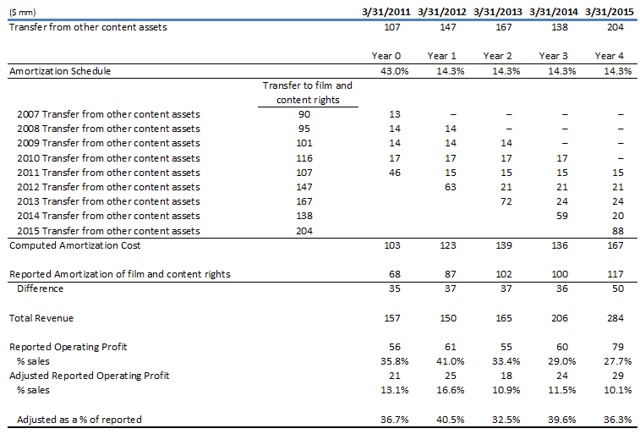

The following table shows that EROS has consistently overstated its operating profit by more than 60% once we apply its historic amortization policy from 2009 and before.

(click to enlarge)

Note: Transfer to film and content rights for 2007 and 2008 are not available in the financials. Assumes $90 million in 2007 and $95 million in 2008.

Under the pre-2010 amortization policy, Diluted EPS for fiscal-year 2015 would have been 14.4 cents, 80% lower than reported.

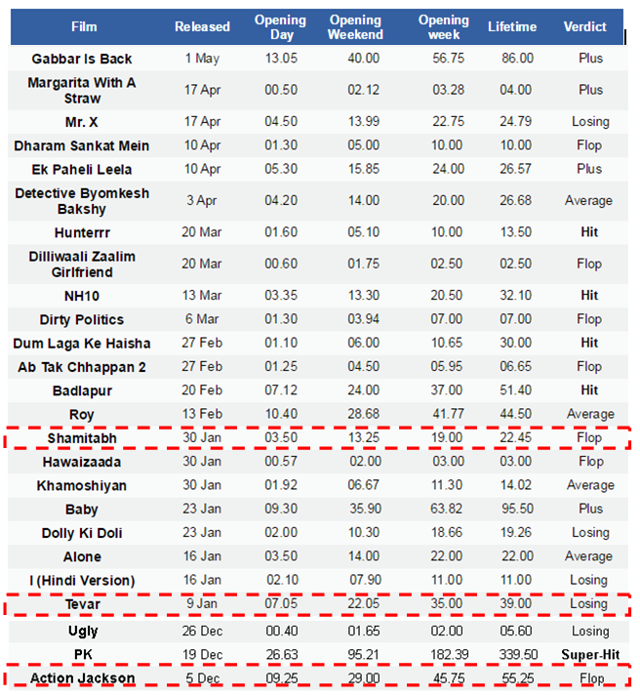

The company's amortization of intangible assets is not just aggressive when it comes to amortization periods, but it also appears that the company may not be taking write-downs when it produces films that fail commercially. The following chart shows the box-office verdict of the major Bollywood releases of late 2014 and early 2015 (Source). EROS produced two of the "flops" (Shamitabh and Action Jackson), which are defined as movies losing more than 50% of the initial investment. EROS also produced one of the "losers" (Tevar), which is defined as a film that has losses less than 50% of the initial investment. Despite producing what are almost certainly money-losing films, EROS has never disclosed or quantified any impairment charges related to movies that failed in the box office. This appears to be consistent with the company's pattern of under-expensing amortization.

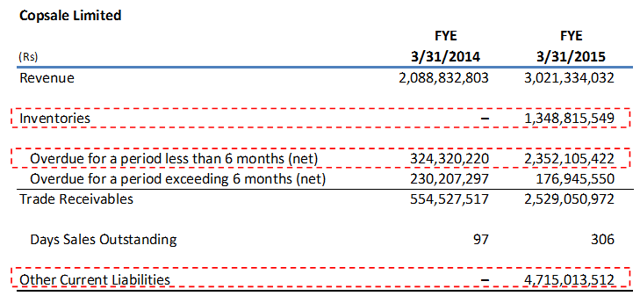

EROS' Aggressive Accounting: Negative Free Cash Flow, Ballooning Accounts Receivable & Subsidiary Financials

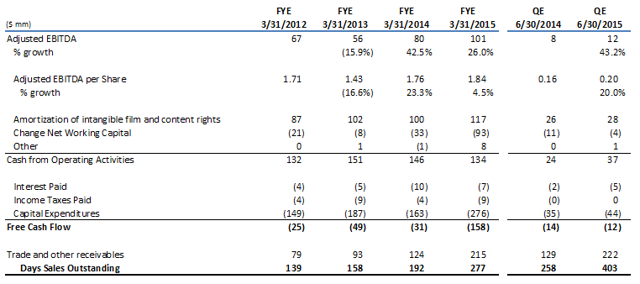

The company's trade and other receivables have been mushrooming. From 6/30/14 to 6/30/15, EROS booked revenue of $289 million. Over that same period, trade and other receivables increased $93 million. In other words, 32% of EROS' booked revenue wasn't actually received in cash. Days sales outstanding now stand at 403 days, which is an increase of 145 days from its level on 6/30/2014. As a result of the company's inability to collect receivables and its high capital investment, free cash flow has been negative for the past four years and fiscal-year 2016 looks to be no different.

We have also examined the financials of many of EROS' subsidiaries. Interestingly, $41 million, or 45% of the company's trade and other receivables growth during fiscal-year 2015, was derived from three subsidiaries. Further, the receivables that were overdue for a period exceeding 6 months grew by $56 million at these three subsidiaries. The three largest subsidiaries show significant receivable increases in the most recent fiscal year, including those overdue for a period exceeding 6 months. Copsale Limited's other current liabilities (advances from customer) increased from ₹0 at fiscal year 2014 to over ₹4.7 billion at fiscal year 2015 (Source). The auditor of these three subsidiaries, Anil Jagetiya & Co., recently resigned from auditing Eros Digital Private Ltd. It is unclear if it is still the auditor of these three subsidiaries or if it resigned from them as well. As can be seen in the tables below, the accounts receivable balances have been rapidly increasing and, in some cases, the growth in accounts receivable from one year to the next has actually increased by more than the total revenue recorded. This should be an accounting impossibility.

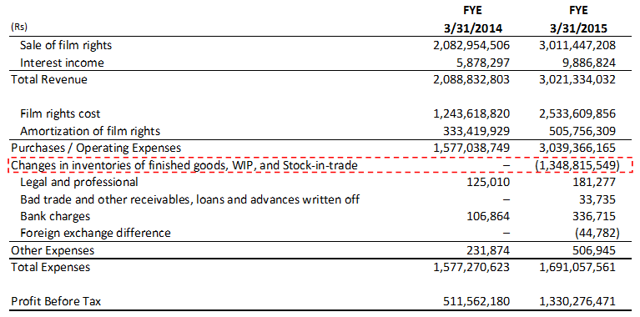

Copsale Limited's trade receivables increased nearly ₹2 billion, which represents approximately 65% of the revenue booked during the period. A new account, other current liabilities (advances from customer), was created this year and increased from ₹0 on 3/31/2014 to over ₹4.7 billion on 3/31/2015. A new account for inventory also appeared on the balance sheet in 2015. This new ₹1.35 billion asset has also flowed onto Copsale's income statement, greatly reducing its expenses and increasing its profitability.

(click to enlarge)

(click to enlarge)

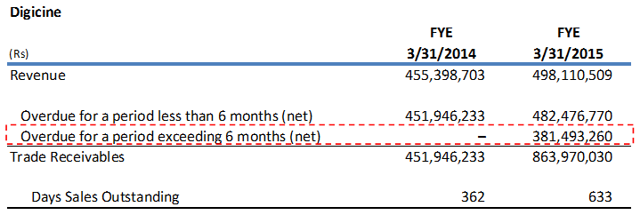

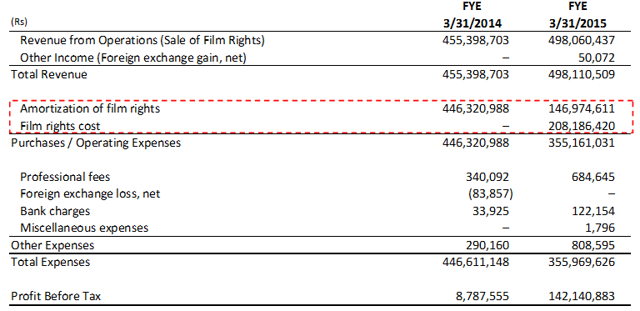

Digicine's trade receivables increased ₹412 million, which represents approximately 83% of revenue booked during the period (Source). The majority of this increase came from receivables overdue for a period exceeding 6 months. On Digicine's income statement, amortization of film rights fell 67%, despite an increase in revenue from the sale of film rights. Also, a new line item, film rights cost, appeared this year containing ₹208 million. Taken together, purchase/operating expenses fell 20% despite the 9% increase in total revenue.

(click to enlarge)

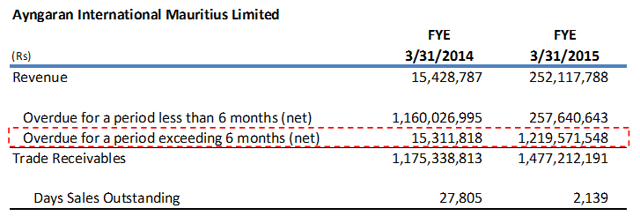

Ayngaran International Mauritius Limited's trade receivables increased ₹302 million, which represents approximately 120% of revenue booked during the period, an accounting impossibility (Source). The majority of this increase came from receivables overdue for a period exceeding 6 months. Ayngaran International Mauritius Limited's income statement also shows that it went from (₹63) million in losses for fiscal year 2014 to ₹48 million in profits for fiscal-year 2015. In addition, Ayngaran's revenue growth occurred despite consistent employee reductions. Headcount stood at 43 on 12/31/2011 and now stands at 21 as of fiscal year ending 2015. We find it implausible that a company grew its revenue by 16x while cutting its staff by 51%.

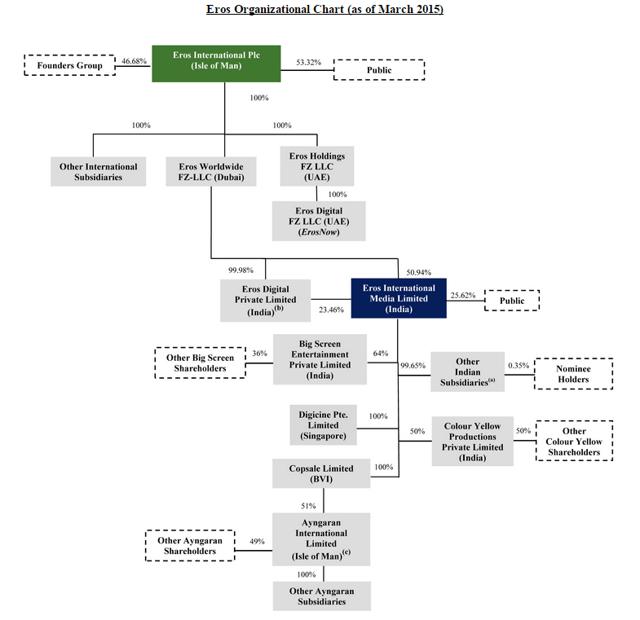

Finally, EROS has shifted much of its revenue recognition to EROS Holdings FZ LLC and its subsidiary EROS Digital FZ LLC, both of which are incorporated in the United Arab Emirates (see the corporate organization chart below). Revenue generated within the United Arab Emirates based on the customer's location was $103.8 million in fiscal-year 2015 vs. $46.6 million in fiscal-year 2014, or growth of $58.2 million. Over that same time period, total revenue grew $48.7 million from $235.5 million to $284.2 million. The company's explanation is tax planning, but we find it difficult to believe that more than 100% of the company's revenue growth took place with customers located in the UAE. In addition, this does not make sense because we know that the company's revenue increased by $26.9 million in just the Copsale, Digicine, and the various Ayngaran subsidiaries, as discussed above . Hence, we can say that 175% of the company's growth took place in subsidiaries located in non-core locales such as Singapore, the UAE, the BVI, and the Isle of Man. We believe that there are almost certainly at least some revenue overstatements here, as an auditor like Anil Jagetiya & Co. (as explained below) is ill-equipped to handle companies in these locales.

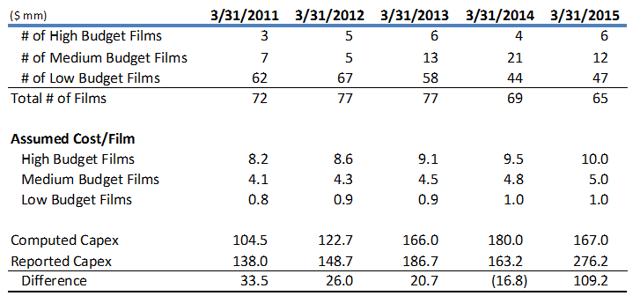

In addition to the likely revenue overstatements, the company also appears to be capitalizing costs. A detailed analysis of the company's recent capital expenditures shows a sudden gap between what investors should expect and the reported capex. Per EROS' disclosure, "High budget" films are $7 million and up, "Medium budget" films cost between $1 million and $7 million, and "Low budget" films are less than $1 million. Based on these disclosures as well as disclosures regarding the number of films made in each category, we compared the company's reported capex with what its guidance implies. This comparison is in the chart below:

As can be seen, capital expenditures closely matched what is implied by the company's disclosed costs per film until fiscal-year 2015. However, in 2015, there is a substantial increase in capex without any explanation. We spoke with management to better understand the $100 million jump in capital spending despite no significant change in the number of films produced. We specifically asked why the capital spending in fiscal-year 2013 was $90 million less than it was in fiscal-year 2015 despite producing 12 additional films in fiscal-year 2013, including the same number of high budget films and an additional medium budget film. We were unable to get an answer. We believe the two most likely answers are either that the company has begun to capitalize additional expenses in order to flatter profitability or that the company has engaged in additional undisclosed related-party transactions to enrich insiders, similar to those described below.

EROS has enriched its family management team through related-party transactions and by appointing family members to management posts

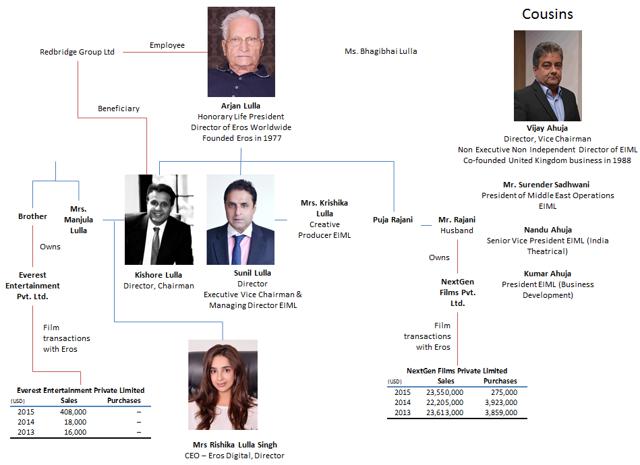

We have created the following "family-tree" for EROS to show how the Lulla family controls all aspects of the company and enriches itself at the expense of minority shareholders:

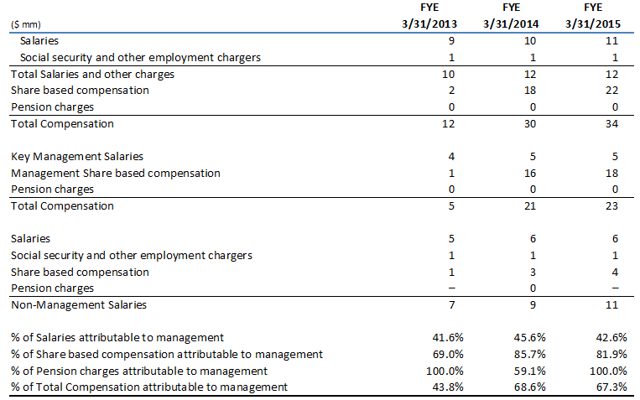

EROS is a third-generation family company. Arjan was the founder and appears to be the patriarch of the family while many other family members are also employees, such as Rishika Lulla Singh, his 28 year-old granddaughter, Board Member, and CEO of Eros Digital and Eros Now. Due to this dynamic, there are many transactions that are not done at arm's-length and insider compensation is generous. In fact, personnel costs have increased from $12 million in 2013 to $34 million in 2015, a staggering 68% CAGR. What's more astonishing is that the vast majority of this increase has been paid directly to key management as its compensation has more than quadrupled (109% CAGR) as compared to the modest $4 million increase for non-management.

To make matters worse, EROS has been consistently issuing stock to pay for its cash shortfalls. During fiscal-year 2015, EROS issued 8.5 million of shares on eight separate occasions. The share count excluding Class B stock grew 36% from 23.5 million to 33.0 million. So while Adjusted EBITDA grew 26.0% in fiscal-year 2015, Adjusted EBITDA per share grew only 4.5%. Further, on an unadjusted basis, EBITDA actually decreased 1.3% on a per share basis. In addition, the Founders Group has been consistently selling its shares. As of March 2015, the Founders Group owned 46.7% of EROS, representing virtually only Class B ownership stock. Three years earlier, its ownership was 69.8%.

In addition to the outright cash payments that management has received, there have also been numerous related-party transactions:

- Next Gen Films: EROS filings state that Next Gen Films is an entity owned by the husband of Puja Rajani, sister of Kishore Lulla. Based on our review of documents, Viki Rajani transferred his ownership stake to his mother. Viki now owns 1% and Rajkumari Rajani owns 99% .

EROS purchased film rights of $23.5 million, $22.2 million, and $23.6 million during fiscal-year 2015, fiscal-year 2014, and fiscal-year 2013, respectively, from Next Gen Films. These acquisitions represented 9%, 14%, and 13% of total film right investments during those years. EROS also has provided performance guarantees to a bank amounting to $32.5 million in fiscal-year 2015 and $26.3 million in fiscal-year 2014 in connection with funding commitments under film co-production agreements with Next Gen that mature over the next 24 months.

Interestingly, Next Gen has produced very few films, and the vast majority of them have been box office failures. Despite these failures, there appear to have been no impairments taken to EROS' film rights .

- B4U: In April 2008, EROS PLC exercised a call option granted on June 27, 2006, to acquire Acacia Investments Ltd. from a family trust, in which Kishore Lulla and Sunil Lulla were shareholders, for $10.8 million. Acacia Investments is a holding company that owns 24% of LMB Holdings Ltd., which operates two entertainment channels, B4U Music and B4U Movies.

There are two points of significance related to B4U. First, B4U has been a commercial failure. Fifteen years ago, investors put more than $100 million in to launch the business. Kishore had initially planned that by 2005 B4U would have 1.5 million paid subscribers and generate $110 million in profits. At the 2008 transaction price of $10.8 million for 24% of the company, B4U was therefore valued at just $45 million, less than half of the cash invested to build it. During fiscal year 2011, B4U only generated $2.5 million in net income and had $28.7 million in net assets. In addition, B4U's profitability may have been overstated because EROS had been known to license its film rights to B4U at a cost and these transactions were not viewed as arm's length by third parties.

Acacia Investments is now held on the balance sheet at a value of $16.8 million and is considered an available-for-sale financial asset, meaning that EROS has not taken a write-down even though B4U significantly underperformed its business plan. The income/loss from this business is considered "other income/loss" as EROS considers itself a passive investor in the company. However, Jyoti Deshpande, CEO of EROS, was part of the core team that founded B4U TV. We don't see how it is appropriate for EROS to consider itself a passive investor in B4U when its CEO was one of the founders of B4U.

- Drishti Creations: In 2011 and 2012, EROS licensed a large portion of its satellite TV syndication rights to Drishti, which accounted for $37.9 million (23.0%) and $24.4 million (11.8%) of its revenue during fiscal-year 2011 and fiscal-year 2012, respectively. The son of Mr. Sadhwani, one of EROS' executive officers, served as a director of Drishti between May 5, 2011, and October 21, 2011.

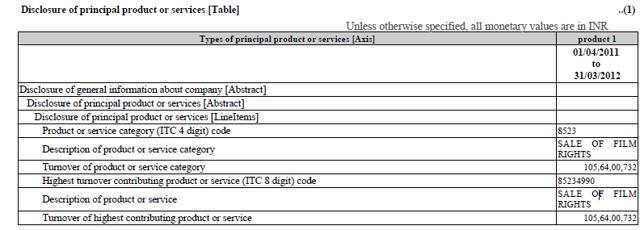

Interestingly, the revenue EROS reported from Drishti was greater than the revenue that Drishti reported of $20.1 million in 2011 and $21.5 million in 2012, and zero profits. The following is an excerpt from Drishti's financial statements which shows revenue of 1,056.4 million INR, which translates to $21.5 million based on the exchange rate at that point in time .

It is also not clear how $21 million went unaccounted for (the difference between the revenue that EROS reported of $62.3 million and the revenue Drishti reported of $41.6 million).

- During fiscal-year 2011, EROS entered into transactions with special purpose entities that were incorporated to produce films within the UK. Andrew Heffernan, CFO, was a director of these special purpose entities. These entities included Illuminati Films Ltd., Vijay Galani Movies Ltd., and Nadiadwala Grandson Entertainment Ltd.

- Mr. Sadhwani is the beneficial owner of Victoria Landmark Global Holdings Ltd. Victoria Landmark received $1.6 million for consultancy services during fiscal-year 2011 from Ganges Green Energy. Ganges Green is owned by an entity that indirectly owns 66% of Beech Investments, of which Kishore Lulla and Sunil Lulla are potential beneficiaries.

EROS' Auditor For Many Of Its Most Important Subsidiaries Appears Woefully Under-Qualified

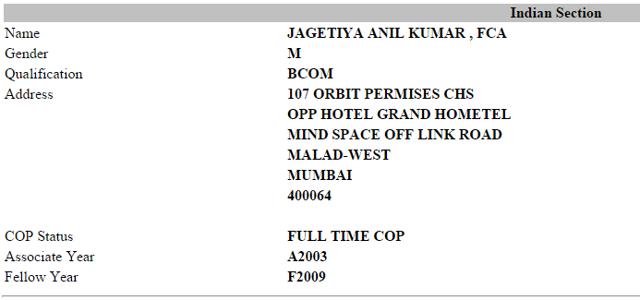

Anil Jagetiya & Co. is the auditor of Eros Digital Private Ltd, Copsale Limited (BVI), Ayngaran International Limited (Isle of Man), Ayngaran International UK Limited, Ayngaran International Mauritius Limited, Digicine PTE Limited (Singapore), EROS Animation Private Limited, EM Publishing Private Limited, and EyeQube Studios Private Limited. Based on a recent phone call with Anil, we believe his firm is woefully under-qualified to serve as the auditor for EROS' important international subsidiaries.

Anil Jagetiya is located in Mumbai (LinkedIn). It is possible to search The Institute of Chartered Accountants of India using his 6-digit Membership Number (114991). He is also associated with SJ Corporate Pvt. Ltd. Information is scarce on both Anil Jagetiya & Co. and SJ Corporate Pvt. Ltd. We have been able to find only two other employees associated with Anil Jagetiya & Co., Mamta Doshi and Abhishek Singhvi.

We believe Anil Jagetiya & Co. is a tiny company consisting of only a few people. We were unable to find a website for the company, and we would note that the firm appears to operate from a personal Gmail account (see below). As a point of reference, the firm does not appear on the list of the top 20 Certified Accounting firms in India. The 20th ranked company on this list, Khanna & Annadhanam, does not have any international offices, has only 12 Chartered Accountants and consists of 83 total employees, 16 of which serve administrative roles. We question whether even Khanna & Annadhanam is qualified to audit far-flung subsidiaries in locales such as the Isle of Man, the UAE, Singapore, and the BVI, and we sincerely doubt the ability of Anil Jagetiya & Co. to properly audit entities all over the world.

Anil Jagetiya & Co. resigned on May 28, 2015, as auditor for Eros Digital Private Ltd. because it claimed "we are not in a position to devote our time to the affairs of the Company." We have not found separate resignation letters for its other engagements with EROS. Given the convoluted structure, numerous foreign subsidiaries and accounting irregularities at EROS, we are not surprised that a small audit firm was unable to devote the time to EROS.

Furthermore, with the large inconsistencies in the financial statements, we would not be surprised if Anil Jagetiya just wanted to disassociate himself from EROS.

Our concerns about the company’s financial reporting are only reinforced by its experience listing on the NYSE. In March 2012, the shareholders of Eros PLC approved a resolution to cancel its AIM admission in favor of a NYSE listing. However, just months later these plans were delayed on June 8th, 2012. Eros PLC didn’t list until November 13, 2013. A member of the management team disclosed to us during a meeting that its admission to the NYSE was delayed due to financial reporting and control issues. In addition, the CFO of Eros PLC and CFO of EIML both departed within 7 months of each other. Kamal Kumar Jain, the CFO of EIML, resigned from his office on November 30, 2014. Andrew Heffernan served his notice to resign from his Group CFO position in June 2015.

EROS is unlikely to ever be the Netflix of India

For some investors, EROS has provided a great growth story based on Eros Now and the potential to reach 1.2 billion people in India. We believe Eros Now faces significant headwinds from Internet access availability, piracy, and competition, all of which we discuss below. A careful analysis of these impediments to success suggests to us that Eros Now has poor prospects. In addition, we have identified a number of inconsistencies which suggest that investors have been misled regarding Eros Now.

Streaming video is not the first extension from traditional movie distribution that EROS has touted. During 2012, EROS planned on acquiring the 76% of B4U Television that it didn't already own. At the time, the purpose of the acquisition was to provide EROS with a captive outlet for its film library to be distributed via television. That plan changed in February 2013 when EROS partnered with HBO Asia to distribute its movies via two new premium advertising-free movie channels through Dish TV and Airtel Digital TV. Sell-side firms were modeling $30 million in profits by fiscal year 2018 based on 5% penetration, or 9 million subscribers with an ARPU of $1.58/month. In an IDBI Capital report from May 21, 2014, it wrote that HBO will be "A game changer in the long term." As of 2Q15, EROS stated that the collaboration is generating no revenue. In the fiscal-year 2015 20-F filing, there is no mention of HBO at all.

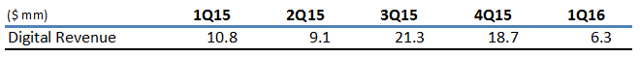

EROS discloses revenue broken down as Theatrical, Television Syndication, and Digital & Ancillary. Digital is defined as revenue that is sourced from Internet protocol television, video on demand, Internet channels, and Eros Now. Given the hype, we would expect the revenue from this source to be increasing. Surprisingly, 1Q16 ended June 2015 saw a 42% decline year over year and a 66% decline quarter over quarter. The company gave no explanation.

We believe limited Internet access will be a headwind to all streaming video providers in India. According to a recently published report by the Internet and Mobile Association of India (IAMAI), Internet users in India have grown by 17% during the first 6 months of 2015, with 52 million new users. However, the vast majority of this increase is coming from low-cost cell phones and basic data services. There are a total of just 20 million wired Internet connections in India.

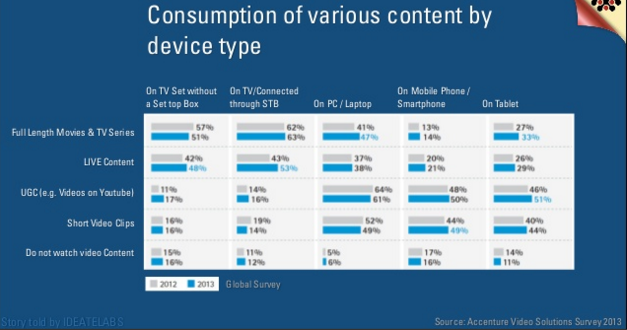

Including wireless Internet connections, the total internet connections are just over 300 million total users. According to IAMAI, as of December 2014, there are only 65-70 million 3G subscribers and video access on mobile devices is driven by 3G adoption. However, this is primarily short-format mobile video such as music videos and 30 minute shows, not full-length movies, because mobile phone users have limited data plans that are not suitable for watching full-length movies. Also, 44% of smartphone users do not watch mobile video due to poor network speeds. The percentage of broadband connections above speeds of 4Mbs is estimated at less than 7% in India.

The following table provides numerical support. Mobile phones are being used mainly to watch short video clips, and only 14% of smartphone users use their phone to watch full-length movies.

With broadband access both scarce and expensive in India, people have historically turned to pirated movies for widespread access to films. Pirated movies are widely available for less than $1 from street vendors in India while a film is still playing in the theaters. They are also available at many Indian stores in North America and the UK for as little as $2. People can also watch movies for free on streaming sites like bwcinema.com and einthusian.com. Our research also reveals that 12-15 weeks after theatrical release, high-quality DVDs become available. Until broadband connections become both more prevalent and lower cost, it is difficult for us to see why broadband streaming will gain widespread popularity.

The following quote from an MD at NGC Network India and Fox International Channels summarizes our view on the interplay between low-cost content and high-cost broadband:

"The biggest challenge for digital is monetization. Nobody is talking about the elephant in the room. Everybody talks about digital. For example 1GB of data costs around Rs500 ($7.69). In 1GB data, you will get about three hours of content. This content if you had to buy, you would probably buy it for less than Rs10. So the distribution method is costing you Rs500 and your content is only costing you Rs10. Most broadcasters are struggling with this imbalance. They are giving their content at affordable prices to consumers, but the method the customer can use to download that content or view it on digital is proving to be phenomenally expensive and does not make it affordable to watch a lot of videos in the long run. So until this cost of data consumption comes down to more affordable levels, there is no digital video play in the country."

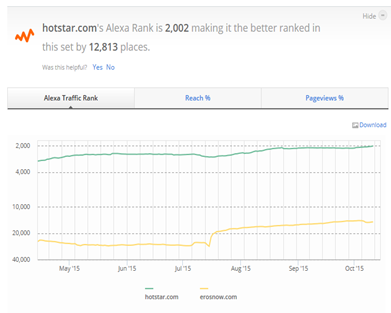

EROS is not alone in the battle for streaming video subscribers. Star India is an Indian media and entertainment conglomerate owned by 21st Century Fox. hotstar is Star India's mobile application for digital media. It was launched on February 1, 2015, and has already overtaken Eros Now, which claims to have launched in 2012. hotstar's acceptance and use has been driven by its cost-free content and a technology solution for bandwidth and content discovery.hotstar.com is ranked #150 in India based on Alexa traffic ranks, compared toErosNow.com at #2,549.

Another larger competitor is dittotv.com (#1,728 on Alexa), owned by Zee TV. Zee TV has disclosed that it had 3.2 million paid subscribers, and 1.75m unpaid subscribers, of which about 20,000 were from outside of India. Zee's subscriber numbers in light of its higher traffic make Eros Now's subscriber numbers look quite dubious. Zee launched Ditto in 2012, and has not yet broken even on its $5 million initial investment despite the fact that it has a paid subscriber business model. Ditto is very direct in explaining the challenges of monetizing this distribution channel. First, the cost of acquiring a subscriber and keeping a customer active is very high. Second, it is very difficult to collect payment. Ditto is currently selling prepaid cards and virtual cards at stores where Internet services or devices are sold. It uses distribution and payment collection solution providers like Oxigen as well as the mobile telco operators. Ditto appears to be trying to partner with every company that a customer is likely to have a billing relationship with. Ditto is also offering a cash-on delivery model where a Ditto prepaid card is delivered to the door-step in exchange for payment (Source).

Other existing competitors include but are not limited to: Sony Liv, Box TV, Big Flix, Hungama, and Spuul. There are rumors that Amazon (NASDAQ:AMZN) plans to invest $5 billion in India, with plans to include instant video services. Netflix is also planning on entering the Indian market in 2016 .

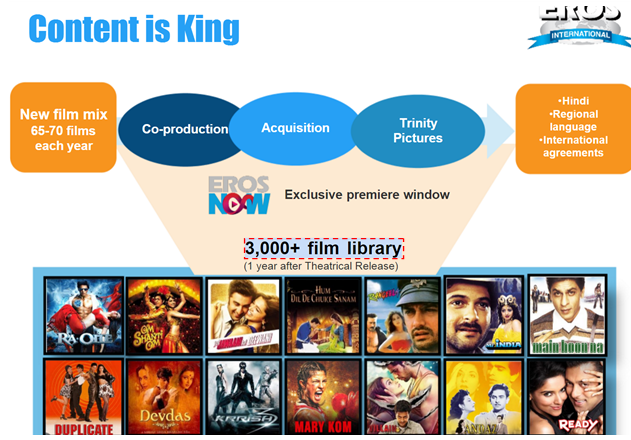

Of course, no discussion of EROS would be complete without a discussion of inexplicable and contradictory claims from the company. Beyond the inflated subscriber numbers, EROS' oft-quoted 3,000+ library is in stark contrast to its 1,162 films on Eros Now. Furthermore, EIML on its website states it has "aggregated rights to over 1,100 films in our library, plus an additional 700 films for which we hold digital rights only" and quotes 2,000+ films in its most recent annual report, but EROS PLC claims a 3,000+ film library. It's difficult to reconcile these disparate claims.

We are quite concerned by the obvious exaggerations put forth by management regarding facts that are easily confirmed. For example, in an August 18, 2015 article by the Economic Times Jyoti Deshpande, CEO of Eros International, is quoted as saying "We have already notched up 26.5 million registered users worldwide since our soft launch 18 months ago (in February 2014)" (Source). This statement implies Eros Now launched in February 2014 and is in direct contradiction to Eros India's repeated assertions that Eros Now was launched August 2012. The August 2012 start date was stated in both the fiscal-year 2013 and fiscal-year 2014 annual reports of EIML.

Similarly interesting, is the supposed acceleration in the growth of subscribers despite no corresponding increase in marketing spending. As of March 2014, Eros Now only had 2.3M free subscribers on the Eros Now YouTube channel. This relationship began in 2007, and as discussed later, YouTube (NASDAQ:GOOGL) is a very popular app in India. However, investors are also supposed to believe that in March 2014, 19 months post the "soft" launch, Eros Now had 14M subscribers (and 19M subscribers as of March 2015). Between March 2015 and June 2015, EROS claims it added 5 million subscribers. Somehow that was accomplished with lower advertising spend year over year. Between June 2015 and October 2015, EROS claims it added another 3.5 million subscribers. We are awaiting the financials to see if there was any correlation with a pick-up in marketing spending.

We also believe YouTube data calls the Eros Now subscriber numbers into question. As of March 2015, YouTube has 60 million users in India. Per alexa.com, India is the source of 9.5% of all visitors to youtube.com andyoutube.com has a global rank of #3 in terms of traffic. It is inconceivable to us that Eros Now could have half the number of users in India as YouTube yet its Alexa rank is thousands of spots below YouTube's rank. It is also not clear to us why a population that is happy with an advertising model rather than a subscription model would not be fully content relying on YouTube nearly exclusively for its video content. Our research has indicated that YouTube has more than 700 Indian movies available for download, including EROS movies.

Valuation

We believe that the company's persistent negative free cash flow, financial statements that make no sense, and growing debt levels and share counts make the stock most likely worthless. In the event that investors wish to rely on the company's financial statements (a mistake, we believe), then we would point out that fiscal-year 2015 EPS under the company's prior amortization policy was only $0.144. Even if the company could grow that to $0.20 this year (39% EPS growth) and achieve a growth company multiple of 25x EPS, the stock would still be worth only $5.00 per share. We believe that even $5.00 per share is much too high because it assumes that the company's financial statements can be trusted. We believe otherwise.

Conclusion

As a testament to its namesake, we believe EROS has infatuated investors with its story, blind to the ugly truth. Underneath the convoluted structure and reported earnings, EROS is a company that burns cash and continuously issues stock. We think the main benefactor has been the Lulla family. The promise of Eros Now, which has been pumped to the investing community during 16 events over the past five months, is a myth . Internet access, piracy, and competition in India will prevent Eros Now from meaningfully contributing to EROS' already non-existent cash flow. The lack of future prospects, absence of current cash flow, and concerns about accounting lead us to believe EROS is most likely worthless.

Appendix

EROS Corporate History

Arjan Lulla founded the film acquisition company, now known as Eros International Media Ltd. ("EIML"), in 1977. A partnership was formed under the name of Jupiter Enterprises in 1981 which included Arjan, as well as Kishore Lulla (Arjan's son) and Bhagibhai Lulla. In 1994, that company was incorporated as Rahima International Private Limited, and in 1999, EIML acquired the business. During 2008, the company was converted to a public limited company. The name was changed to EIML in 2009 and listed on the Bombay Stock Exchange and National Stock Exchange of India in June 2010. The business originally involved the purchase of Indian content for exploitation in international markets. However, our sources have indicated that the company is reputed to have been involved with pirating its own content and selling it within India.

Eros PLC was incorporated in the Isle of Man in 2006 and was admitted for trading on the Alternative Investment Market of the London Stock Exchange. At that time, Eros PLC owned EIML, but we have been unable to find any documentation of the purchase. Unfortunately, regulatory filings on the AIM exchange are not as well maintained as they are in the U.S. by the SEC.

On December 19, 2009, Eros PLC, EIML, and all involved subsidiaries entered into a relationship agreement. Under the agreement, EIML purchases Indian film rights, exploits the content within India, Nepal and Bhutan, and then licenses the international rights to Eros PLC for an upfront fee equal to 30% of the production costs plus pre-approved distribution expenses with an additional mark-up of 30%, or 39% of EIML's upfront costs. Additionally, Eros PLC pays Eros International Media (via its Eros Worldwide Dubai subsidiary) 30% of the gross proceeds it receives from exploiting the content internationally. This agreement expired on February13, 2014, but was extended for an additional two year term. With the basis of the whole business model up for renegotiation in less than four months, we are surprised that there has been no discussion of this topic either by the company or the sell side.

In April 2012, the shareholders of Eros PLC approved a resolution to cancel its admission on AIM following its listing on the NYSE. However, due to financial reporting and control issues, its admission to the NYSE was delayed until November 2013. EROS has a dual share class structure with Class A shares having 1 vote and Class B shares having 10 votes. Class B is entirely owned by the Founders Group: Beech Investment Limited, Olympus Foundation, Arjan Lulla, Kishore Lulla and Vijay Ahuja. As of March 2015, 53% of the shares are publicly traded, with insiders holding the balance.

If this isn't complicated enough, it is important to understand the organizational structure and related parties. Eros PLC is at the top of the organizational chart. Eros Network Ltd. was incorporated in the UK June 2006, and appears to be the subsidiary responsible for all international distribution. Eros International Ltd. was also incorporated in the UK June 2006, and it is not clear why this layer exists. Eros Worldwide FZ was incorporated in UAE June 2006, and owns the subsidiaries responsible for acquisition of content and distribution within India. Eros International PTE and Belvedere Holdings PTE were both incorporated during 2010 in Singapore. We have been unable to ascertain what these companies do. Acacia Investments Holding was incorporated in 2008 in Isle of Man, and is the holding company for a 24% ownership stake in L.M.B. Holdings, which operates B4U Music and B4U Movies.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.