”Basket-cases”? ”Frontier economies”? How about ”phoenixes”?

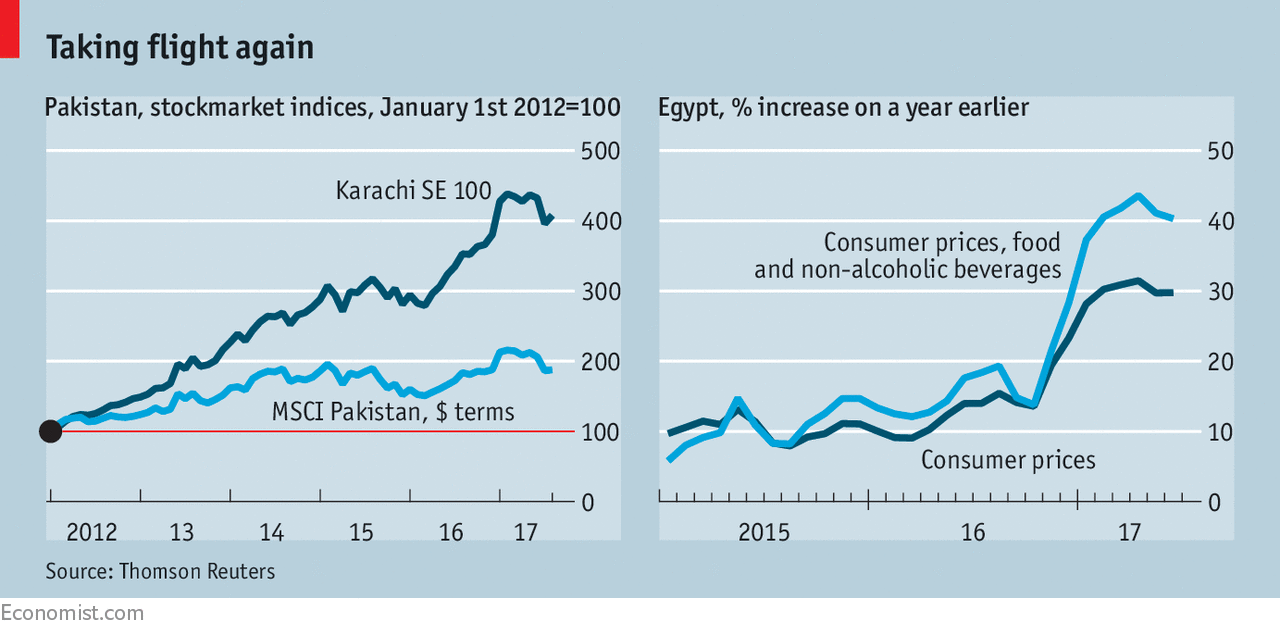

NAWAZ SHARIF is the ex-prime minister of Pakistan again. His third stint in the job ended on July 28th after the Supreme Court disqualified him from office. Yet he could justifiably claim that he left Pakistan’s economy in a better state than he found it. When Pakistan last went to the polls, GDP had been growing at around 3%, a dismal rate for a poor country with a burgeoning population. Inflation was above 10%. The budget deficit had ballooned. A crisis loomed. Four years on, inflation is in the low single digits. The budget deficit has shrunk to a little above 4% of GDP. The GDP growth rate is closing in on 6%. Investors too have taken notice. Since 2012, Pakistan’s stockmarket capitalisation has doubled in dollar terms (see chart).

Pakistan is not Sweden. It remains at the wrong end of global rankings of security, corruption and human development. At the last count, almost 30% of the population were living in poverty. Yet a crisis-prone economy has at least been put on a steadier footing. In the process, Pakistan has become something of an investment darling. It is thus a template for a particular kind of turnaround, one that reflects an upgrade in macroeconomic policy.

Bounce-back stories of this kind are quite rare, because the reforms needed are initially painful. They are typically found in what are called “frontier markets”, which lie beyond even emerging markets at the riskiest edge of the investment universe. Not all such markets will follow the path taken by Pakistan. A more apt description for one that has come back from the near-dead to a tolerable life might be “phoenix economy”.

Which places fit the bill? The spectrum runs from disaster zones, such as Zimbabwe (or even Venezuela), which might one day bounce back; through early-stage recovery stories that may yet falter, such as Argentina, Egypt and perhaps Nigeria; to graduates, such as Pakistan or the Philippines, which has been “flavour of the month for about ten years” in the words of one frontier investor. Not much unites such economies beyond a history of bad management. But there are some common themes. Politics are usually unstable. The army lours over Pakistan, Egypt and Nigeria, for instance. And phoenixes tend to go through the same three phases: a crisis, or “ashes” stage, as trouble comes to a head and capital flees the country; a “response” stage, where a politician grasps the reform nettle, often with IMF support; and a third “rebirth” stage, as capital is lured back by the prospect of economic recovery.

Start with the ashes. Circumstances will differ from country to country but the general pattern is quite similar. The economy hits a financial constraint: sometimes it is the budget deficit; more often the trade deficit. Investors become loth to offer financing. Interest rates shoot up. The flow of foreign capital dries up or—worse—capital begins to flee. The currency is propped up by intervention: foreign-exchange reserves are run down to sustain the illusion that it is worth more than it really is. Reserves grow thin. Hard currency is rationed, creating shortages of essential imports. The economy falters.

The triggers for crisis vary. A weak spot in Pakistan, for instance, was its reliance on oil imports to fuel much of its electricity supply. When the price of crude rose above $100 a barrel in 2013, the cost of the government’s fuel subsidies blew out its budget deficit. In Egypt the constraint was its current-account deficit, which widened from 0.8% of GDP in 2014 to 5.6% by 2016. The descent in the oil price hit fees from the Suez canal and crimped the value of remittances from oil-rich neighbours. Security fears led to a drop in revenue from tourism.

The second stage of a turnaround sees the realisation that orthodox exchange-rate, monetary and fiscal policies are required. This usually means allowing the currency to fall, cutting the budget deficit by trimming wasteful subsidies, and using monetary policy to control inflation rather than to finance the government.

It is not enough for senior technocrats to argue for such changes. The head of government must back the reforms. Andrew Brudenell, of Ashmore, a fund manager, says that once an example is set from the top, the effect trickles down to other institutions. A big plus is a high-profile champion for policy changes, such as Mauricio Macri, Argentina’s president, who was elected on a platform of economic reform. Often the IMF will be brought in to lend hard-currency reserves and policy advice. Egypt began a three-year IMF programme last November. Pakistan signed up to its most recent one in September 2013.

That is often the cue for the rebirth, during which capital flight goes into reverse. Attracting capital back is “somewhere on the scale between pretty important and absolutely crucial”, says Paul McNamara, of GAM, a fund-management firm. It takes a while to shrink a big current-account deficit, even with a cheaper currency. Capital inflows are thus needed both to finance the residual deficit and to rebuild foreign-exchange reserves.

The first people to tempt back are those citizens who shifted money offshore ahead of the crisis. The lure of high interest rates (needed to curb inflation) and the diminished currency risk that follows a big devaluation will tempt others, too. For instance, foreign investors now hold almost a quarter of Egypt’s treasury bills, according to JPMorgan Chase. Tax amnesties are another way to tempt money back. Argentina raised $117bn in 2016-17 in that way.

The hope is that within, say, two years of the crisis, inflation has peaked, the economy is growing at a decent rate and the current-account deficit is manageable. That then provides a platform for more reform and a period of crisis-free economic growth. But lots can go wrong.

A danger is that hardship and social unrest derail the reform process. Cuts to subsidies on top of big devaluations in both Argentina and Egypt have pushed up inflation rates to 22% and 31% respectively. In Egypt food-price inflation is close to 40% (see chart). Even so, in both places the economy is starting to pick up steam. Optimists hope Nigeria is in the very early stages of another turnaround, but there have already been a few false dawns. Nigeria bounced back impressively from a slump in the price of oil, its principal export, in 2009. Its reform champion was Lamido Sanusi, the central-bank governor, who won plaudits for taming inflation and cleaning up the banks. The stockmarket boomed. But the reforms dried up. Mr Sanusi was sacked. By 2016, Nigeria’s economy was deep in trouble again.

There are risks even for graduates of the phoenix-economy school. Once a modicum of stability returns, the impetus for further reform often fades. Take Pakistan. Since it reached the end of its IMF programme last year, there has been a slackening of fiscal and monetary discipline and a re-emergence of old problems in its power companies. The prospects for faster growth now rest on Chinese investment in a 3,000km (1,875-mile) China-Pakistan Economic Corridor, or CPEC. But that also puts Pakistan in a familiar spot: a reliance on foreign capital, which can turn out to be fickle and expensive. Trouble would take a while to surface. By then, investors may be talking about the big turnaround in Zimbabwe or Venezuela.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.