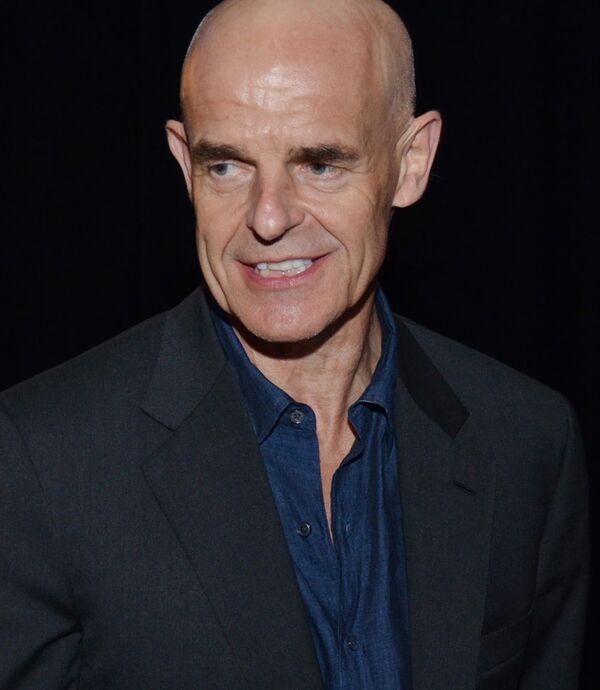

If an oil trader so good that he was known as “God” can’t win in today’s markets, it’s hard to imagine who can.

Andy Hall is closing down his main hedge fund after big losses in the first half of the year, according to people with knowledge of the matter. His flagship Astenbeck Master Commodities Fund II lost almost 30 percent through June, a separate person with knowledge of the matter said, asking not to be identified because the details are private.

The capitulation of one of the best-known figures in the commodities industry comes after muted oil prices wrong-footed traders from Goldman Sachs Group Inc. to BP Plc’s in-house trading unit. At least 10 asset managers in natural resources have closed since 2012, including Clive Capital LLP and Centaurus Energy LP. Goldman Sachs reported its worst-ever result trading commodities in the second quarter.

“I’m shocked,” said Danilo Onorino, a portfolio manager at Dogma Capital SA in Lugano, Switzerland. “This is the end of an era. He’s one of the top oil traders ever.”

Hall shot to fame during the global financial crisis when Citigroup Inc. revealed that, in a single year, he pocketed $100 million trading oil for the U.S. bank. His career stretches back to the 1970s and includes stints at BP and legendary trading house Phibro Energy Inc., where he was chief executive officer.

“Andy Hall is one of the grandees of oil trading,” said Jorge Montepeque, a senior vice president of trading at Italian energy major Eni SpA.

A representative of Astenbeck Capital Management LLC declined to comment. The Southport, Connecticut-based company managed $1.4 billion at the end of last year, according to a Securities and Exchange Commission filing.

Bullish bet

Hall appeared victim of a common curse of hedge funds: concentration in relatively small markets and debt leverage. "Hedge funds are almost by their nature levered players," Bill Gross, fund manager at Janus Henderson Group, told Bloomberg Radio. "To the extent that leverage is injected into a market, whether it’s about gold or about oil, one way or the other there is significant potential for damage and destruction."

Oil hedge funds such as Astenbeck wagered earlier this year that production cuts led by Saudi Arabia and Russia would send prices climbing. Yet, their bets backfired as U.S. shale producers boosted output and Libya and Nigeria recovered from outages caused by domestic disturbances and civil war.

“Andy Hall is not alone,” said Philippe Ferreira, a strategist at Paris-based Lyxor Asset Management that invests in hedge funds. “Even the best experts in the field cannot anticipate correctly future price changes. Most commodity specialists have suffered double digit losses so far this year on bullish trades turning sour.”

Against Tide

Hall consistently pushed against the bearish tide on oil this year, using investor letters to cast doubt on data showing rising crude supplies and arguing that a sustained rally was on its way.

Then last month he changed tack, telling investors that the global crude market had “materially worsened” and that prices may be stuck around $50 a barrel or below. Brent crude fell 22 percent from the start of the year to a low in June, and though it has since rallied, it’s still only about $52.

The fund closure shows “how the world of forecasting the oil market changed after the shale revolution,” said Anas Alhajji, an independent analyst and former chief economist at private-equity group NGP Energy Capital Management LLC.

Hall, 66, is also a prodigious collector of art who, with his wife and their foundation, owns more than 5,000 pieces by several hundred artists including Andy Warhol and Joseph Beuys. They exhibit some of it at Schloss Derneburg, a 1,000-year-old castle in Germany they bought in 2006.

“This is sad news,” said Jean-Jacques Duhot, chief investment officer at Arctic Blue Capital, a commodity trading adviser with nearly $200 million in assets. “Andy Hall has been one of the most respected risk-takers in the energy markets over the past few decades.”

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.