Governments skilfully tackled the symptoms, not the underlying disease

TEN years ago this month, America entered the “Great Recession”. A decade on, the recession occupies a strange space in public memory. Its toll was clearly large. America suffered a cumulative loss of output estimated at nearly $4trn, and its labour markets have yet to recover fully. But the recession was far less bad than it might have been, thanks to the successful application of lessons from the Depression. Paradoxically, that success spared governments from enacting bolder reforms of the sort that might make the Great Recession the once-a-century event economists thought such calamities should be.

Good crisis response treats its symptoms; the symptoms of a disease, after all, can kill you. On that score today’s policymakers did far better than those of the 1930s. Government budgets have become a much larger share of the economy, thanks partly to the rise of the modern social safety net. Consequently, public borrowing and spending on benefits did far more to stabilise the economy than they did during the Depression. Policymakers stepped in to prevent the extraordinary collapse in prices and incomes experienced in the 1930s. They also kept banking panics from spreading, which would have amplified the pain of the downturn. Though unpopular, the decision to bail out the financial system prevented the implosion of the global economy.

But the success of those policies, and the relatively bearable recession that resulted, allowed governments to avoid more dramatic interventions of the sort which, after the 1930s, gave the world half a century of (relative) economic calm. By reducing the need for radical innovation, the speed and efficacy of the response left the world economy less reformed and so vulnerable to the same forces that made the crisis possible in the first place.

Several shortcomings stand out. In dealing with the Depression, governments ultimately discarded the gold standard, the global currency regime that helped propagate the disaster. Countries on gold sacrificed monetary-policy independence, and had to respond to a loss of market confidence with an economy-bashing increase in interest rates, for instance. The system transmitted distress around the world. When one country acted to build up its gold reserves, others saw a sudden drain on theirs. The sooner a country left gold in the 1930s, the sooner its recovery began.

But the international system that facilitated the more recent financial crisis has been neither abandoned nor reformed. Open capital flows can put countries at the mercy of sudden swings in market sentiment. To manage this, many emerging markets accumulate foreign-exchange reserves, which can be drawn on in crisis. But these reserves add to a global glut of capital which depresses interest rates and encourages borrowing. Because reserves are so often held in the form of dollar-denominated bonds, they can destabilise the American economy. They also heighten the world’s exposure to American financial stumbles. This regime helped turn an American housing bust into a global crisis, and remains in place now. Although dangerous financial vulnerabilities in America will take time to build up again, the present financial peace is likely to be far shorter than the 75 years that separated the Depression and the Great Recession.

Big short memories

That would be less troubling had the world made itself more robust to future crises after the last one. In the years after the Depression, sweeping banking and financial reforms created new regulatory institutions and placed tight constraints on financial behaviour, which made finance a very boring industry for most of the next half-century. From the 1980s to the 2000s, those restrictions were largely undone: banks were given freer rein over the activities they could engage in and products they could create. The financial crisis could not have occurred without this liberalisation. Yet in its wake, the financial sector has been treated relatively gently. Oversight and disclosure have been improved and capital-adequacy rules toughened (see previous story). But some of these rules are now being relaxed, at least in America, and the financial industry’s weight in the world economy has scarcely changed. As a share of American GDP it has actually increased somewhat since 2007.

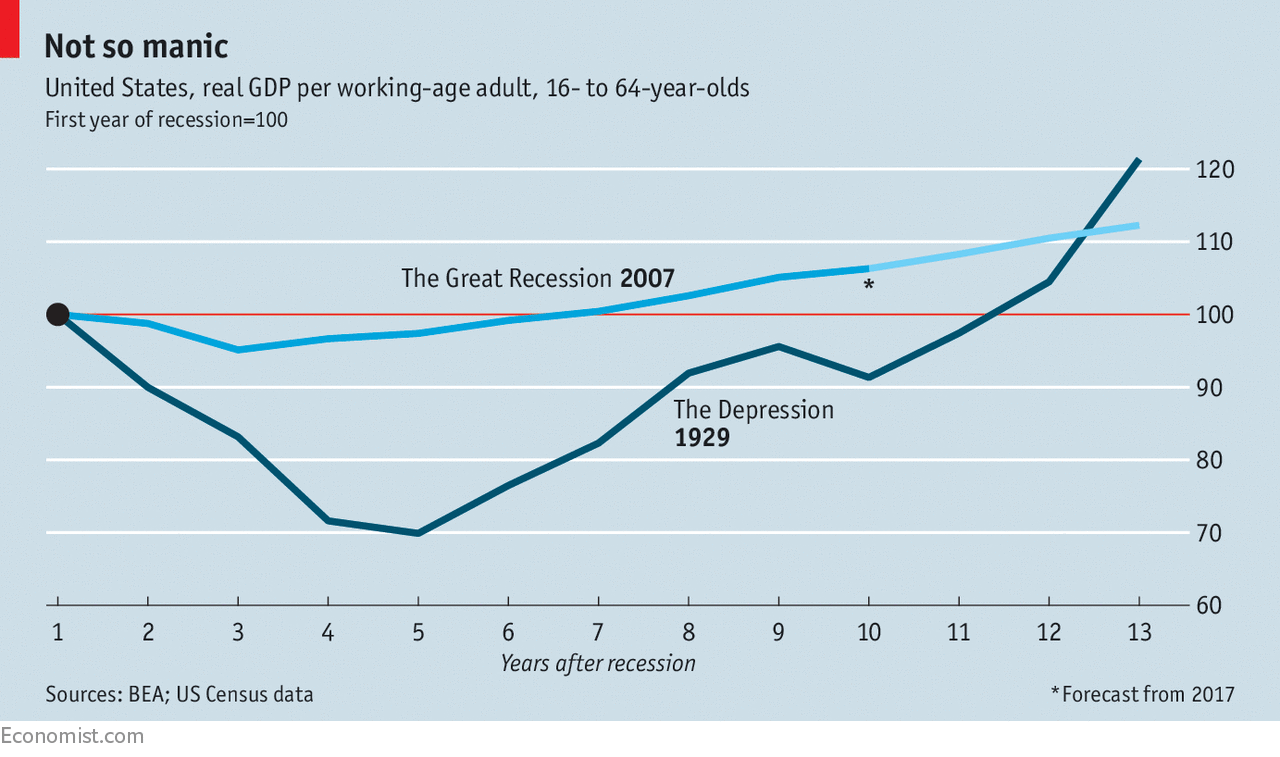

The stabilisation policies used in the Great Recession were vastly superior to those of the Depression. But today’s governments have done a worse job of learning from experience than did their forebears. Franklin Roosevelt did not simply seek to restore growth. Rather he promised reflation in order to make up the ground lost during the downturn. After the Great Recession, in contrast, most central banks (the Bank of Japan being a notable exception) were content to prevent prices falling, and have not actively worked to make up lost output. As a result, the recovery has been much weaker than in previous cycles, including the Depression (see chart), and monetary policy has taken longer to return to normal, leaving economies poorly prepared for the next recession. Similarly, the Great Recession demonstrated the value of automatic fiscal stabilisers, but governments failed to seize the opportunity to link tax and benefits more closely to the business cycle. Indeed, rules that have recently been adopted, such as Europe’s fiscal compact, constrain rather than harness fiscal policy.

The Depression enabled radical change by discrediting untrammelled capitalism and the elites who supported it. That had dangerous side-effects: it also empowered fanatical and dangerous political outsiders. Though financial and political elites were not spared a populist backlash after the Great Recession, they have largely kept their seat at the table, blocking the enactment of bolder reforms. The success of the response to the downturn helped avoid some of the disasters of the 1930s. But it also left the fundamentals of the system that produced the crisis unchanged. Ten years on, the hopes of radical reform are all but dashed. The sad upshot is that the global economy may have the opportunity to relearn the lessons of the past rather sooner than hoped.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.