Being the world’s trade policeman is tough work

EVERY Tuesday, senior members of the administration gather in the White House to discuss trade. They are divided between hawks, who argue that America needs to be tougher in its defence against what they see as economic warfare waged by China, and doves, who worry about the costs of conflict. So far, against all expectations when President Donald Trump entered the White House, the doves have prevailed. The first of a series of legal deadlines could soon unleash the hawks.

Last April Wilbur Ross, the commerce secretary, initiated a probe into whether steel imports were a threat to America’s national security. His department pointed to a “dramatic” increase in steel imports over the previous year and to the idling of nearly 30% of America’s steel-production capacity, as imports feed a quarter of its consumption. If the report, due by January 15th, finds imports are a threat, Mr Trump, under Section 232 of the Trade Expansion Act of 1962, will have 90 days to respond.

The report’s conclusion is not in much doubt. The government is likely to argue that steel is important for the defence industry. It is used to make navy ships and submarines; “exotic” high-strength, low-weight alloys are used for fighter jets. The armed forces use only a tiny fraction of domestic steel output, but some producers claim that to make the requisite high-end specialised steel, they rely on selling lower-quality stuff in volume to cover their fixed costs. The government can also consider the importance of steel to America’s “critical infrastructure”, including chemical production, communications and dams.

In fact, a hefty chunk of America’s steel imports come from long-standing allies, like Canada and the EU, rather than China, the hawks’ real target. And an investigation into iron ore and semi-finished steel in 2001 found that on a broad definition, an upper limit for the fraction of domestic production required by critical industries was only 31%. It is unlikely to be very much higher now. But the law is so vague that the government can decide as it wants.

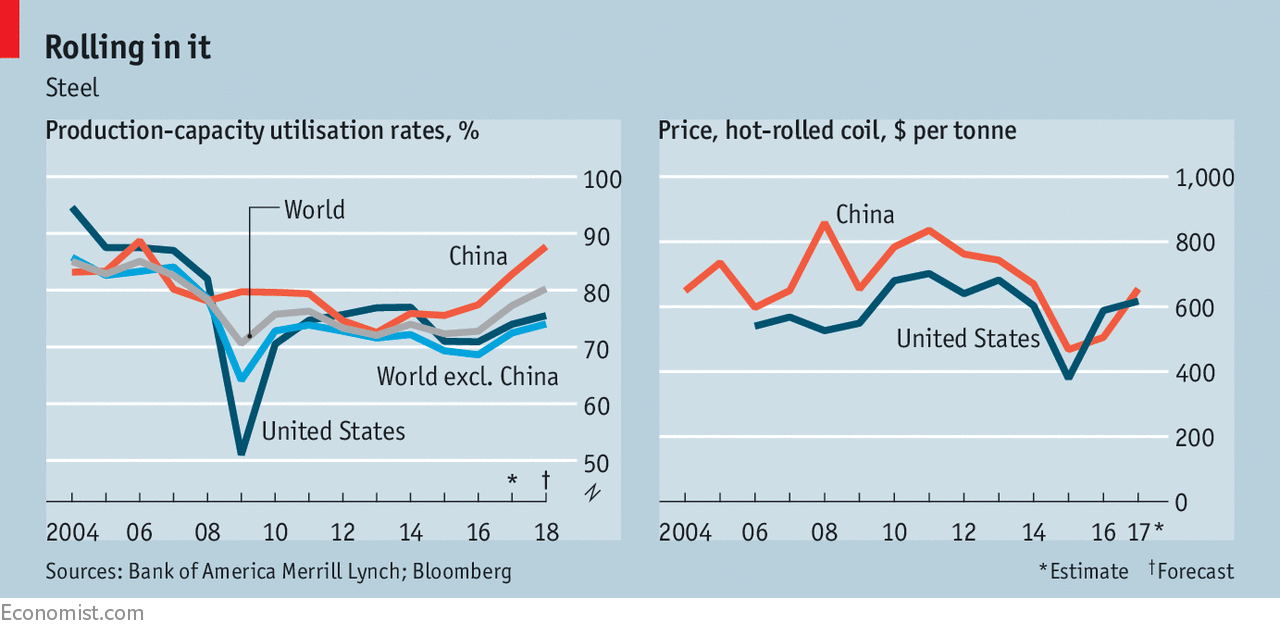

The national-security case may be specious. But the Trump administration is right that the world has too much steelmaking capacity. The industry has long been prone to bloating, because of state support that blunts price signals. This time, China is the main culprit. Its production bulged from 15% of the global total by volume in 2000 to 50% in 2016. When its domestic demand declined, exports rather than plant closures took the strain, and mills elsewhere were left idle. Excluding China, global capacity use fell from 86% in 2004 to 69% in 2016 (see left-hand chart).

Even so, it is hard to blame China for all the world’s steel woes. A document seen by The Economist, produced in August by Mr Trump’s Council of Economic Advisers, suggested that the surge of steel imports in the first half of 2017 was consistent with changing domestic demand, not dumping by foreigners (nor did it seem, as some suggested later, to have been fed by importers stockpiling steel in anticipation of tariffs).

The steel market’s struggles may be abating. Analysts at the OECD, a think-tank, reckon global capacity stopped growing in 2017. Research from Bank of America Merrill Lynch (BAML) suggests that hefty cuts in China mean it is on track to use a full 88% of its capacity in 2018. Steel prices have rallied (see right-hand chart). There is further to go. Global capacity-utilisation rates need to be five to ten percentage points higher to give steel mills sustained pricing power, says Michael Widmer, a metals strategist at BAML. And, unlike cutting subsidies, paring capacity by decree, as China has, will not stop the problem recurring.

Some in the Trump administration see steel as part of a much bigger problem of Chinese mercantilism. They worry that China plans to build enough capacity in strategic industries to weaken, and ultimately destroy, America’s. Even if this is alarmist, influencing China is extremely difficult. A multilateral initiative last year to curb excess capacity yielded some recommendations, such as limiting subsidies and sharing information. But action is voluntary, and the data self-reported. China’s recent cuts have been driven less by pressure from the West than by domestic imperatives such as cutting pollution.

The Trump administration may now lash out unilaterally. According to one person familiar with its internal debates, some argue for the hammer of a broad tariff, while others prefer the chisel of a narrower mix of tariffs and quotas directed at particular products. Others still favour doing nothing, arguing that trade measures would complicate the handling of delicate international issues, such as North Korea’s nuclear programme.

The costs of severe trade restrictions would indeed be great. As a result of 48 existing defensive duties on steel imports from China, they represent a mere 3% of America’s total. Broad trade barriers would upset America’s allies, invite retaliation and raise costs for American steel consumers. A legal challenge would give the World Trade Organisation the dangerous task of arbitrating over America’s perceived national-security interests.

Narrower restrictions would hurt less, but raise the chances of imports leaking into America anyway. Using the report as a threat to trigger negotiations could be the least damaging option. But others might question whether the threat of tariffs is credible, given the self-harm they entail.

For a year Mr Trump has refrained from a big trade confrontation. This is the most serious test yet of the doves’ ability to keep him from scratching his tariff itch. Document on desk and pen in hand, he may feel he has to do something. When it comes to steel, there are no good options.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.