-By Robert Kiyosaki

Most people know me for my best-selling book, Rich Dad Poor Dad.

It told the story of my poor dad, my real father, who taught me to get an education, so I could get good grades… get a good a job… and work for a good paycheck…

And my rich dad, who taught me to work for assets so my money could work for me.

But what far fewer people know is that I have another rich dad…

One that taught me a method for seeing into the future.

It’s not a system many people know. Its origins don’t come from finance, either.

But when I learned it years ago, I began to see beyond the limits of linear time and space to find the truth.

The truth about human behavior, purpose, engineering, architecture, technology and yes, even money.

It’s helped me throughout my career find my mission in life…

It’s helped me build the successful Rich Dad Co…

And it’s helped me and my wife, Kim, create a multi-million-dollar real estate empire that provides us with tax-free cash flow year after year.

Today, this same method is pointing to one opportunity just over the horizon that few people are paying attention to. A hidden play on a financial story that’s been splashed on the front pages for days now.

I’ll share it all with you in just a moment. But first, to fully understand everything…

We Need to Rewind the Clock to a Sunny Day in April of 1967

I was 20 years old, standing on the side of this highway with my thumb out.

I was hitchhiking a ride from Kings Point, New York, to Montreal.

I was going to Expo ‘67 — the World’s Fair on the future. It was in Montreal. The centerpiece of the World’s Fair was the U.S. Pavilion, a massive geodesic dome that could be seen for miles.

The creator of the dome was a brilliant man, considered to be one of the greatest geniuses of our time.

And I made the trek to meet him in particular.

He supposedly could see the future.

In fact, his reputation as a futurist earned him the nickname “Grandfather of the Future.”

It seemed appropriate that the U.S. government had chosen his dome, a structure that represented the future, to be the U.S. Pavilion.

When I attended his lecture and heard him speak about the systematic way you and I can actually see the future…

I knew I had to make some changes. I knew I had so much to learn from this man.

And I knew my life wasn’t going to be the same.

His Name was Dr. R.Buckminster Fuller

Some called Fuller an enigma, someone who could not be defined.

If you research him, you’ll see that Harvard University claims him as one of their more prominent alums… but he didn’t graduate from Harvard. In fact, he never graduated from college at all.

Despite never graduating, he was awarded 47 honorary degrees over his lifetime.

Yet he often referred to himself as “just a little guy.”

I refer to him as “Bucky”… and I consider him my other rich dad and teacher.

Bucky taught me so much about how the world works and how to become truly wealthy ― mentally, physically, spiritually and financially.

After reading his book Grunch of Giants in 1983, I began to understand why the subject of money is not taught in schools.

GRUNCH is an acronym, which stands for Gross Universal Cash Heist.

Up until then, I didn’t have the courage to criticize the school system.

Like many, it was beaten into my head that schools and teachers were smarter than the rest of us, that they knew best and had our best interests at heart.

Reading Bucky’s work confirmed many of my unspoken — even unconscious — suspicions about the way the world worked.

I began to understand why we don’t teach kids about money in school. Our educational system is rigged to only allow education in money to the uber-rich and powerful.

This system has no interest in creating a well-educated nation and populace.

What they want is a world filled with obedient employees, soldiers and consumers. Bodies to buy their products, fill their factories and fight their battles for them.

The more I studied people like Bucky, the more angry I became.

But Bucky wasn’t focused on the negative…

He focused on improving humanity’s future through acting on opportunities. He even inspired John Denver’s lyrics “grandfather of the future” in his song “What One Man Can Do.”

Fuller is considered one of the most accomplished Americans in history, having more than 2,000 patents after his name.

I believe he made 50 predictions in his life. And, at the time of his death on July 1, 1983, 48 of his predictions had come true.

One of his last predictions was that a revolutionary new technology would enter the system before 2000. And of course you know how the internet emerged before 1990.

I mean it when I say Bucky had a method for seeing the future!

Several years after the World’s Fair, after attending one of his talks, I got the chance to study under him.

That’s when I learned his method first-hand…

The Power of Precession

Dr. Fuller taught me an important framework for thinking called the Law of Precession.

It can be used to peer into the future… and to decipher where the truly great investments are.

The term precession comes from physics. Technically, it is the change in a rotational axis… around an axis… around another body…

But here’s a simpler way to think about it.

The Law of Precession simply states that for every action we take… a 90-degree side effect will form. That side effect will produce its own path (creating an L).

Here’s another way to think of it. What happens when a drop of water falls into a still pond?

Ripples go out, right?

Those ripples are the side effect of the water drop.

Or, think about honey bees. They spend their lives flying from flower to flower collecting nectar to make honey.

They act as if that’s their purpose but their true and (and much larger) purpose is to pollinate the flowers.

You can apply Dr. Fuller’s little-known law, to business and investment. Advancements in technology start-ups, partnerships, etc., can all cause ripple effects of opportunities.This simple but effective method of going beyond the surface and asking questions will help you see that there is always an opportunity.

No matter what a deal looks like to investors, someone somewhere is making money off of it.

A restaurant fails, the equipment supplier made money.

An office full of people gets laid off, the contractors that hung the drywall made money.

No venture is a failure to those who can look beyond the mundane, beyond the layers, beyond the straight lines, beyond rules and even beyond time.

Technology’s Accelerating Acceleration

Bucky Fuller once said that the speed of change will increase exponentially, the speed of progress getting faster and faster, compounding upon itself.

He went on to talk about a new technology that would explode before the end of the decade.

He said this technology would create change moving so fast it would become invisible — it was a concept he termed in an article called “Accelerating Acceleration.”

As an example, he used the rapid advance of aviation technology.

Think about how amazingly fast flight technology has expanded in the past century.

In 1903, the Wright Brothers flew the very first sustained airplane flight.

In 1969, we put the first man on the moon.

In 1981, we had the first NASA shuttle launch exceeding 18,000 mph.

And today, space travel is entering the private sector with aspirations of colonizing Mars… which we’ll get into momentarily. This is accelerating acceleration.

Technology, and how that technology affects business, is changing at such a rapid pace it is nearly impossible to keep up.

“We are entering the world of the invisible…”

That really stuck with me.

But as unpredictable, uncontrollable and scary as that may sound, he said something else that intrigued me…

By tracking the rate at which technology advanced, he claimed he could predict the future. This would be change moving too fast for us to actually see, though.

What did that mean?

Clarifying, he said, “Humans could see the automobile. They could see that change. If a car came toward them, they could get out of the way.” Because they could see the car, they could adapt and make changes to their lives.

But future inventions, he claimed, would be invisible.

Was he talking about cellular tech? Was he talking about the internet?

This is the man who came up with the theory of ephemeralization… the ability of technological advancement to do “more and more with less and less until eventually you can do everything with nothing.”

We can only guess what Fuller would have to say about the rapid growth of the information age.

We can only guess his feelings about a world where information is available to everyone, at all times.

Today, people are being replaced by technological innovations they cannot see and that they do not understand. Millions of people all over the world are unemployed because their skill set is no longer needed.

They are obsolete.

The teachings of our school systems, more than any time in history, set us up for a doom scenario. By the time you’re a junior in college, the expertise you’ve gained is outdated.

We cannot rely solely on careers and paychecks any longer. We cannot invest in whatever hot company comes along and expect to become a paper millionaire. Those days are over. We must train ourselves to look deeper. To examine the secrets of wealth.

Once I understood what Dr. Fuller meant by accelerating acceleration, I took decisive action to stay ahead of the curve. I have no plans to become obsolete. I’m not waiting for the economy to come back.

I’m working hard to stay ahead of an exponentially accelerating economy.

And that’s what I want you to do too…

The Art of Precessional Investing™

I have taken Fuller’s teachings and applied them to the financial world.

I call this method Precessional Investing™.

It means identifying something different from what a novice investor would identify as an opportunity.

Some people mistake it for being a slight tweak in their investment strategy. If they are looking into investing in the stock market, they might think it means to trade in and out of the market quickly.

To me, that’s just gambling. In my opinion, day trading is no better than playing the craps table. In fact, the craps table is better — at least you get a free drink!

When I talk about Precessional Investing™, I’m talking about something else entirely. It involves perspective and it involves research…

It takes an educated investor to look at their investments like a battlefield.

You must know the terrain, you must know the weather, you must know what’s on the horizon.

You must know when to advance, and, most importantly, you must know when to retreat.

Cutting the Bull…

Why do I talk in analogies so much? Because jargon is the language of secret keepers, not real teachers.

Many so-called experts want to sound intelligent, so they use uncommon words like “credit default swap” or “hedge” to baffle the average person. Both terms simply mean forms of insurance, but God forbid the experts use

that word.

Experts like to seem special, almost magical, and magic isn’t as impressive when everyone knows the trick.

Dr. Fuller writes, “One of my many-years-ago friends, long since deceased, was a giant, a member of the Morgan family. He said to me: ‘Bucky, I am very fond of you, so I am sorry to have to tell you that you will never be a success. You go around explaining in simple terms that which people have not been comprehending, when the first law of success is, ‘“Never make things simple when you can make them complicated.’”

My goal has always been to cut the bull. To take all the big words that everyone else is using, and make things simple. It was Dr. Fuller’s mission to teach the world, not to keep knowledge hidden behind clever words.

Dr. Fuller was adamant about the power of words. During one of his lectures I attended, he said, “Words are the most powerful tools invented by humans.”

Before I studied under Dr. Fuller, I had never respected the power of words. Words were just something people wasted. But in reality, they can be a tool used to get what you want.

I had flunked out of high school English twice. I did not respect the power of words. But by not respecting the power of words, I had denied myself the power to change my life, to change the lives of others.

I realized that words are the fuel to our brain — our greatest asset, and also our greatest liability. That’s why I believe that, in 1903, financial vocabulary was taken out of the educational system intentionally.

It was during this period that the “Industrial Revolution” had evolved into the “Machine Age.”

Huge conglomerates and corporations had formed and needed trained workers to keep their assembly lines running. The world’s richest families looked at the population and wondered how they could incentivize the people to train themselves for labor. It’s believed that this is when the rich realized that they didn’t need to incentivize workers if the choice was simple: work or starve.

If the average person is denied the tools and knowledge to understand how money really works, they’ll believe that their only option to take care of their families is to work till they die.

The idea of precession’s application to money was stolen from generations of people. By removing the knowledge that could free the masses, a nation has been created to work, earn a check, repeat, repeat, repeat… until death.

I knew I would always be a pawn, victim, or slave of the conspiracy if I didn’t understand and use the words the conspirators used. It was at that point that I stopped myself from using the words like “Get a good job,” “Save money,” “Live below your means,” “Investing is risky,” or “Debt is bad.”

Still today, our children are taught to believe only what the educational system wants us to believe. They are taught: follow insctructions, don’t look below the surface, don’t break the rules.

But if children only ever learn to stick to the status quo, they’ll never have any idea of everything they’re missing out on.

The key is education and seeing the precessional opportunities.

But most people have never learned Bucky Fuller’s Law of Precession.

The schools created their educational system to cater to the mass labor agenda.

They taught students that there was one path to “success” — getting a job, collecting paychecks, collecting government benefits, climbing the ladder… you know, the story we’ve been told our entire lives.

And they taught, and continue to teach, that any deviation from that path means ruin.

The students who believed that garbage cling onto their blue chip stocks for dear life or throw their money into the government machine, hoping to one day be rewarded for their years of patient service. There are still droves of financial lemmings following the line of Amazon and Apple off the cliff, not realizing that fame alone is unlikely to result in dividends.

The Biggest Example of This Today Is Tesla

At writing, the news is in a frenzy about Elon Musk and his company Tesla.

It’s a perfect example of a surface story everyone is paying attention to when they really should be looking for the Precessional Investment™.

Tesla is the next flashy brand to offer an overvalued stock to uneducated investors.

Musk has leveraged his sense of showmanship in a way not seen since the golden age of Apple, when Steve Jobs would have the world glued to their laptops, watching a four-hour keynote speech like it was the Super Bowl.

Much like Jobs, Musk has used his showmanship in equal parts to create his vision and tech-savvy companies, promising dreams of living in the future made real. He dominates the corporate news cycle with stories of private space exploration… mass transit systems that remind me of something from a Jetsons cartoon… and even personal flamethrowers (my team member is holding one of the flamethrowers in the photo below. It’s from Musk’s The Boring Co.)

But what remains of Musk’s companies when the flash fades away?

They are captivating, innovative and exciting, and — let’s be honest — have yet to turn a profit.

Sure, Tesla vehicles zip around every major city in America. And SpaceX has been responsible for blasting rockets into low orbit and returning them safely to Earth under their own power (a feat even NASA could not accomplish).

As a citizen of the world, all that is impressive.

But none of it turns my head as an investor.

Remember the Third Side of the Coin

All we have seen the past few weeks on the news, in the paper, wherever you look: Elon Musk and his Twitter rants.

The best thing about geniuses is you never know what they’ll do next.

And the worst thing about geniuses is you never know what they’ll do next.

Whether you concede that Elon Musk is a genius or not, it’s hard to deny he has all the unpredictability and volatility of his spiritual predecessor Steve Jobs.

Jobs was notorious for his ruthless production demands and unpredictable moods. It was said that if you were unlucky enough to get on an elevator with Jobs on the fourth floor, you could end up fired by the time you hit the lobby.

One thing Steve Jobs had going for him was his general indifference toward social media.

Musk, on the other hand, can’t seem to keep his thoughts to himself and has what some would call a compulsive Twitter habit.

For anyone else, a heat-of-the-moment rant on Twitter would be embarrassing…

But for the CEOs of several major corporations, it’s a whole different can of worms.

One Twitter tirade from Musk is enough to push Tesla investors over the edge.

Why?

Because the current trend is that anytime Musk opens his mouth, or rather, whips out his cell phone, Tesla’s stock plummets.

Was he trying to manipulate stock prices?

Was he being genuine?

Was he drunk?

I don’t know. And it doesn’t matter.

Remember what I wrote in the welcome cover letter to this issue.

There are three sides to every coin. Heads, tails and the edge.

The truth exists in grayscale, not black and white. The capability to hold two perspectives at once is what makes the strongest investors.

So the question you have to ask is…

Who Wins No Matter How Tesla Performs?

This is where we get back into Precessional Investing™.

Precession tells us we should not go with the surface opportunity everyone is paying attention to.

We should examine the all other pathways that come from or lead to that surface opportunity.

Look at the ripple effect of opportunities that are set in motion by that first “obvious” investment opportunity.

Why?

Because sometimes those opportunities are richer by a long shot.

Let me give you an example of what I’m talking about…

Rockefeller Always Got Paid Thanks to Precession

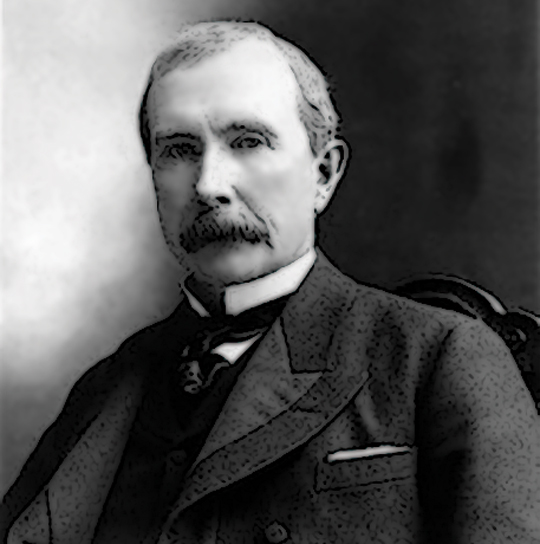

Look at Standard Oil, the company founded by John D. Rockefeller.

By most accounts, it was the most profitable company in American history, run by perhaps the single- wealthiest human being in modern history.

In the 1870s, he gained his wealth through his creation of Standard Oil Co.

Big shock right?

Except that he wasn’t content to invest in just oil…

Rockefeller also saw a huge chunk of money exiting his company through packaging (oil needs barrels) and logistics (you can’t burn oil in California if it’s stuck at a train station in Ohio).

To make sure he was in on it, Rockefeller used precession to see the opportunities beyond the obvious.

He invested his sizeable wealth into gaining influence over storage facilities, as well as the railroads that zipped back and forth across our growing nation.

Why did he invest in those spaces when he was already a billionaire?

Because the only thing better than profiting from your own oil is profiting from everyone’s use of oil.

By the time Rockefeller was done, there was nowhere to hide…

You wanted to burn oil? You paid Rockefeller.

You wanted to store oil? You paid Rockefeller.

You wanted to transport oil? You paid Rockefeller.

The lesson here is simple.

Be like Rockefeller. Use precession. Look at one opportunity and see the opportunities that surround it.

And that brings me back to Musk and Tesla…

Tesla Bears… Tesla Bulls… Tesla Precessionals

At writing, Bloomberg reports “the SEC” is intensifying its probe of Tesla… in the wake of Elon Musk’s provocative tweet Tuesday about taking the electric-car company private.”

A lot of smart investors who are “Tesla bears” say this is the beginning of the end for the stock and to short it…

A lot of smart investors who are “Tesla bulls” say now is an opportunity to go long the stock…

Here’s how I look at it as a precessional investor…

We already know that Musk is somewhat unstable, and we can see from that instability that there must be some struggles happening behind the curtain.

If you look at some news reports from recent months, you’ll see that a bigger picture is being painted here.

The Wall Street Journal reported that Tesla has been asking for refunds from some of its largest suppliers in a seemingly frantic attempt to close profit gaps and reclaim absent working capital.

It doesn’t take a financial expert to understand things aren’t ideal if a company is going hat in hand to its own subcontractors looking for a cash donation.

Other worrisome events include Tesla’s decision to end the $1,000 refundable deposit in its registration system for pre-ordered vehicles. Instead, they decided to require a non-refundable early payment of $2,500 for delivery of a pre-ordered vehicle.

You’d never imagine there were any concerns if you based your decisions on Tesla’s plans for catalog expansion.

Musk is more than happy to talk about plans to expand their vehicle production to commercial vehicles, SUVs, light trucks and residential energy storage (with solar aspirations being hinted at).

Tesla claimed they had 455,000 reservations for the Model 3 before they switched to the deposit system, but independent analysis suggests the number is actually almost 10% less than that.

Does this mean Tesla puffed its number?

Does this mean people’s excitement waned since the release announcement?

It’s hard to tell and you’re unlikely to get a straight answer from Musk himself.

Needham analytics downgraded Tesla to a “sell” status due to the slowdown in Model 3 pre-orders as well as (what they describe to be) Tesla’s “unsustainable capital structure.”

There are in fact many who see blue skies for Tesla and the Model 3 over the coming year.

Argus Analytics has said:

Strong demand for the new Model 3 alongside continued revenue gains for the Model S and Model X project significant sequential improvement in the second quarter, with the Model 3 likely to become Tesla’s top-selling vehicle and costing less for Tesla to build in 2019… We thus expect the company to achieve its target gross margin of 25% on the Model 3 in late 2019.

Regardless of the details, there is no shortage of reasons to shift focus away from Tesla as an investment opportunity and focus on precessional opportunities.

So where should you look if not to Tesla stock?

Let’s go through the method…

Since we’ve been standing on the edge of the coin and examining both sides of the Tesla argument, let’s examine everything we know about the motivations of Musk and Tesla.

What do we know for sure?:

- Tesla wants to produce the Model 3.

- ….That’s it.

That’s honestly the only conclusion you can draw with 100% certainty. Everything else is speculation.

We don’t know if Model 3 sales will remain positive over time.

We don’t know if Tesla will turn a profit.

We don’t know if Musk will derail company value with another social media tantrum… again.

Perhaps we should stop concerning ourselves with questions about Tesla’s profitability all-together.

Instead, use the precessional investment method to look into the future for the real opportunity!

Ask yourself:

- What opportunities does Tesla create outside its own assembly line?

- Who is profiting from Tesla manufacturing cars in the first place?

- What does every Tesla vehicle use?

The answer is clear…

Lithium Batteries… and Lots of Them

Lithium batteries are technologically advanced, efficient (by today’s standards) and most of all, expensive.

Someone somewhere is profiting from Tesla’s hunger for lithium, so who is it?

The Model 3 and every other Tesla run on lithium batteries (big ones) and Tesla is going to need an awful lot of them to meet a full production run.

So where is all this lithium coming from?

The Clayton Valley mine in Nevada is currently the largest known lithium mine in America and is under the control of Pure Energy Minerals (PEMIF).

You should take a look at the company. PEMIF is not only a powerful controlling force in lithium mining but an environmentally conscious innovator as well (all the better to keep company with Tesla).

PEMIF has developed a more effective and environmentally sound method of mining lithium, moving from an evaporation process to a natural solvent process, which is not only safer but more profitable.

Tesla struck a deal with PEMIF to acquire a “significant quantity” of lithium at a “predetermined price below current market rates.”

Do you see the inherent advantage of investing in PEMIF over Tesla?

PEMIF is supplying Tesla with lithium, which means they profit whether or not the Model 3 is profitable.

As long as Tesla is making cars, PEMIF is profiting from them, even when Tesla’s shareholders, executives and anyone in between are not.

Possibly more important than PEMIF’s leverage with Tesla is the fact that the majority of their business comes from other sources.

PEMIF has the potential to supply contracts with numerous companies.

Even though Tesla is a major client, if Tesla suddenly failed, PEMIF would not collapse. It would simply sell its lithium to its other customers.

Here are some varying uses for lithium to show this point:

Energy storage: The most important use of lithium is in rechargeable batteries for electric vehicles, energy grid storage, mobile phones, laptops, digital cameras and other small electronic devices. Lithium is also used in some non-rechargeable batteries.

Lithium alloys: Lithium metal is combined with aluminum and magnesium to form strong and lightweight alloys for armor plating, aircraft, trains and bicycles.

Optics, glassware and ceramics: Lithium is used to produce optics, glassware and ceramics.

Industrial/HVAC: Lithium chloride is one of the most hygroscopic materials known and is used in air conditioning and industrial drying systems.

Lubricants: Lithium stearate is used as an all-purpose and high-temperature lubricant.

Pharmaceuticals: Lithium carbonate is used in medications to effectively treat manic depression.

These are all products that reach into different markets.

This broad and established series of potential clients protects PEMIF against any significant drop in revenue. (They like doing business with Tesla, but they don’t need them.)

As if that weren’t enough, PEMIF’s share price (PEMIF) is currently $0.09 making it a significantly less expensive entry point for investors.

Investing in PEMIF is MUCH less expensive than Apple, Google or Microsoft, all companies who depend on a company like PEMIF, by the way.

This makes the potential for gains much greater. Since PEMIF is tied so snuggly to technology, as technology grows so does PEMIF.

PEMIF would be a strategic investment opportunity because of their product; lithium has multiple uses and will only continue to grow in demand as technology evolves.

PEMIF is attractive because it does not cost much to invest in at $0.09 a share.

There are a lot of ways to profit from stocks, though. Stocks can make you money going up AND going down. They can pay dividends (cash flow) and they can make money as options.

I would research other precessional opportunities in lithium too, outside of PEMIF.

It could be another lithium miner… a battery maker… or perhaps a different electric-car maker than Tesla, with better prospects that’s getting less attention.

If one looks attractive and pays a good dividend, then you might consider buying 100 shares of that stock.

This could make you money two ways:

- Dividend payments or…

- You can hold on to the stock and sell options on it.

Then you’d be cash-flowing two ways. You’d get your dividends and be renting out your stocks in the form of selling options.

If neither stock pays a dividend, I might try buying call options. Instead of buying the actual stocks, I would buy the option to buy the stock in the future. Then if the stock went up in value, I would sell.

Why would I buy options instead of the actual stocks?

Options are far less expensive so the risk is less, but the profit upon selling is the same.

It’s just another way to maximize your profit while minimizing the risks.

The Precessional Investing™ method is important to understand and practice for these three reasons:

- It’s how the rich invest

- There are more opportunities to be found

- It greatly minimizes risk

Being a successful investor means being in tune with the world.

Optimists love the idea of buying and holding on to their investments in hopes that they will pay off.

But if you plan on taking control of your future, you need to do better than just hope.

You need to educate yourself. Sir Francis Bacon

said often that “Knowledge is power.” Gain that knowledge and go down the road less traveled.

What You Should Do with This Information…

You should use this information to think for yourself.

Read more about lithium if that stood out to you.

Read more about options if that sounded interesting, but you don’t know enough.

You shouldn’t outsource your brain to me. That’s lazy. And laziness will keep you poor.

That’s why I’m not telling you not to invest in Tesla… or to dump your money into PEMIF.

I’m trying to show you that the choice right in front of your eyes is almost never the only path.

Most times the best decision is two steps away from the obvious thing everyone is focusing on.

You must have the awareness of an opportunity moving parts.

You must be able to see the choices that orbit and branch from one another. That is the core of Precessional Investing™.

Repeating the advice Buckminster Fuller received from his friend,

“The first law of success, ‘Never make things simple when you can make them complicated’.”

And that is what the financial world does. It takes the simple and makes it complex.

By making the simple complex, the financial world sounds intelligent and makes you feel stupid when it comes to money. When you feel stupid, it’s easier to take your money.

My objective has always been to make finance simple by creating financial education products such as games, books, web products, coaching, advanced financial education programs ― and now this newsletter.

You can be a kid or a Ph.D. and still understand our work.

The key to growing your options and your precessional opportunities is to keep growing your financial knowledge.

Play it smart,

Robert T. Kiyosaki

Editor, The Rich Dad Poor Dad Letter

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.