Rebalancing stops portfolios becoming riskier or safer than desired.

BENJAMIN GRAHAM is considered the father of value investing, the business of picking stocks that are cheap. He might also fairly be described as the father of not trying to pick stocks at all. In his book “The Intelligent Investor”, Graham distinguished between two archetypes. Enterprising investors are willing to devote time and care to stock-picking. Defensive investors want a quiet life. So they should simply buy a diversified list of leading stocks instead.

The emergence of low-cost indexed funds has made it easy to be this kind of know-nothing investor. Yet there is still a decision to make, namely asset allocation. How much of a portfolio should be in risky stocks and how much in safe bonds? In theory the split depends on expected returns, volatility (how much asset prices fluctuate), the investor’s appetite for such volatility—and even the investor’s age and job. Thankfully Graham had a simpler answer: a 50-50 split between stocks and bonds, maintained by adjusting as required by market prices.

The merit of this approach—or indeed the 60-40 rule favoured by many pension funds—is simplicity. There is a better chance of sticking to a simple, fixed-weights rule than a complex one. Deciding on the right portfolio weights is not the most important part of asset allocation. What matters is sticking to whatever weights are chosen. And that requires regularly rebalancing your portfolio.

Rebalancing has many plusses. For a start, it prevents the portfolio becoming riskier or safer than desired. If stockmarkets boom while bond prices drift, a 50-50 split can quickly become 70-30. A timely rebalancing would mean selling shares and buying bonds to restore parity. This is also a crude way of taking account of changing valuations. To say a security is cheap is to say it has a high expected return. When prices rise a lot, expected returns go down. Investors should want to hold more cheap assets and fewer dear ones. Rebalancing is helpful in this regard. It requires the shedding of assets whose expected returns have fallen most in favour of those that are cheaper.

All this would seem to go against a lot of market wisdom. “Cut your losses and let your winners ride” is a doctrine for the hedge-fund traders who bet on short-term shifts in market prices. Rebalancing does the opposite. Recent winners are cut in favour of more exposure to recent losers.

The long and the short of it

Yet the two approaches can be reconciled. Short-term “directional” trades—that the dollar will fall or oil prices surge, say—are highly speculative. The premise behind them might be wrong. So it is best to cut losses quickly. If a forecast is right and prices veer in a new direction, they often travel a long way. In which case, it is best to let winning trades run. Rebalancing, in contrast, is a strategy for the long term. It is a bet that extremes in market prices will be corrected eventually.

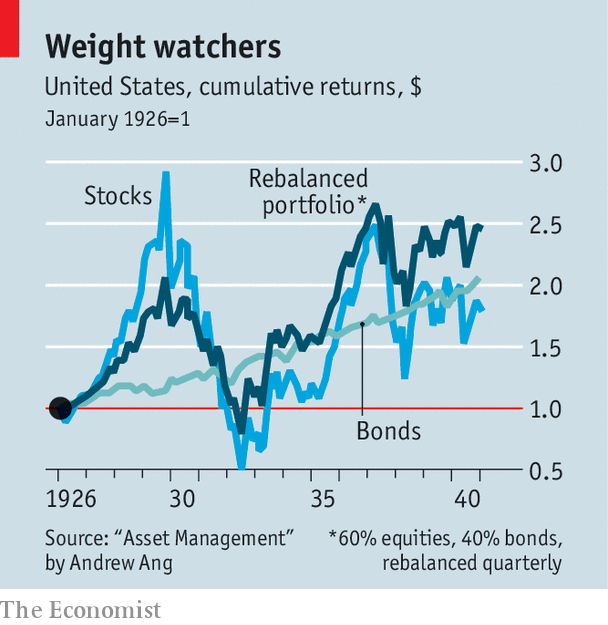

This is not an easy policy to follow. It goes against instinct to buy assets that have fallen heavily in price. But having a clear and simple strategy helps. It has parallels with other goals that require personal discipline, such as staying fit. “It doesn’t really matter whether you are swimming, playing tennis or running,” says Mr Ang. “What’s really important is getting into the habit of making a regular time to exercise.” If a rebalancing habit is established in calm markets, it will be much easier to follow when markets become stormy. How often should you do it? It is best to put a date in your diary for once a quarter, says Victor Haghani of Elm Partners. Indexed funds can be traded quite cheaply. But a lot of rebalancing can be done by diverting the flow of regular savings into the underweighted asset.Andrew Ang of BlackRock offers an example of how rebalancing works, drawing on the 15 years between 1926 and 1940, which included the 1929 crash and the Depression. A $1 investment in stocks in January 1926 was worth $1.81 by December 1940 (after some extreme ups and downs). Bonds did better. A dollar invested in 1926 was worth $2.08 by 1940. A buy-and-hold portfolio of 60% stocks and 40% bonds in 1926 left untouched would be worth just $1.92. But a 60-40 portfolio, rebalanced every quarter, would be worth $2.46, beating both stocks and bonds (see chart). Rebalancing pays off because it cuts back on equities when they become dear and adds to them when they become cheap.

Not everyone can manage this. Indeed, rebalancing is effective because it works against the boom-bust cycle. Different weights will lead to different paths of returns. But what really matters is not the nature of an investment rule. It is whether you can stick to it. So keep it simple.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.