The cash-strapped government is threatening to gut the RBI

Central bankers are not normally fiery types. But on October 26th Viral Acharya, the deputy governor of the Reserve Bank of India (rbi), brought a dispute between it and India’s government into the open with a flaming speech. Mr Acharya said that “governments that do not respect central-bank independence will sooner or later incur the wrath of financial markets, ignite economic fire and come to rue the day they undermined an important regulatory institution.” His words, which he made clear had been approved by his boss, Urjit Patel, have had incendiary effects.

Arun Jaitley, the finance minister, seems to have taken them as an invitation to a trial of strength. “The nation that is India is higher than any institution,” he said the following day. Local papers reported that the government had invoked a law dating to the establishment of the rbi in 1934, never before used, that allows it to issue directions to the governor. As The Economist went to press, rumours were flying that Mr Patel might step down.

The row, which has simmered in private for months, threatens to wreck one of the government’s main policy achievements. Three years ago, after a short bout of double-digit inflation, the rbi and the government agreed on a target for annual inflation of 4% and created a monetary-policy committee to set interest rates. Inflation has remained subdued ever since.

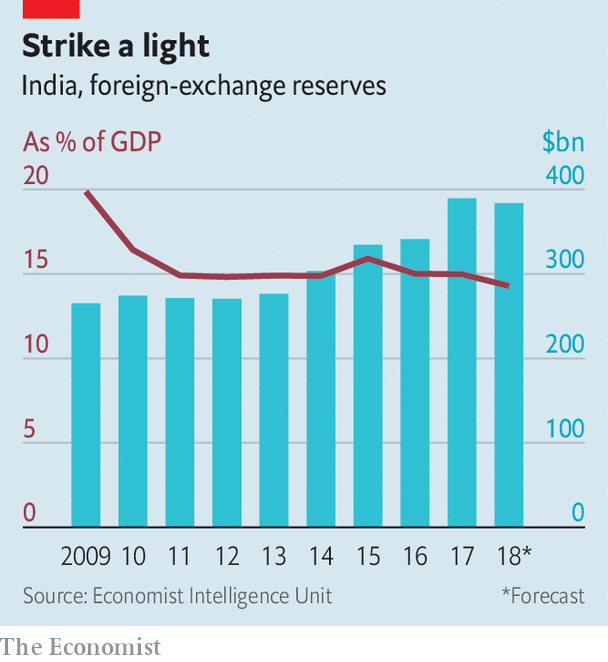

But now the government wants to meddle. Various economic indicators are moving the wrong way. The central-government deficit has widened recently. That has sucked in imports, increasing the current-account deficit. Since January the rupee has fallen by 12.5% against the dollar. The rbi’s foreign-exchange reserves, which had been rising, have started to fall (see chart).

Credit is tightening, too. The main reason is banking regulation. State-owned banks, which have about 70% of total deposits, are weighed down by rotten loans; 11 of them are subject to “prompt corrective action”, which means that they cannot lend. Last month the government took over il&fs, a large infrastructure lender, after it defaulted on debt payments, chilling commercial credit.

The government, and many businesspeople, would like the rbi to compensate by cutting rates or perhaps by easing up on public banks. Yet India’s economy is growing at 8.2% annually, faster than any other big country. This growth has been fuelled by a pre-election splurge in government spending, and the politicians will soon need even more cash. In September, for example, the government launched a huge new health-insurance scheme, which it claims will somehow cost almost nothing. A particular worry for the rbi is that some government officials have raised the idea of increasing the dividend that the bank pays to the government, or even confiscating its “excess” reserves. In his speech, Mr Acharya referred pointedly to the dire consequences when Argentina’s government made a similar move in 2010.

The row goes beyond policy and into nationalist politics. Two years ago the rbi’s previous governor, Raghuram Rajan, left after the government refused to renew his term. An ally of Narendra Modi, the prime minister, had called him “mentally not Indian”. Both Mr Rajan and his successor are American-educated economists. Some nationalists think Mr Patel is a cosmopolitan technocrat who wants to wreck their chances in next year’s election.

Petty arguments, for example about whether the rbi should switch from millions and billions to lakhs and crores (Indian terms for 100,000 and 10m), are indicative of the culture clash. So too is the appointment of Swaminathan Gurumurthy, a firebrand nationalist journalist who was among the architects of Mr Modi’s ill-conceived demonetisation policy (whereby 86% of banknotes were suddenly withdrawn in 2016), as a part-time director on the rbi’s board.

If Mr Patel is forced out, it will be an “incalculable disaster”, says Vivek Dehejia of the idfc Institute, a think-tank in Mumbai. For his replacement, “they’d be sure to appoint essentially a stooge”. Confidence in the rupee would crumble; that in turn could cause inflation to shoot up. Having granted the central bank independence, India’s government would have undermined it for short-term gain—precisely the risk that Mr Acharya warned against.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.