Lost in all the Chinese stock and currency market gyrations, policy missteps and mixed data is this economic reality: The government is constrained by a credit bubble that has ballooned to $28 trillion in an economy growing at its slowest pace in 25 years.

Policy zig-zags have left investors divided over how wedded President Xi Jinping and Premier Li Keqiang are to financial sector reform and shifting their $10 trillion-plus economy from one powered by investment and exports to one more focused on consumption and services.

China has appeared to backtrack on pledges to make its management of the yuan more market driven and there’s uncertainty over the government’s willingness to remove stock price supports imposed during a $5 trillion sell-off last summer. Amid the confusion, the benchmark CSI 300 Index, down 14 percent in 2016, has revisited the lows of last year’s rout and pressure on the currency continues.

Against that backdrop, Chinese officialdom faces the high-wire act of trying to keep the economy growing rapidly enough to repay past obligations, without resorting to a fresh pick-up in debt to fund more stimulus. It was China’s reliance on credit-fueled growth in the wake of the 2008 global financial crisis that resulted in one of the biggest debt expansions in recent history, and today’s hangover.

"China is nowhere close to reining in its debt problems," said Charlene Chu, the former Fitch Ratings Ltd. analyst known for her warnings over China’s debt risks and now a partner of Autonomous Research Asia Ltd. "It is one of the key factors weighing on GDP growth and one of the reasons why foreign investors are so concerned about China’s trajectory."

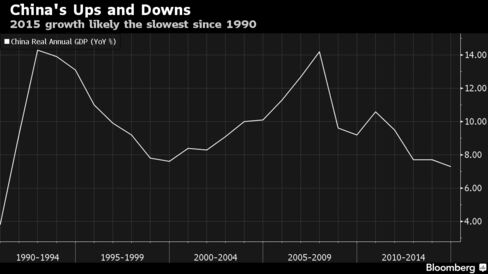

A report Tuesday is forecast to show China’s 2015 expansion slowed to 6.9 percent -- the weakest pace since 1990. Strength in services and consumption last year cushioned a slowdown in old growth drivers like heavy industry and residential construction.

Chinese renewed share rout has roots in the debt mess: an eye-popping rally late 2014 and early 2015 was fueled in part by official media commentary that championed the surge as a new way for companies to finance growth and repay borrowing. But instead of companies deleveraging, the result was a surge in margin traders taking loans to pile in as the number of equity investors surpassed the number of communist cadres. When the inevitable bust came, policy makers responded to cushion the fall.

The meddling has proved largely ineffective and often counterproductive: Leaders had to abandon a newly imposed stock circuit-breaker system introduced on Jan. 4 after price plunges cut short trading sessions twice last week. Even as regulators tried to calm sentiment, the People’s Bank of China surprised traders as it weakened the yuan the most since August by cutting the currency’s daily reference rate against the dollar.

Meantime, the central bank has been spending hundreds of billions to offset massive capital outflows and support the yuan. Its stockpile of foreign exchange reserves plunged by $513 billion in 2015 to $3.33 trillion.

With global assets from commodities, U.S. blue chips and emerging currencies shaken this year by China’s sliding equities and weakening yuan, policy makers have been criticized.

"The government has made a complete hash of the past six months in terms of sending signals," said Fraser Howie, co-author of the 2011 book “Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise."

Examples abound. When authorities last year lifted a ceiling on bank deposits to allow freer pricing, they followed up with guidance to banks not to use too much of their new-found freedom, showing the tension between reform and control. In Shanghai, a much championed free-trade zone has largely disappointed.

Policy Blunders

"It makes one wonder whether Chinese policy makers are students of Goethe -- ‘By seeking and blundering we learn,’" said Barry Eichengreen, a University of California-Berkeley professor.

In an effort to restore confidence among investors and strengthen oversight, China’s cabinet has created a new department to coordinate financial and economic affairs, under the General Office of the State Council, according to a person familiar with the matter. The No. 4 secretary office is tasked with coordinating between financial and economic regulators and gathering data from local offices.

Hand of State

How effective that move will be remains to be seen. Since taking power in late 2012, President Xi has consolidated power and dominates economic policymaking, a role traditionally left to the premier. Xi promised in 2013 to let markets have a decisive role, but analysts have been disappointed by the pace of change.

The Communist Party is unlikely to relinquish its control over economic matters any time soon, said Chen Zhiwu, who sits on the International Advisory Board of the China Securities Regulatory Commission (CSRC), the nation’s stock market regulator. "It’s that misunderstanding that goes to the heart of China’s dilemma," the Yale University academic said.

"In my lifetime, an American-style free market will never become a reality in China," said Chen, who advised the government on establishing the China Investment Corporation, one of the nation’s sovereign wealth funds. "China is much more for a very active government hand. That cultural heritage will not be easy to change."

Debt Pile

There’s also been no real progress in chipping away at the debt burden, supercharged by spending on infrastructure and housing, that delivered average economic growth of 10 percent over the past 30 years. Government, corporate, and household borrowing totaled $28 trillion as of mid-2014, or about 282 percent of the country’s GDP at the time, according to McKinsey & Co.

"Some of the recent policy moves on the stock and foreign-exchange markets are indicative of tension between the leadership’s desire for market-oriented reform and the apparent fundamental objective of control by the government and, ultimately, the Party," said Louis Kuijs, head of Asia economics at Oxford Economics Ltd in Hong Kong. "Indeed, the response of international markets may in part reflect rising worries about this tension."

The dilemma for the nation’s leadership is that they have highlighted the need for a more market-driven allocation of capital, which would stoke productivity gains and drive growth as the working-age population shrinks. Yet the turbulence that markets produce threaten to undermine confidence in the party that’s dominated government since 1949.

Markets Spooked

To be sure, it doesn’t take much to spook investors on China these days, and recent market ructions appear disconnected from signs of stabilization in the underlying economy. Evidence indicates consumers are still spending, house prices are steadying and export demand is recovering.

"The international reaction has probably been bigger than it should have been, given that China’s equity markets are not very related to the real economy nor yet very connected to international markets," said Tim Summers, senior consulting fellow on Asia at Chatham House.

There’s also been some progress on the reform front. Most interest rates are now at least influenced by market forces, and the PBOC scored a big win by qualifying for reserve currency status for the yuan from the International Monetary Fund late last year. All this while Xi’s drive to root out government corruption continues to roll ahead.

Still, given the ever-present debt overhang and muddled market policies, there’s been an erosion in confidence as to whether Xi and his policy makers are in control and have the ability to manage the scale of the tasks at hand.

"At the most basic level, we have no idea whether Xi understands what modern markets require," Arthur Kroeber, the Beijing-based founding partner and managing director at Gavekal Dragonomics, a research firm, wrote in a note. "China is unlikely to collapse. But it is losing its way. And it is this loss of direction, rather than a moment of confusion on foreign exchange markets, that should really worry investors."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.