After the IMF cuts its global growth outlook to slowest since crisis, its going to be an interesting day with the Fed not really telling us what it might really think, and the ECB trying to fool us that “these are not the droids we’re looking for” as they get set to pump prime the ailing Eurosphere through further monetary experimentation. (With the American’s about to impose tariffs on Yoorp’s helicopter exports, perhaps the ECB should consider buying any surplus birds? Since zero rates have had zero effect, maybe direct money dropped from above will…)

Elsewhere, the EU clocks up a tactical win against UK by granting a further Brexit extension. Political analysts are trying to figure what this does to UK politics: will May be replaced as leader of the Selfservatives, and/or will political gridlock precipitate an election, resulting in a Labour minority supported by a greedy SNP? New Years day sounds like a damn stupid day for a UK exit into thin markets. It looks like we’re in for further Sterling-Brexit uncertainty. Joy.. oh joy…

Let's see this big bond story:

ARAMCO

There will be thousands of disappointed fixed income investors this morning… gutted about their low allocations on the Aramco Saudi Oil deal. The $12 billion deal attracted a book of over $100bln – meaning most hopeful investors will be scaled back to effectively zero. As the world’s largest and most profitable company, I am sure most fund managers will justify their attempted purchases of the Aramco bonds with mumble-swerve about the need for “portfolio-exposure-balance” and “index-tracking/matching”.

The Saudis will be delighted with the reception for the bonds and the apparent rehabilitation of the country after last year’s “unpleasantness. The investment banks leading the deal will be pleased and happy with their fees. For the life of me I can’t understand what’s to like about this deal. The risk reward – the 10-year benchmark priced at 105 over US Treasuries – might look good to yield tourists, but from my perspective it doesn’t properly factor Saudi risk. There is massive execution risk in Saudi paper… and I don’t mean a sword in the central square.

What did investors think they were buying?

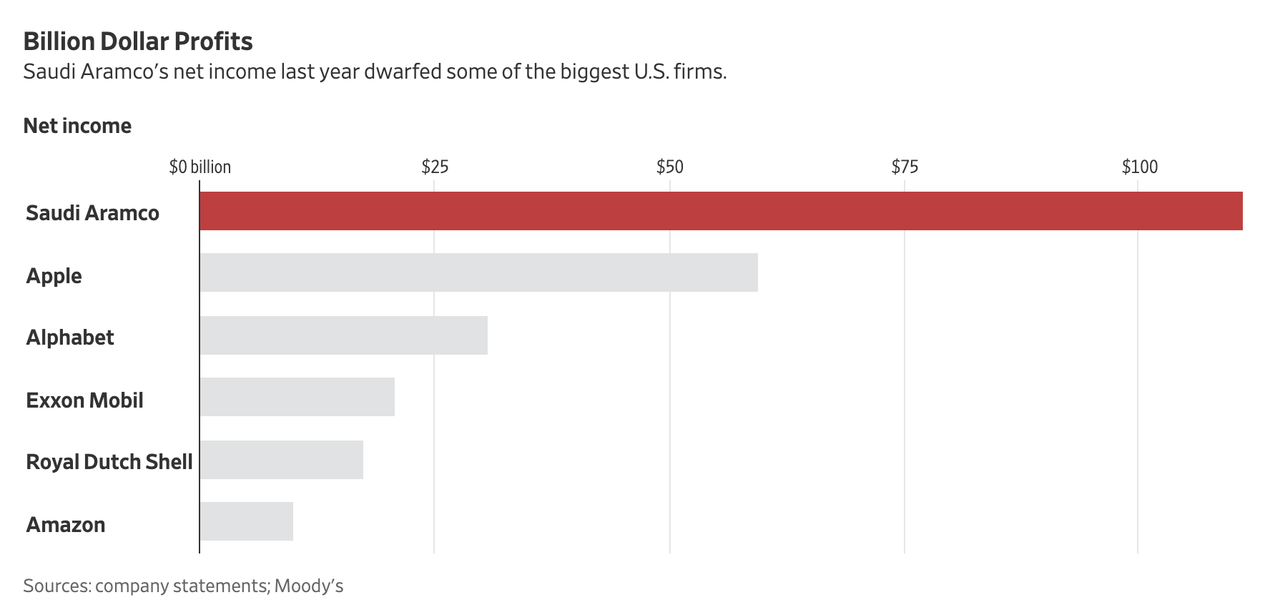

Aramco made 111bln profit in 2018, and would be the largest company in the world if floated. Moody’s gives Saudi Aramco a A1 rating, stable outlook and admits it has all the characteristics of a Aaa rated company. Its got scale, downstream integration, strong financial flexibility, the lowest cost structure of any oil producer, and minimal leverage. It’s got exclusive access to the largest oil and gas reserves. It does oil very well. There are a few negatives like geographic concentration in Saudi and oil volatility.

But the key issues investors seem to have missed in terms of implications is contained within Moody’s comment: “Aramco is (100%) wholly owned by the state and is expected to remain under government ownership even after any potential IPO in the future….”

Let’s consider what that really means for the Credit.

Last year we got hints of what’s to come when Aramco bought SABIC, (Saudi Basic Industries) the state wealth fund – putting $70 bln into state coffers. The delay/cancellation of the planned Aramco IPO means Saudi ruler, Prince Mohammed Bin Salman, is left with limited funding options for the critical transformation of Saudi from tribal oil state into a modern technologically diverse society. Folk have asked why Aramco, the world’s richest company, is raising $12 bln. Because… MBS is going to lever it up to pay for Saudi’s future. Effectively Aramco is going to be MBS’s piggy bank.

Now that could have been a good thing. When he came to power MBS was hailed as a reformer – letting women drive and opening cinemas, blahbity blah blah. That didn’t last long. In a very short time MBS went from saviour to despot. First, he took the country into an ill-advised war which his military was unprepared for with rebels in Yemen. Then he shook down the country’s richest businessmen to fund his “vision”, (and the same day bought a luxury yacht). 6 months ago Saudi was untouchable, pilloried by global opinion for the state-sanctioned brutal pre-meditated murder of dissident journalist Jamal Khashoggi. World Leaders refused to be seen with the Kingdom’s ruler and snubbed his Desert Davos.

MBS is not the product of Western Universities with an educated liberal streak – he’s been raised and educated to be an absolute monarch with traditional Saudi values – which pretty much equates with “wahhabi, mercurial autocrat and an approach to problems who out-Trumps Trump”.

However, Saudi’s problems didn’t start with MBS. They have been brewing for years as the bloated multi thousand princes making up the royal family consumed most of the oil revenue, leaving the bulk of the population underemployed and living on the fringes. The Saud royal family deal with the tribes was always: we’ll take the money and keep you comfortable. That is breaking down. MBS needs Aramco to fund the modernisation of his kingdom, run economic and social reform, innovate new technologies and diversify the economy beyond oil.

That’s a massive investment execution risk, and he only has a few short years to put it all in place: the major cities are surrounded by sink estates of unemployed Saudi youth hooked on state handouts and highly susceptible to radicalism. Officially unemployment is 13%, but underemployment across Saudi Society is much higher after years of oil subsidy. Youth unemployment was recently cited by Brookings as high as 42%! Educational standards and achievements are very low outside the top strata of society. Meanwhile, Saudi wobbles politically trying to retain US support, its regional allies, while Iran hovers on the doorstep. Add a level of political risk to the equation.

The execution risk of Saudi Arabia being able to transform itself – which is the real risk investors who piled into the 30-year Aramco bond are taking – is huge.

And it gets even bigger with you add in the ESG perspective – Environmental, Social and Governance. Saudi’s human rights record is abysmal. Its starving political prisoners in its jails, is willing to shakedown business leaders and ignore the rule of law, is blockading counties like Qatar that disagree with them, and dropping some of the most sophisticated and expensive weapons available on unarmed civilians in neighbouring Yemen. I could go on to talk about Jared Kushner and the culture of patronage clientism, but I’m sure most people already get it.

For whatever bizarre reasons investors pledged over $100 bln of orders into the $12 bln of bonds Aramco sold yesterday. Much of the demand was for the long-end 30-yr bonds. Bearing in mind likely social, educational, and political issues facing Saudi as its attempts to transition its economy into something diverse, vibrant and sustainable, it’s a long-term investment picture that looks… well, frankly risky. Some would say about as much sense as buying Argentina 100-year bonds.

I’m really struggling to find anything positive to say about the Aramco deal.

The unprecedently strong demand for MBS’s private slush fund exposes the myth that everyone wants to be seen to be supporters of ESG investment, and that Green and Socially aware investment is where your financial advisors are investing your savings. Boll-Chocks. The brutal reality is more money was voted into proxy Saudi oil risk over two days of marketing than will go into environmental charities over the next hundred years.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.