Of all the lines of all the characters in all the scenes in “Casablanca”, the ones that resonate most are spoken not by Humphrey Bogart, the leading man, but by Claude Rains, who plays Louis Renault, a cynical police captain. Needing a pretext to shut down Rick’s, the nightclub owned by Bogart’s character, he declares that he is “shocked, shocked to find that gambling is going on in here”.

Renault’s line captures the fake distaste for gambling that lives on in polite circles. It finds expression even in impolite circles, such as finance. Take the market for oil futures. Only the gauche would describe it as anything other than a system for transferring risk. Oil producers sell futures to insure themselves against a price rout that would threaten solvency. Investors earn a risk premium by buying them.

There is something to this characterisation. Producers are indeed short futures much of the time. But often, they are long. Perhaps the real reason for a thriving futures market is that people both inside and outside of the oil business enjoy a punt on the price of crude. If so, that is all to the good. The prices that wash out of these wagers are an invaluable guide to decision-making about production, storage and investment.

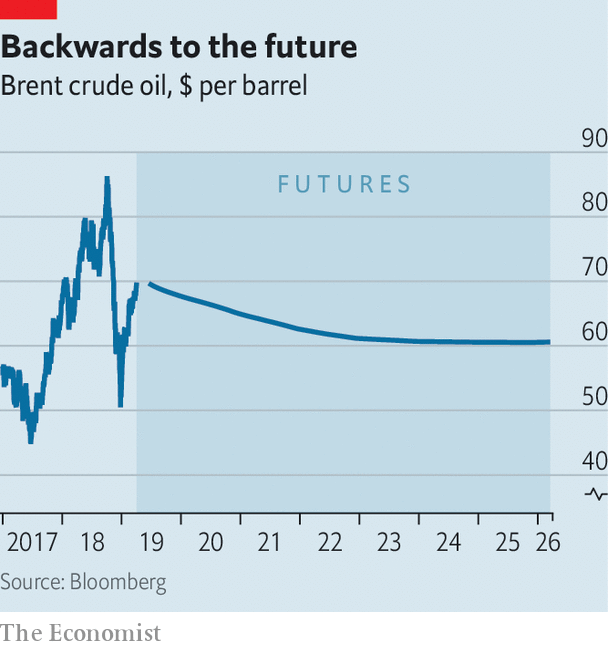

The benefits hinge on the relationship between spot prices, futures prices and inventories. The spot price is what you pay if you need a barrel of oil immediately. The futures price is more like a wager on a sporting match. If the spot price of Brent crude in a year’s time proves to be higher than $67, the current 12-month futures price, the buyer wins the bet; if it is lower, the seller wins. If oil prices are hard to predict, futures prices should be lower than spot prices. This theory assumes there is excess demand to hedge against falling prices. Speculators are needed to take the other side of the bet. Low futures prices are the inducement they in turn require.

In practice, periodic gluts and shortages mean that oil prices are prone to wild swings. The oil market switches between “backwardation” (where futures prices are below spot) and “contango” (where they are above it). The volatility of prices makes it difficult to detect a reward for speculation, or risk premium, in any single commodity market. But studies by Gary Gorton and Geert Rouwenhorst of Yale University find that a buyer of a varied basket of commodity futures would earn a hefty risk premium.

What links the spot and futures prices is the level of stocks held by the oil industry. Storage is costly, but so is running out of supply. As a rule, the lower stocks are, the higher the premium speculators should demand. Just as ample stocks tend to dampen price volatility, skimpy stocks tend to amplify it, making speculation riskier. Backwardation gives speculators a compensating reward.

What is today’s oil market telling us? opec agreed in December to cut production. Demand is picking up. The spot price has risen from $53 to $70 a barrel since the start of the year. The market may well tighten further in the short term. Saudi Arabia, opec’s largest producer, is pumping less than its quota; it seems keen on higher prices. Meanwhile foreign-policy hawks in America want to tighten the screws on Iran’s oil exports. Power cuts in oil-rich but inflation-ravaged Venezuela have further reduced its capacity to pump oil.

The other message from the oil curve is that high spot prices will not last. In this regard, opec faces a dilemma. Higher prices solve short-term problems: Saudi Arabia needs an oil price of around $80 to balance its budget, for instance. But they are a spur to non-opec sources of oil and to non-oil sources of energy. The long-run result is an oversupplied market and lower oil prices.Futures prices are below spot prices (see chart). This backwardated curve is a signal to run down stocks while prices are high. And inventories have indeed been falling, according to an analysis by Martijn Rats of Morgan Stanley, suggesting that the market is undersupplied. If stocks fall further, backwardation is likely to become more extreme. And the more futures prices fall relative to spot prices, the more tempting is the risk premium they offer to investors.

“Casablanca” is full of such dilemmas. Rick is forced to choose between love and honour, and judges that dishonour would spoil love. For Renault, having Rick arrested for the murder of a German major would be a feather in his cap. Instead he plays the long game and orders his squad to “round up the usual suspects”. As time goes by, an alliance with Rick might prove more profitable.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.