Ongoing trade conflicts have forced China to increase financial decoupling between the US. China wants to decrease its US exposure and diversify its reserves away from dollars, according to economists at Australia and New Zealand Banking Group (ANZ).

"The ongoing trade war and geopolitical issues have increased the risk of a financial decoupling between China and the US," Raymond Yeung, Greater China chief economist, wrote in a recent note.

ANZ predicts Beijing will quickly diversify its foreign exchange reserves away from dollars.

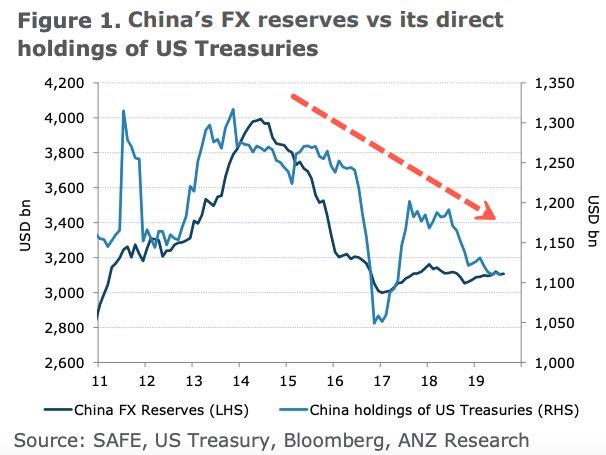

"Although China still allocates a high share of its FX exchange reserves to the US dollar, estimated at around 59% as of June 2019, the pace of diversification into other currencies will likely quicken going forward," Yeung said.

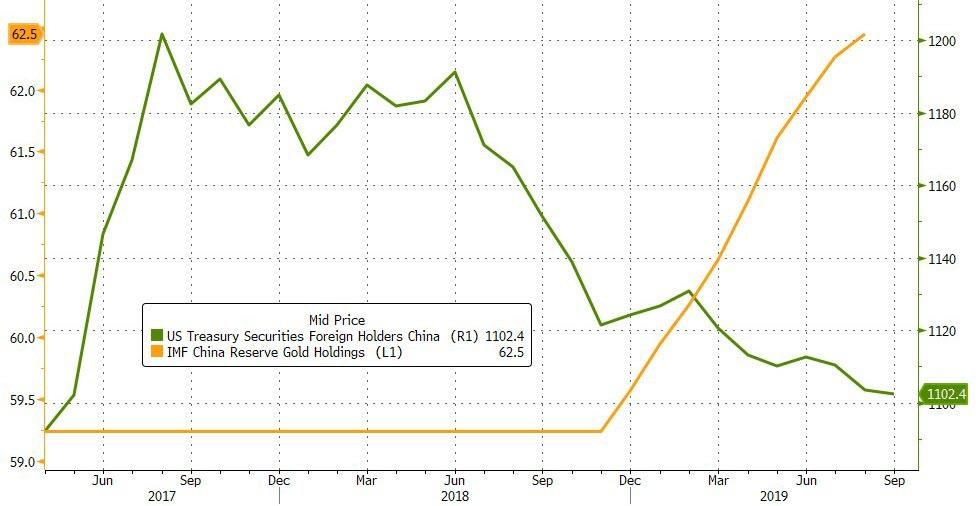

ANZ told CNBC that China would likely diversify into British pounds, Euros, and Japanese yen... and gold.

Source: Bloomberg

ANZ believes China is building "shadow reserves" as a way to diversify from the dollar.

"In fact, we believe that the Chinese government has already discreetly diversified its offshore portfolios to include alternative investments," the report said.

Yeung said, "factory-dollar recycling" has contributed to "the global prominence of the US dollar over the past decade. However, if China initiates a convertible standard superior to the fiat-money regime, not only will it gain a market following, but it will also boost the global acceptance of the RMB."

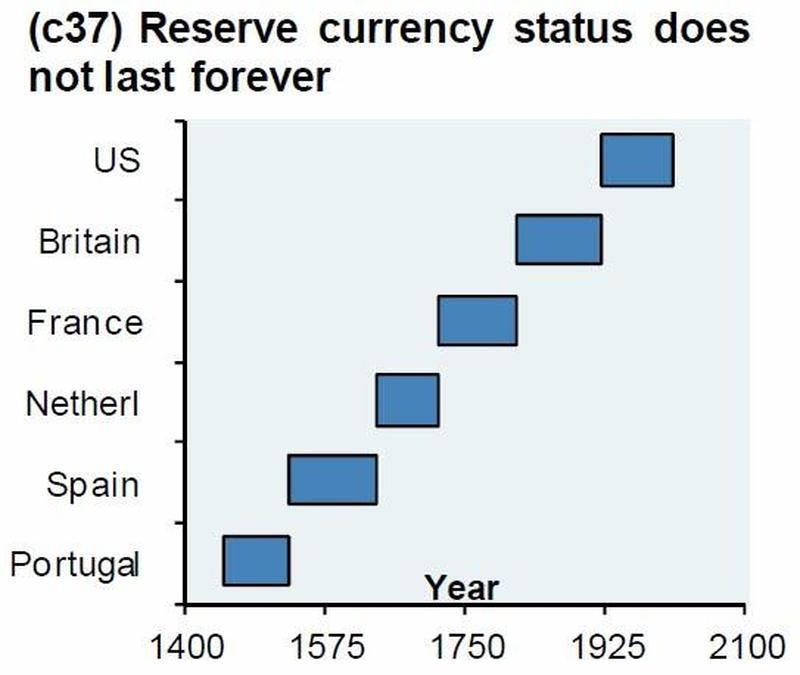

Although the dollar is the world's reserve currency, Yeung warns it could be displaced in the coming decade.

China has spent the last six years, reducing its holdings of US Treasurys.

Efforts of de-dollarization by China could reduce the world's reliance on the dollar by 2030, and at some point, catapult the renminbi into the hot seat.

Remember, nothing lasts forever...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.