In 2010 the US Department of Energy’s Critical Materials Strategy included lithium as one of 14 elements expected to play a vital role in America’s clean energy economy.

Lithium is also among 23 critical metals President Trump has deemed critical to national security; in 2017 Trump signed a bill that would encourage the exploration and development of new US sources of these metals.

According to the US Geological Survey, the United States last year imported around half of 48 minerals and 100 percent of 18 minerals.

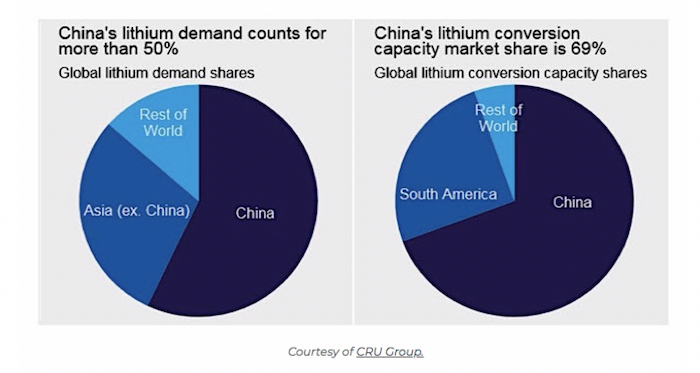

According to Benchmark Mineral Intelligence the US only produces 1 percent of global lithium supply and 7 percent of refined lithium chemicals, versus China’s 51 percent.

A Tesla executive earlier in the year said the company is worried about a shortage of lithium. The number of EVs is expected to multiply in the coming years, but they can only progress as fast as lithium-ion batteries can get built that go into them. Tesla CEO Elon Musk said, in June of 2019, that in order to ensure Tesla has enough batteries to expand its product line Tesla might get into mining lithium for itself.

The world’s leading lithium battery companies in 2016 produced 29 gigawatt-hours (GWh) of batteries. By 2028 forecasted production is expected to hit 1,049 GWh, an increase of 3,516 percent!

Consider that in 2018, China sold 1.182 million NEVs (new energy vehicles including electrics and hybrids), 520,000 or 78 percent more than in 2017.

As China’s mark on the lithium market becomes more pronounced, growth in the sale of lithium end products is taking off.

(Click to enlarge)

According to Adamas Intelligence, in February 2019, 75 percent more lithium carbonate was deployed for batteries in electric and hybrid passenger vehicles compared to February 2018.

Lithium price explainer

Before we go any further let’s take a look at the different prices of lithium; with 11 lithium products currently being assessed, it can get confusing. While the mineral used to be priced in long-term contracts like uranium, recently there has been a push by end-users, particularly automotive manufacturers, for more price transparency.

As we can see in the price chart below, short-term the lithium bears have the upper hand, with lithium prices falling in China and South America, along with the price of spodumene concentrate in Australia.

(Click to enlarge)

How are prices determined? There are three factors Benchmark Mineral Intelligence uses to set the industry standard reference prices: quality/ grade of lithium, shipping costs/ volumes, and the reliability of the information given.

The grade and level of impurities affect the price a miner receives, for the lithium to be processed into spodumene concentrate, lithium carbonate or lithium hydroxide. Often the product is refined into the exact specifications required by the end-user.

Currently, there are six prices of lithium carbonate, four for lithium hydroxide and one spodumene concentrate price:

Benchmark Minerals, Lithium Carbonate, 99 percent, FOB South America, USD/tonne

Benchmark Minerals, Lithium Carbonate, 99 percent, CIF North America, USD/tonne

Benchmark Minerals, Lithium Carbonate, 99.2 percent, CIF Europe, USD/tonne

Benchmark Minerals, Lithium Carbonate, 99.2 percent, CIF Asia, USD/tonne

Benchmark Minerals, Lithium Carbonate, Battery Grade, 99.5 percent, EXW China, RMB/tonne

Benchmark Minerals, Lithium Carbonate, Technical Grade, 99 percent, EXW China, RMD/tonne

Benchmark Minerals, Lithium Hydroxide, 55 percent, FOB North America, USD/tonne

Benchmark Minerals, Lithium Hydroxide, 56.5 percent, CIF Asia, USD/tonne

Benchmark Minerals, Lithium Hydroxide, 55 percent, CIF Europe, USD/tonne

Benchmark Minerals, Lithium Hydroxide, 56.5 percent, EXW China, RMB/tonne

Benchmark Minerals, Spodumene Concentrate, 6 percent, FOB Australia

In July Benchmark Intelligence published an update on lithium prices titled ‘Lithium’s price paradox’. Current prices are a paradox because lithium investors are making decisions based on short-term supply versus long-term market fundamentals.

Indeed there has been an influx of new supply entering the market. Last year four hard-rock (spodumene) operations in Australia started production. The number of active lithium mines in Australia grew from one in 2016 to nine by year-end 2018.

A total of five new lithium conversion plants (plants that convert lithium carbonate to lithium hydroxide) have come into production and another three have expanded their output to meet market demand.

What is promised in not always delivered

Past success, however, is not necessarily indicative of the future. We know that between 2012 and 2016, major lithium miners planned to produce an extra 200,000 tonnes of new supply. But when 2016 rolled around, under 50,000 new tonnes came online, due to technical problems.

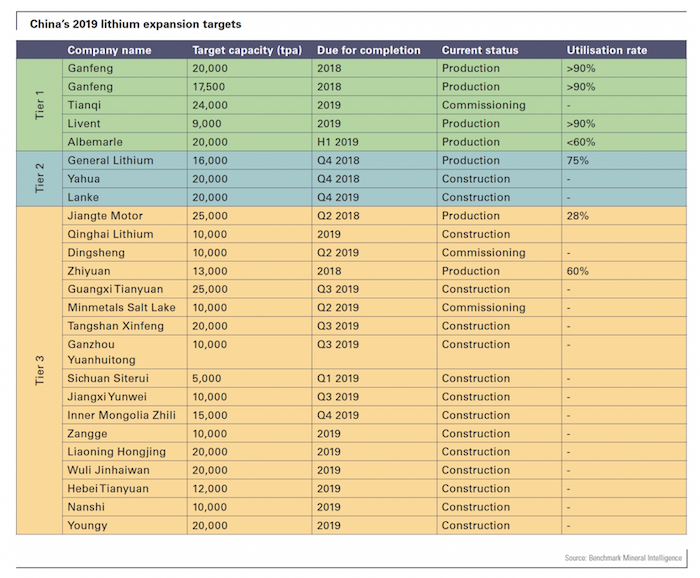

According to Benchmark’s research, only three plants in China have reached production and full capacity. Beyond the Tier 1 producers shown in green in the table below, just two - General Lithium (16,000t) and Jiangte Motor (25,000t) - managed to meet production targets of 41,500t. That means only 87,000t of new Chinese capacity has hit the market since 2016, of a planned 481,500t:

The false narrative which emerged from these expansions and spilled over into 2019 was that the industry was awash with battery-grade lithium chemicals, sufficient to support rapid electrification over coming years.

(Click to enlarge)

Benchmark notes more major expansions outside China are planned this year but the timelines for completion are vague and delays are expected; thus the myth of over-supply in the face of exponentially high future demand for lithium. The research firm predicts supply would have to increase at a compound annual growth rate (CAGR) of 19 percent over the next six years to meet 2025 demand. From 2015 to 2018 it grew at just 11 percent:

While the supply response has addressed the relatively minor growth of today, it is still far from meeting the needs of tomorrow’s EV expansions.

Spectators that flocked to the market in 2016 on the promise of an EV super-cycle have left before the warm-up, let alone the main event.

While a downturn in prices has reflected a necessary correction towards near-term market fundamentals, it fails to represent the increasing possibility of another major deficit in the market by the early-2020s, creating a deceptive narrative in both share prices and surrounding markets.

Another important point is that, despite the hundreds of thousands of tonnes more lithium chemical production capacity, only a small percentage will make it into lithium-ion batteries. Why?

Lithium carbonate contained in brines must have contaminants removed before it can be considered battery-grade quality; the process of removing impurities can be expensive.

Technical-grade lithium used in applications other than for EV batteries such as glass and ceramics, is cheaper than battery-grade material, but it has to have low concentrations of iron to be upgraded. There may also be teething problems at new operations. Says Benchmark:

As with any new lithium chemical production, only a proportion of this material will likely be sold into the battery sector from the outset. Even leading producers have problems meeting specs in the initial stages of production.

Both lithium carbonate and hydroxide can be used in the EV battery cathode. Lithium for the cathode and electrolyte materials is produced from lithium carbonate. In brine deposits, the lithium chloride is concentrated by evaporating lithium-rich brines in shallow pools from 12 to 18 months. It is then treated with sodium carbonate (soda ash) to precipitate out the lithium carbonate.

Lithium carbonate can also be produced from clay deposits and spodumene, a silicate of lithium and aluminum.

All lithium batteries contain some form of lithium in the cathode and electrolyte materials. The battery anode is generally graphite-based, containing no lithium.

Lithium carbonate derived from brine operations can be used directly to make lithium-ion batteries, but a hard-rock, spodumene concentrate needs to be further refined before it can be used in batteries, adding costs and complexity.

Despite being more expensive lithium hydroxide is becoming more popular as a battery feedstock because it is said to produce cathode material more efficiently and is necessary in certain cathode combinations such as nickel-cobalt-aluminum (NCA) oxide batteries and nickel-manganese-cobalt (NMC) oxide batteries.

About 75 percent of the 65,000 tonnes of lithium chemical production expected to come online this year is targeting lithium hydroxide.

While brine operations that suck up the lithium in a salt-water solution and then evaporate it in large ponds have historically been cheaper than hard-rock spodumene operations like Greenbushes in Australia, that is beginning to change. A higher royalty structure in Chile and a plant’s ability to make lithium hydroxide directly from spodumene are two factors challenging this assumption.

But according to Benchmark, the case for lithium hydroxide being the more competitive lithium-ion battery feedstock is predicated on the battery market adopting high-nickel, hydroxide-dependent cathode chemistries” (a proposition that looks increasingly unlikely in the near-term) and secondly, that all spodumene producers are integrated lithium chemical suppliers. So far none of the new lithium assets are owned by chemical converter companies:

The question in the lithium market is no longer whether spodumene or brine resources will be developed – both are needed to take us anywhere near the growth estimates of the next 2-3 years. The new questions are what other channels of supply will be developed to take us close to the demand forecasts for 2025 and beyond.

Indeed if these new spodumene mines fail to meet production costs, they will either cut output or close, which would tighten the lithium market even further than expected. Already we are seeing some spodumene producers in Australia balk at the prices they are currently receiving, preferring to stockpile material instead.

Reuters reports, Converters of hard rock lithium into battery chemicals in China were holding around four months’ worth of stocks, or double usual levels... This has slowed sales from overseas suppliers. Galaxy sold 44,630 tonnes in the first half of 2019, against more than 90,000 tonnes a year earlier, at an average price of $584, down from $940 a year ago.

If Australia’s spodumene producers are priced out of the market, where would the lithium come from to meet surging market demand?

The way things are going, it’s not likely to be the United States. Despite having several properties at the development stage, no new lithium mine has entered production on US soil for over 50 years. The only producing mine is Albemarle’s Silver Peak in Nevada - which has been going since the 1960s and is rumored to have falling lithium brine concentrations.

China resource lock-up

We know from previous articles that China has been extremely active in acquiring ownership or part-ownership of foreign lithium mines and inking offtake agreements.

By 2025, the Chinese government wants EVs to represent 20 percent of all cars sold.

By comparison, the US sold 361,307 EVs in 2018, just under a third of China’s volume.

China, of course, has also locked up the rare earths market and is the primary player in a number of critical mineral markets including cobalt, graphite, manganese and vanadium.

For years the United States and Canada didn’t bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends. Dirty mining and processing? NIMBY. Let China do it, let the DRC do it, let whoever do it.

China recognized opportunity knocking and answered the door, seizing control of almost all REE processing and magnet manufacturing, in the space of about 10 years.

Earlier this year, as part of its trade war strategy, China raised the prospect of restricting exports of these commodities, that are critical to America’s defense, energy electronics and auto sectors.

Over half of the world’s cobalt - a key ingredient of electric vehicle batteries - is mined as a by-product of copper production in the Democratic Republic of Congo (DRC). In a $9 billion joint venture with the DRC government, China got the rights to the vast copper and cobalt resources of the North Kivu in exchange for providing $6 billion worth of infrastructure including roads, dams, hospitals, schools and railway links.

China controls about 85 percent of global cobalt supply, including an offtake agreement with Glencore, the largest producer of the mineral, to sell cobalt hydroxide to Chinese chemicals firm GEM. China Molybdenum is the largest shareholder in the major DRC copper-cobalt mine Tenke Fungurume, which supplies cobalt to the Kokkola refinery in Finland. China imports 98 percent of its cobalt from the DRC and produces around half of the world’s refined cobalt.

In 2018 the United States produced just 500 tons of cobalt compared to 90,000t mined in the DRC. The US did not produce any vanadium either; the top three producers of the steel additive are, in order, China, Russia and South Africa.

As Quartz notes, in order to maintain its dominance in the EV market, Chinese manufacturers need a lot of cheap lithium. That explains why its largest lithium miner, Tianqi Lithium, owns 51 percent of Australia’s Greenbushes spodumene mine - the world’s dominant hard-rock lithium mine. And why China bid for, and got, a 23.7 percent stake in Chilean state lithium miner SQM, the second largest in the world, for $4.1 billion.

China produces roughly two-thirds of the world’s lithium-ion batteries and controls most of its processing facilities.

Russia goes after lithium

This week the Uranium One Group, a subsidiary of Rosatom, Russia’s state-owned nuclear company, signed a deal with Wealth Minerals which has a lithium property in northern Chile. The Vancouver-based junior sold 51 percent of its Atacama lithium project to U1G.

It’s unclear what Uranium One - the same company at the center of a scandal involving the Clintons - plans to do with the 42,600-hectare property. WML would only say it’s interested in partnering with U1G to “accelerate the development of lithium projects by using modern technology and moving away from outdated solar evaporation to a more efficient and environmentally friendly sorption technology,” the company’s president, Tim McCutcheon, remarked in Monday’s news release.

We do know that Russia is paying more attention to electric vehicles, despite petroleum being its number one export by far. According to the Russian Ministry of Industry and Trade, EV sales in the largest cities particularly Moscow and St. Petersburg, grew 150 percent between 2017 and 2018, despite a 40 percent price increase.

The most popular model is the Nissan Leaf, accounting for some 40 percent of all sales in 2018, followed by the Mitsubishi i-MiEV and the Tesla Model S. Minister of Energy Alexander Novak reportedly said that EVs should represent 8-10 percent of Russia’s total car fleet by 2025- which would be a huge increase from the 10,000-11,000 EVs estimated to be on Russian roads at the end of 2018, Automotive Fleet reported earlier this year.

It’s certainly curious, if not alarming, that Russia is already locking up lithium supplies, even though its EV penetration rate is paltry compared to the top electric vehicle use countries. Canada, for example, has about eight times more.

We can’t help but notice Uranium One is doing the same thing with lithium, that it has done with uranium - be the Russian government’s Trojan horse in dominating the world’s uranium supply.

Is it possible that Russia wants to be a price-setter of lithium too, which even in oil and gas-soaked Russia is likely to be a major new growth industry? It’s easy to see offtakes developing between Russia and South American lithium brines, or maybe Russia partnering with Chinese companies as they have done in the energy sphere, as the country ramps up production of lithium batteries and electric vehicles.

A run through the latest uranium mine closures reveals the strong likelihood that Russia, through its Kazakhstan proxy, aims to seek and destroy any threats to its dominance. Besides Cameco’s mine shutdowns and US uranium production controlled by Americans reduced to almost nil, other casualties of low U prices and high-cost mining include French state-owned nuclear juggernaut Areva. West Africa-focused Areva went bankrupt and had to be restructured into a new company, Orano.

Australia’s Paladin Energy placed its Langer Heinrich mine in Namibia on care and maintenance in May 2018, following the mothballing of its Kayelekera mine in Malawi.

Rio Tinto’s Rossing uranium mine in Namibia is an example of a high-cost mine that was carved up by the Russians and handed over to the Chinese. The world’s longest-running open-pit uranium mine, opened in 1976, produced the most uranium of any mine. However, with production costs over $70 per pound, and the uranium price still limping along at around $20/lb, it was only a matter of time before too much red ink had spilled; in November 2018, Rio agreed to sell its stake in Rossing to China National Uranium Corp.

With their low-cost production and state-owned enterprises doing the mining and enriching, Russia, Kazakhstan, and upcoming China can easily out-compete the private uranium industry.

For example, Uranium One, the Canadian company that was swallowed up in 2013 by ARMZ, a subsidiary of Rosatom, currently mines uranium in Kazakhstan, the world’s leading uranium-producing country, at an average cash cost of $8 a pound. In-situ mines operated by Uranium One and Kazatomprom dominated the first two quartiles of uranium-mining costs in 2018.

In contrast, Cameco, the third-biggest uranium miner behind Kazakh state-owned Kazatomprom and Orano (formerly Areva), reports its only mine left after four closures, Cigar Lake, will be mined at $15-16/lb over the remainder of its life.

Uranium One is vitally important not only to Kazakhstan’s uranium production, but Russia’s.

As a wholly-owned subsidiary of Rosatom, the company is responsible for Rosatom’s entire uranium production outside of Russia. That makes it the world’s fourth-largest uranium producer. Uranium One has part-ownership of six producing uranium mines in Kazakhstan, the Willow Creek mine in Wyoming, and a 13.9 percent interest in a uranium development project in Tanzania.

Russia and Kazakhstan have signed several nuclear cooperation agreements over the past decade or so.

The former Soviet satellite nation and Russia currently account for over a third of US imported uranium, effectively setting the price of the nuclear fuel.

US mine to battery to EV supply chain

The International Energy Agency is predicting 24 percent growth in EVs every year until 2030. The global fleet is expected to triple by 2020, from 3.7 million in 2017 to 13 million in 2020, according to the IEA.

Bloomberg forecasts there will be a 54-fold increase in EVs between 2017 and 2040, when global light-duty EV sales are expected to hit 60 million; there are currently about 4 million EVs in the world.

Globally, battery makers and automobile manufacturers are scrambling to ensure they have enough supply of the silvery-white metal.

A Reuters analysis shows that automakers are planning on spending a combined $300 billion on electrification in the next decade.

Volkswagen has said it will invest $800 million to construct a new electric vehicle – likely an SUV - at its plant in Chattanooga plant, starting in 2022. For more read Volkswagen to drag Tesla, making EVs in Tennessee.

Opened in 2016, Tesla’s Gigafactory in Nevada is a going concern. Every day 1,000 car sets are trucked from the Gigafactory to an assembly plant in Fremont, California. The three-story structure, the size of a dozen football fields, has 13,000 people working for Tesla and its Japanese battery partner, Panasonic.

The company’s Model 3 was the best-selling electric vehicle in the US during the first half of 2019. InsideEVs claims Tesla sold 67,650 Model 3s through June, seven times the next best-selling electric vehicle, Tesla’s Model X SUV. The Chevy Bolt and Nissan Leaf were also among the top five best sellers.

GM is planning to sell its first EV this year, a 2020 Cadillac SUV, built in Spring Hill, Tennessee, in a move designed to challenge Tesla.

In 2017, coinciding with its 20th anniversary, Mercedez-Benz announced plans to set up an electric car production facility and battery plant at its existing Tuscaloosa, Alabama plant. The $1-billion expansion will include a new battery factory near the production site, with the goal of providing batteries for a future electric SUV under the brand EQ. Six sites are planned to produce Mercedes’ EQ electric-vehicle family models, along with a network of eight battery plants.

Meanwhile, more battery factories are being built, driven by the demand for lithium-ion batteries which is forecast to grow at a CAGR of over 13 percent by 2023.

There are 68 lithium-ion battery mega-factories already in the planning or construction stage. The first phase of Tesla’s Chinese Gigafactory is reportedly almost complete; plans are also in the works for a Gigafactory in Europe.

(Click to enlarge)

Korean company SK Innovation has said it will invest US$1.6 billion in the first electric vehicle battery plant in the United States, and is considering plowing an additional $5 billion into the project, planned for Jackson County, Georgia.

All of this explosive growth in battery plants and EVs will mean an unprecedented demand for the metals that go into them. This includes lithium, cobalt, rare earths, graphite, nickel and copper. Lithium, for example, is expected to see a 29X increase in demand according to Bloomberg.

How will the United States obtain enough lithium for the electric-vehicle storm of demand that is brewing?

The US only produces 1 percent of global lithium supply and 7 percent of refined lithium chemicals, versus China’s 51 percent. The country is about 70 percent dependent on imported lithium.

To lessen US lithium dependency will require the building of a mine to battery to EV supply chain in North America.

The first step is to develop new North American lithium mines.

Lithium products from Albemarle’s Silver Peak brine operation in Nevada are sent to its processing plant in North Carolina. This material is then loaded on ships and sent to Chinese battery manufacturers, which sell the batteries to automakers.

We don’t know how much lithium hydroxide Albemarle exports from Kings Mountain (the company does not disclose the amount to the USGS in tabulating global production statistics), but we do not think it is significant in global terms. According to Visual Capitalist, Silver Peak only produces 1,000 tonnes per year of lithium hydroxide, within a current lithium market of roughly 280,000 tonnes per annum of lithium carbonate equivalent (LCE), a term that encompasses both lithium hydroxide and carbonate used in EV batteries.

Recently, oil-field services giant Schlumberger inked an earn-in agreement with Pure Energy Minerals that could see Schlumberger - normally associated with oil and gas operations - own a lithium brine project in Nevada. The company and its subsidiaries have three years to acquire 100 percent ownership in return for constructing a pilot plant for processing lithium brine.

Lithium Americas is advancing its Thacker Pass lithium project in Humboldt County, Nevada, about 100 km northwest of Winnemucca. In 2018 LAC completed a PFS that envisions an open-pit mine that would produce 60,000 tonnes per annum of lithium carbonate, for 46 years. The two-phase project, targeted for 2022, would start with 30,000 tonnes per annum (tpa) then ramp up to 60,000 tpa. The company recently said it has completed a Plan of Operation for submission to the Bureau of Land Management (BLM), secured two partners for mining engineering, and started a definitive feasibility study (DFS).

Conclusion

This brief survey of lithium juniors operating in the United States shows there is tons of potential for building the foundation of a true mine to battery supply chain right here in North America. Doing so would put an end to US import dependence on foreign suppliers of lithium, needed to serve the burgeoning electric vehicle industry; the shift that occurred in the US oil industry, from net importer to net exporter, is analogous to what could, and should, happen with lithium.

The only way to break this dependence is to develop lithium mines in the US. And that spells opportunity for ahead of the herd investors.

Consider - Bacanora Minerals Sonora clay lithium project in Mexico attracted buy-in from China’s Ganfeng Lithium. A payment of £21,963,740 from Ganfeng in exchange for a 29.99 percent equity interest and a 22.5 percent joint venture (JV) investment, helped boost Bacanora’s share price by over 50 percent this year.

Battery and EV manufacturers in the United States need to get out in front of the looming lithium supply shortage. Buy secure mine supply now or pay the pipers, Russia and China.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.