Investors are cautiously returning to a fickle market

THE Valentine Day’s special at Sharps Pixley, London’s first high-street bullion showroom, is a £115 ($166) rose dipped in gold. But what that special someone would really want is the £27,000 “kilobar”, smaller than a slab of chocolate but reassuringly weighty in this time of turmoil in financial markets. Both have sold well since the shop opened last month, says Ross Norman, the boss. Yet he is struck by how “apologetic” his British clients are about buying gold. It suggests many are novices, gingerly placing their first bets against the global economy.

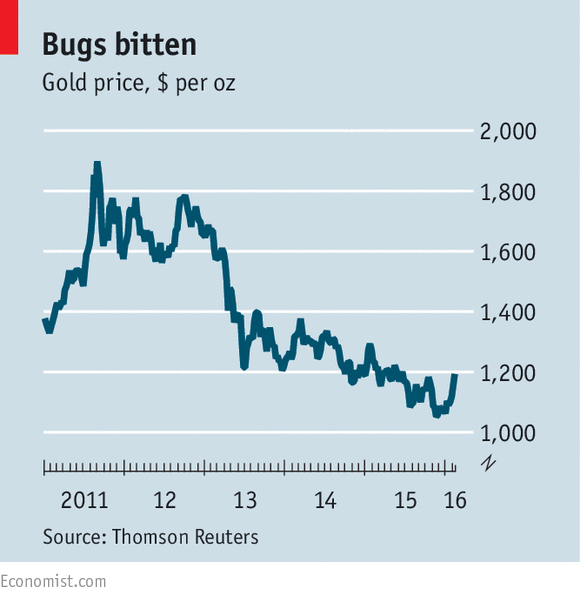

They are not alone. From libertarians in America to Indian housewives, gold’s fans have helped push spot prices up sharply this year, defying the rout in global commodity markets (although gold also defied the prior boom in commodities—see chart). In early trading on February 11th gold surged above $1,200 an ounce, its highest level in more than eight months, amid a big sell-off in global stockmarkets. Mr Norman notes that January rallies in the past two years quickly petered out, partly for seasonal reasons: retail buying in the biggest markets, India and China, starts with the Hindu Diwali festival in late autumn and ends at this time of year with Chinese new year. He says the rally is still tentative, though this year “it has a bit more oomph.”

Fear is one source of oomph. One Swiss-based bull likes to call gold “a hedge against ignorance”, noting the myriad question-marks hanging over the global economy. They include the strength of China’s economy, the impact of falling oil prices on emerging-market producers, the debt woes in America’s shale-oil industry and the fragility of global banks. What’s more, the dollar—which rivals gold as a haven—has also weakened recently.

Other factors have been on gold’s side. Its recent rally has coincided with falling oil prices and renewed fears of deflation that have pushed down interest rates. Because gold offers no yield, the lower the returns offered by alternative investments such as bonds, the more attractive it looks. The move by big central banks to impose negative interest rates on commercial-bank deposits makes gold an even more attractive store of value—the shiny equivalent of cash under the mattress.

Supply may also help the bulls’ case. The World Gold Council said on February 11th that the amount of gold mined in the fourth quarter of 2015 was down by 3%, its first quarterly drop since 2008. It expects the trend to continue as cash-strapped mining firms trim investment.

The demand picture is more nuanced. Overall, global demand dipped slightly in 2015. But Indians vastly increased their holdings of gold jewellery in the second half of last year, befitting one of the world’s fastest-growing economies. In China, shoppers bought fewer gold trinkets but more gold coins and bars as investments, perhaps reflecting concerns about their falling currency and stockmarket.

This year the latest data suggest there has been a net inflow of funds into gold-related exchange-traded funds, which are investment vehicles that account for about a tenth of global gold demand, says the World Gold Council’s Juan Carlos Artigas. He expects buying by central banks in the developing world, which surged in the fourth quarter, to continue as they diversify their assets.

Sceptics—among them Goldman Sachs, an investment bank—nonetheless argue that gold will fall for a fourth straight year in 2016, largely because of higher interest rates in America. On February 10th Janet Yellen, chair of the Federal Reserve, offered a downbeat assessment of the American economy in testimony to Congress. Though she still left the door ajar to further rate rises, stockmarkets and the dollar reacted negatively, while gold rallied. The more pressing financial fears become, the higher it is likely to go

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.