It will take time, but a fragmented market is on the verge of going global

THE Singapore Sling is a cocktail with such a variety of ingredients that few ever taste exactly alike. So it may seem an odd name to apply to a contract to help standardise the global trade in gas. That has not deterred the Singapore Exchange, a market for stocks, bonds and derivatives. Last year, as part of the city-state’s push to become a global trading hub for liquefied natural gas (LNG), it developed the slightly laboured SLInG, a spot-price index for Asian LNG. On January 25th it complemented this with a derivatives contract. There is a long way to go though. As yet the spot market accounts for only about 5% of volumes traded in Asia, executives say.

Instead, the international gas market is dominated by long-term contracts linked to the price of oil, both for gas delivered via pipeline and as LNG. This is an anomaly that dates back to the 1960s, when European suppliers developing their first gasfields had no price on which to base long-term contracts, so used oil instead. Since then, supply and demand for these commodities have diverged; oil indexation increasingly fails to reflect the disparities.

Analysts believe that, as a result, the pricing mechanism for natural gas is on the verge of change, and that a real global market will start to emerge, adding Asian trading hubs to those in America and Europe. This should spur the spread of natural gas, the cleanest fossil fuel and one that should be in the vanguard of the battle against global warming. But producers, who fear any change will lead to a drop in prices, are set to resist. They say long-term oil-linked contracts are still needed to offset the risk of their huge investments in LNG. (Gazprom, a Russian producer, has made the same argument in Europe about pipelines.)

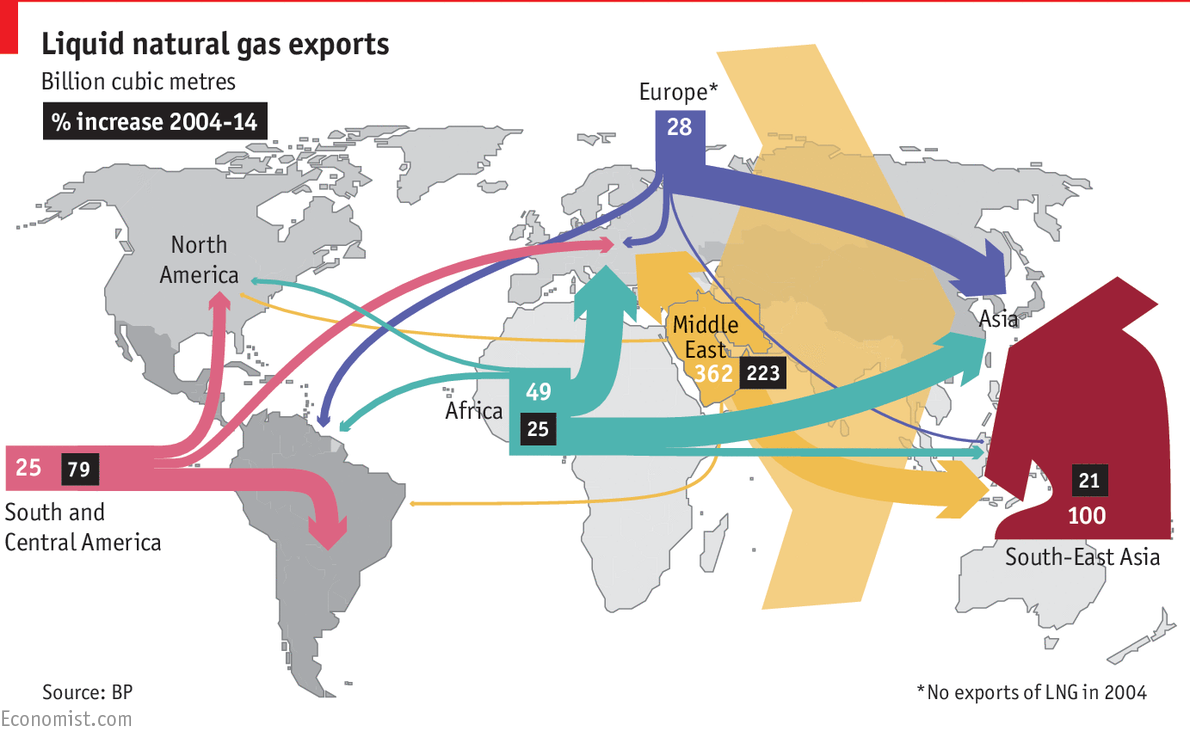

Long-term and cyclical shifts explain why the gap between the two fossil fuels has widened. The LNG trade has grown massively in the past decade (see map). Daniel Lunt of the Singapore Exchange says LNG now rivals iron ore as the world’s second-biggest traded commodity, after oil. In the past 40 years natural gas’s share of the energy mix has grown from 16% to more than 21%. Oil’s has shrunk. Gas generates 22% of the world’s electricity; oil only 4%. It might make more sense to tie the price of natural gas to coal, against which it competes as a power source.

Moreover, during the current decade, the outlook for gas prices has become even more bearish than for oil. Sanford C. Bernstein, a research firm, reckons global LNG supply will increase by about a third over the next three years, pushing overcapacity to about 10%. (There is far less spare capacity in the oil market.) At least $130 billion of this investment in supply is in Australia, which within a few years will overtake Qatar as the world’s largest LNG producer. America will also add to the surplus. Its first, much-delayed LNG exports are due to be shipped from the Gulf Coast in weeks.

Investment in the liquefaction trains, tankers, regasification terminals and other paraphernalia needed to ship natural gas was boosted by a surge in demand from Asia. Japan and South Korea scrambled for LNG after Japan’s Fukushima disaster in 2011 forced them to shut down nuclear reactors. China saw LNG as a way to diversify its energy sources and curb pollution from coal. Last year, however, those countries, which account for more than half of global LNG consumption, unexpectedly slammed on the brakes.

The subsequent supply glut means that the spot price of gas in Asia has plunged. Those buyers who took out long-term oil-indexed contracts when crude was much higher are suffering. Mel Ydreos of the International Gas Union, an industry body, says that Chinese firms saddled with such contracts are urging suppliers to renegotiate them. He notes that a Qatari company recently agreed to renegotiate a long-term contract with an Indian buyer, cutting the price by half.

The drop in Asian prices has brought the cost of natural gas traded in different parts of the world closer to each other. America is an outlier. Thanks to the vast supplies unleashed by the shale revolution, its Henry Hub benchmark is by far the world’s cheapest, at just over $2 per million British thermal units (MBTU). But add liquefaction and transport costs, and American LNG prices rise above $4 per MBTU. In Europe and Asia they are a dollar or two higher. A few years ago the range would have been much wider, from $5 at Henry Hub to $19 in Asia. More homogenous prices are an important step towards a globalised market, says Trevor Sikorski of Energy Aspects, a consultancy.

But to get there several more hurdles must be overcome. First, traded markets must become deeper, with a mix of piped gas and LNG, to provide more reliable prices. Asia, in particular, lacks infrastructure and international interconnections. Second, derivatives markets are needed to allow producers to hedge against price swings when investing in expensive new capacity. Third, end-users need deregulated energy markets to encourage competition for the best sources of supply. These, too, are scarce in Asia. Japan is only just starting to free its electricity and gas markets. (In the meantime the likely flood of American LNG into Asia may make Henry Hub a useful reference price.)

The strongest impetus for reform may be the fear of what happens without it. Few expect the overcapacity in oil markets to last much more than a year or two, after which prices of crude may spike. Yet the glut in the LNG market could last into the 2020s, in which case the disparity between spot and oil-indexed prices could balloon and buyers would rebel.

Other commodities have gone through similar upheavals when spot prices diverged from long-term contracts. The system of “posted prices” for oil fell apart in the 1970s. The spot iron-ore market got a boost as a result of the collapse in demand during the 2008-09 financial crisis.

Producers and consumers appear to be lining up for battle. On January 27th shareholders of Royal Dutch Shell, an Anglo-Dutch oil major, gave their approval to the $35 billion purchase of BG (formerly British Gas). The deal will create the undisputed world leader in LNG. On the other side, TEPCO and Chubu Electric, two Japanese utilities, have teamed up to create the world’s biggest LNG buyer, to demand better terms from suppliers, including spot contracts. It will be a long, hard fight. But the days of oil-linked contracts seem to be numbered.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.