Thanks to his ambitions, Indians are getting online faster than ever

For a glimpse of how the internet is taking hold in India, catch one of Mumbai’s double-decker buses. Even at rush hour, when people pack so tightly into the ancient vehicles that it is difficult for the conductors to collect fares, and stragglers hang out of the open door, commuters still find space to get out their mobile phones. Dozens of tiny screens glow with WhatsApp messages, news and gossip sites, Bollywood films and Hindi serials.

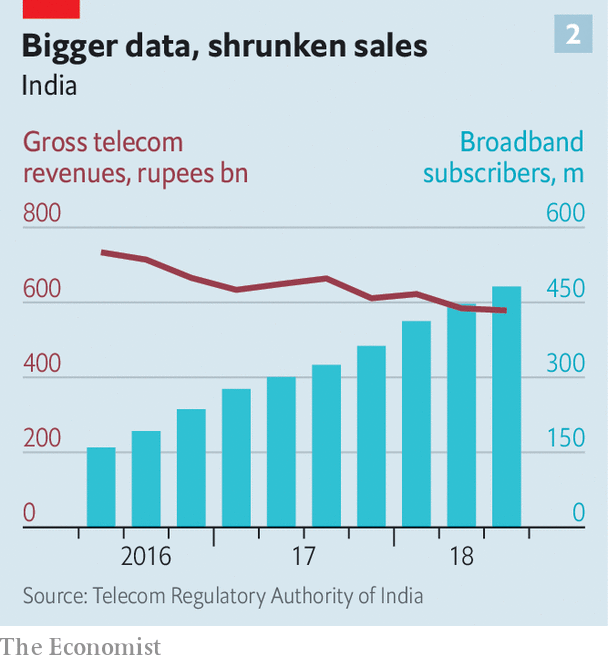

Just three years ago there were only about 125m broadband internet connections in India; by last November the number had reached 512m. New connections are growing at a rate of 16m per month, almost all on mobile phones. The average Indian phone user now consumes more mobile data than most Europeans.

If any one person can take credit for this spectacular growth, it is Mukesh Ambani, India’s richest man. With his service, Jio, a mobile network launched in 2016 offering cheap, high-speed data, he has upended Indian telecoms and changed his country. Much of his fortune comes from a chemicals and refining business inherited from his father; his conglomerate, Reliance Industries Limited (ril), is one of India’s biggest. Unlike other phone firms, which make their money from call charges, Jio from the start gave phone calls and text messages away freely alongside data.

Now Mr Ambani seems to want to go further and become an Indian Jeff Bezos or Jack Ma, using Jio as a launch pad—the platform now has a whopping 280m users. One prong of this will be online shopping; on January 18th he announced that Jio would join up with ril’s retail arm, which has nearly 10,000 outlets across the country, to launch a new e-commerce platform, taking on both Amazon and Flipkart, a local firm last year bought by Walmart for $16bn. More digital services, and content creation, are in the offing.

Both foreign and local competitors grumble about the circumstances of Jio’s birth. The radio spectrum it uses was initially reserved for data-only services, and bought in a government auction in 2010 by an unknown company called Infotel Broadband Services. Mere hours afterwards, the company was bought by ril. In 2013 the company won the right to run voice services on its 4g spectrum, using voip(Voice over Internet Protocol), after the government ordered the regulator to change its rules. When Jio was launched in 2016 it had had plenty of time to prepare. Rivals complain that they would have paid more attention in 2010 had they known Reliance would back the venture.

So as not to limit the market to people who can afford smartphones, Jio also launched its own 4g feature-phone, the JioPhone, which it says is “effectively free”. Customers pay only a refundable deposit of 1,500 rupees ($21) for the device, with which they can use WhatsApp, watch YouTube and take pictures. As Mr Ambani said last year, for most users their Jio connection “is not only their pehla [first] phone but also their pehla radio and music player, pehla tv, pehla camera and pehla Internet”.

Data in India now cost less than in any other country. On average Jio’s users each download 11 gigabytes each month. Finns, the world’s hungriest consumers of cellular data, gobble 14 gigabytes. Jio users watch 17.5 hours of mobile video a month, far more time than they spend watching tv.

Astrological development

Fast-rising consumption is provoking changes, many for the good. Yogendra Mertiya, who runs a farmers’ collective in rural Rajasthan, says the internet is subtly altering the village he lives in. “Rajasthan is a feudal sort of a state, and on the face of it everything looks like it did ten years ago, but actually there are huge social changes,” he says. Lower-caste men these days can check their horoscopes online, instead of having to visit the local Brahmin astrologer, for example. Women who are scarcely allowed to leave home are able to search for information online. Politicians calling for the prohibition of alcohol have been able to win votes by appealing to female voters through their phones. Enterprising young people can become local celebrities by building what Mr Mertiya calls “a small following” of “perhaps a million subscribers” on YouTube. A Bollywood channel of songs and clips, t-Series, seems set to soon become YouTube’s most-subscribed.

Not all the effects are positive. Rumours and spam spread through WhatsApp messages have become a public menace, in some cases even inciting lynchings. Another problem, at least in the eyes of the government, is the spread of pornography. In September a court ordered telecoms operators to block 827 porn sites to stop children being exposed. That so many men seem to like watching it in public places may have weighed on the judges’ minds.

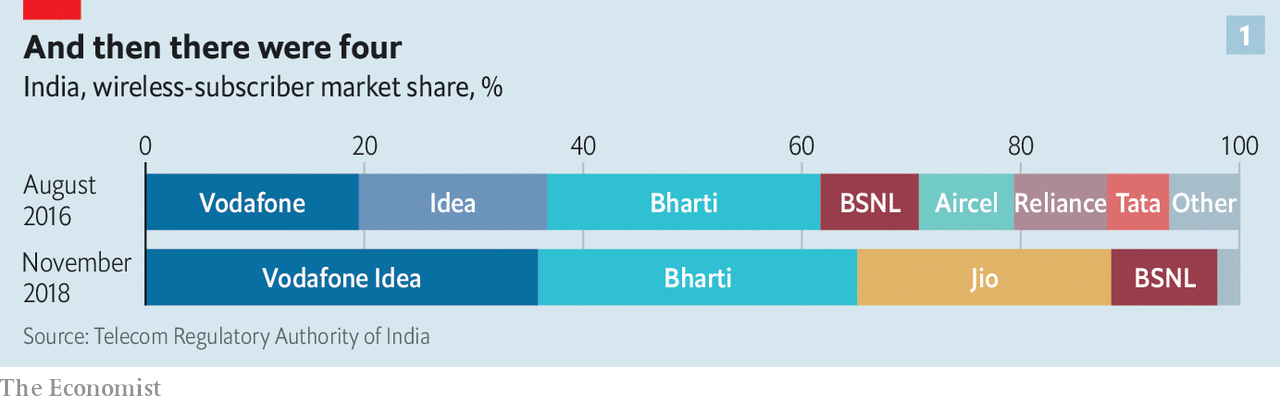

So India is being transformed. But will the bet pay off for ril and its shareholders? So far ril has spent a massive $32bn on Jio, with limited return. Mr Ambani’s firm has certainly succeeded in ejecting competitors. Since its entrance, six firms have gone out of business, including the one owned by his brother Anil, rCom. India’s telecoms industry has shrunk to four big companies (see chart 1). Bharti Airtel, previously the market leader, now relies on its enterprise and African businesses to keep it afloat. Vodafone has merged with another firm, Idea, and the new group is selling assets and raising capital to cover its cashflow deficit.

Squeezing out competitors has not yet translated into juicy profits for Jio. Since the middle of 2016 total revenue earned in Indian telecoms has shrunk by 21%, even as connectivity has soared (see chart 2). According to ril, Jio made a profit of 25bn rupees in the latest quarter. Bernstein, an equity-research firm, has suggested that its treatment of depreciation and amortisation is unusual in the industry and may understate its costs. Jio says its method adheres to Indian accounting standards.

And by some targets it set earlier, Jio seems to be doing less well than it had hoped. In 2017 it said that by 2020 it aimed to capture a 50% revenue share of a market it said would grow by 50%. Today Jio’s share is around 26% of an industry it has made smaller in revenue terms. It has all come at a big cost to ril and its shareholders. According to Credit Suisse, a bank, by 2018 capital investment in Jio reached about 700bn rupees a year. The conglomerate’s debts have risen to around 3trn rupees, close to its annual revenue of 4.3trn rupees.

For India’s telecoms industry to be profitable again, prices need to go up by about 50-70%, reckons one analyst. Competitors are holding on, assuming that will happen, and ril’s share price has risen by 28% in the past 12 months on hopes Jio can cash in later. But it is hard to predict Mr Ambani’s next moves. His ambition to become a tech tycoon goes beyond making money in telecoms. As well as the new e-commerce platform around Jio, ril separated its fibre-optic cables and towers from Jio last December to create a new firm that is preparing to provide wired broadband to homes. Other digital services would follow, such as web-hosting for firms. ril has also invested in content creation, and has bought rights to distribute cricket matches and Disney films on its “Jiotv” platform.

All this will bring Mr Ambani into direct competition with big e-commerce firms already investing heavily in India, including Google, Amazon and Flipkart. Their appetite for India’s market has been whetted by Jio’s connectivity explosion, but their executives will be worried that the government may favour Jio, a local champion. On January 18th Mr Ambani argued that the government should prevent data colonisation; Indians’ data, he said, must not be controlled by global corporations.

Foreign e-commerce firms are already banned from holding inventory in India. In December they were also banned from selling products from firms in which they have an equity stake (a common workaround). Incumbent telecoms firms, too, have seen many recent regulatory decisions (such as one on whether rules on predatory pricing apply to Jio) go against them.

Mr Ambani will need to keep regulators happy if ril is to earn decent returns on its investment in Jio. Even if he fails in that, he will have helped hundreds of millions of Indians get a first taste of the internet. One recent Indian social-media craze was sharing grainy pictures from the weeklong wedding for Mr Ambani’s daughter in December, where the entertainment featured Beyoncé. A few years ago, Mumbai’s hard-pressed bus commuters would have had no idea of the extravagance in their midst.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.